ID: PMRREP12073| 175 Pages | 18 Sep 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

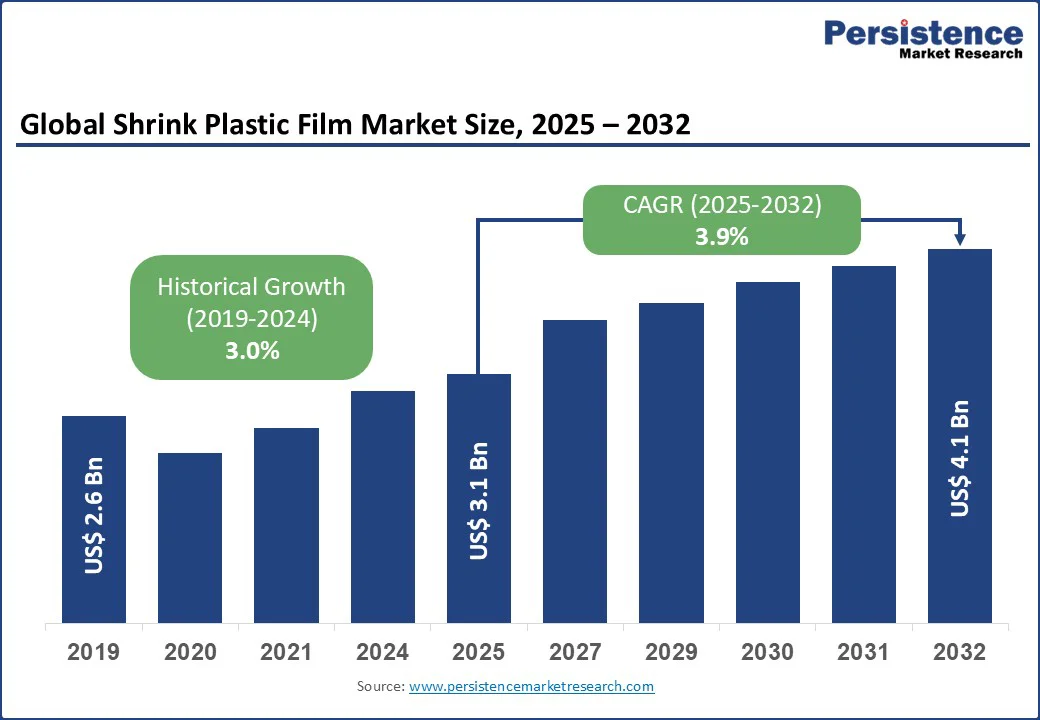

The global shrink plastic film market size is likely to value at US$ 3.1 Bn in 2025 to US$ 4.1 Bn by 2032, registering a CAGR of 3.9% during the forecast period from 2025 to 2032 driven by the rising prevalence of packaged goods in food and beverages, advancements in packaging technologies, and increasing demand for protective and tamper-evident packaging solutions.

Key Industry Highlights:

| Key Insights | Details |

|---|---|

| Shrink Plastic Film Market Size (2025E) | US$3.1 Bn |

| Market Value Forecast (2032F) | US$4.1 Bn |

| Projected Growth (CAGR 2025 to 2032) | 3.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 3.0% |

The global surge in demand for packaged products is a primary driver of the shrink plastic film market. According to the World Packaging Organization, the global packaging market size grew substantially in 2024, with food packaging being a leading segment.

This rising incidence, particularly in urban areas with high consumer spending and e-commerce growth, underscores the urgent need for protective packaging such as shrink plastic films, which can provide tamper-evidence and extend shelf life linked to product safety changes.

The growing demand for packaged food highlights the need for efficient packaging tools that shrink films provide, especially for food, where quality preservation improves significantly with proper wrapping.

Technological advancements in shrink film systems are significantly boosting market growth. Modern platforms, such as Sealed Air’s Cryovac systems, offer high durability and clarity, reducing material waste and enabling faster production through real-time shrinking processes.

Advanced shrink films also improve efficiency for food bundling, making them highly suitable for large-scale packaging operations. Innovations such as multilayer films and bio-based materials further enhance adoption, particularly in resource-limited settings where sustainable alternatives are challenging.

The high cost of materials remains a significant barrier to widespread adoption, particularly in low- and middle-income countries. Advanced film platforms, equipped with features such as high-clarity printing and bio-based compositions, require substantial upfront investment. Additionally, ongoing costs for raw materials, machinery calibration, and quality control add to the total cost of ownership.

In regions such as Sub-Saharan Africa and rural parts of South Asia, where manufacturing budgets are constrained, these financial burdens limit access to shrink films, even amidst rising packaging demands. The World Packaging Organization has noted that “the cost of advanced packaging materials may be a disincentive,” emphasizing material costs as a barrier to the broader adoption of innovative packaging tools in many countries.

The requirement for skilled personnel to operate and manage shrink film production systems also hinders market growth. Processing printed films or multilayer materials demands specialized training for technicians. A shortage of certified experts in film extrusion in developing regions exacerbates this challenge. This skills gap, combined with high training costs, restricts the adoption of advanced systems in emerging markets, ultimately slowing market expansion.

The development of sustainable and recyclable shrink plastic films presents significant growth opportunities, enabling deployment in eco-conscious markets, retail chains, and export scenarios. These sustainable systems overcome the limitations of traditional plastics, making them ideal for regulated healthcare and food settings.

For example, Berry Plastics’ eco-friendly shrink films offer rapid application, supporting their use in diverse settings. As industries prioritize green packaging, demand for such solutions is rising, particularly in regions with strict environmental laws.

The growing popularity of printed shrink films for branding, such as customizable designs for consumer products, provides another avenue for market expansion. These films require minimal additional labeling and deliver strong aesthetic appeal, making them suitable for competitive environments. Printed shrink films also enhance product visibility compared to traditional methods, driving demand for innovative products in high-growth sectors such as beverages.

The integration of smart packaging platforms for tracking and data sharing further enhances market potential. Companies such as Amcor are incorporating QR-enabled films into their systems, allowing real-time supply chain monitoring and analysis. This trend improves traceability and operational efficiency, supporting market growth in both developed and emerging regions.

The shrink plastic film market is segmented into printed and unprinted. Unprinted dominates, and is likely to account 35.5% share in 2025, due to its critical role in cost-effective and bulk packaging during high-volume production. Advanced unprinted tools, such as Sealed Air’s platforms, are widely adopted for their ease of use and durability, making them essential in industrial settings.

Printed is the fastest-growing segment, driven by increasing demand for branded packaging in retail and consumer settings. Innovations in high-resolution printed technologies, such as those from Coveris Holdings, offer superior aesthetics and customization, boosting adoption in high-volume markets.

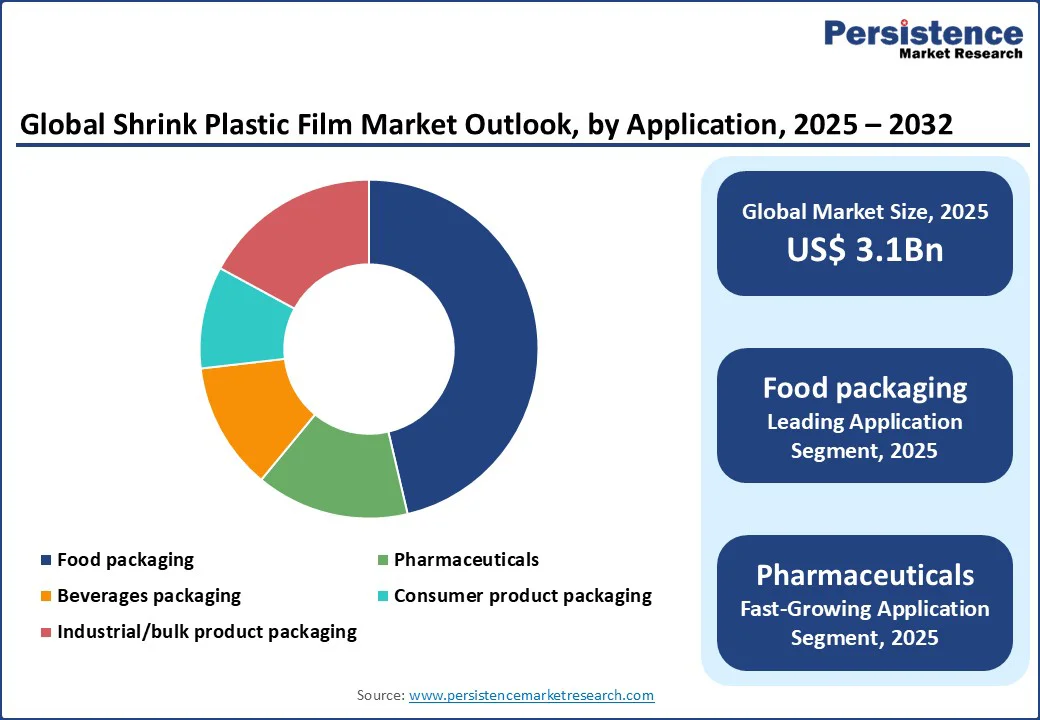

The global shrink plastic film market is divided into beverages packaging, consumer product packaging, food packaging, industrial/bulk product packaging, material goods packaging, and pharmaceuticals packaging. Food packaging leads with a 38% share in 2025, driven by its widespread use in retail and supply chain settings. These applications, which protect perishable items, are critical for quality preservation, with large volumes used worldwide each year for food wrapping.

Pharmaceuticals packaging is the fastest-growing segment, fueled by advancements in tamper-evident films and the rising prevalence of healthcare products. Its ability to ensure product integrity drives its adoption in advanced facilities, particularly for regulatory compliance post-global pandemics.

The shrink plastic film market is segmented into shrink film rolls, shrink film bags, and shrink film tubing. Shrink film rolls dominate with a 55% share in 2025, driven by its high versatility and non-customized nature. This form type relies on simple application methods for large-scale packaging, making it essential for routine production in factories and warehouses.

Shrink film tubing is the fastest-growing segment, propelled by the increasing focus on customized bundling for complex products. These forms, which allow for seamless wrapping, cater to the growing demand for efficient packaging and industrial applications.

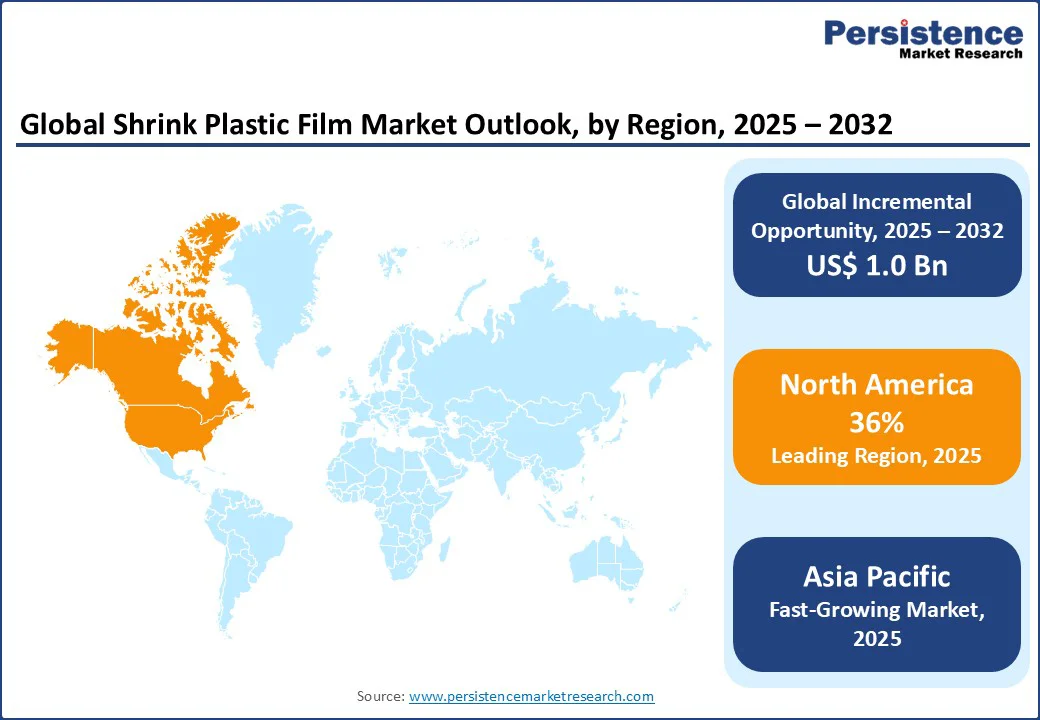

North America dominates the global shrink plastic film market, expected to account for a 36% share in 2025. This dominance is driven by high demand for packaged goods, advanced manufacturing infrastructure, and increasing consumption of beverages and food items.

The USDA reports a substantial number of packaged food units annually, underscoring the urgent need for robust protective solutions. To address this demand, leading brands such as Sealed Air and Berry Plastics are developing innovative platforms designed to support production teams with efficiency, speed, and eco-friendly methods.

Consumer preferences are shifting toward sustainable, bio-based film systems, such as Amcor’s recyclable films, which enhance product protection and reduce waste. Stringent FDA regulations prioritize safety, encouraging the adoption of reliable, high-durability components. Favorable policies for green packaging further incentivize factories and suppliers to invest in advanced equipment, supporting market growth.

Europe’s market is led by Germany, the U.K., and France, driven by regulatory support and high packaging volumes. Germany holds the largest share, supported by strong sales from companies such as RKW SE and Clondalkin Group. The EU’s Medical Device Regulation (MDR) fosters innovation and compliance, promoting the adoption of advanced printed and unprinted systems in major manufacturing facilities.

In the U.K., market growth is driven by the rising demand for sustainable packaging, with products such as Coveris Holdings’ eco-films gaining popularity for their durability and recyclability. France is witnessing increased demand for pharmaceutical-related films, with Ceisa Packaging offering specialized solutions. Regulatory support for sustainable manufacturing practices across Europe further enhances market prospects.

Asia Pacific represents the fastest-growing market for shrink plastic films, driven by expanding manufacturing infrastructure, increasing consumer demand, and rising investments in packaging technologies.

India remains a key growth engine, where rising e-commerce rates and government programs such as the Make in India scheme are boosting demand for affordable, unprinted solutions. Domestic manufacturers such as Vishakha Polyfab and Plastotecnica cater to local needs with cost-effective films designed for both urban and rural settings.

In China, rapid market expansion is supported by large-scale factory upgrades, growing adoption of printed shrink films, and the presence of leading players such as Aep Industries.

Japan’s market is characterized by demand for high-precision films used in electronics and food surveillance, with companies such as Bemis Company gaining market share. Across the region, increased spending, digital platforms, and the emphasis on product protection are collectively accelerating adoption, making the Asia Pacific a critical hub for future market growth.

The global shrink plastic film market is highly competitive, with global and regional players vying for market share through innovation, competitive pricing, and reliability. The rise of sustainable and printed films intensifies competition, as companies strive to meet stringent environmental standards and packaging demands. Strategic partnerships, mergers, and regulatory approvals are critical differentiators in this dynamic market.

The shrink plastic film market is projected to reach US$3.1 Bn in 2025.

Rising demand for packaged products, technological advancements in sustainable films, and government initiatives for eco-packaging are the key market drivers.

The shrink plastic film market is poised to witness a CAGR of 3.9% from 2025 to 2032.

Innovations in sustainable film systems and eco-friendly point-of-care solutions present significant growth opportunities.

Sealed Air, Amcor Limited, and Berry Plastics Corporation are among the leading market players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Print Type

By Application

By Form

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author