ID: PMRREP35773| 188 Pages | 26 Oct 2025 | Format: PDF, Excel, PPT* | Food and Beverages

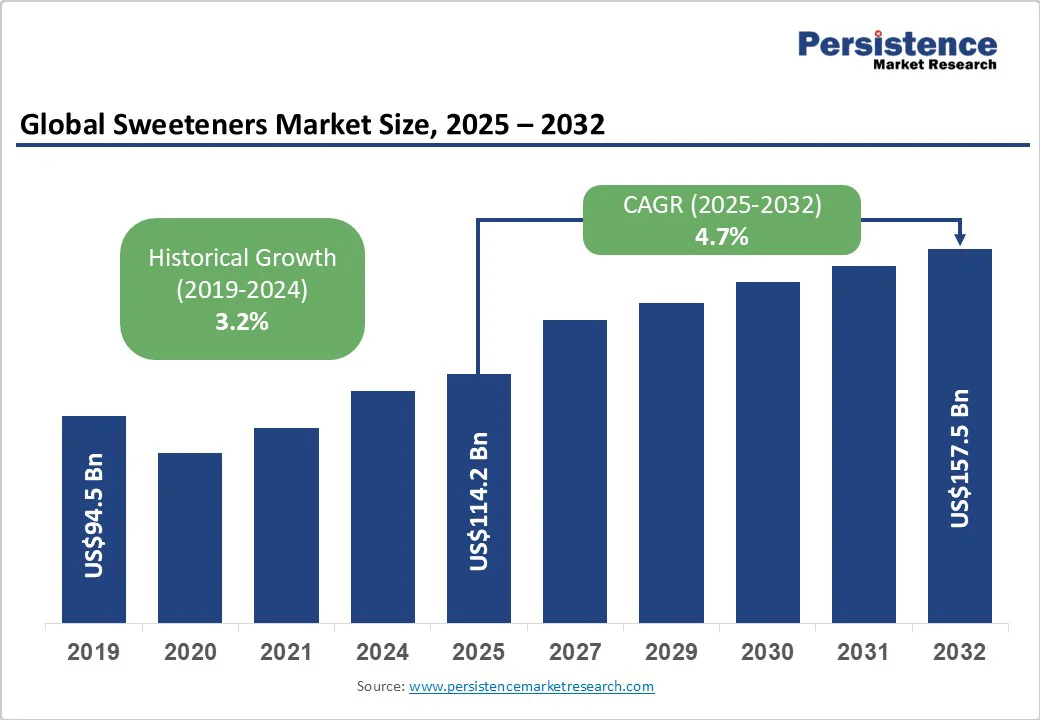

The global sweeteners market is expected to reach US$114.2 billion in 2025. It is estimated to reach US$157.5 billion in 2032, growing at a CAGR of 4.7% during the forecast period 2025-2032, driven by rising health awareness, shifting dietary habits, and regulatory efforts to curb sugar intake. Consumers are now opting for low-calorie alternatives to manage weight and prevent lifestyle diseases.

| Key Insights | Details |

|---|---|

|

Sweeteners Market Size (2025E) |

US$114.2 Bn |

|

Market Value Forecast (2032F) |

US$157.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.2% |

Consumers are increasingly turning to low-calorie and zero-calorie sweeteners as part of their efforts to manage weight without giving up sweet-tasting foods. With obesity rates climbing, the demand for sugar substitutes that allow calorie reduction has intensified. For example, the World Obesity Federation projects over 1 billion obese adults globally by 2030.

Beverage and snack companies are reformulating products using stevia, monk fruit, and allulose to appeal to calorie-conscious buyers. For example, Coca-Cola and PepsiCo have both introduced reduced-sugar product lines using natural sweeteners to meet this rising health-driven demand.

Sweeteners have become essential for individuals managing diabetes, as they provide sweetness without triggering rapid increases in blood glucose levels. According to the International Diabetes Federation, more than 90 million adults in Southeast Asia alone live with diabetes, pushing demand for safe sugar alternatives.

Stevia and sucralose are especially popular in diabetic-friendly food and beverages. Brands such as Splenda and Equal have also broadened their ranges to cater specifically to diabetic consumers seeking sweet taste with better glycemic control.

One of the major limitations in the adoption of sugar alcohol-based sweeteners is their potential to cause digestive side effects. Compounds such as sorbitol, xylitol, and mannitol are only partially absorbed in the intestine, and when consumed in large amounts, they can lead to bloating, gas, or diarrhea.

It has led some consumers to avoid products labeled with polyols, especially in the functional food and confectionery segments. As awareness of gut health grows, brands are becoming more cautious about dosage levels and are exploring alternative blends that minimize gastrointestinal effects without compromising sweetness.

Increasing scientific scrutiny is another key restraint for the global market. A 2023 study published in Nature Medicine associated high levels of erythritol in the bloodstream with an increased risk of heart attack and stroke, sparking consumer hesitation and renewed debate over artificial sweeteners.

Although further studies are required to confirm causation, such reports have led retailers and manufacturers to reassess formulations and marketing claims. This uncertainty around long-term safety could slow down adoption, especially among health-conscious consumers seeking natural and transparent ingredient options.

The introduction of sugar taxes across several countries has created a new opportunity for sweetener manufacturers to expand their presence. Countries such as the U.K., Mexico, and Thailand have imposed levies on high-sugar beverages, pushing food and drink producers to seek calorie-free or reduced-calorie substitutes.

This shift has prompted beverage giants such as PepsiCo and Nestlé to reformulate products using stevia and erythritol blends to comply with regulatory standards. The economic pressure of these taxes is encouraging companies to innovate with naturally derived sweeteners that not only meet health requirements but also preserve taste. This trend is further opening new growth avenues for low-calorie sweetener suppliers.

Recent developments in monk fruit extraction and blending technologies are addressing the long-standing issue of bitterness found in earlier natural sweeteners such as stevia. Companies, including Tate & Lyle and Apura Ingredients, have introduced next-generation monk fruit formulations with improved sweetness profiles suitable for premium food and beverage applications.

These developments enable manufacturers to deliver a clean and sugar-like taste in health-oriented and zero-sugar product categories. The surging appeal of monk fruit as a label-friendly, plant-based sweetener presents an opportunity for companies targeting consumers who want both taste authenticity and natural origin.

Sucrose is speculated to hold nearly 42.1% of the share in 2025, backed by its clean, balanced sweetness and versatility across food and beverage formulations. It not only improves flavor but also provides texture, volume, and color development during baking and caramelization. Also, its natural origin and consumer familiarity make it the benchmark for sweetness intensity in new product formulations. Even as companies experiment with natural and low-calorie substitutes, sucrose remains the reference point for taste and mouth-feel optimization.

Tagatose will likely gain popularity through 2032 as a rare sugar that provides about 90% of sucrose’s sweetness, with significantly fewer calories and a low glycemic index. It behaves like regular sugar in baking and dairy applications, making it attractive to manufacturers seeking clean labels without compromising taste. The U.S. FDA’s ‘generally recognized as safe’ (GRAS) status for tagatose and rising research activities by Bonumose and Südzucker have accelerated its use.

Solid sweeteners are expected to capture around 72.7% of the share in 2025 owing to their ease of use, stability, and suitability for both industrial and household consumption. They are preferred in dry mixes, bakery premixes, and tabletop formats as they provide consistent sweetness and long shelf life. The rise of on-the-go health products, including protein bars and instant beverages, has further boosted the use of solid sweeteners that maintain formulation integrity without affecting texture or flavor.

Liquid sweeteners are gaining traction as they blend smoothly into beverages, sauces, and processed food, delivering uniform sweetness distribution. They simplify large-scale manufacturing processes by eliminating the requirement for additional mixing or dissolving steps. Beverage companies use liquid forms of stevia, agave syrup, and sucralose for faster production and improved taste stability. For example, Coca-Cola and PepsiCo utilize liquid sweetener blends to fine-tune sweetness profiles in low-sugar and zero-sugar drink formulations.

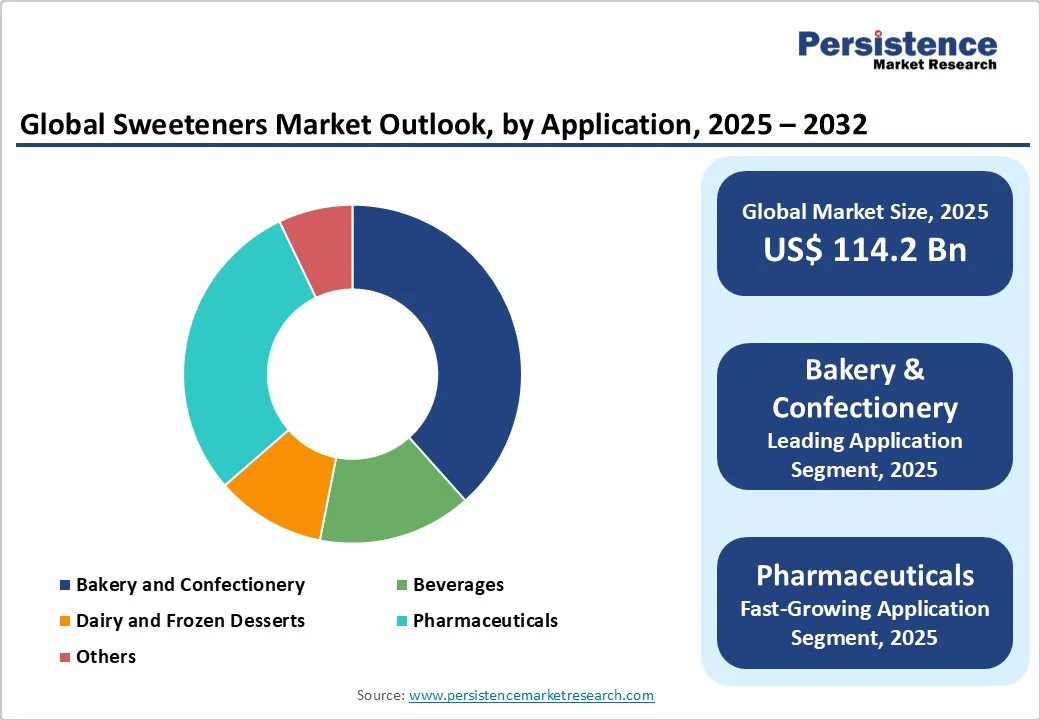

The bakery and confectionery segment is poised to account for approximately 38.4% of share in 2025, as sugar and its alternatives play multiple roles beyond sweetness, including bulk formation, moisture retention, and color improvement during heating. Sweeteners such as stevia and allulose are now being incorporated into sugar-free chocolates, cookies, and pastries to meet clean-label and low-calorie demands. Brands such as Hershey and Mondelez have recently launched reduced-sugar confections, reflecting the rising trend toward indulgent yet health-conscious treats.

Sweeteners are important in the pharmaceutical sector for improving the palatability of syrups, chewable tablets, and oral suspensions. Artificial and natural sweeteners such as sucralose and sorbitol help mask the bitterness of active ingredients without affecting stability or absorption. In addition, sugar alcohols serve as bulking agents in lozenges and vitamin gummies. With the rising consumption of pediatric and geriatric medicines, demand for safe and non-cariogenic sweeteners is increasing, thereby prompting drug manufacturers to reformulate with low-calorie options such as xylitol and maltitol.

In 2025, the Asia Pacific is estimated to account for approximately 37.2% of the share, as consumers move away from artificial sweeteners toward natural and low-calorie alternatives. Rising health awareness, particularly around obesity and diabetes, is driving this shift. India, China, and Japan are seeing a constant rise in the use of stevia and monk fruit-based sweeteners in packaged food and beverages. The demand is also spurred by government initiatives promoting sugar reduction, such as front-of-pack labeling and ‘healthier choice’ logos in several ASEAN countries.

South Korea and Japan have emerged as early adopters of next-generation sweeteners such as allulose. South Korea-based companies, including Samyang and Daesang, are expanding domestic production of allulose to cater to rising demand for clean-label and sugar-like taste profiles. In Japan, allulose and other rare sugars have received regulatory approval and are used in snacks, beverages, and bakery items. This early acceptance gives both countries a competitive advantage in developing unique and low-calorie food formulations.

North America’s market is witnessing a steady shift toward natural, low-calorie, and clean-label options. Consumers are moving away from traditional artificial sweeteners such as aspartame and saccharin due to long-term health concerns and a surging preference for plant-based ingredients. This has created new opportunities for stevia, monk fruit, and allulose.

In 2024, the U.S. Food and Drug Administration (FDA) confirmed that allulose does not need to be included in the ‘total sugars’ or ‘added sugars’ section on nutrition labels, which has accelerated its adoption across beverage and snack categories. Brands such as Chobani and Quest Nutrition have already reformulated products using allulose to provide a sugar-like taste without calories. The sweetener has become one of the most talked-about products in North America, delivering about 70% of sugar’s sweetness with negligible calories.

Europe’s market is defined by strict regulations, rising preference for natural ingredients, and a steady move toward sugar reduction augmented by public health policies. The European Food Safety Authority (EFSA) maintains one of the toughest approval systems globally, which has limited the penetration of new sweeteners, including allulose, compared to the U.S. In April 2024, EFSA issued a positive scientific opinion on allulose’s safety, opening the door to its inclusion in EU food and beverage formulations. This is predicted to trigger reformulations across baked goods, soft drinks, and dairy alternatives once final EU approval is granted.

Consumer sentiment in Europe is highly health-oriented, with increasing skepticism toward artificial sweeteners such as aspartame and acesulfame-K. The World Health Organization’s 2023 advisory against using non-sugar sweeteners for weight control further influenced purchasing decisions. Natural sweeteners such as stevia and monk fruit have gained popularity, especially in Western Europe. Stevia-based products are now common in brands such as Coca-Cola Life and Danone’s Light & Free yogurt line, as companies work to balance sweetness and calorie control while maintaining clean-label credentials.

Large ingredient houses, including Cargill, ADM, Tate & Lyle, Ingredion, and Roquette still characterize the global sweeteners market. They sell both commodity sweeteners, such as cane sugar and HFCS, as well as ingredient-grade alternatives, including stevia extracts and polyols.

These firms compete on expansion, supply-chain reach, and co-development deals with big Consumer Packaged Goods (CPGs) rather than on consumer branding. A new tier of competition is precision-fermented and high-purity plant-derived sweeteners, such as EverSweet/next-gen stevia blends.

The sweeteners market is projected to reach US$114.2 Billion in 2025.

Rising health consciousness and sugar reduction initiatives are the key market drivers.

The sweeteners market is poised to witness a CAGR of 4.7% from 2025 to 2032.

Expanding applications in beverages and the growth of rare sugars such as tagatose are the key market opportunities.

The Archer-Daniels-Midland Company, Ingredion Inc., and Cargill, Incorporated are a few key market players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Form

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author