ID: PMRREP32515| 230 Pages | 9 Feb 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

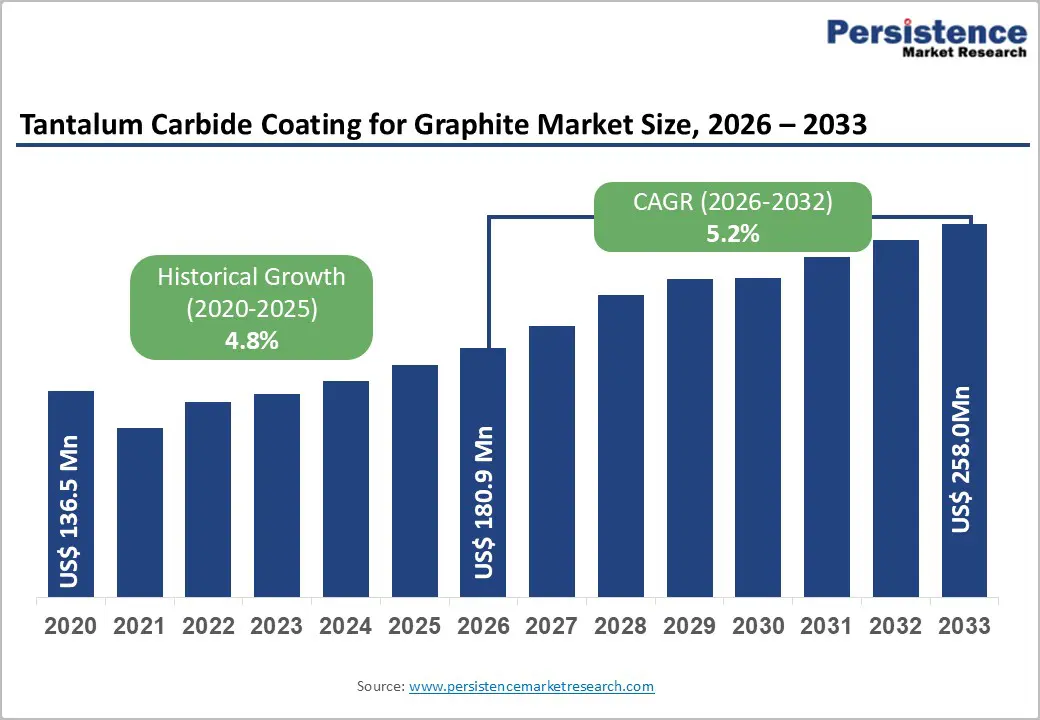

The global tantalum carbide coating for graphite market size was valued at US$ 180.9 million in 2026 and is projected to reach US$ 258.0 million by 2033, growing at a CAGR of 5.2% between 2026 and 2033.

The tantalum carbide coating for the graphite market is experiencing sustained expansion driven by escalating demand for advanced semiconductor manufacturing materials supporting wide-bandgap semiconductor production, including silicon carbide (SiC), aluminum nitride (AlN), and gallium nitride (GaN), growing requirements for thermal barrier and corrosion-resistant coatings in high-temperature industrial applications, and increasing adoption across epitaxial growth technologies.

| Key Insights | Details |

|---|---|

| Tantalum Carbide Coating for Graphite Market Size (2026E) | US$ 180.9 Mn |

| Market Value Forecast (2033F) | US$ 258.0 Mn |

| Projected Growth CAGR (2026 - 2033) | 5.2% |

| Historical Market Growth (2020 - 2025) | 4.8% |

The rapid expansion of wide-bandgap semiconductor manufacturing is a key driver for the global tantalum carbide coating for graphite market. Wide-bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN) are increasingly adopted in power electronics, electric vehicles, renewable energy systems, and advanced communication infrastructure due to their superior performance under high-voltage, high-temperature, and high-frequency conditions. The manufacture of these semiconductors involves extreme thermal, chemical, and mechanical conditions, particularly during crystal growth, epitaxial deposition, and high-temperature processing. Tantalum carbide-coated graphite components are widely used in these processes because they offer exceptional thermal stability, ultra-high melting point, chemical inertness, and resistance to erosion and contamination.

These coatings protect graphite susceptors, heaters, and crucibles from aggressive process gases while minimizing particle generation, which is critical for achieving high wafer yields and device reliability. As global investments in SiC and GaN fabrication facilities accelerate, driven by electrification trends and energy-efficiency mandates, demand for high-purity, long-life, coated graphite components continues to rise. The need for longer equipment lifecycles, reduced downtime, and higher process consistency further reinforcesthe adoption of tantalum carbide coatings, positioning wide-bandgap semiconductor manufacturing growth as a strong and sustained driver for market expansion.

Tantalum carbide coatings exhibit exceptional performance in extreme thermal environments, with corrosion rates approximately 6 times lower than those of silicon carbide (SiC) coatings in high-temperature ammonia and more than 10 times lower in high-temperature hydrogen. The coating exhibits superior resistance to thermal shock, chemical corrosion from process gases, and mechanical wear compared to conventional protective systems, extending equipment service life to approximately 200 hours before requiring replacement or restoration. TaC-coated graphite components maintain consistent performance under repeated thermal cycling, which is critical for bulk aluminum nitride (AlN) single-crystal growth and bulk silicon carbide (SiC) single-crystal growth operations.

Research demonstrates that AlN single crystals grown in TaC crucibles exhibit improved crystal quality with reduced defect density, micropore density, and etching pit density compared to uncoated graphite crucibles. The superior thermal conductivity of TaC coatings enables a more uniform temperature distribution during epitaxial growth, supporting the production of higher-quality semiconductor wafers with improved electrical properties and device performance.

Tantalum carbide coating application requires substantial capital investment in specialized manufacturing facilities equipped for advanced Chemical Vapor Deposition (CVD) and Physical Vapor Deposition (PVD) technologies. Tantalum raw material availability is geographically concentrated in limited regions, including Africa, Australia, and Southeast Asia, creating supply chain vulnerability and pricing pressures.

Manufacturing costs for TaC-coated graphite components remain significantly higher compared to conventional uncoated graphite or basic SiC-coated alternatives, limiting market adoption among cost-sensitive applications and emerging market manufacturers. Complex regulatory compliance requirements and quality assurance protocols necessitate continuous facility upgrades and validation testing, increasing operational expenses. The requirement for specialized technical expertise in coating process management and quality control further elevates production costs relative to conventional graphite processing technologies.

Silicon carbide (SiC) coatings are established alternatives for many applications, with extensive performance validation in semiconductor manufacturing and lower production costs than tantalum carbide systems. Emerging coating materials, including advanced ceramic composites and novel carbide formulations, are being developed, potentially displacing tantalum carbide in certain niche applications.

The continuous improvement in SiC-coated graphite technology and development of specialized coating systems for specific applications create competitive pressure on the tantalum carbide market share. Major competitors, including Bay Carbon, Toyo Tanso, and international graphite suppliers, continue optimizing SiC coating processes, potentially limiting TaC adoption expansion.

Bulk aluminum nitride (AlN) and bulk silicon carbide (SiC) single-crystal growth applications represent significant opportunities, as global demand for high-quality semiconductor substrates expands rapidly alongside the adoption of SiC and GaN in power electronics. The crystal growth segment for semiconductor materials is vital for producing high-purity, single-crystal materials essential for advanced device fabrication. Epitaxial films and Metal-Organic Vapor Phase Epitaxy (MOVPE) applications for GaN and AlN growth represent the fastest-growing application segments at approximately 7.8% CAGR, driven by LED lighting expansion, radio frequency device manufacturing, and power electronics proliferation.

China's emerging dominance in semiconductor manufacturing, supported by strategic government initiatives targeting semiconductor self-sufficiency, is driving substantial investments in advanced crystal growth equipment. TaC-coated graphite components enable improved crystal quality, extended equipment service life, and production efficiency gains supporting economic justification for premium coating adoption across high-volume manufacturing facilities.

Aerospace and defense applications represent emerging growth opportunities for tantalum carbide coatings, where extreme thermal stability, thermal shock resistance, and mechanical durability are critical performance requirements. Advanced aerospace propulsion systems, hypersonic vehicle development, and next-generation aircraft electronics require specialized high-temperature materials capable of withstanding operational temperatures exceeding 1600°C while maintaining structural integrity and preventing thermal cycling damage.

Machine tool applications, including precision cutting tools, grinding wheels, and specialized machining equipment, employ TaC-coated graphite components for enhanced wear resistance and extended service life. Emerging applications in nuclear reactor components, space vehicle heat shields, and advanced composite manufacturing support long-term market expansion. The global expansion of the aerospace and aviation sector, driven by rising air travel demand and defense modernization programs across developed and emerging economies, positions specialized coating materials as critical enablers of advanced vehicle and equipment development.

Chemical Vapor Deposition (CVD) represents the dominant coating method, commanding approximately 70% market share, driven by superior coating quality, exceptional adhesion strength, and proven performance validation across diverse semiconductor manufacturing applications. CVD processes enable precise control of coating thickness, microstructure, and composition by manipulating temperature, pressure, and precursor gas concentrations, thereby delivering customized formulations optimized for specific application requirements. CVD-applied tantalum carbide coatings exhibit a uniform thickness distribution, minimal porosity, and superior thermal-cycling resistance compared with alternative coating methods.

The segment's dominance reflects established global manufacturing infrastructure, comprehensive technical expertise among semiconductor equipment suppliers, and extensive performance validation across production environments. Physical Vapor Deposition (PVD) technologies, including sputtering and evaporation, represent alternative approaches gaining incremental adoption, with PVD accounting for approximately 30% market share. PVD-based coatings offer advantages, including lower processing temperatures and potential cost optimization, but generally deliver inferior corrosion resistance compared with CVD systems. The segment is projected to expand at a CAGR of approximately 4.8% through 2033.

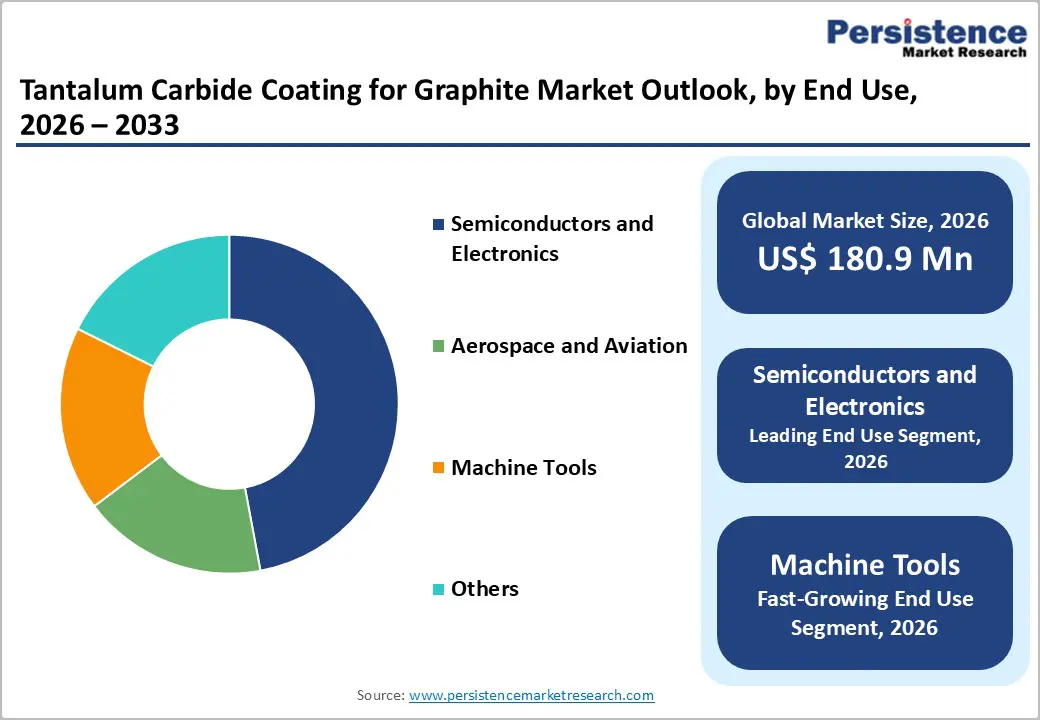

Semiconductor and electronics applications constitute the dominant market segment, accounting for approximately 48% of tantalum carbide coating demand, driven by essential use in bulk AlN single-crystal growth, bulk SiC single-crystal growth, and MOVPE epitaxial film production for wide-bandgap semiconductor manufacturing. Tantalum carbide-coated graphite crucibles serve as critical thermal-management components, enabling the production of high-purity, high-quality single-crystal semiconductor substrates essential for advanced device fabrication. Bulk silicon carbide (SiC) single-crystal growth is the largest application segment in semiconductor manufacturing, with SiC substrates commanding premium pricing and enabling high-performance power-electronics devices for electric-vehicle and renewable-energy infrastructure applications.

Epitaxial SiC films and Metal-Organic Vapor Phase Epitaxy (MOVPE) applications for GaN and AlN represent the fastest-growing segments, with an approximately 7.2% CAGR, driven by the expansion of LED manufacturing, radio-frequency device production, and power-electronics fabrication. Corrosion-resistant coatings for metal components represent secondary applications at approximately 22% market share, with tantalum carbide providing superior protection compared to conventional coating systems in high-temperature, chemically aggressive environments.

Semiconductors and electronics industries represent the dominant end-use segment, accounting for approximately 52% global tantalum carbide coating demand, driven by rapid wide-bandgap semiconductor market expansion and substantial investments in advanced manufacturing infrastructure. Aerospace and aviation applications constitute the second-largest end-use sector, with an approximately 24% market share, driven by increasing adoption of thermal-barrier and corrosion-resistant materials in advanced propulsion systems and vehicle components. Machine tool applications, accounting for approximately 18% of the market, reflect the use of precision cutting tools and grinding wheel components that require superior wear resistance and thermal stability.

North America maintains a strong market presence driven by advanced semiconductor manufacturing infrastructure, substantial investments in wide-bandgap semiconductor development, and significant aerospace and defense sector activity. The United States semiconductor equipment suppliers, including Advanced Energy Industries and specialized manufacturers, maintain substantial tantalum carbide coating capabilities supporting both domestic consumption and international export markets. Federal initiatives, including CHIPS Act, 2022 and semiconductor manufacturing incentives, are driving substantial capital investments in advanced semiconductor fabrication facilities across the region, supporting demand for specialized manufacturing equipment and coated graphite components.

North America's focus on high-end applications, advanced aerospace propulsion development, and next-generation power electronics manufacturing supports sustained demand for premium coating materials. Strong intellectual property protections and advanced research capabilities enable continuous innovation in coating technologies and the optimization of applications. Major graphite suppliers maintain established regional presence supporting semiconductor equipment manufacturers and specialized industrial customers with technical service capabilities and customized coating solutions.

Europe is a technologically advanced market characterized by stringent manufacturing standards, an emphasis on precision engineering, and substantial investments in semiconductor manufacturing and renewable energy infrastructure. Germany maintains market leadership at approximately 24% European market share, supported by advanced industrial infrastructure, precision manufacturing heritage, and the strong presence of semiconductor equipment manufacturers. The United Kingdom, France, and Spain contribute significant market activity through specialized applications in aerospace, defense, and advanced electronics manufacturing. European Commission regulatory frameworks emphasizing sustainability and circular economy principles drive adoption of advanced coating technologies, enabling extended component service life and reduced material wastage.

Europe's focus on high-precision applications and advanced materials development supports continued market growth through 2033. Strategic partnerships between coating suppliers and automotive manufacturers focusing on electric vehicle power electronics support emerging demand segments. The region's commitment to the renewable energy transition and energy-efficient manufacturing drives the adoption of wide-bandgap semiconductor technologies that require specialized graphite-coated components.

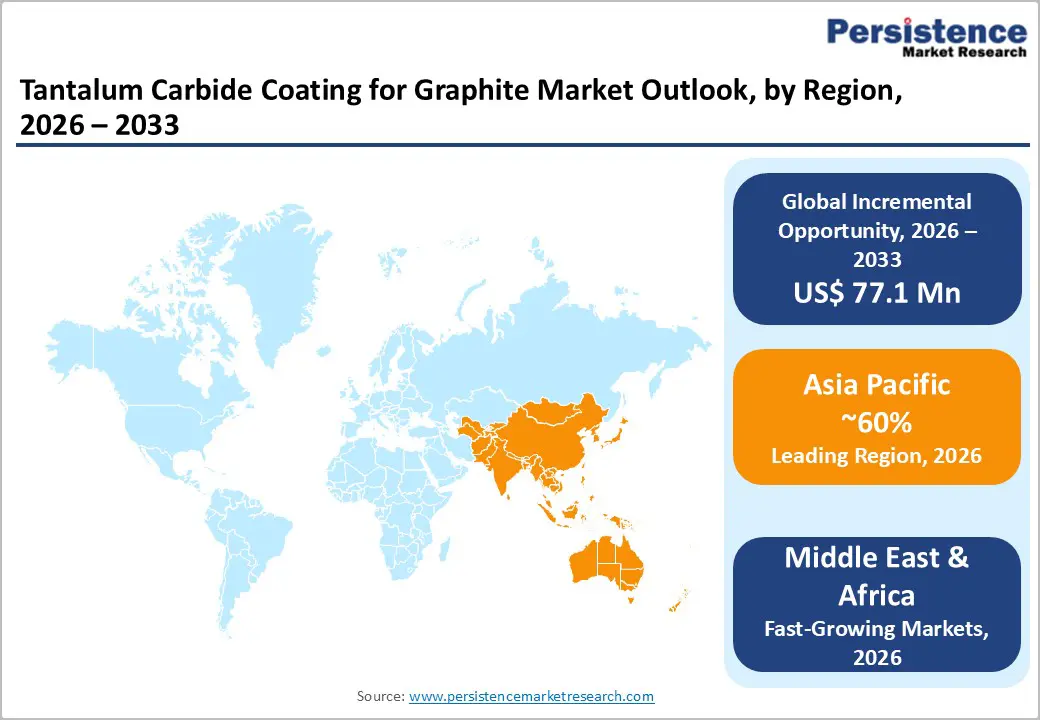

Asia-Pacific represents the fastest-growing regional market, accounting for approximately 60% global tantalum carbide coating demand, driven by China's semiconductor manufacturing dominance and rapid capacity expansion across the region. China is emerging as the dominant force in both production and consumption, with government strategic initiatives targeting semiconductor self-sufficiency and massive investments in advanced wafer fabrication facilities. The country's comprehensive supply chain, from graphite raw material sourcing to finished coated products, solidifies its leading position with continued capacity expansion anticipated through 2033. China's SiC and AlN crystal growth operations are expanding rapidly, directly supporting demand for specialized TaC-coated graphite components.

India is projected to exhibit robust growth at approximately 7.2% CAGR through 2033, driven by ongoing industrial expansion and increasing recognition of high-efficiency tantalum carbide coating systems as essential components for advanced manufacturing. Japan maintains an established presence through major graphite manufacturers, including Toyo Tanso, which has significantly expanded TaC-coated graphite production capacity through 2025-2026. South Korea and the ASEAN regions contribute to emerging demand driven by semiconductor manufacturing expansion and electronics industry growth. The region's manufacturing cost advantages, rapidly expanding industrial infrastructure, and growing domestic demand for electronic components position Asia-Pacific as the dominant regional growth driver through 2033.

The tantalum carbide coating for the graphite market exhibits moderate consolidation, with leading manufacturers including Toyo Tanso Co., Ltd., Bay Carbon Inc., Momentive Performance Materials, and Hunan WISE New Material Technology Co., Ltd. maintaining significant market positions through vertically integrated graphite processing, advanced coating technology capabilities, and established customer relationships. Toyo Tanso, a Japanese manufacturer, operates as a global leader with substantial production capacity and strategic focus on SiC and TaC-coated graphite product expansion, with the company announcing significant capital investment in TaC-coated graphite capacity expansion by 2026.

Bay Carbon and Nanoshel LLC compete through specialized technical capabilities, customized coating formulations, and targeted focus on niche applications across the semiconductor and aerospace sectors. Regional manufacturers, including American Elements and Pacific Particulate Materials (PPM) Ltd., compete through localized distribution networks, technical support capabilities, and responsive customer service. Companies emphasize continuous innovation in coating methodologies, cost optimization through process improvements, and emerging application development supporting market differentiation and competitive positioning.

The global tantalum carbide coating for graphite market is projected to reach US$ 258.0 million by 2033 from US$ 180.9 million in 2026, representing a compound annual growth rate (CAGR) of 5.2% during the forecast period.

Primary demand drivers include explosive expansion of SiC and GaN power semiconductor market projected at 19.1% CAGR through 2029, growing requirements for specialized materials in bulk AlN and bulk SiC single crystal growth operations, increasing adoption of MOVPE and CVD technologies in advanced semiconductor manufacturing.

Epitaxial SiC films and Metal-Organic Vapor Phase Epitaxy (MOVPE) applications represent the fastest-growing segments at approximately 6.8-7.2% CAGR, driven by expansion of LED manufacturing, radio frequency device production, power electronics fabrication, and wide-bandgap semiconductor market proliferation.

Asia-Pacific represents the dominant regional market, accounting for approximately 60% global tantalum carbide coating demand, with China and India emerging as fastest-growing markets at 6.5% CAGR and 7.2% CAGR respectively.

Primary opportunities include rapid expansion of bulk crystal growth and epitaxial applications for wide-bandgap semiconductors, emerging aerospace and machine tool applications requiring advanced thermal stability materials, China's semiconductor self-sufficiency initiatives driving substantial equipment investments.

Key market players include Toyo Tanso Co., Ltd., Bay Carbon Inc., Momentive Performance Materials, Hunan WISE New Material Technology Co., Ltd., American Elements, Nanoshel LLC, and Pacific Particulate Materials (PPM) Ltd.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units |

|

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Coating Method

By Application

By End-Use Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author