ID: PMRREP35799| 186 Pages | 31 Oct 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

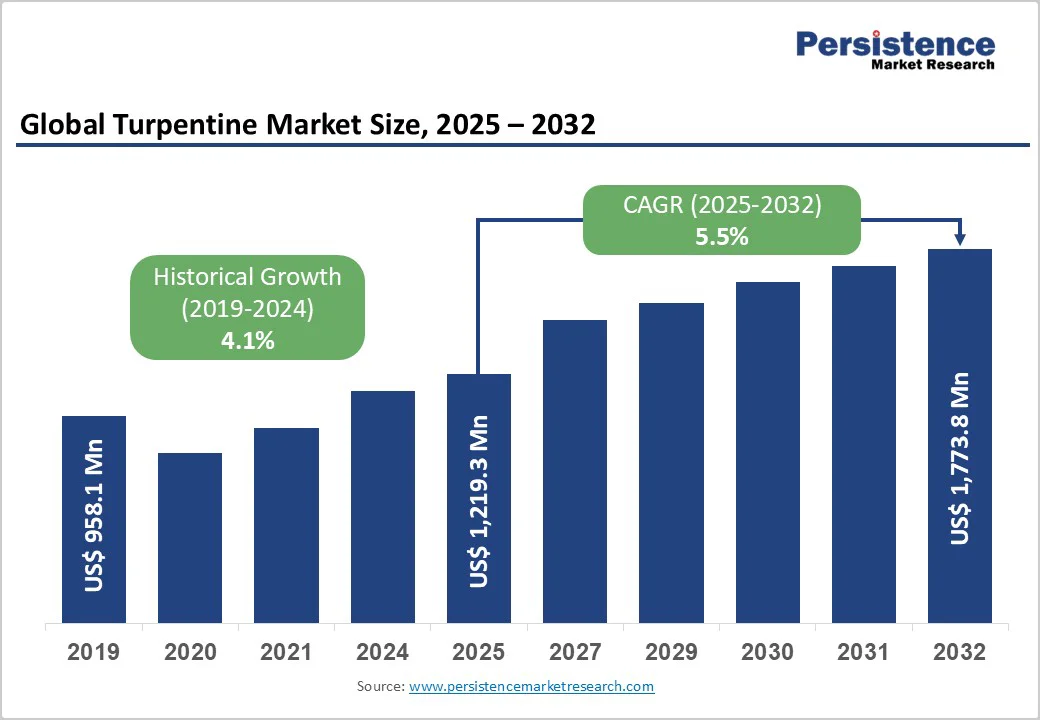

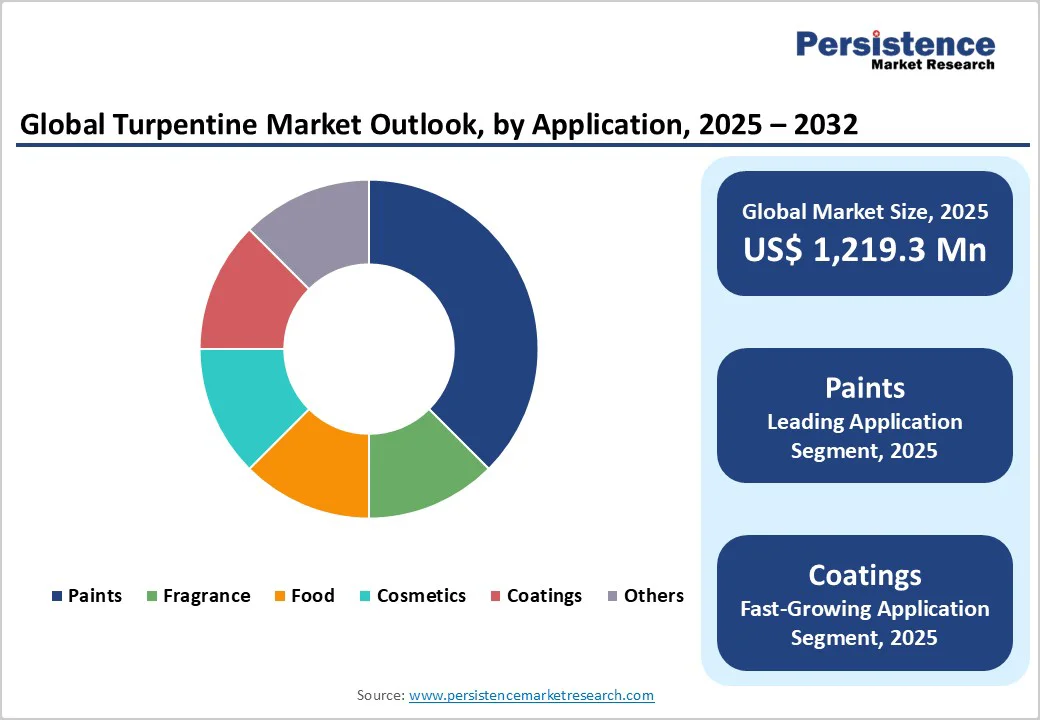

The global turpentine market size was valued at US$1,219.3 Mn in 2025 and is projected to reach US$1,773.8 Mn by 2032, growing at a CAGR of 5.5% between 2025 and 2032.

The market's expansion is primarily driven by rising demand for natural and bio-based solvents across industries such as paints, coatings, and fragrances, supported by stringent environmental regulations that promote sustainable alternatives to petrochemical products.

| Key Insights | Details |

|---|---|

| Turpentine Market Size (2025E) | US$ 1,219.3 Mn |

| Market Value Forecast (2032F) | US$ 1,773.8 Mn |

| Projected Growth CAGR (2025-2032) | 5.5% |

| Historical Market Growth (2019-2024) | 4.1% |

The growing preference for sustainable and renewable chemicals is a primary driver propelling the turpentine market forward, as industries transition from petroleum-derived solvents to bio-based alternatives amid growing environmental concerns.

Turpentine, derived from pine resin and wood byproducts, serves as an effective natural solvent in paints, adhesives, and cleaning products, aligning with global sustainability goals outlined in the United Nations Sustainable Development Goals (SDGs).

According to the International Energy Agency (IEA), bio-based chemical production is expected to increase by 30% by 2030, directly benefiting turpentine suppliers through enhanced market penetration in green formulations.

This driver is particularly evident in the paints and coatings sector, where turpentine's low toxicity and biodegradability reduce volatile organic compound emissions, complying with regulations like the U.S. Environmental Protection Agency (EPA) standards that mandate a 50% reduction in VOCs for industrial coatings by 2025.

Manufacturers report cost savings of up to 15% in compliance expenses when using turpentine instead of synthetic alternatives, fostering innovation in product development and improving supply chain efficiency. The integration of turpentine in the Crude Sulfate Turpentine Market further amplifies this growth, as pulp mills recover byproducts for commercial use, enhancing resource utilization and economic viability across the value chain.

The burgeoning applications of turpentine in fragrances, flavors, and pharmaceuticals represent a significant growth driver, fueled by consumer demand for natural ingredients and advancements in extraction technologies. As a key source of terpenes such as alpha-pinene and beta-pinene, turpentine enables the synthesis of essential oils and aroma compounds, meeting the rising demand for clean-label products in the personal care and food sectors.

Data from the World Health Organization (WHO) indicates that global fragrance consumption has surged by 20% since 2020, driven by wellness trends and aromatherapy, where turpentine derivatives provide antimicrobial and therapeutic benefits. Pharmaceutical formulations increasingly incorporate turpentine for its anti-inflammatory properties, with clinical studies published in the Journal of Natural Products highlighting its efficacy in drug delivery systems, potentially expanding market volumes by 12% annually.

Supply chain disruptions and price volatility in raw materials pose a substantial restraint on the Turpentine Market, hindering consistent production and profitability for stakeholders.

Turpentine sourcing relies heavily on pine forests and pulp byproducts, which are susceptible to climate events and logging restrictions, leading to supply shortages, as seen in 2024, when the FAO reported a 15% decline in global pine resin yields due to droughts in key regions like Brazil and Indonesia.

This variability results in price spikes, with turpentine costs fluctuating by up to 25% year-over-year according to commodity indices from the U.S. Department of Agriculture (USDA), increasing operational burdens for manufacturers in paints and chemicals.

Furthermore, reliance on seasonal harvesting intensifies issues, as inconsistent quality affects downstream applications in fragrances, where purity standards set by the International Fragrance Association (IFRA) require stable inputs.

These challenges reduced the profit margins, particularly for small-scale producers, and slowed market expansion by deterring investments in capacity building, ultimately constraining accessibility and scalability in emerging markets.

Regulatory hurdles related to health and environmental safety significantly restrain the turpentine market, as compliance costs and restrictions limit widespread adoption. Turpentine's volatile nature raises concerns over inhalation risks and skin irritation, prompting agencies like the EPA and ECHA to impose limits on VOC emissions and workplace exposure, with 2023 guidelines requiring a 40% reduction in solvent hazards for industrial use.

Studies from the National Institutes of Health (NIH) link prolonged exposure to respiratory issues, leading to bans on certain consumer products and increasing certification expenses by 20% for exporters. In Europe, the REACH framework mandates extensive testing for turpentine derivatives, delaying product launches and favoring synthetic alternatives in cost-sensitive sectors like automotive coatings. These regulations not only inflate production costs but also fragment the market, as non-compliant regions face trade barriers, ultimately impeding growth and innovation in traditional applications.

Market participants can capitalize on innovations in sustainable extraction and fractionation technologies, particularly for high-purity turpentine derivatives targeting the pharmaceutical and fine chemicals markets, promising significant revenue growth. Advances in distillation and biorefinery processes enable efficient recovery of terpenes from pulp byproducts, with the FAO noting a 25% improvement in yield efficiency through modern kraft pulping in 2024.

This opportunity is bolstered by rising demand for bio-based antiseptics and anti-inflammatories, where turpentine-derived compounds like camphor offer cost-effective alternatives, potentially generating US$500 million in new value by 2030, according to industry white papers from the American Chemical Society (ACS). Pharmaceutical giants are investing in these technologies, as evidenced by partnerships in Brazil's pine plantations, enhancing supply reliability and opening doors to high-margin segments amid global sustainability mandates.

The surge in demand for natural fragrances and flavors presents a key opportunity for turpentine producers, especially in cosmetics and food industries, which favor clean-label ingredients over synthetics. Consumer preferences for organic products have driven a 30% increase in sales of natural aromas, according to WHO wellness reports, positioning turpentine as a vital precursor for essential oils such as limonene and geraniol.

Emerging policies in the European Union (EU) promoting bio-based flavors, such as the Green Deal's target of 50% sustainable sourcing by 2030, create pathways for market entry. Key events in 2025 highlight expansions in Southeast Asian resin tapping, boosting output by 15% and enabling competitive pricing, which convinces stakeholders of the segment's potential to drive diversified revenue streams through ethical sourcing and product innovation.

Gum Turpentine leads the product type segment in the Turpentine Market with approximately 45% market share, attributed to its superior purity and versatility derived from direct pine resin distillation, making it ideal for high-value applications.

This dominance is supported by production data from the FAO, which indicates that gum turpentine accounts for over 40% of global resin-based outputs due to abundant pine resources in regions like China and Indonesia, ensuring cost-effective supply.

Its natural composition aligns with sustainability trends, as evidenced by a 20% rise in adoption for fragrance formulations per IFRA standards, outperforming sulfate variants in quality consistency. Manufacturers prefer gum turpentine for its low impurity levels, facilitating easier integration into pharmaceuticals and cosmetics, where regulatory approvals from the FDA emphasize bio-based purity, solidifying its leadership through reliable performance and market alignment.

Paints dominate the application segment with around 40% market share, driven by turpentine's role as an efficient solvent that enhances viscosity and drying in eco-friendly formulations. This leadership is justified by industry statistics from the American Coatings Association (ACA), reporting turpentine's use in 35% of low-VOC paints globally, spurred by construction booms and environmental mandates reducing petroleum solvents.

Its biodegradability reduces emissions by 30% compared to alternatives, as per EPA assessments, making it indispensable for automotive and architectural coatings. The segment's growth is further evidenced by a 15% annual increase in demand from infrastructure projects in Asia-Pacific, according to IEA reports, ensuring sustained dominance through technical superiority and regulatory compliance.

The Chemical industry holds the top position in end-use with about 35% market share, leveraging turpentine as a foundational feedstock for resins, adhesives, and terpene derivatives in industrial processes. This preeminence is backed by data from the ACS, showing chemical applications consuming 30% of global turpentine output due to its reactivity in polymerization, vital for synthetic rubber and solvents.

Economic analyses from the World Bank highlight a 12% growth in chemical production linked to bio-based inputs, underscoring turpentine's cost-efficiency and versatility. Its integration in value chains supports scalability, as seen in partnerships boosting output by 18% in 2024, per trade journals, affirming its pivotal role in driving sector innovation and efficiency.

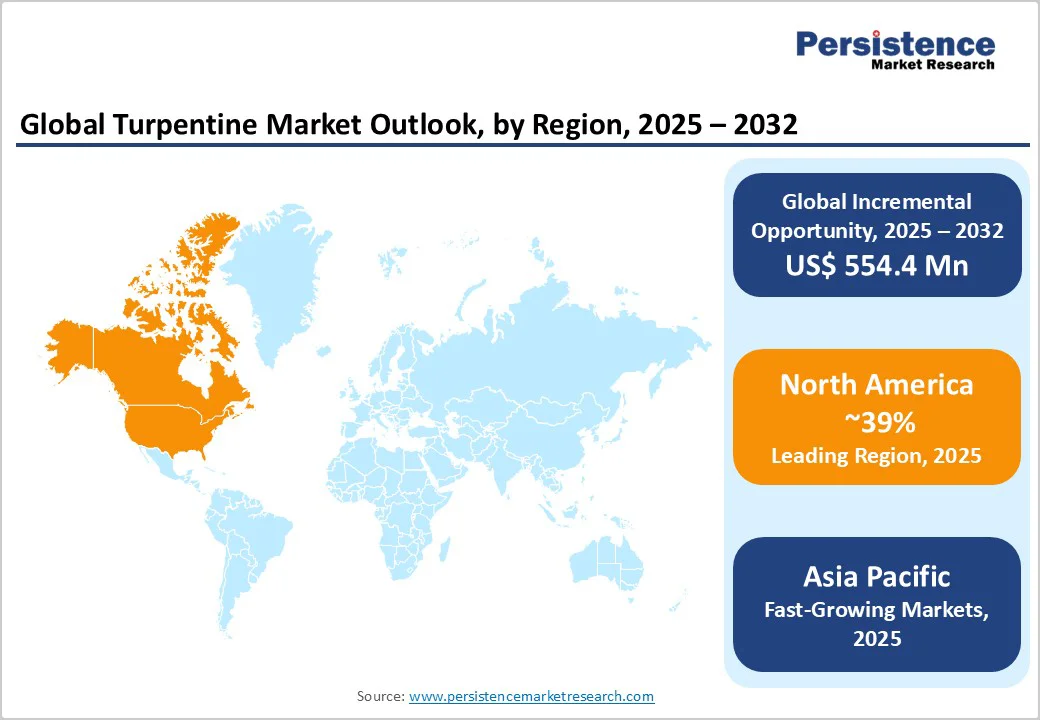

North America's Turpentine Market is characterized by robust U.S. leadership, underpinned by advanced pulp and paper infrastructure and a strong innovation ecosystem in bio-based chemicals. The region benefits from stringent EPA regulations promoting low-VOC solvents, with turpentine adoption in paints rising 20% post-2023 updates, as reported by the USDA.

Key developments include expansions in sustainable forestry, enhancing supply from southern pine plantations. Innovation thrives through R&D hubs like those in Georgia, where companies develop high-purity derivatives for pharmaceuticals, aligning with TSCA frameworks that favor renewables. This ecosystem fosters 15% annual growth in fragrance applications, per NIH studies on natural antimicrobials, positioning North America as a trendsetter in green chemistry.

Europe's Turpentine Market exhibits strong performance in Germany, U.K., France, and Spain, driven by harmonized REACH regulations that mandate sustainable solvents, boosting turpentine use in coatings by 25% since 2022, according to ECHA compliance reports.

Germany's pulp sector leads with efficient recovery technologies, while the U.K. focuses on fragrance innovations. The European Environment Agency (EEA) directives targeting 30% VOC emission reductions over five years are compelling manufacturers to reformulate products with bio-based solvents, including turpentine.

Regulatory alignment across the EU promotes bio-based alternatives, with France and Spain advancing in cosmetic applications amid a 18% rise in natural ingredient imports per Eurostat data. This fosters market stability, with developments like joint ventures enhancing terpene purity for pharmaceuticals.

Asia Pacific's Turpentine Market is propelled by manufacturing advantages in China, Japan, India, and ASEAN, where cost-effective production and rapid urbanization drive demand in chemicals and construction. China's vast pine resources support 30% of global output, with 2025 expansions increasing yields by 12%, as per FAO forestry updates.

India and ASEAN exhibit dynamic growth through infrastructure projects, utilizing turpentine in paints amid a 20% CAGR in building activities reported by the Asian Development Bank (ADB). Japan's precision in fragrance derivatives, tied to the Aroma Chemicals Market, enhances efficiency, while policy incentives for bio-solvents in India bolster regional dominance in volume-driven segments.

The global Turpentine Market is moderately fragmented, with a mix of integrated pulp producers and specialized chemical firms competing through regional strengths rather than global consolidation. Asian players dominate volume via low-cost resin sourcing, while North American and European entities focus on high-purity innovations.

Expansion strategies emphasize sustainable forestry and R&D for terpene derivatives, with key differentiators like eco-certifications and supply chain traceability. Emerging models include biorefinery integrations, enabling value addition in pharmaceuticals, and partnerships for market access, fostering growth amid regulatory pressures.

The global Turpentine Market is expected to reach US$ 1,773.8 Mn by 2032, growing from US$ 1,219.3 Mn in 2025 at a CAGR of 5.5%, driven by bio-based demand.

Key drivers include rising needs for natural solvents in paints and fragrances, supported by sustainability regulations and a 30% increase in bio-chemical production per IEA forecasts.

Gum Turpentine leads with 45% share, favored for its purity and applications in high-value sectors like cosmetics, per FAO resin data.

North America leads with 39% share, propelled by U.S. innovations and EPA compliance in sustainable solvents.

Advancements in terpene extraction for pharmaceuticals offer high-margin growth, with potential US$ 500 million value by 2030 via bio-derivatives.

Prominent players include Wuzhou Pine Chemicals Ltd., PT. Naval Overseas, and Guilin Songquan Forest Chemical Co., Ltd., leading through production capacity and innovations.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Mn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author