ID: PMRREP4362| 199 Pages | 12 Jun 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

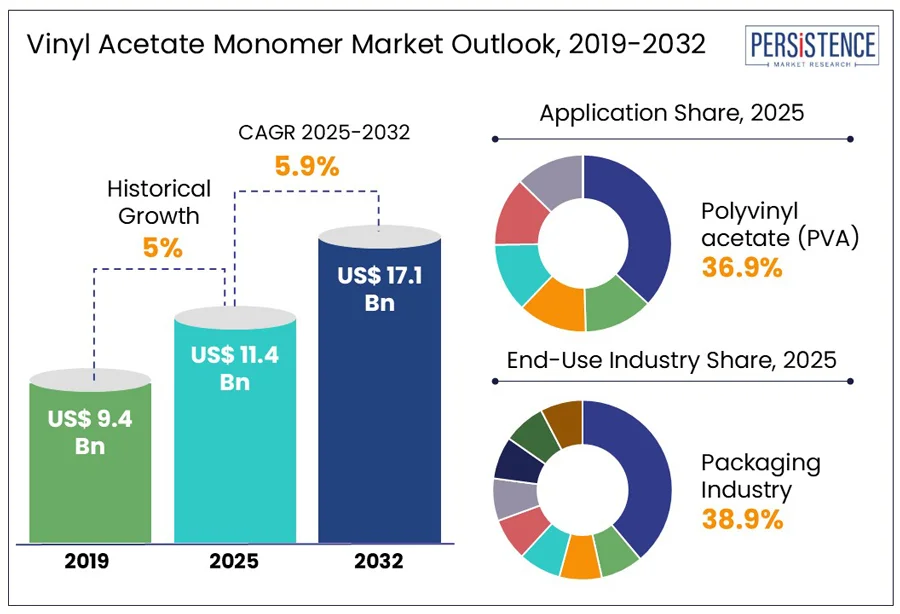

The global vinyl acetate monomer market size is projected to grow from US$ 11.4 billion in 2025 to US$ 17.1 billion, achieving a CAGR of 5.9% by 2032.

According to the Persistence Market Research report, the global vinyl acetate monomer industry is experiencing steady growth, driven by its widespread applications across various industries, including packaging, construction, textiles, and automotive. Vinyl acetate monomer is a crucial building block in the production of polyvinyl acetate (PVA) and polyvinyl alcohol (PVOH), both of which are used in adhesives, paints, coatings, films, and textiles. The increasing demand water-based adhesives and eco-friendly packaging solutions, is increasing along with rising infrastructure development and industrial activity in emerging economies.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Vinyl Acetate Monomer Market Size (2025E) |

US$ 11.4 Bn |

|

Market Value Forecast (2032F) |

US$ 17.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.0% |

Global demand for vinyl acetate monomer is significantly driven by the growing use of polyvinyl acetate-based adhesives across the construction and packaging industries. Enhanced bonding properties, ease of application, and compatibility with various substrates are valued particularly in flooring, woodworking, and insulation in the construction sector. Simultaneously, there is an increased demand for durable, lightweight, and recyclable materials in the packaging industry, further encouraging vinyl acetate monomer consumption.

In 2024, a strategic partnership took place between Celanese Corporation and Henkel Corporation to produce adhesives using captured CO? emissions, reinforcing sustainability in packaging and consumer goods. Celanese’s carbon capture and utilization (CCU) technology converts CO? into methanol, which is a key input in vinyl acetate monomer production. This monomer is then used by Henkel in manufacturing water-based adhesives, enabling customers to reduce environmental impact while incorporating renewable content. The collaboration is recognized as a model for advancing circular economy practices through innovation.

Stringent environmental and health regulations confine growth of the vinyl acetate monomer market. Moreover, the handling of acetic acid and the emission of volatile organic compounds (VOCs) add to the challenges. Regulatory frameworks enforced by agencies such as the EPA and REACH have mandated stricter limits on workplace exposure, storage, transportation, and waste management associated with hazardous chemicals used in VAM production.

Compliance requirements have necessitated the installation of advanced emission control systems and additional safety protocols, which have added complexity to manufacturing operations. As a result, production processes have been delayed or limited, especially in regions with tight environmental oversight. The scalability of VAM manufacturing has therefore been adversely impacted by the regulatory pressure to reduce environmental and occupational health risks.

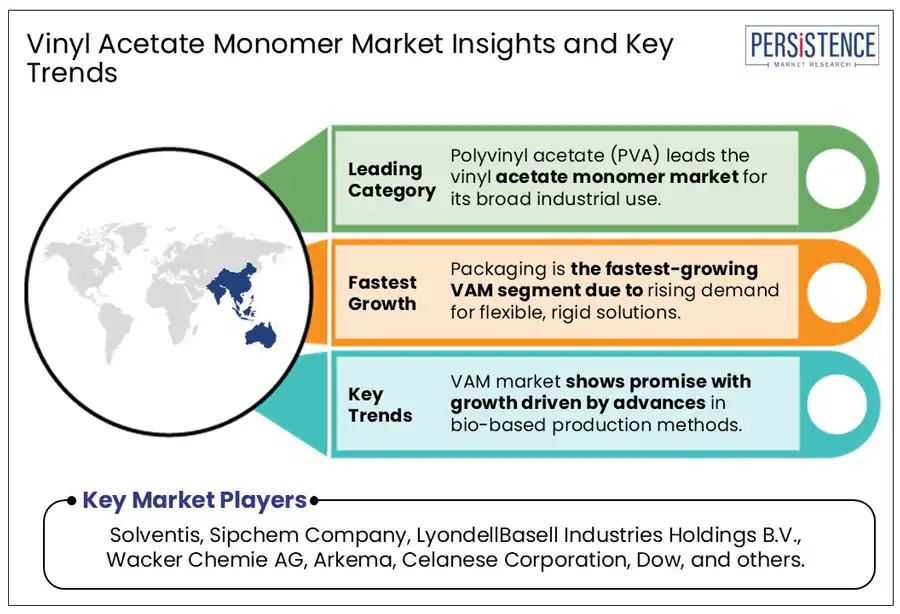

The vinyl acetate monomer (VAM) market presents a promising opportunity driven by advancements in bio-based production methods. As environmental regulations become increasingly stringent, conventional petrochemical-based synthesis routes are being scrutinized, prompting manufacturers to pursue renewable feedstocks such as bio-based acetic acid and ethylene derived from biomass. Supportive policies and incentives for low-carbon technologies are being introduced by regulatory bodies, further encouraging this shift.

In January 2024, Celanese Corporation initiated its carbon capture and utilization (CCU) project at its Clear Lake, Texas site. Through this project, approximately 180,000 tonnes of CO? emissions are being captured annually and converted into 130,000 tonnes of low-carbon methanol, a vital feedstock for VAM production. By integrating bio-methanol and bio-ethylene, Celanese has introduced ECO-B, a bio-content VAM material designed for eco-conscious customers. This initiative is being recognized as a pivotal step toward sustainable chemical manufacturing and aligns with the growing demand for greener alternatives.

Polyvinyl acetate (PVA) has been established as the dominant segment in the vinyl acetate monomer market due to its wide-ranging industrial applications. Its strong adhesion properties and water-based formulation have enabled its extensive adoption in adhesives, particularly for wood, paper, and packaging uses. PVA has been preferred for its film-forming capability, flexibility, and resistance to environmental stress in the paints and coatings industry. Increased regulatory pressure to reduce volatile organic compounds (VOCs) has further accelerated the shift toward water-soluble, low-emission materials, thereby driving sustained demand for PVA. As sustainability and performance continue to influence market preferences, the use of vinyl acetate monomer in PVA production is consistently reinforced.

The packaging industry is recognized as the fastest-growing end-use segment in the vinyl acetate monomer market, driven by increasing demand for flexible and rigid packaging solutions. VAM-based polymers, such as polyvinyl acetate (PVA) and ethylene-vinyl acetate (EVA), have been widely utilized for their strong adhesion, flexibility, and barrier properties. These materials are incorporated into laminating adhesives, sealants, and coatings to enhance shelf-life and visual appeal of packaged goods. The rapid growth of e-commerce and the rising preference for lightweight, durable, and recyclable packaging have further accelerated VAM consumption. As sustainability becomes a priority, low-VOC and recyclable packaging materials produced with VAM are being increasingly favored.

The U.S. vinyl acetate monomer industry is evolving due to increased investments in sustainable packaging. This shift is driven by rising demand from sectors like packaging, automotive, and construction, as consumers favor eco-friendly options such as recyclable and biodegradable materials. Low-VOC and water-based adhesives from VAM are gaining traction as they meet environmental standards. Regulatory pressures further encourage this trend, with stricter guidelines promoting sustainability.

Celanese Corporation has taken decisive action by expanding its VAM production capacity at its state-of-the-art facility in Clear Lake, Texas. This strategic move, announced in March 2024, highlights the company's investment in advanced catalytic technology. This innovative approach not only enhances production efficiency but also plays a critical role in significantly reducing carbon emissions, underscoring the commitment to both quality and the environment.

In Europe, the vinyl acetate monomer (VAM) market is experiencing significant growth in the coatings sector, driven by the region’s stringent environmental regulations and rising consumer demand for sustainable products. The push for low-VOC (volatile organic compound) formulations has led manufacturers to adopt VAM-based resins in waterborne, UV/LED, and powder coatings. These technologies not only meet regulatory standards but also provide enhanced durability and chemical resistance.

Arkema’s launch of global mass balance solutions for all coating technologies. In December 2024, Arkema achieved ISCC PLUS certification across multiple European sites France, Germany, and Spain allowing the production of coatings with up to 100% reduced carbon footprint through the use of renewable and recycled feedstocks. This initiative exemplifies the growing industry commitment to eco-friendly formulations and highlights Arkema's pivotal role in promoting sustainable coating solutions across Europe.

Rapid industrialization and infrastructure development are key drivers of vinyl acetate monomer (VAM) consumption in the Asia Pacific, particularly in the construction sector. Countries such as China and India are undergoing accelerated urbanization and executing large-scale infrastructure projects, fueling demand for VAM-based products such as adhesives, coatings, and emulsions. These materials are critical for enhancing the durability, insulation, and overall performance of construction components such as flooring and wall coverings.

In 2024, Sipchem Company made a US$189 million investment in a new ethylene vinyl acetate (EVA) production plant. The project aims to strengthen the supply chain for high-performance construction materials in Asia Pacific and position Sipchem as a key supplier in the growing market for advanced VAM derivatives. These strategic developments underscore the pivotal role of VAM in meeting the region’s infrastructure and urban development demands.

The global vinyl acetate monomer (VAM) market is characterized by the presence of several key players who dominate through innovation, strategic expansions, and strong distribution networks. Leading companies such as Celanese Corporation, Wacker Chemie AG, Dow, Arkema, and Sipchem Company maintain competitive advantages by investing heavily in research and development to enhance product quality and develop sustainable bio-based VAM alternatives. These players focus on expanding their production capacities across key regions, especially in Asia Pacific to meet rising demand from construction, adhesives, and packaging sectors.

Strategic partnerships, acquisitions, and technology collaborations are commonly employed to strengthen market position and diversify product portfolios. Additionally, companies prioritize compliance with environmental regulations by adopting greener manufacturing processes and reducing VOC emissions. The competitive landscape is further intensified by the entry of regional manufacturers aiming to capitalize on local demand. Overall, innovation, sustainability initiatives, and regional expansion are critical drivers shaping competition within the vinyl acetate monomer market.

The global Vinyl Acetate Monomer Market is projected to be valued at 11.4 bn in 2025.

The Vinyl Acetate Monomer Market is driven by the growing consumption of polyvinyl acetate-based adhesives in the construction and packaging sectors is propelling demand.

The Vinyl Acetate Monomer Market is poised to witness a CAGR of 5.9% from 2025 to 2032.

Expansion into bio-based VAM production presents a sustainable growth opportunity amid tightening environmental norms is the key market opportunity.

Major players in the Vinyl Acetate Monomer Market include Solventis, Sipchem Company, LyondellBasell Industries Holdings B.V., Wacker Chemie AG, Arkema, Celanese Corporation, Dow, and others.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Grade

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author