ID: PMRREP35959| 224 Pages | 17 Dec 2025 | Format: PDF, Excel, PPT* | Packaging

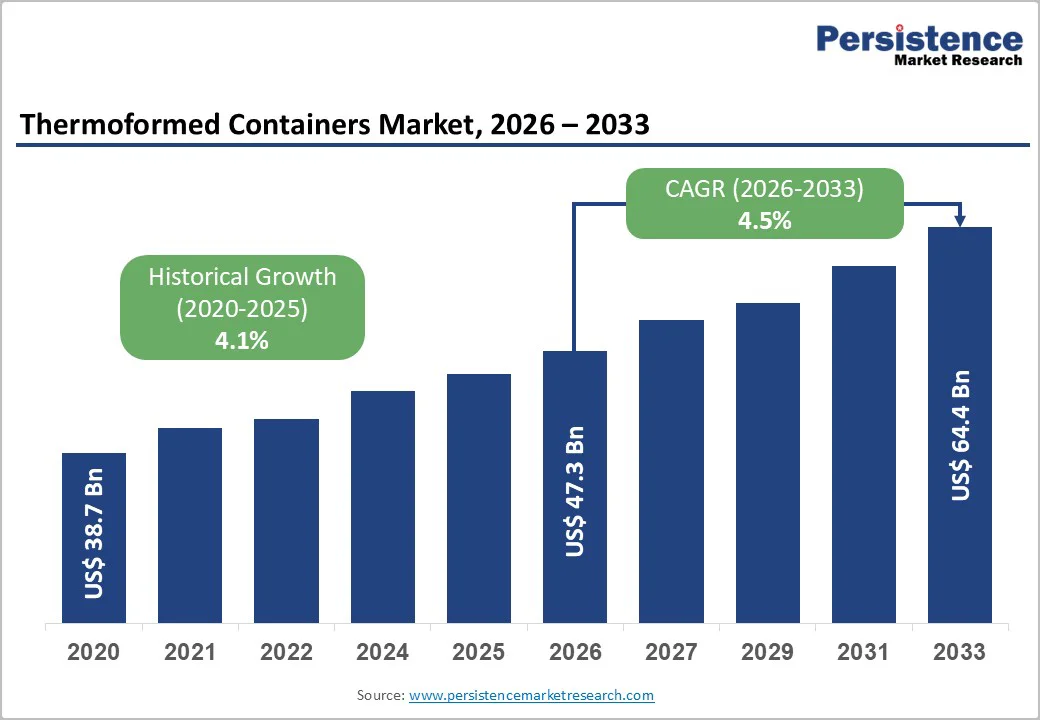

The global thermoformed containers market size is likely to be valued at US$47.3 billion in 2026 and is expected to reach US$64.4 billion by 2033, growing at a CAGR of 4.5% between 2026 and 2033, driven by rising demand for cost-efficient, lightweight packaging across food and pharmaceutical industries, increasing adoption of mono-material formats to improve recyclability, and steady advancements in thin-gauge thermoforming that reduce cycle times and material consumption.

The growing demand for packaged food, e-commerce, and retail-ready packaging is driving the use of clear, protective thermoformed trays, blisters, and clamshells. Regulatory pressures and consumer expectations are fueling investments in rPET and bio-based polymers.

| Key Insights | Details |

|---|---|

| Thermoformed Containers Market Size (2026E) | US$47.3 Bn |

| Market Value Forecast (2033F) | US$64.4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 4.5% |

| Historical Market Growth (CAGR 2020 to 2025) | 4.1% |

Food packaging represents the largest end-use segment for thermoformed containers, accounting for roughly 51% of total market volume. Demand continues to be driven by the rapid expansion of ready-to-eat meals, fresh-cut produce, meal kits, and shelf-ready retail formats. These applications rely heavily on thermoformed trays, lids, and clamshells that offer product visibility, physical protection, tamper resistance, and shelf-life extension.

Urbanization trends, changing household structures, time-constrained consumer lifestyles, and the ongoing expansion of refrigerated and frozen retail infrastructure support steady mid-single-digit volume growth across developed and emerging markets.

In response to evolving performance and sustainability expectations, packaging formats increasingly emphasize lightweight thin-gauge designs, improved oxygen and moisture barriers, and compatibility with automated filling and sealing systems. Brand owners and retailers are progressively specifying mono-material and recyclable solutions, particularly rPET and polypropylene, aligning packaging choices with broader environmental and circular economy commitments.

Regulatory pressure and retailer-led sustainability initiatives continue to reshape the thermoformed packaging landscape. Governments across major economies are tightening recyclability criteria, recycled-content thresholds, and extended producer responsibility requirements, accelerating the shift toward packaging formats that are compatible with existing collection and recycling systems.

Large retail chains increasingly incorporate sustainability metrics into supplier qualification processes, reinforcing demand for mono-material and recycled-content thermoformed containers. These policy and procurement frameworks are driving capital investment across the value chain, including new rPET processing capacity, bio-based polymer development, and upgraded thermoforming equipment.

While compliance-related costs are elevated in the near term, alignment with regulatory and retailer standards is increasingly associated with preferred supplier status and longer-term contract visibility.

Technological advancements in thermoforming equipment are contributing to improved productivity, quality consistency, and material efficiency. High-speed plug-assist forming, precision CNC trimming, in-line sealing, and automated inspection systems enable tighter dimensional control and higher output rates.

Modern thermoforming lines commonly achieve material reductions of approximately 10-25% per unit through gauge optimization, improved tool design, and enhanced nesting efficiency.

Increased automation also reduces labor intensity and variability, supporting scalability and cost control in high-volume food packaging applications. These efficiency gains play an important role in mitigating the impact of raw material price fluctuations and competitive pressure from alternative packaging formats such as flexible packaging and fiber-based solutions.

Thermoformed container production remains highly dependent on commodity polymers, including polystyrene, polypropylene, and PET, which are closely linked to petrochemical feedstock pricing. Resin price volatility can significantly affect converter profitability, particularly for companies with exposure to spot-market procurement.

Historical fluctuations have resulted in gross margin variability of several percentage points within single fiscal years. In response, industry participants increasingly diversify sourcing strategies through long-term supply agreements, financial hedging mechanisms, and selective incorporation of recycled or bio-based materials.

While recycled and alternative feedstocks can reduce exposure to virgin resin pricing, they often introduce higher initial costs, supply variability, and material requalification requirements.

Despite progress in mono-material design and recyclability-focused packaging development, recycling infrastructure for thin-gauge thermoformed plastics remains inconsistent across regions. Collection and sorting systems in many markets are optimized for rigid bottles rather than lightweight trays, lids, and clamshells, limiting effective recovery rates.

In regions with underdeveloped infrastructure, recycling rates for certain thermoformed products remain below 20-30%, increasing regulatory scrutiny and reputational exposure for value chain participants. Infrastructure gaps are particularly pronounced for food-contaminated packaging and complex multi-layer structures.

As a result, actual recycling outcomes often lag behind design intent, reinforcing the importance of material traceability, design-for-recycling alignment, and coordination among packaging producers, recyclers, retailers, and municipalities.

Opportunity Analysis - rPET and Bio-Polymer Conversion

The acceleration of recycled-content mandates and sustainability commitments across foodservice and retail sectors is creating a significant growth opportunity for rPET and bio-based thermoformed containers. As regulatory frameworks and retailer procurement standards increasingly favor recycled and renewable materials, adoption rates for rPET thermoforms are expected to rise steadily.

As approximately 20% of food packaging thermoform volume shifts to rPET over the next five years, it will create a significant increase in global recycled PET demand, impacting resin availability, pricing, and supply chain integration. This transition is altering the competitive landscape in the thermoforming market. rPET and bio-polymer formats require more advanced material handling, contamination control, and traceability compared to virgin polymers.

Consequently, value is increasingly concentrated among companies with strong recycled-resin sourcing networks, robust quality assurance processes, and verified chain-of-custody documentation. In addition to meeting regulatory requirements, rPET thermoforms are being marketed as a key brand differentiator, especially in premium fresh food, produce, and ready-meal categories, where sustainability and product visibility are highly valued.

Demand growth is supported by structural healthcare trends, including aging populations, the expansion of outpatient and home-based care, increased diagnostic and testing volumes, and the rising use of single-use medical devices to reduce infection risk.

Thermoformed trays, blisters, and device packaging are widely used for their dimensional precision, cleanliness, and compatibility with sterilization processes. Although total volumes are significantly lower than those in food packaging, medical and pharmaceutical thermoforms typically achieve higher average selling prices and more stable demand profiles.

Market participation is shaped by stringent regulatory requirements, including clean-room manufacturing, process validation, and compliance with medical device and pharmaceutical standards.

These requirements contribute to higher capital intensity and longer qualification timelines, reinforcing entry barriers and supporting margin differentiation relative to commodity food packaging applications. As healthcare spending continues to rise globally, medical thermoforming is expected to remain a structurally attractive niche within the broader thermoformed packaging market.

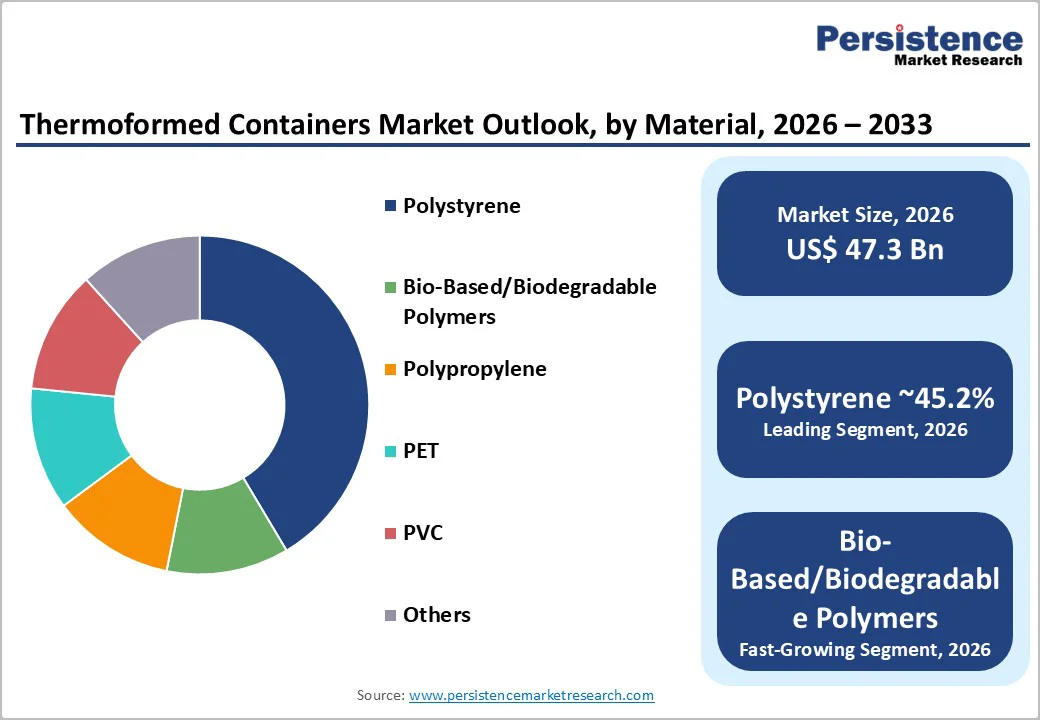

Polystyrene is anticipated to account for approximately 45.2% of total thermoformed container material demand, making it the most widely used polymer in the market. Its low resin cost, high clarity, and excellent thermoformability support extensive use across trays, blisters, and clamshells in food and consumer goods packaging.

PS and high-impact polystyrene (HIPS) are particularly common in high-volume applications such as fresh produce trays, bakery clamshells, and foodservice lids, where cost efficiency and fast cycle times are critical.

In retail environments, PS enables strong shelf visibility while maintaining structural rigidity at low material gauges. To address environmental concerns, manufacturers are increasingly redesigning PS packaging into mono-material formats that improve compatibility with mechanical recycling streams, especially in regions with established polystyrene recovery programs.

Bio-based and biodegradable polymers represent the fastest-growing material category. Materials such as PLA blends, starch-based polymers, and compostable composites are gaining adoption in single-use foodservice containers, on-the-go meal packaging, and specialty deli applications.

Growth is primarily driven by corporate sustainability commitments, regulatory pressure to reduce fossil-based plastics, and consumer preference for environmentally responsible packaging.

For example, compostable thermoformed cups and clamshells are increasingly used by quick-service restaurants and event caterers in markets with access to industrial composting. While higher material costs and processing constraints limit widespread adoption, early adopters benefit from premium pricing and long-term partnerships with sustainability-focused brands.

Blister packaging is estimated to account for approximately 36.5% of total thermoformed product demand, positioning it as the leading product type in the market. Thermoformed blisters are widely used in pharmaceuticals, small consumer electronics, batteries, and personal care products due to their ability to provide product protection, tamper evidence, and high shelf visibility.

In pharmaceutical packaging, thermoformed blisters are increasingly favored over cold-form foil in non-light-sensitive applications, as they offer lower production costs, faster forming speeds, and clear visibility of dosage units. Consumer electronics manufacturers also rely on thermoformed blisters to protect small components while enabling anti-theft display in retail environments.

Trays and lids represent the fastest-growing product segment, supported by strong demand from food retail, meal-kit providers, and e-commerce fulfillment operations. Growth is driven by increasing consumption of pre-packaged fresh foods, heat-and-serve meals, and retail-ready packaging formats that require consistent sizing and stackability.

For example, thermoformed trays with peelable lidding films are widely used for fresh protein packaging and ready meals in supermarkets. Converters investing in high-cavitation tooling, automated trimming, and integrated forming-to-ceiling lines can achieve higher throughput, reduced labor dependency, and improved cost efficiency, making this segment attractive for scale-oriented manufacturers.

North America represents a mature yet high-value thermoformed containers market, supported by strong demand from foodservice, retail-ready food packaging, and regulated medical applications.

The U.S. accounts for the majority of regional market value due to higher average selling prices, particularly in pharmaceutical blister packaging and medical device trays. Steady growth is sustained by rising convenience food consumption, expansion of private-label grocery offerings, and increasing healthcare utilization driven by aging demographics.

Regulatory oversight from agencies such as the U.S. Food and Drug Administration (FDA) and Health Canada shapes material selection, process validation, and quality documentation, especially for food-contact and medical packaging. As a result, converters continue to invest in automation, in-line inspection, and clean-room thermoforming capacity.

For example, companies such as Sonoco Products Company and Berry Global have expanded their North American thermoforming operations with a focus on rPET food trays and pharmaceutical packaging formats. Recycling initiatives at the state level, including recycled-content mandates and extended producer responsibility (EPR) discussions, are accelerating the qualification of recycled polymers and influencing packaging design decisions.

Strategic consolidation remains an important regional trend. Mid-sized converters increasingly pursue acquisitions to improve geographic coverage, tooling capabilities, and customer concentration in high-margin segments. These dynamics reinforce North America’s position as a technology- and compliance-driven market rather than a high-volume growth region.

Europe is defined by stringent regulatory frameworks, advanced sustainability adoption, and strong alignment with circular economy principles. Germany and the U.K. lead the region in high-value thermoformed packaging, supported by sophisticated food processing, pharmaceutical manufacturing, and retail sectors. France and Spain continue to show solid growth, driven by fresh produce exports, private-label retail expansion, and demand for portion-controlled food packaging.

EU-wide regulatory harmonization, including packaging waste directives and extended producer responsibility schemes, is accelerating the transition toward recyclable mono-material structures and higher recycled-content usage. Thermoformed PET and rPET trays are increasingly replacing multi-material formats, particularly in meat, dairy, and ready-meal applications.

Companies such as Faerch Group and Greiner Packaging have expanded rPET thermoforming capacity in Western and Central Europe, strengthening closed-loop recycling partnerships with retailers and brand owners.

Investment priorities across the region include recycling-compatible barrier technologies, digital traceability systems, and long-term contracts for recycled feedstock supply. Compliance capability, material transparency, and lifecycle documentation have become critical competitive differentiators, particularly for suppliers serving multinational food and pharmaceutical brands operating across multiple EU markets.

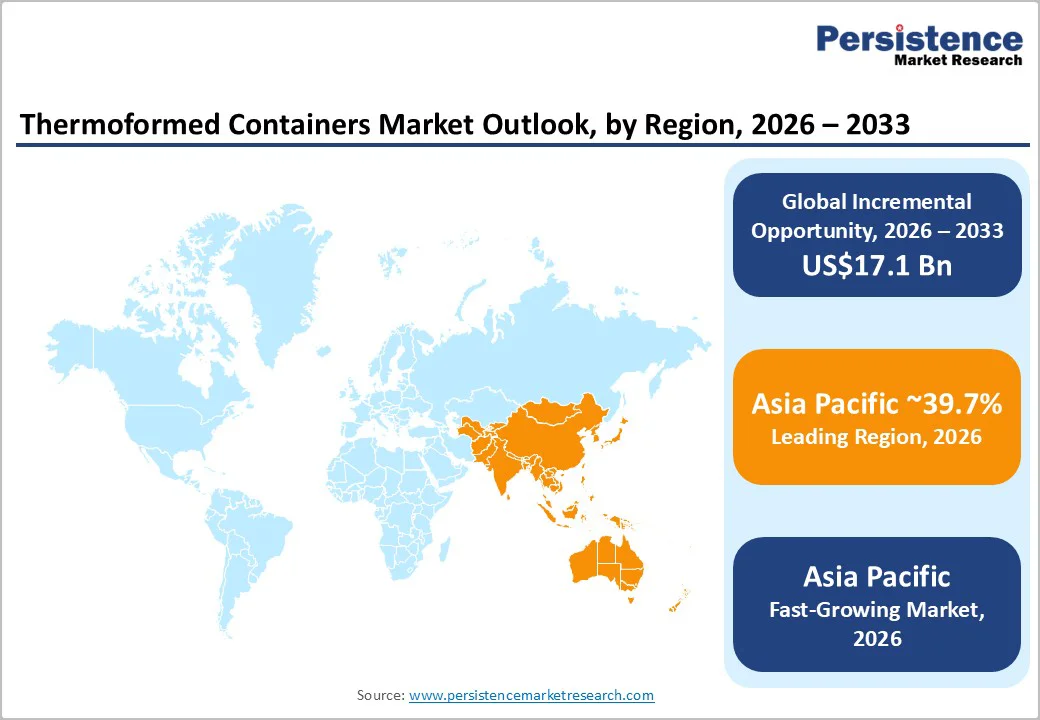

Asia Pacific is the largest and fastest-growing regional market, projected to account for approximately 39.7% of the market. Growth is driven by rapid urbanization, expanding middle-class populations, rising consumption of packaged foods, and large-scale manufacturing capacity across multiple countries. The region benefits from cost-efficient production, improving logistics infrastructure, and increasing adoption of modern retail and foodservice formats.

China represents the largest demand base, supported by high food processing volumes, export-oriented manufacturing, and growing pharmaceutical production. Japan emphasizes high-quality, precision thermoforming for medical, electronics, and specialty food applications, where material performance and consistency are critical.

Meanwhile, India and ASEAN markets are experiencing rapid growth due to expanding e-commerce, cold-chain logistics development, and rising disposable incomes that support packaged and convenience foods.

Global packaging companies such as Amcor and Huhtamaki continue to expand thermoforming capacity across Asia Pacific, focusing on thin-gauge food containers, cups, and trays for regional and export markets.

Investment activity increasingly targets high-speed, high-cavitation forming lines, regional tooling hubs, and export-compliant packaging formats, positioning Asia Pacific as both a consumption-driven and production-led market. These factors reinforce the region’s central role in shaping global supply chains for thermoformed containers.

The global thermoformed containers market is moderately fragmented, comprising global packaging groups, equipment manufacturers, and numerous regional converters. Large players dominate high-value segments such as pharmaceuticals and foodservice contracting, while smaller firms serve local and niche applications. Competitive differentiation is driven by scale, automation, sustainability capability, and regulatory compliance.

Recent developments include expansion of rPET thermoforming capacity, partnerships focused on automation and integrated packaging lines, and consolidation activity aimed at building scale in food and pharmaceutical packaging. These initiatives enhance cost efficiency, sustainability compliance, and customer reach.

Key strategies include sustainability-driven product differentiation, investment in validated medical packaging, automation-led cost optimization, and geographic expansion with a focus on Asia Pacific. Emerging models emphasize circular economy partnerships and value-added services.

The global thermoformed containers market size is likely to be valued at US$47.3 billion in 2026.

The thermoformed containers market is expected to reach US$64.4 billion by 2033, reflecting steady growth over the forecast period.

Key trends include rising demand for lightweight, low-cost food and pharmaceutical packaging and increasing adoption of mono-material and recycled PET (rPET) formats to meet sustainability targets.

The leading material segment is polystyrene with 45.2% share, widely used for trays, blisters, and clamshells in food and consumer goods.

The thermoformed containers market is projected to grow at a CAGR of 4.5% between 2026 and 2033.

Major players include Sealed Air Corporation, Amcor plc, Berry Global, Inc., Sonoco Products Company, and Huhtamaki.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Materials

By Product Type

By Applications

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author