ID: PMRREP21127| 198 Pages | 5 Nov 2025 | Format: PDF, Excel, PPT* | Food and Beverages

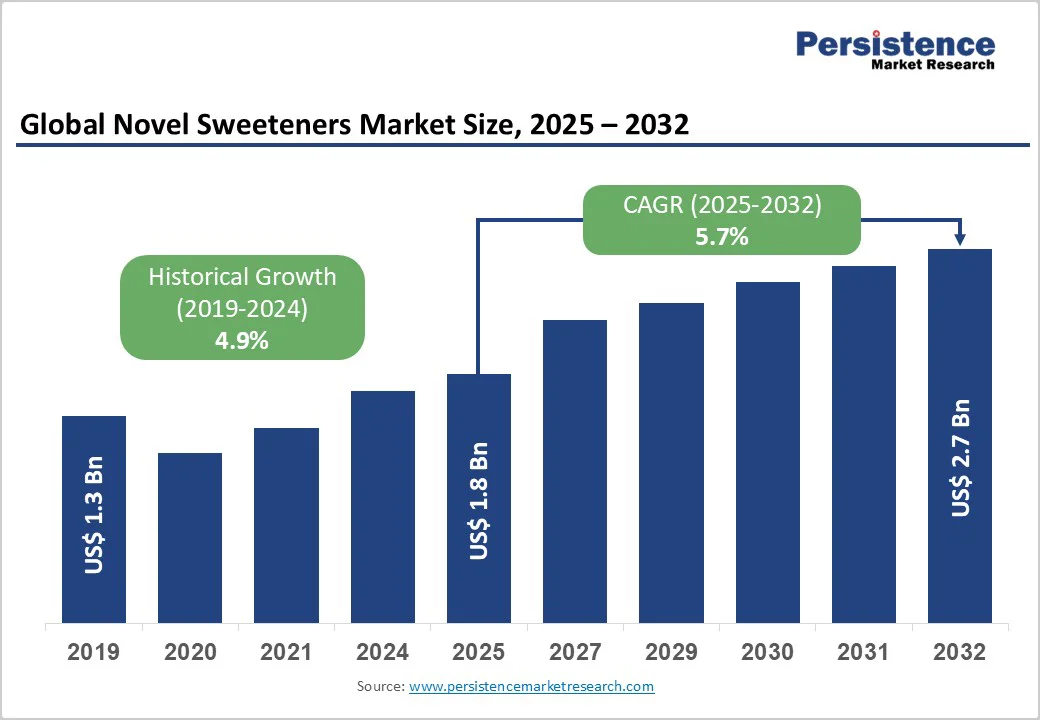

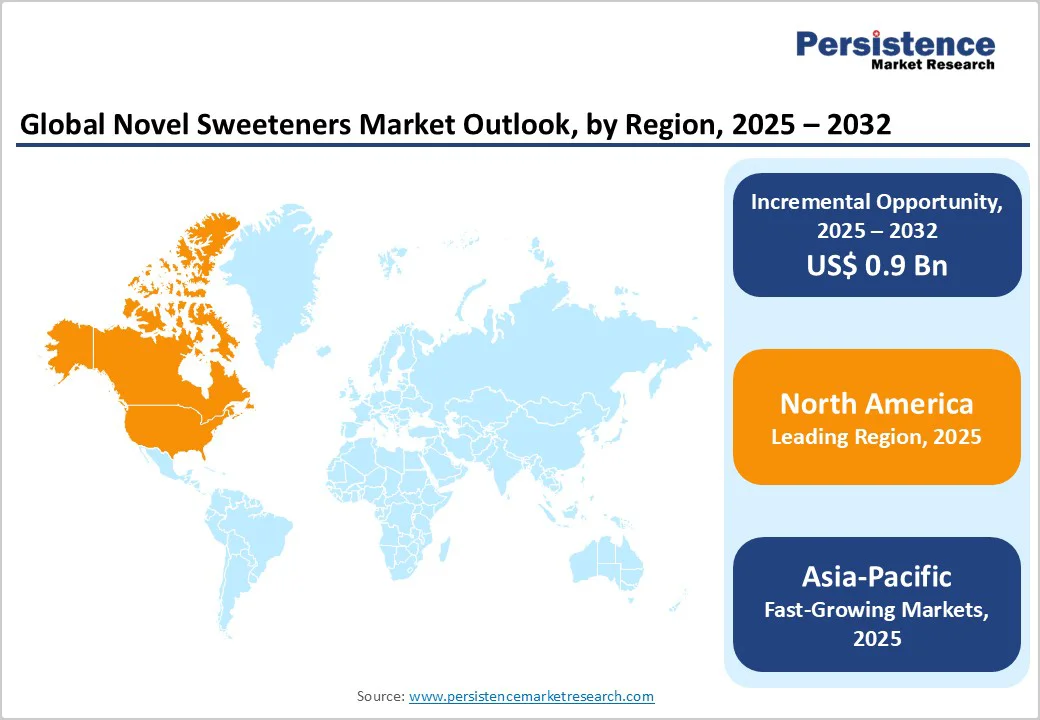

The global novel sweeteners market size is likely to value at US$ 1.8 billion in 2025 and projected to reach US$ 2.7 billion, growing at a CAGR of 5.7% during the forecast period from 2025 to 2032. The global market is expanding steadily due to rising demand for low-calorie, natural ingredients in food, beverages, and personal care. North America leads with strong health awareness, while Europe benefits from its developed organic industry. Asia-Pacific is the fastest-growing region, driven by urbanization, higher incomes, and increasing adoption of sugar alternatives.

| Key Insights | Details |

|---|---|

|

Global Novel Sweeteners Market Size (2025E) |

US$ 1.8 Bn |

|

Market Value Forecast (2032F) |

US$ 2.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

5.7% |

|

Historical Market Growth (CAGR 2019 to 2024 |

4.9% |

The global surge in lifestyle-related health issues, such as obesity and diabetes, is significantly influencing consumer preferences towards healthier food and beverage options. According to the World Health Organization (WHO), the number of people living with diabetes worldwide increased from 200 million in 1990 to 830 million in 2022, with the prevalence rising more rapidly in low- and middle-income countries. Additionally, in 2022, 1 in 8 people globally were living with obesity, and 43% of adults aged 18 years and over were overweight. These alarming statistics underscore the urgent need for dietary interventions.

In response, health authorities such as the WHO recommend reducing the intake of free sugars to less than 10% of total energy intake, with a further reduction to below 5% providing additional health benefits. This guidance aligns with the growing consumer demand for low-calorie, sugar-free, and natural ingredients in food and beverages. Consequently, the novel sweeteners market is experiencing significant growth, driven by the increasing preference for alternatives that support healthier lifestyles without compromising on taste.

The production of novel sweeteners such as stevia, tagatose, and allulose involves intricate extraction, purification, and formulation processes that are more expensive than conventional sugar. For instance, the preliminary local cost of producing stevia is approximately $301 per kilogram, primarily due to labor-intensive cultivation and complex extraction methods. Similarly, the retail price of tagatose was reported to be $26 per kilogram in 2020, significantly higher than the cost of sucrose, which was only $0.05 per kilogram. Allulose, while gaining popularity, is still relatively costly, with prices ranging from $2.80 to $7 per kilogram, depending on the supplier.

These elevated production costs result in higher retail prices, making these sweeteners less accessible for price-sensitive consumers and limiting their large-scale adoption in mass-market food, beverage, and personal care products. Additionally, fluctuations in raw material availability and energy-intensive manufacturing steps further exacerbate cost pressures, posing a significant restraint on the global market’s growth.

The rise in global health concerns, particularly obesity and diabetes, are significantly influencing dietary choices, leading to a surge in demand for low-calorie and sugar-free products. The World Health Organization (WHO) reports that in 2022, 43% of adults aged 18 years and over were overweight, and 16% were living with obesity. Furthermore, the number of people living with diabetes rose from 200 million in 1990 to 830 million in 2022.

In response to these health challenges, WHO recommends reducing the intake of free sugars to less than 10% of total energy intake, with a further reduction to below 5% providing additional health benefits. This guidance has led to increased consumer interest in products containing novel sweeteners like stevia, tagatose, and allulose, which offer sweetness without the associated health risks of traditional sugars.

Consequently, the novel sweeteners market is experiencing robust growth, driven by the rising consumer preference for healthier, low-calorie, and sugar-free alternatives in food and beverage products.

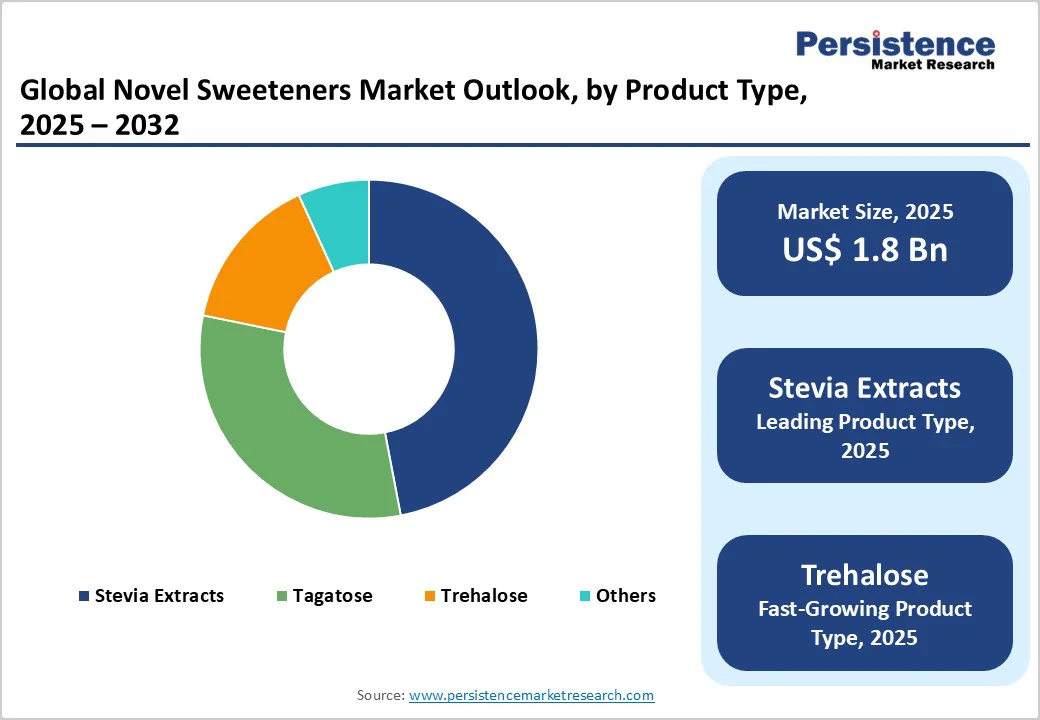

Stevia Extracts dominate the market with a 47.6% share in 2025 due to their zero-calorie content, low glycemic index, and natural origin. These attributes align with the growing consumer preference for healthier alternatives to sugar. Regulatory bodies, including the U.S. Food and Drug Administration (FDA), have recognized high-purity stevia extracts as Generally Recognized as Safe (GRAS), further boosting consumer confidence and market adoption. Stevia’s natural sweetness, versatility, and ability to maintain taste in beverages, dairy, and confectionery products make it highly preferred by manufacturers. Additionally, increasing health concerns over excessive sugar consumption and rising demand for clean-label, natural ingredients are strengthening stevia’s dominance in the global market, positioning it as the leading choice among novel sweeteners.

Bakery goods holds a 22.3% share in the global market in 2025, due to high consumption rates of baked goods globally and the industry's ongoing efforts to reformulate products in response to rising health concerns. The World Health Organization recommends reducing free sugar intake to less than 10% of total energy intake, with a further reduction to below 5% suggested for additional health benefits, prompting manufacturers to seek healthier alternatives. Consequently, there's a growing preference for low-calorie and sugar-free bakery items, leading to increased use of novel sweeteners like stevia, erythritol, and tagatose in formulations. This trend is particularly evident in regions such as North America and Europe, where consumer demand for clean-label and health-conscious products is robust. The bakery sector's significant share underscores its pivotal role in the adoption of novel sweeteners.

The North American market dominates the global market with 46.3% share in 2025, North America leads in the adoption of novel sweeteners because of strong regulatory endorsement, rising health awareness, and a shift in consumer behavior. U.S. government data (NHANES) shows that between 1999-2000 and 2007-2008, consumption of beverages containing low-calorie sweeteners (LCSs) nearly doubled among children (from about 6.1% to 12.5%) and increased among adults (from ~18.7% to ~24.1%). Also, data from CDC indicates that nearly 50% of U.S. adults consume sugar-sweetened beverages daily, creating a base market incentive for replacements. Regulatory approval of multiple high-intensity sweeteners by the FDA (e.g. aspartame, sucralose, advantame) facilitates usage in many food and beverage applications.

Europe is an important region in the novel sweeteners market because of its strong regulatory framework, formal safety assessments, changing consumer diet patterns, and efforts to reduce sugar intake. For example, the European Food Safety Authority (EFSA) has set Acceptable Daily Intakes for many sweeteners aspartame at 40 mg/kg bw/day, sucralose at 15 mg/kg bw/day, advantame at 5 mg/kg bw/day etc. In the EU, there are 19 sweeteners authorised under Regulation (EC) No.1333/2008 (intense sweeteners and sugar substitutes/polyols) with purity, labelling and use criteria. Also, European consumption of imported natural syrups (used as sweeteners) reached 3,838 thousand tonnes in 2023, valued at €3,738 million, with import volumes rising ~1.7% annually and values ~19.8%. These show both regulatory safety assurances and growing consumer demand.

Asia Pacific is the fastest-growing region for novel sweeteners because of a rapidly rising burden of diabetes, increasing awareness of sugar’s health risks, and expanding regulatory approvals that enable alternatives. In the WHO South-East Asia Region, over 96 million people already have diabetes, and the number is projected to increase by 68% by 2045. Additionally, in the WHO Western Pacific Region (which includes China, Australia, etc.), there were 215.4 million adults (20-79 years old) with diabetes in 2024 - representing about 37% of the global adult diabetes population. In India, FSSAI has formally approved six artificial sweeteners (including saccharin, aspartame, sucralose, neotame), reflecting regulatory frameworks catching up to demand. These factors are motivating consumers and food manufacturers to shift toward novel sweeteners.

The global novel sweeteners market is expanding as manufacturers adopt advanced biotechnological extraction, enzymatic conversion, and precision-fermentation methods to enhance sweetness intensity and purity. Leading producers emphasize natural origin, stability, and calorie reduction, while emerging companies target clean-label and plant-based formulations.

Regulatory approvals and R&D collaborations are enabling safer, more sustainable sweetener innovations. Growing consumer demand for low-glycemic and diabetic-friendly products further accelerates adoption across food, beverages, nutraceuticals, and pharmaceuticals. Additionally, advancements in stevia glycoside purification, monk fruit extraction, and allulose production are boosting formulation flexibility and product performance, supporting steady global market growth.

The global novel sweeteners market is projected to value at US$ 1.8 Bn in 2025.

Rising health awareness, diabetes prevalence, and demand for low-calorie natural sugar alternatives drive growth.

The Global market is poised to witness a CAGR of 5.7% between 2025 and 2032.

Expansion in plant-based sweeteners, clean-label products, and innovative fermentation technologies offers major opportunities.

Major players in the global are Cargill Inc., Archer Daniels Midland Company, Ingredion Incorporated, Tate & Lyle PLC, Ajinomoto Corporation Inc., Associated British Foods Plc, and Others.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author