ID: PMRREP32767| 217 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

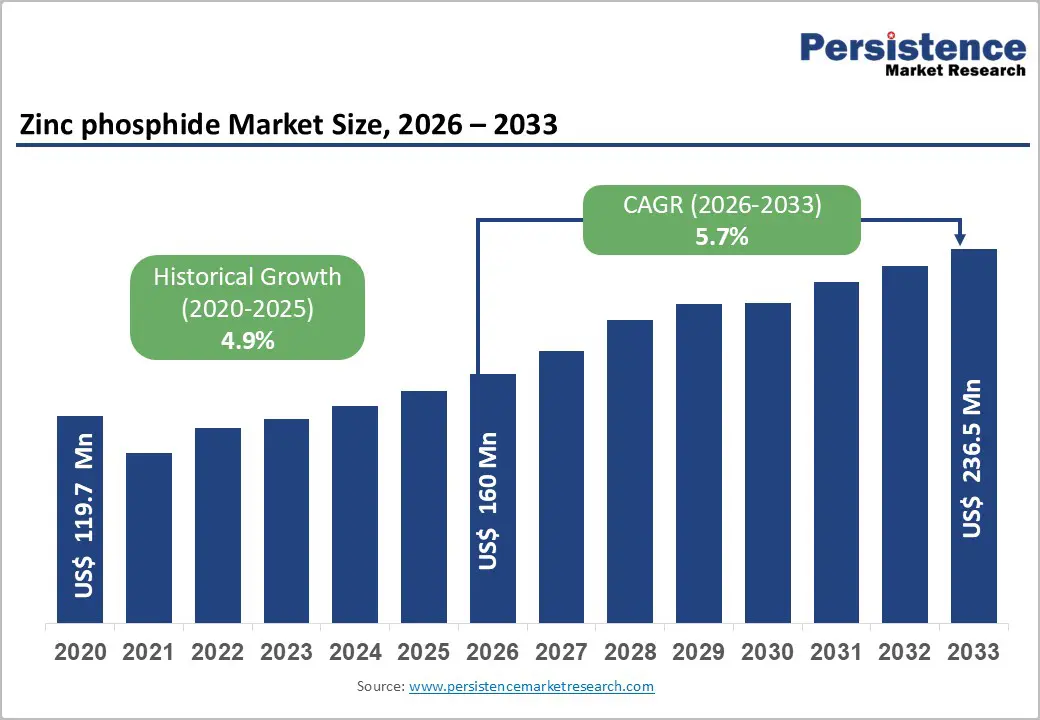

The global Zinc Phosphide market was valued at US$ 160 Million in 2026 and is projected to reach US$ 236.5 Million by 2033, growing at a CAGR of 5.7% during this forecast period. The zinc phosphide market demonstrates robust growth driven by escalating demand for effective rodent control solutions in agricultural and pest management sectors. Rising awareness of food security challenges and the increasing prevalence of rodent-borne diseases across emerging markets are propelling market expansion. The sector is characterized by strategic innovations in formulation technologies, regulatory harmonization favoring safer pesticide alternatives, and expanding agricultural operations in Asia-Pacific regions. Market growth is further supported by heightened awareness regarding crop protection and the shift toward integrated pest management (IPM) practices globally, positioning zinc phosphide as a critical component in modern agricultural and public health strategies.

| Key Insights | Details |

|---|---|

| Zinc Phosphide Market Size (2026E) | US$ 160 Mn |

| Market Value Forecast (2033F) | US$ 236.5Mn |

| Projected Growth (CAGR 2026 to 2033) | 5.7% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.9% |

Key Growth Drivers

The worldwide agricultural sector faces unprecedented pressure to enhance productivity while managing crop losses attributable to rodent populations. According to the Food and Agriculture Organization (FAO), rodent-induced crop losses globally exceed 5-10% of annual agricultural output, translating to billions of dollars in economic damage. Asia-Pacific regions, particularly India and China, report crop losses ranging from 8-15% in certain agricultural zones. This critical challenge has positioned zinc phosphide—a cost-effective and environmentally acceptable rodenticide—as an essential agricultural input. The compound's efficacy in controlling multiple rodent species, combined with its lower toxicity profile compared to alternative rodenticides, has increased adoption rates among smallholder and commercial farming operations. Market projections indicate that countries expanding agricultural mechanization and intensification will drive proportional increases in zinc phosphide demand through 2033.

Market Restraining Factors

Despite favorable toxicity profiles relative to alternative rodenticides, zinc phosphide exposure carries documented risks for non-target wildlife species. Secondary poisoning incidents involving raptors and carnivorous species have raised environmental concerns in certain jurisdictions, prompting stricter application protocols and usage restrictions. Studies from Australian agricultural regions and European ecosystems document instances of ecological damage from indiscriminate zinc phosphide deployment. These environmental concerns have triggered enhanced regulatory scrutiny in developed markets, increasing compliance costs for manufacturers and limiting application flexibility for end-users. Furthermore, organic and environmentally-conscious agricultural segments face philosophical objections to chemical-based rodent control, constraining market penetration in premium product categories. Estimated market restraint impact: 0.6-0.8 percentage points reduction in potential CAGR expansion.

Zinc Phosphide Market Trends and Opportunities

Global agricultural policies increasingly mandate integrated pest management approaches combining biological, chemical, and mechanical control strategies. IPM frameworks position zinc phosphide as a targeted intervention within comprehensive pest management systems, enhancing sustainability credentials and regulatory acceptance. International development institutions, including the World Bank and Asian Development Bank, actively promote IPM adoption in emerging markets, creating institutional demand drivers. Manufacturers developing zinc phosphide products specifically formulated for IPM protocols can capture market share in government-led agricultural extension programs. Estimated market opportunity: 8-12% of total addressable market through strategic positioning in IPM platforms, particularly in government procurement and subsidy programs across Asia-Pacific regions.

Form Insights

Pellet-based zinc phosphide formulations dominate the global market, accounting for over 45% of total revenue and maintaining their leadership position across key agricultural and pest control applications. Pellets are widely preferred due to their cost-effectiveness, ease of handling, and compatibility with existing application equipment, particularly in large-scale agricultural operations. Their discrete particle size, stable physical structure, and superior shelf-life performance reduce product losses during storage and transportation, especially in hot and humid climates common across Asia-Pacific. Major markets such as India, China, and Southeast Asia continue to favor pellet formulations due to farmer familiarity, established usage practices, and reliable field performance. As a result, pellets are expected to retain market dominance through 2033, although growth is likely to stabilize as alternative formats gain acceptance.

In contrast, granule formulations are emerging as the fastest-growing segment, registering a robust CAGR of 6.1%. Growth is driven by advantages such as improved dispersal, better adherence to target surfaces, and significantly lower dust generation compared to powders. These characteristics make granules increasingly attractive to institutional buyers, government pest control programs, and professional pest management companies focused on worker safety. Stricter occupational health regulations and innovations such as coated and microencapsulated granules are accelerating adoption, positioning granules as a premium, safety-oriented growth segment within the market.

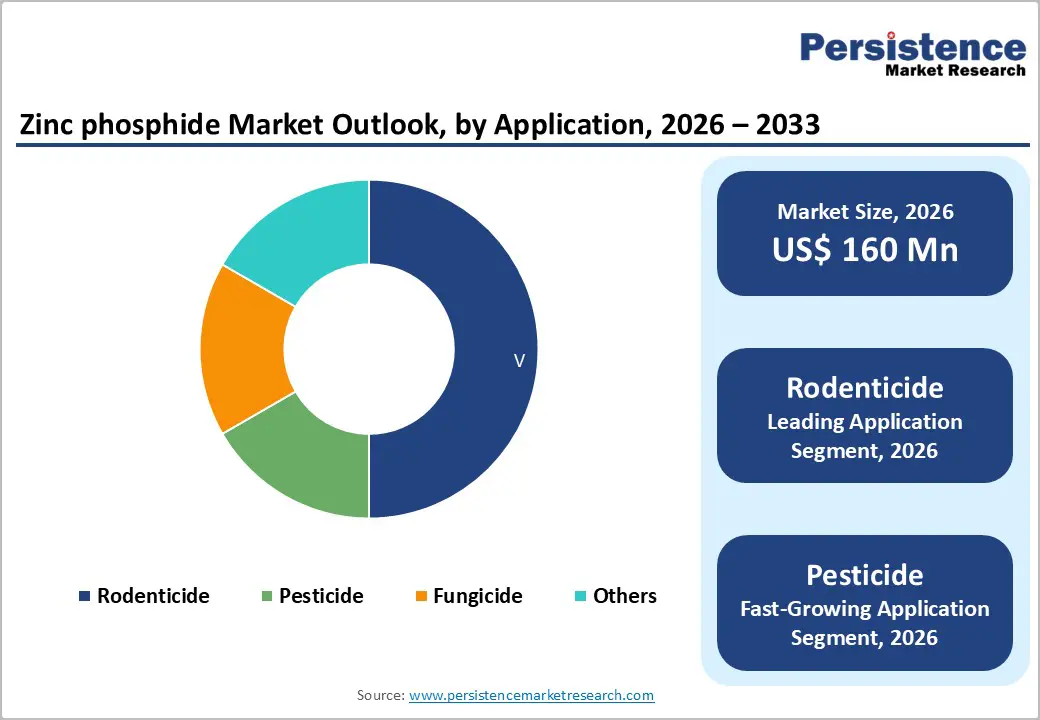

Application Insights

Zinc phosphide’s application landscape is clearly led by rodenticide uses, which account for over 50% of total market revenue, underscoring the compound’s core value in effective rodent population control. This dominance is driven by widespread adoption across agricultural fields, urban and commercial pest management, and public health programs aimed at controlling rats, mice, and other rodents that threaten food security and sanitation. Demand for rodenticide formulations remains structurally stable across regions and economic cycles, as pest control is considered an essential expenditure by farmers, municipalities, and government agencies. Institutional procurement by agriculture and health departments further strengthens volume stability. Additionally, specialized rodenticide formulations command price premiums of 15–20% over multipurpose products, enabling attractive margins for manufacturers focused on performance-driven solutions.

In contrast, pesticide applications represent the fastest-growing segment, expanding at a CAGR of around 6.2%. This growth reflects increasing awareness of zinc phosphide’s broader efficacy against secondary agricultural pests beyond rodents. Its integration into integrated pest management (IPM) frameworks, particularly in Asia-Pacific markets, is accelerating adoption. Ongoing evaluations by research institutions and agricultural extension services are supporting regulatory approvals and encouraging formulation innovations. As application scope widens through improved delivery mechanisms, the pesticide segment is expected to expand zinc phosphide’s total addressable market by approximately 12–15%, positioning it as a key growth engine alongside its established rodenticide base.

End-Use Industry Insights

Agriculture remains the dominant end-use industry in the zinc phosphide market, accounting for over 40% of total revenue. This leadership reflects the sector’s heavy reliance on effective rodent control to safeguard crop yields and farm incomes. Zinc phosphide is widely used across large commercial farms, cooperative agricultural systems, and smallholder farming communities, particularly in developing economies. Rodent infestations cause an estimated 8–15% crop losses in parts of Asia, making cost-effective rodenticides a critical input for food security. Government-backed agricultural extension programs, awareness campaigns, and subsidy support have further accelerated adoption. The agriculture segment also benefits from stable, recurring demand driven by annual crop cycles and persistent rodent populations. Moreover, significant untapped potential exists in sub-Saharan Africa and Southeast Asia, where mechanized farming and commercial agriculture are expanding rapidly.

In contrast, the pest control industry represents the fastest-growing end-use segment, registering a CAGR of around 6.3%. Growth is fueled by rapid urbanization, rising hygiene standards, and increased outsourcing of pest management services. Professional pest control operators increasingly deploy zinc phosphide formulations for residential complexes, food processing units, warehouses, and commercial buildings. This segment offers attractive margins due to premium service pricing, recurring contracts, and long-term client relationships. Additionally, stricter regulations on occupational safety and chemical handling favor professional service providers, further strengthening demand for specialized zinc phosphide products in the pest control sector.

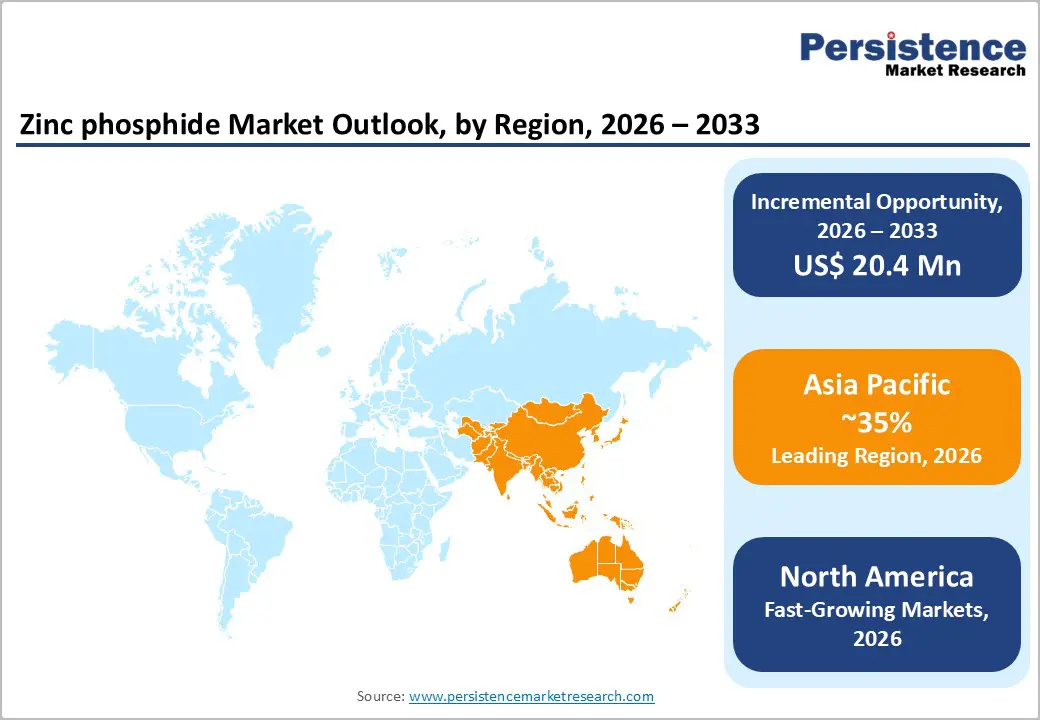

Asia-Pacific dominates the global zinc phosphide market, accounting for over 35% of total revenue and exhibiting the strongest absolute growth outlook. The region is projected to expand at a robust 6.3% CAGR through 2033, supported by large-scale agricultural expansion, rapid urbanization, and heightened institutional focus on food security. China, India, and Southeast Asia collectively contribute more than 70% of regional consumption, positioning them as the primary growth engines.

China’s vast cultivated area and ongoing agricultural mechanization programs are accelerating adoption of modern pest control solutions, including zinc phosphide. India, with over 140 million hectares under cultivation and significant rodent-related crop losses, is witnessing rising usage driven by government extension services and subsidy-backed pest management initiatives. Southeast Asian economies such as Vietnam, Thailand, and Indonesia are experiencing agricultural intensification, while Bangladesh and Pakistan represent emerging opportunities as farming systems modernize.

Key growth drivers include rising institutional investment in agriculture, integration of zinc phosphide within government-led pest management programs, and expanding urban pest control demand. Climate variability and shifting monsoon patterns are intensifying rodent pressures, further increasing reliance on effective rodenticides. Regulatory alignment with international standards, coupled with growing emphasis on pesticide safety, is favoring zinc phosphide over higher-toxicity alternatives.

The competitive landscape remains fragmented, with multinational and regional players competing on cost efficiency, regulatory compliance, and strong local distribution. Ongoing capacity expansions, partnerships, and low-cost formulation innovations continue to strengthen Asia-Pacific’s leadership position.

North America represents a mature and well-regulated zinc phosphide market, supported by advanced agricultural systems and sophisticated pest management infrastructure. The region accounts for approximately 18–20% of global zinc phosphide market value and is projected to grow at a CAGR of around 6.2%, making it the fastest-growing major regional market. The United States dominates regional demand, underpinned by more than 370 million acres of cultivated land and strong institutional support. Government bodies such as the USDA and the EPA actively promote zinc phosphide as a preferred rodenticide due to its validated environmental and toxicological profile, strengthening regulatory confidence and institutional procurement.

Canada also shows rising adoption, particularly in grain-producing provinces, as integrated pest management practices gain regulatory backing. Key growth drivers include regulatory harmonization favoring safer pesticide alternatives, increasing agricultural mechanization, and the adoption of precision farming techniques that require effective rodent control inputs. Public health initiatives targeting rodent-borne diseases have further expanded demand from municipal and government agencies. Climate variability, which influences rodent population dynamics, is also prompting higher pest control investment across vulnerable farming regions.

At the regulatory level, EPA registration frameworks and state-level approvals in major agricultural states reinforce market stability, while occupational safety norms encourage substitution away from higher-toxicity products. The competitive landscape is moderately consolidated, with regional specialists and multinational agrochemical companies focusing on formulation innovation, application efficiency, and strategic partnerships, creating sustained investment and consolidation opportunities across the region.

The zinc phosphide market is characterized as moderately fragmented, with presence of multinational agricultural chemical manufacturers, specialized regional producers, and emerging domestic manufacturers. The top three market participants collectively account for approximately 35-40% of global market revenue, while remaining market share is distributed among mid-tier players and regional specialists. Market consolidation is ongoing, with multinational corporations expanding geographic reach through acquisition of regional manufacturers. The competitive landscape reflects differentiation strategies emphasizing product quality, regulatory compliance capabilities, distribution network breadth, and technical customer support. Barriers to market entry are moderate, encompassing regulatory approval requirements, manufacturing quality standards, and established distribution relationship development. Regional markets demonstrate varying competitive dynamics, with developed markets characterized by higher consolidation ratios and developing markets exhibiting greater fragmentation.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

| Customization and Pricing | Available upon request |

?????

By Form

By Application

By End-Use Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author