ID: PMRREP12037| 210 Pages | 19 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

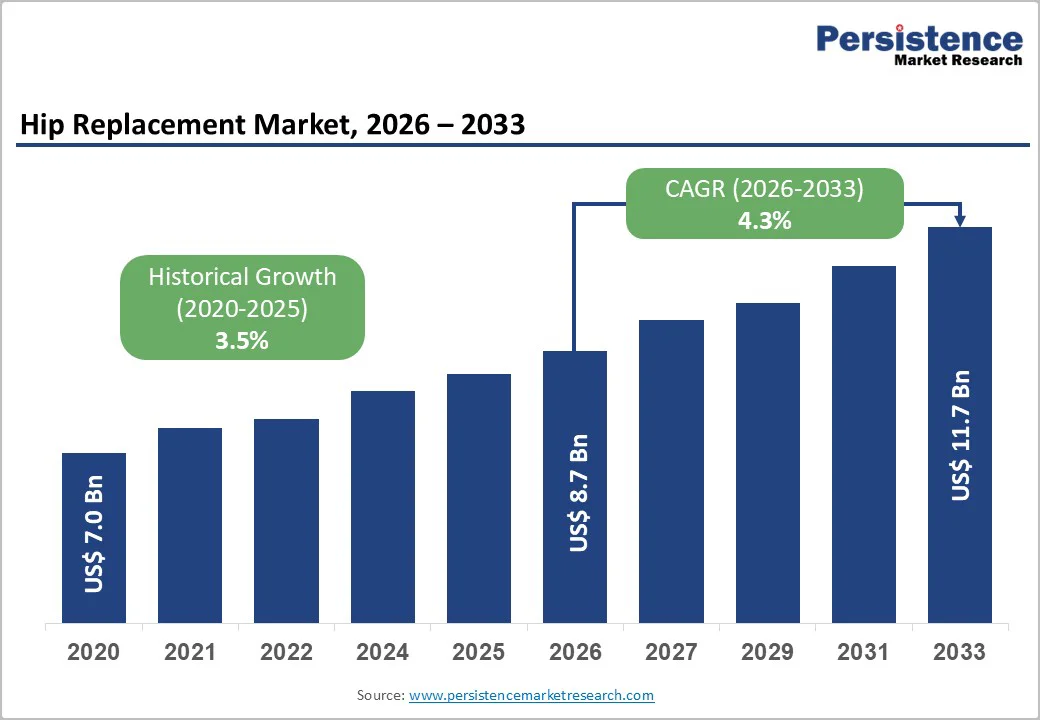

The global hip replacement market size is estimated to grow from US$ 8.7 billion in 2026 to US$ 11.7 billion by 2033. The market is projected to record a CAGR of 4.3% during the forecast period from 2026 to 2033.

The hip replacement market is expanding steadily, fueled by rising osteoarthritis and fractures, aging populations, and increasing demand for cost-effective joint implants.

| Key Insights | Details |

|---|---|

| Global Hip Replacement Market Size (2026E) | US$ 8.7 Bn |

| Market Value Forecast (2033F) | US$ 11.7 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.3% |

| Historical Market Growth (CAGR 2020 to 2025) | 3.5% |

Technological advancements in implants are a major driver of the hip replacement market. Modern hip implants, including ceramic-on-polyethylene designs and cemented or cementless stems, have significantly improved long-term outcomes. Registry data show that many hip replacement constructs now achieve a 15-year survival rate with revision rates under 5%, reducing the need for repeat surgeries.

In the United States alone, over 400,000 hip replacement procedures are performed annually, reflecting both high demand and confidence in implant durability. These improvements not only enhance patient outcomes but also lower overall healthcare costs by minimizing complications and revisions.

Innovations in materials, such as highly cross-linked polyethylene and advanced ceramics, combined with improved implant geometries, have increased implant longevity and performance, leading to greater surgeon and patient preference.

The combination of reliability, better recovery profiles, and long-term success has reinforced hip replacement as a cost-effective, widely adopted solution for osteoarthritis, fractures, and other hip disorders, driving steady market growth.

Post-surgical complications remain a significant restraint on the hip replacement market. In large-scale data from over 4.6 million primary hip replacements, the pooled rate of dislocation was found to be about 2.1%. Deep infections or prosthetic-joint infections, while less common, still contribute significantly to revision surgeries. Among patients who undergo a first revision surgery, rates of dislocation rise (e.g. around 5.7% in first revisions), and infection also increases.

These complications, dislocation, infection, loosening, or instability often lead to revision surgeries, prolonged hospital stays, increased costs, and worse functional outcomes. The risk of re-revision after a revision increases further.

Because of these risks, patients and surgeons may hesitate to opt for primary replacements, especially in regions with limited surgical expertise or postoperative care. This restraint limits demand growth, particularly in low and middle-income countries where follow-up care and revision capacity may be constrained, thereby dampening broader market expansion.

Use of robotic-assisted total hip arthroplasty (THA) is increasingly associated with shorter hospital stays, faster recovery, and more precise implant placement, opening an important growth opportunity for hip replacement demand.

In one large study of nearly 10,000 primary THA patients, those treated with robotics had a significantly higher chance of achieving optimal mobility immediately post-op and more often left the hospital in under 24 hours compared to conventional surgery.

Another series found that robotic-assisted THA produced excellent two-year functional outcomes with very low complication rates: no dislocations, very rare infections, or implant loosening. Such benefits include shorter convalescence, less tissue trauma, better implant alignment, and patient satisfaction, which appeal strongly to both patients and surgeons.

As hospitals and surgeons adopt minimally invasive and robotic methods, demand for hip replacements is likely to rise, especially among younger, active patients or those seeking quicker recovery.

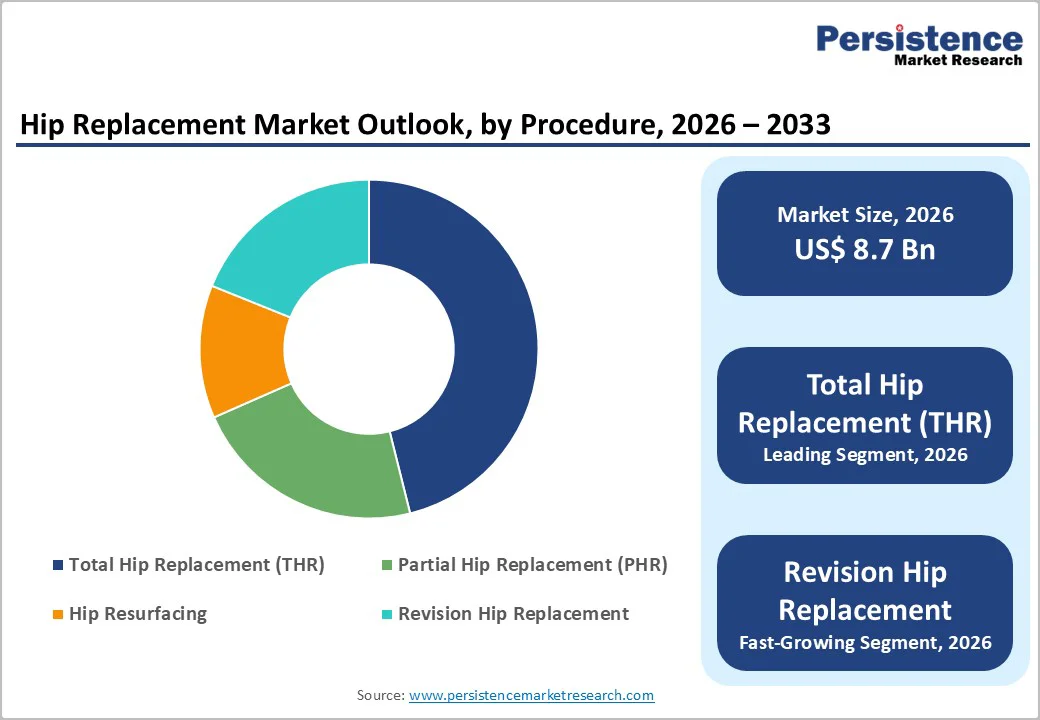

Total Hip Replacement (THR) occupies 46.1% share of the global market in 2025, because it provides complete joint restoration, replacing both the acetabulum and femoral head, which is essential for patients with severe osteoarthritis or advanced hip degeneration.

National registry data indicate that uncemented and hybrid THR accounted for approximately 76.5% of all primary hip replacements in recent years. Long-term outcomes favor THR over alternatives; for example, surface or hip resurfacing procedures have a revision rate of around 11% at nine years, whereas THR revision rates are only about 3% over the same period.

Its superior durability, high success rate, and suitability for a broad patient population make THR the preferred choice for surgeons and patients, resulting in its leading market share globally.

Hospitals remain the primary venue for hip replacements because they handle the majority of complex orthopedic surgeries that require full infrastructure, post-operative care, and inpatient support. Data from a U.S. registry show that hospitals accounted for about 71% of hip replacement procedures in 2024, far more than outpatient centres.

This distribution reflects that many hip replacement patients are older or have comorbidities, requiring careful perioperative monitoring, anesthesia support, and the option of an overnight stay. Historically, inpatient hospital stays for hip replacement averaged several days, with associated costs and care protocols.

Also, hospitals are equipped for revision surgeries, complications, and post- operative rehabilitation, which smaller outpatient or ambulatory surgical centres might not reliably support. Because hip replacement often involves high-risk patients and complex prostheses, hospitals remain the default and dominant care setting worldwide.

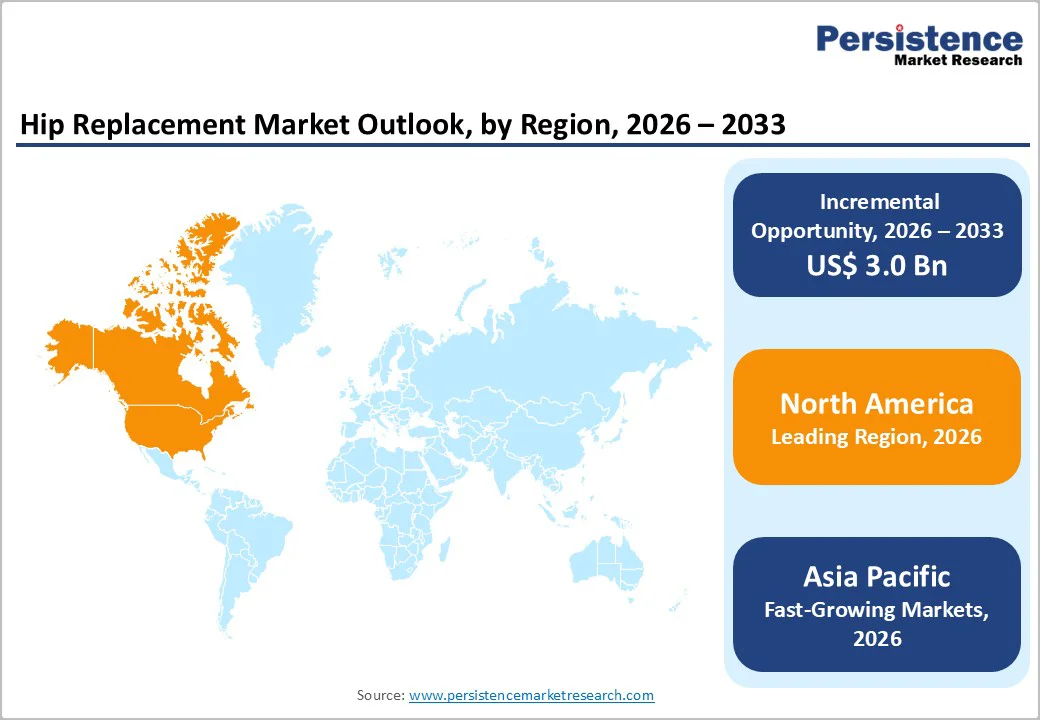

North America dominates the hip replacement market with 37.7% share in 2025, due to high procedural volumes, advanced healthcare infrastructure, and strong insurance coverage. In the United States, over 2.5 million people were living with a total hip replacement, representing around 0.8% of the total population, with prevalence exceeding 5% among those over 80 years old.

Annually, more than 370,000 primary total hip replacements are performed, reflecting both the high incidence of osteoarthritis and degenerative hip conditions and the population’s access to surgery. The region’s hospitals are well-equipped with modern surgical technologies, including minimally invasive and robotic-assisted systems, enabling safer procedures and faster recovery.

Combined with well-established rehabilitation programs and post-operative care, these factors ensure high adoption rates, making North America the leading market for hip replacement globally.

Europe is a key region in the hip replacement market due to its high procedure volumes, aging population, and strong healthcare infrastructure. In 2018, European countries averaged around 191 hip replacements per 100,000 people annually, with nations like Germany and Switzerland exceeding 300 per 100,000. The large elderly population, combined with widespread access to orthopedic care, drives consistent demand.

Europe also maintains extensive joint-replacement registries, tracking over 3.1 million hip arthroplasties since the 1970s, which support implant quality, long-term outcomes, and regulatory oversight. These registries enable continuous improvement in surgical techniques and implant selection.

High adoption rates, robust post-operative care, and reliable data collection make Europe a mature, stable, and influential market for hip replacements globally, offering predictable growth and opportunities for advanced implant technologies.

Asia-Pacific is the fastest-growing region in the hip replacement market due to rapid population ageing and rising hip fracture and osteoarthritis incidence. Between 2018 and 2050, hip fractures in the region are projected to more than double, from approximately 1.12 million to over 2.56 million annually.

In 2022, nearly 719,000 hip replacement procedures were performed across the Asia Pacific, reflecting growing adoption and surgical capacity. Expanding healthcare infrastructure, increasing numbers of orthopedic centers, and improving access to affordable implants in countries like China and India support this growth. Rising awareness of joint health, higher osteoporosis prevalence, and trauma-related hip injuries further fuel demand.

Leading companies in the hip replacement market emphasize precise implant manufacturing, advanced materials, and strict quality control. They invest in innovative designs, 3D-printed and durable implants, & surgical technologies, while partnering with hospitals and surgeons. R&D enables improved implant longevity, safety, and cost-effectiveness, enhancing patient outcomes, expanding access, and supporting global adoption of advanced hip-replacement solutions.

The global hip replacement market is projected to be valued at US$ 8.7 Bn in 2026.

Aging population, rising osteoarthritis and fractures, technological implant advancements, increased healthcare access, and demand for minimally invasive surgeries drive growth.

The global hip replacement market is poised to witness a CAGR of 4.3% between 2026 and 2033.

Opportunities include minimally invasive and robotic-assisted surgeries, advanced implant materials, revision procedures, emerging markets expansion, and strategic collaborations for innovation.

Stryker Corporation, Zimmer Biomet Holdings, Inc., DePuy Synthes (Johnson & Johnson), Smith & Nephew plc, Exactech, Inc., MicroPort Scientific Corporation.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Procedure

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author