ID: PMRREP20479| 180 Pages | 29 Apr 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

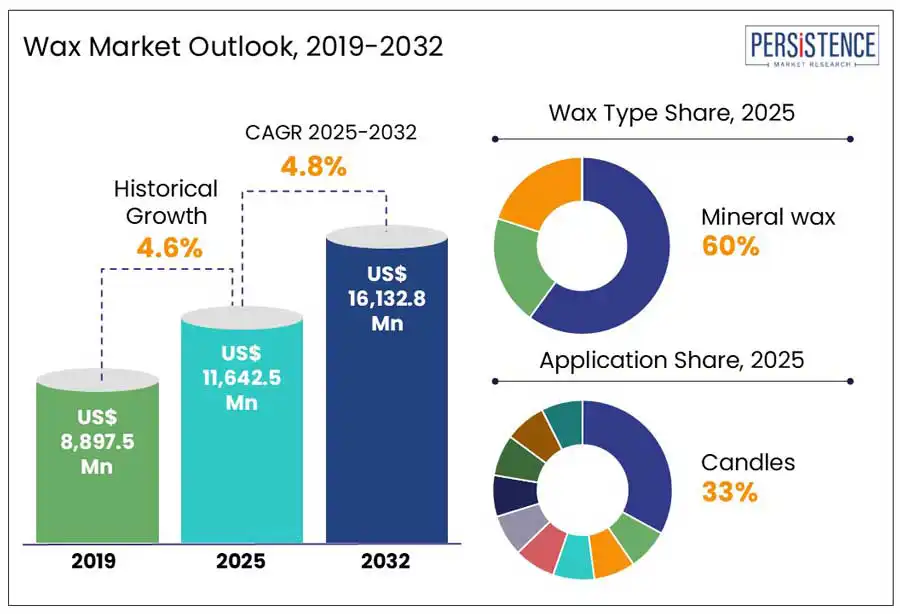

According to the Persistence Market Research report, the global wax market size is poised to reach US$ 11,642.5 Mn by 2025 and expected to reach a valuation of US$ 16,132.8 Mn to witness a CAGR of 4.8% by 2032. The industry is driven by the increasing demand for candles and the expanding applications of wax. Wax is a versatile organic compound that remains solid at room temperature and liquefies upon heating. It is derived from both petroleum-based sources, such as crude oil, and bio-based sources such as plants and animals. Its physical and chemical properties, including hardness, melting point, and flexibility are determined by molecular weight, carbon branching, and hydrocarbon composition.

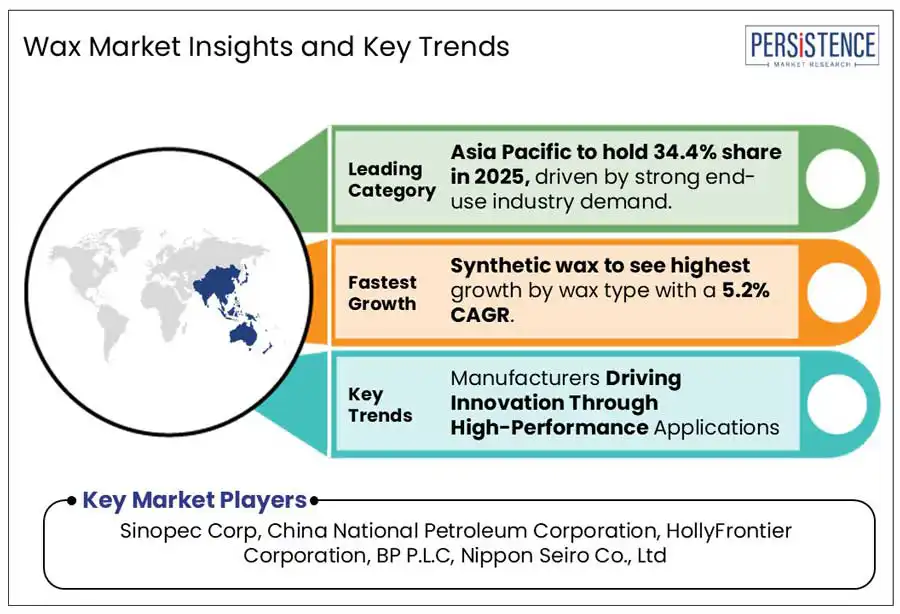

Waxes are broadly categorized into synthetic, natural, and mineral types. Synthetic waxes, such as polyethylene and Fischer-Tropsch waxes, are engineered for specific performance needs. Natural waxes, including beeswax and carnauba wax, are sourced from renewable materials, while mineral waxes like paraffin and microcrystalline wax originate from fossil sources. These waxes serve critical functions across industries, particularly in coatings, cosmetics, packaging, polishes, and printing inks.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Wax Market Size (2024A) |

US$ 11,122.5 Million |

|

Estimated Market Size (2025E) |

US$ 11,642.5 Million |

|

Projected Market Value (2032F) |

US$ 16,132.8 Million |

|

Value CAGR (2025 to 2032) |

4.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.6% |

The global wax market is propelled by the surging demand from the candle and packaging sectors, particularly in regions such as the Asia Pacific and North America. Paraffin wax, a cost-effective and versatile mineral wax product, dominates candle production due to its excellent fragrance retention and clean burn, with over one billion pounds used annually for candles in the wax market in the U.S. alone. Similarly, microcrystalline wax and semi-crystalline wax are widely used in packaging for their moisture resistance, protecting food and consumer goods.

The cosmetics industry significantly drives the wax market, especially for natural wax and plant and animal-based waxes like beeswax and carnauba wax. In North America, the presence of major companies such as Colgate-Palmolive and Johnson & Johnson caters to a wide demand for wax-based products in skincare and makeup. Therefore, the industry is expected to experience a shift toward bio-based waxes due to consumer preference for organic products.

The persistent volatility in raw material prices, particularly for petroleum-derived waxes such as paraffin, microcrystalline, and semi-crystalline wax is a significant restraining factor. Fluctuations in global crude oil prices directly impact wax production costs as perceived in 2022 when oil prices surged by 33%, leading to a 5% increase in paraffin wax prices by mid-2023. These rising costs notably affected price-sensitive markets in the Middle East & Africa and Central & South America.

According to the IEA, oil prices declined slightly in early 2024 due to economic uncertainty and shifting trade dynamics, ongoing geopolitical tensions, proposed U.S. tariffs on Canada and Mexico, and sanctions on Russia and Iran continue to disrupt supply flows and impact pricing. The U.S., currently producing at record highs is forecast to lead global supply growth in 2025, followed by Canada, Brazil, and Guyana. This persistent instability affects both mineral and synthetic waxes and poses challenges for small-scale producers in developing markets, reducing competitiveness and hindering overall market growth.

Stringent environmental regulations particularly in the Europe and North America are challenging due to the use of paraffin wax and other fossil-based mineral wax products. Concerns over carbon emissions and non-biodegradability have led to reduced demand for paraffin wax in packaging with alternatives such as plant and animal-based waxes gaining traction.

In the UK and Germany, stricter regulations on petroleum-based waxes drive the manufacturers to use more expensive natural options such as beeswax and soy wax. Asia Pacific is experiencing the identical trends with some relaxations in the rules followed with a heightened consumer awareness.

The growing consumer preference for sustainable and eco-friendly products presents a significant opportunity for natural wax and plant and animal-based waxes such as beeswax, soy wax, and candelilla wax. In North America, the shift toward bio-based cosmetics boost demand for beeswax and carnauba wax, with companies such as Weleda and Badger Balm known for organic products. Brazil is capitalizing on its abundant carnauba wax production, exporting over 8,000 tons annually.

Rapid industrialization in emerging economies offers a robust opportunity for the wax market, particularly in the Asia Pacific Central & South America. China’s wax production exceeds 300,000 tons annually, driven by demand for paraffin wax and polyethylene wax in packaging and adhesives. In the Brazil, rise in cosmetics and food packaging sectors fuels demand for natural wax and synthetic wax products. The Middle East & Africa Wax Market is expanding due to the increased infrastructure development, requiring wax-based products, such as microcrystalline wax for construction adhesives. The wax market in the U.S. and Europe including Germany, can leverage export opportunities to these regions, where the packaging industry in India alone grows at 22-25% annually.

In 2024, mineral wax is dominant accounting for nearly 60% of total revenue, surpassing both synthetic and natural waxes. This stronghold is primarily driven by the widespread demand for paraffin and microcrystalline waxes, which are affordable and versatile materials derived from petroleum via fractional distillation. Mineral wax is especially valued in the candle industry for its excellent scent throw, effectively releasing fragrance whether the candle is lit or not, making it a preferred choice among manufacturers and consumers alike. Its advantageous properties, including water resistance, lubrication, and chemical stability, contribute to its broad application across various industries. Steady demand from cosmetics, packaging, and rubber manufacturing reinforces market leadership.

Paraffin wax, a key variant of mineral wax, forms the backbone of the candle industry. In the United States, over one billion pounds of wax are used annually for candle production, according to the National Candle Association. Beyond candles, mineral wax is also critical in packaging applications thanks to its moisture-resistant and insulating qualities.

Based on application, the global market is categorized into candles, packaging, plastics and rubber, pharmaceuticals, cosmetics and toiletries, fire logs, adhesives, coating and sealing, lubrication, and others. Among these, the candles segment held the largest share in 2025 poised to account for over 33% market share. This dominance is expected to continue throughout the forecast period, driven by the rising popularity of scented candles for home décor and aromatherapy purposes.

Candles are available in a wide range of scents, sizes, shapes, and price points, making them a versatile product and a popular gift choice for occasions like Christmas, birthdays, and housewarming events. The National Candle Association reports that most American consumers burn purchased candles within a week. Paraffin remains the most widely used wax, though alternatives such as beeswax, soy wax, palm wax, gels, and synthetic waxes are also used, often in blends. Meanwhile, the cosmetics and toiletries segment is projected to be the fastest-growing. Waxes in this category serve as structuring agents, SPF boosters, and waterproofing enhancers in products like lipsticks, balms, foundations, sunscreens, and mascara.

North America is expected to account for a significant 26.8% market share, primarily driven by the industrial capacity of the United States, strong domestic consumption and robust demand from various end-use industries. The United States and Canada together represent the second-largest share in global wax sales, largely due to the dominating presence of major personal care and cosmetics companies such as Colgate-Palmolive, Maybelline, and Johnson & Johnson. These companies continue to innovate and introduce new wax-based products that cater to a wide consumer demand.

Additionally, the regional market benefits from rising demand for specialty waxes particularly synthetic waxes used in cosmetics, pharmaceuticals, and coatings. The U.S. accounts as the largest consumer and importer of wax globally. This growth is further supported by a thriving packaging industry, with the U.S. packaging market valued at USD 211 billion in 2023, according to the Flexible Packaging Association.

On the production front, data from the U.S. Energy Information Administration indicates fluctuating output levels, with refinery net production of waxes at 1,945 thousand barrels in 2022, dropping to 1,723 thousand barrels in 2023, increasing to 2,159 thousand barrels in 2024, and recording 193 thousand barrels in January 2025.

Europe holds a significant share serving as both a major consumer and importer. The region's strong market presence is exemplified by its high demand for candles, with the European Candle Manufacturers Association reporting that approximately 700 million kilograms of candles are consumed annually within the European Union. This demand is largely fueled by the growing popularity of home wellness products such as scented candles, with 59% to 73% of European consumers regularly purchasing or using them.

On a global scale, candle imports increased from USD 2.8 billion to USD 4.6 billion over the same period, with Europe accounting for roughly 60% of total imports. According to UN Comtrade data, Germany emerged as the leading candle importer in Europe in 2022 with a 22% share, followed by the UK (14%) and the Netherlands (10%), while France (6.2%), Belgium (5.0%), and Austria (4.6%) also represent important markets. Beyond candles, Europe is a key player in the cosmetics industry, which heavily relies on beeswax. In 2023, the European cosmetics market was valued at approximately USD 109 billion, making up 24% of the global market. Moreover, sustainability, traceability, and ethical sourcing remain critical considerations across both candle and cosmetic wax segments, particularly for non-European suppliers to meet the regional standards.

In 2024, Asia Pacific dominated with a 34.4% revenue share, driven by the rise in living standards, rapid industrialization, and strong demand from major economies such as China and India. The growing cosmetic usage among the youth in countries such as China, Japan, India, Indonesia, and South Korea is significantly boosting wax consumption, particularly for products such as lotions, sunscreens, and makeup. Additionally, the expanding packaging industry in Southeast Asia is driving up demand for printing inks that use wax. China, one of the world’s top wax producers and consumers is projected to grow at a CAGR of 5.2% by 2032.

India’s wax market is expected to grow at a CAGR of 5.4%, supported by its packaging sector’s annual growth rate of 22–25% and its potential to produce up to 15,000 tons of beeswax annually, according to the Economic Advisory Council Beekeeping Development Report (2019) and the Packaging Industry Association of India. The demand for polyethylene wax is also increasing in the coatings sector, while natural waxes such as carnauba wax are gaining popularity in cosmetic applications. Urbanization and industrial growth continue to propel the use of wax-based products across the region.

The global wax market exhibits a moderately consolidated structure, with a few key players holding a significant share of the market while numerous smaller and regional players also contribute to the industry

Manufacturers are strategically expanding their product portfolios, embracing innovation, and focusing on sustainability to stay competitive. Clariant’s launch of Ceridust 1310 in 2025 addresses the supply chain challenges faced by formulators relying on carnauba wax, emphasizing reliability and market-driven solutions.

ExxonMobil's introduction of the Prowaxx™ brand in 2024 highlights a scalable, customer-tailored approach, ensuring clarity across wax types. Companies like Braskem are investing in renewable-sourced polyethylene wax to meet growing environmental demands, while Cargill’s US$15 million investment in India strengthens its position in the bioindustrial sector. HyImpulse’s 2020 launch of a candle wax-powered rocket showcases the diverse potential of wax beyond traditional applications. These developments illustrate a trend towards diversification, sustainability, and technological advancement, with key players investing in both renewable sources and high-tech innovations to cater to evolving market needs.

The global industry is projected to be valued at US$ 11,642.5 million in 2025.

The Candle segment is projected to hold a more than 33% share in 2024, driven by the rising popularity of scented candles for home décor and aromatherapy purposes.

The market is poised to witness a CAGR of 4.8% from 2025 to 2032.

The industry growth is driven by the rising demand from the candle and packaging industries, as well as the personal care and cosmetics sector.

Key opportunities include rising demand for natural waxes in eco-friendly products across North America, Brazil, and India, and expanding industrial applications in packaging, cosmetics, and construction in emerging markets such as China, Brazil, and Middle East.

The leading players in the market include Sinopec Corp, China National Petroleum Corporation, HollyFrontier Corporation, BP P.L.C, Nippon and Seiro Co., Ltd

|

Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

USD Million for Value, Tons for Volume |

|

Key Regions Covered |

|

|

Key Companies Covered |

|

|

Report Coverage

|

|

|

Customization and Pricing |

Available upon request |

By Wax Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author