ID: PMRREP33536| 250 Pages | 11 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

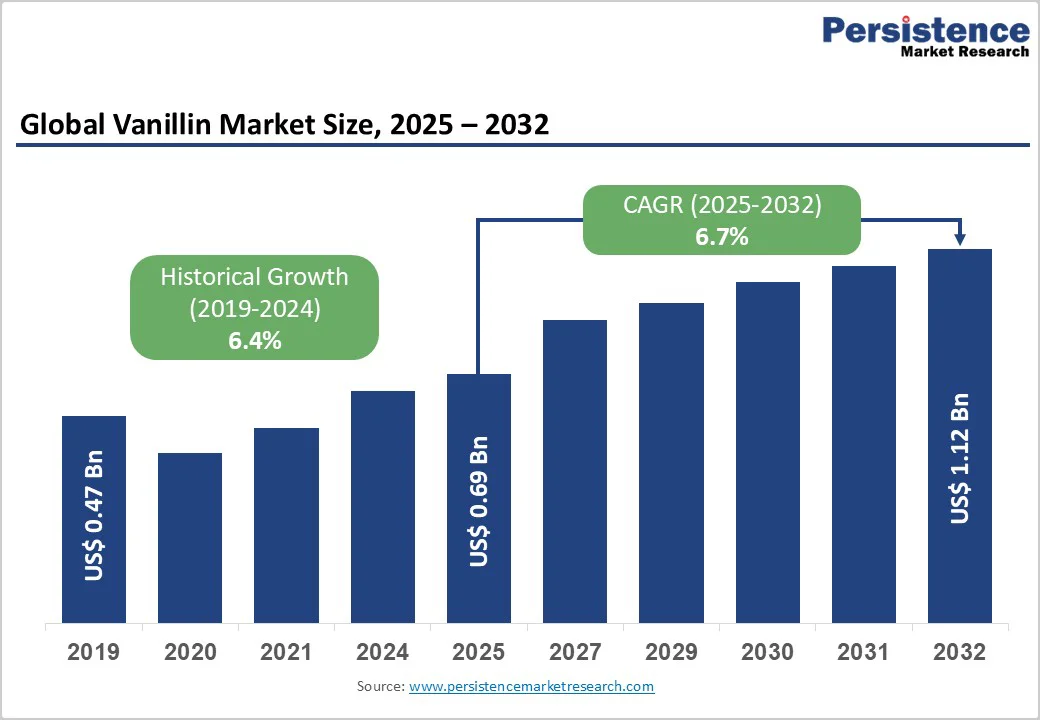

The global vanillin market size is likely to be valued at US$0.69 Billion in 2025 and is expected to reach US$1.12 Billion by 2032, growing at a CAGR of 6.7% during the forecast period from 2025 to 2032, driven by the expanding processed food and beverage sector, rising use in fragrances and personal care, and a clear market shift toward bio-based production using biotechnology and lignin valorization. Price fluctuations in synthetic vanillin, largely linked to raw-material and trade dynamics, are prompting companies to diversify sourcing and invest in bio-routes and certification programs.

| Key Insights | Details |

|---|---|

|

Vanillin Market Size (2025E) |

US$0.69 Bn |

|

Market Value Forecast (2032F) |

US$1.12 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.4% |

The rising preference for clean-label and naturally sourced ingredients is steering the market toward bio-vanillin produced through fermentation and lignin-based conversion. Industrial collaborations and technological advancements in precision fermentation are enhancing production scalability and yield efficiency. The bio-vanillin segment, currently valued in the low hundreds of millions globally, is anticipated to grow steadily throughout the next decade, reflecting increasing consumer and brand willingness to pay premiums for certified natural variants. As a result, global R&D and capital expenditure are shifting decisively toward low-carbon, renewable production routes.

Vanillin’s versatility as a flavor, fragrance, and masking agent continues to underpin robust demand. The compound is essential across confectionery, dairy alternatives, baked goods, and functional beverages, while also gaining ground in personal-care and household applications. Innovations in biodegradable and non-coloring vanillin derivatives are enabling its use in liquid detergents, perfumes, and skincare products, expanding its reach across consumer sectors. The diversification of use cases ensures stable growth momentum for both synthetic and bio-based vanillin in the medium term.

Synthetic vanillin depends heavily on petrochemical and lignin feedstocks, which are subject to volatile price cycles and shipping disruptions. Fluctuations in guaiacol and lignin costs, combined with periodic trade restrictions and tariff actions, have increased procurement uncertainty for downstream users. These factors compress producer margins and heighten the cost differential between synthetic and natural vanillin, adding pressure to reformulate or renegotiate long-term supply contracts.

Despite their environmental advantages, fermentation and lignin routes face commercial-scale challenges, including high capital investment, variable yields, and limited feedstock consistency. Natural vanillin retains a noticeable price premium over synthetic alternatives, constraining rapid substitution. Until unit costs and conversion efficiencies improve, the shift toward bio-based vanillin will remain gradual, concentrated primarily within premium food, fragrance, and cosmetic applications.

Advances in biotechnology are enabling precision fermentation of sugars into vanillin, combining natural-label compliance with industrial scalability. Early commercial projects are demonstrating feasibility at pre-production scale, suggesting strong upside potential once capacity is optimized. Companies that secure contract fermentation partnerships or invest in modular bioreactors can capitalize on the growing premium segment for natural vanillin, which is expected to more than double in value by the early 2030s.

Global brands are emphasizing traceability, biodegradability, and verified sustainability in ingredient sourcing. Producers that develop ISCC-compliant or equivalent certified vanillin, particularly those offering mass-balance or carbon-accounted grades, can differentiate their portfolios and attract long-term supply contracts. These verified supply chains not only support corporate sustainability targets but also open doors to premium pricing and exclusive procurement frameworks across major consumer-goods categories.

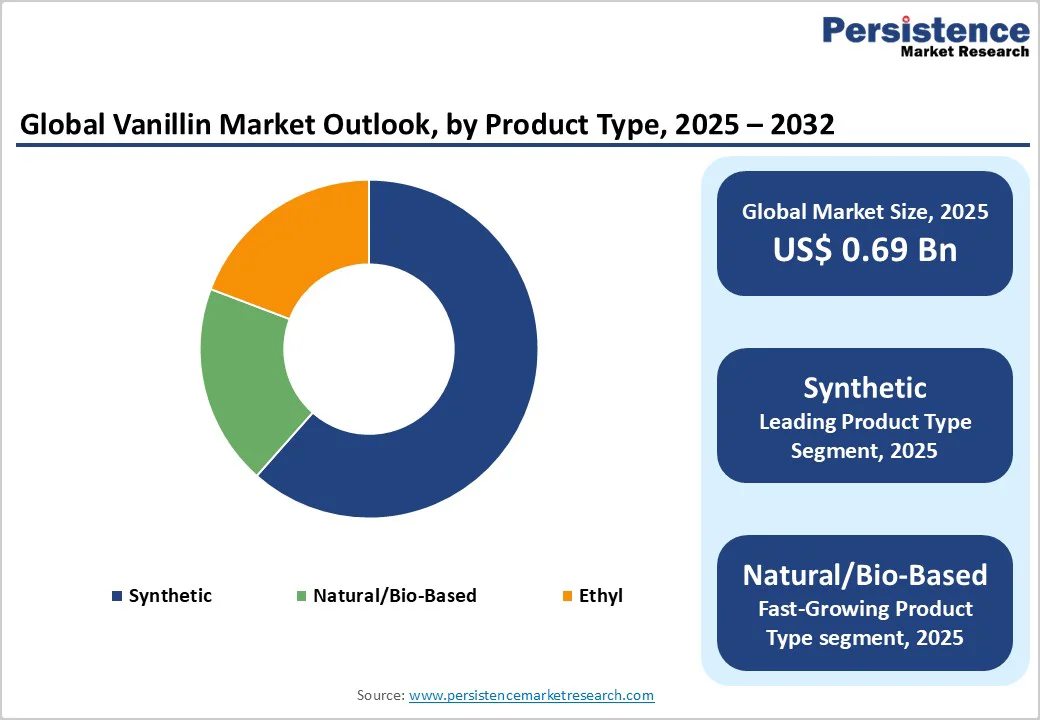

Synthetic vanillin accounts for over 64.6% of the global market in 2025, maintaining dominance due to its cost efficiency, consistent quality, and well-established large-scale production. Primarily synthesized from guaiacol or lignin, synthetic vanillin benefits from decades of process optimization that ensure high yield, stable supply, and uniform product characteristics. Its reliability and affordability make it indispensable across the food, beverage, and fragrance industries, particularly in confectionery, baked goods, dairy desserts, and flavored beverages, where it delivers a strong and consistent vanilla profile at a fraction of the cost of natural alternatives.

The natural and bio-vanillin segment represents the fastest-growing category, fueled by increasing consumer preference for clean-label, plant-based, and sustainable ingredients. Advances in biotechnological fermentation using feedstocks such as ferulic acid, rice bran, and lignin derivatives have improved production efficiency and commercial viability. Bio-vanillin’s adoption is expanding in premium chocolate, dairy, and personal-care products, where “natural flavor” labeling enhances market appeal. Growing regulatory recognition of fermentation-derived vanillin as a natural flavoring in key markets, including North America and the European Union, is further accelerating demand. This shift toward renewable, eco-friendly flavor ingredients underscores the evolving balance between affordability, sustainability, and consumer-driven innovation in the vanillin market.

Powder and crystalline vanillin account for the majority of global sales, commanding over 68.2% of the total market volume in 2025. These solid forms are preferred for their stability, long storage life, and ease of handling, making them ideal for high-volume food, beverage, and fragrance manufacturing. Powdered vanillin integrates seamlessly into dry premixes, instant desserts, baked goods, and confectionery coatings, ensuring uniform flavor distribution and precise dosing accuracy in automated production systems. From a logistical perspective, powdered formats allow bulk packaging in fiber drums or multi-layered bags, optimizing storage and transportation efficiency for industrial buyers. Their compatibility with various blending and encapsulation technologies enhances performance in heat-sensitive applications such as baked confectionery and flavored syrups.

The liquid and soluble formulations segment is projected to witness the fastest growth, driven by demand from ready-to-drink (RTD) beverages, flavored dairy products, and liquid personal-care items requiring rapid solubility and uniform flavor dispersion. Water- and ethanol-based vanillin solutions offer formulation flexibility and ease of incorporation into liquid systems. Manufacturers are advancing emulsified and biodegradable solvent technologies to enhance sustainability and sensory performance. Liquid vanillin blends are increasingly used in plant-based milks, craft sodas, and fine fragrances, while customized microencapsulation and solubilization techniques expand their use in cosmetic emulsions and detergents, supporting the shift toward eco-friendly, high-performance formulations.

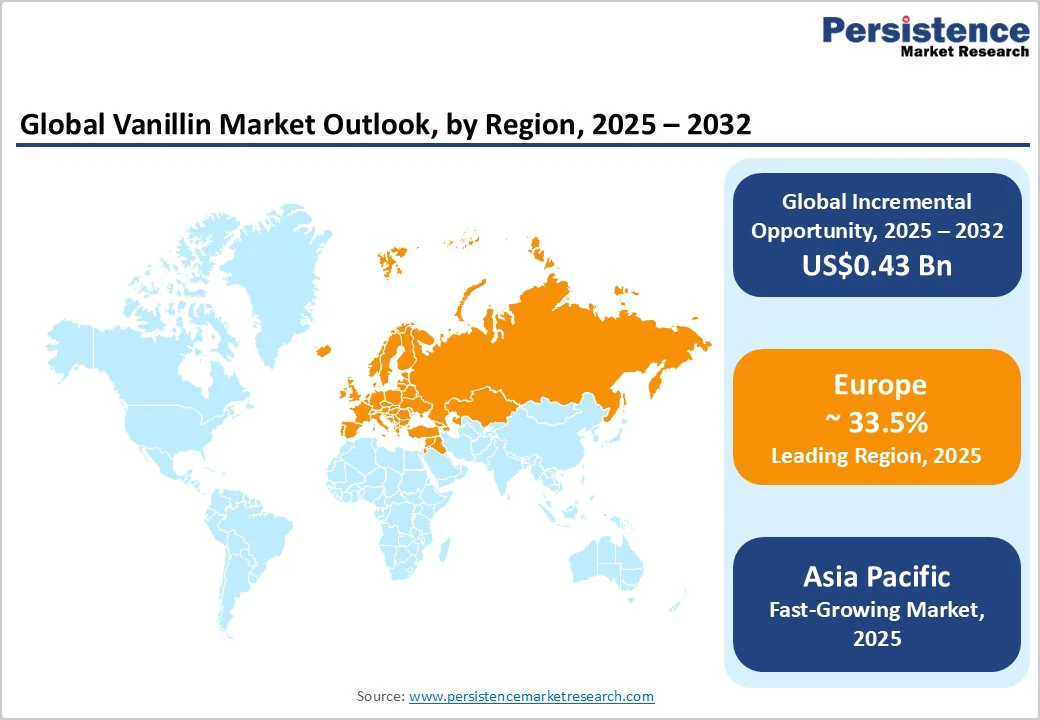

Europe represents one of the most sophisticated and sustainability-driven markets for vanillin worldwide, accounting for 33.5% of the market share. The region’s mature flavor, fragrance, and cosmetics industries, particularly in countries such as Germany, France, and the United Kingdom, are advancing the adoption of biodegradable, non-coloring, and traceable vanillin solutions. Demand is largely supported by strict regulatory frameworks under the European Food Safety Authority (EFSA) and the European Chemicals Agency (ECHA), which encourage suppliers to maintain certified natural and mass-balance compliant production processes.

Germany continues to lead in high-purity vanillin used in fine fragrances and premium foods, while France demonstrates strong adoption in natural dessert formulations and dairy-based flavoring systems. In Southern Europe, Italy and Spain are witnessing a rise in processed food exports, creating additional demand for cost-effective synthetic and hybrid vanillin blends.

In 2025, several flavor producers in Western Europe announced joint R&D initiatives to scale bio-fermentation technology using locally sourced ferulic acid and lignin feedstocks, reinforcing the continent’s shift toward circular bioeconomy principles. As sustainability regulations tighten under the EU Green Deal, Europe is projected to maintain a stable growth trajectory with an increasing share of bio-based vanillin consumption across both food and fragrance sectors through 2032.

North America is primarily driven by the United States’ extensive packaged-food, beverage, and personal-care manufacturing industries. The region’s high per-capita consumption of processed foods and beverages, along with strong preference for clean-label and certified natural ingredients, continues to fuel steady market expansion. The demand for both synthetic and bio-based vanillin is being shaped by reformulation trends in bakery, dairy, and wellness-oriented confectionery segments, where manufacturers are replacing artificial additives with certified sustainable alternatives.

A major driver for the region is the rapid adoption of mass-balance and naturally certified vanillin grades, as companies align their formulations with transparency-focused labeling requirements set by regulatory bodies such as the FDA and USDA. The United States remains the anchor market, witnessing an uptick in domestic fermentation facilities aimed at lowering dependence on imports and stabilizing raw material costs.

Canada is emerging as a strong secondary market, with investments in natural ingredient innovation and food sustainability programs. In 2024, a key development saw several contract fermentation firms in the U.S. Midwest initiate large-scale capacity expansion projects focused on bio-vanillin production from renewable lignin feedstocks.

Asia Pacific stands as the fastest-growing regional market for vanillin, driven by rapid industrialization, urbanization, and expanding food-processing capacity across emerging economies. The region accounts for the bulk of global synthetic vanillin output, with China serving as the central production hub due to its economies of scale, cost-efficient manufacturing, and integrated chemical supply chains.

Synthetic vanillin from China continues to dominate export volumes, supplying major food and fragrance manufacturers across the world. Meanwhile, India is emerging as a promising consumer and production center, propelled by its expanding bakery, confectionery, and dairy industries, along with growing consumer preference for natural ingredients in functional foods. Japan and South Korea are experiencing rising adoption of bio-fermentation technologies, supported by research incentives and investments in biotechnology parks. In 2024, several regional firms in China and India initiated joint projects to establish lignin-to-vanillin bioconversion facilities, signaling an early shift toward sustainable manufacturing practices.

ASEAN markets, particularly Indonesia and Thailand, are seeing steady growth in vanillin imports for use in snack and beverage applications, supported by expanding middle-class populations and food retail modernization. The region’s competitive production costs, coupled with expanding bio-fermentation infrastructure, are positioning Asia Pacific as both a leading exporter and a rapidly growing consumer base. The region is forecast to post the highest CAGR globally through 2032, driven by strong domestic demand, ongoing industrial upgrades, and a growing alignment with global sustainability standards.

The global vanillin market displays a moderately concentrated structure, where a limited number of international producers control significant technological and distribution capabilities, complemented by numerous mid-sized and regional suppliers. Large firms dominate in certified, application-specific, and high-purity grades, while smaller producers cater to cost-sensitive synthetic segments. Market concentration is most evident in premium natural and mass-balance categories, where R&D and certification investments act as high entry barriers. These developments underscore the market’s dual emphasis on technological innovation and supply-chain security, both critical to sustaining long-term competitiveness.

The global vanillin market size is estimated at US$0.69 Billion in 2025.

By 2032, the market is projected to reach approximately US$1.12 Billion.

Key trends include the accelerating shift toward bio-based and mass-balance certified vanillin, expansion of fermentation-derived production, and increased adoption in plant-based and premium confectionery products.

The synthetic vanillin segment leads the market with over 65% share in 2025, primarily due to its cost efficiency and consistent quality in high-volume food and beverage production.

The vanillin market is forecast to grow at a CAGR of 6.7% from 2025 to 2032.

Major companies include Solvay SA, Borregaard AS, Givaudan SA, International Flavors & Fragrances (IFF), and Lesaffre Group.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Form

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author