ID: PMRREP35418| 189 Pages | 11 Jun 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

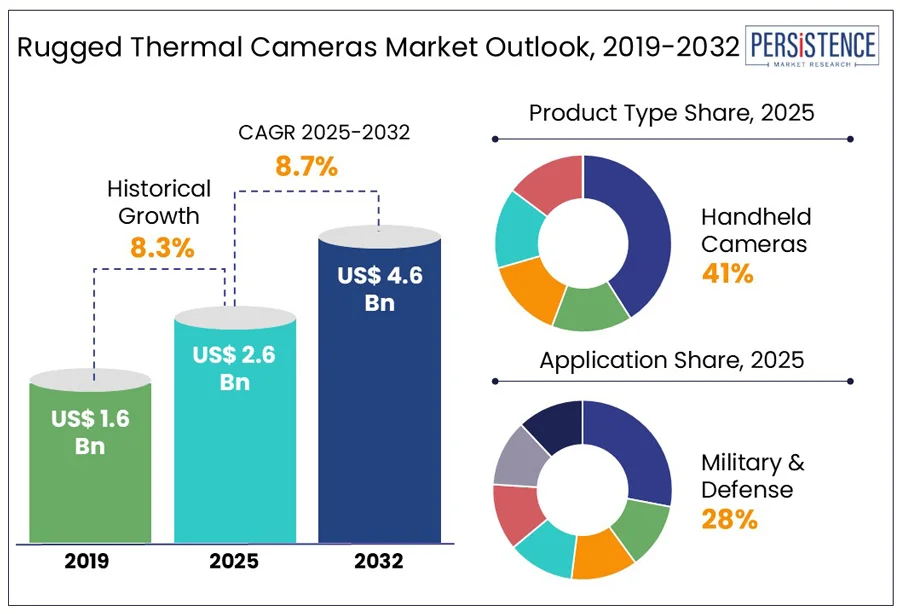

The global rugged thermal cameras market size is anticipated to rise from US$ 2.6 Bn in 2025 to US$ 4.6 Bn by 2032. It is projected to witness a CAGR of 8.7% from 2025 to 2032. According to the Persistence Market Research report, the industry has gained momentum owing to the rise in demand for durable, high-performance imaging in extreme environments. From military operations to industrial inspections and emergency response, these cameras offer critical visibility where conventional systems fail, driving innovation across sectors that rely on precision, resilience, and real-time thermal intelligence.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Rugged Thermal Cameras Market Size (2025E) |

US$ 2.6 Bn |

|

Market Value Forecast (2032F) |

US$ 4.6 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

8.7% |

|

Historical Market Growth (CAGR 2019 to 2024) |

8.3% |

Modern defense and homeland security forces are prioritizing technologies that provide superior situational awareness in challenging operational environments. Traditional visual systems often fail in low-light, fog, smoke, or complex terrain conditions, creating a critical need for advanced imaging tools. Rugged thermal cameras fill this gap by detecting heat signatures, allowing for accurate identification of hidden or camouflaged threats. These systems are increasingly deployed in surveillance towers, armored vehicles, and UAVs for real-time monitoring. Their durability in extreme weather and harsh terrains ensures uninterrupted performance during prolonged missions. As asymmetric warfare and border challenges intensify globally, these cameras are becoming mission-critical assets.

The availability of alternative sensor technologies, such as LiDAR and radar, poses a significant restraint to the widespread adoption of rugged thermal cameras, particularly in autonomous and industrial systems. These alternatives offer high precision in distance measurement, obstacle detection, and environmental mapping often with faster data processing and low-power consumption. In some applications, LiDAR and radar provide more detailed structural or spatial data than thermal imaging, making them preferred choices for navigation, automation, or inspection tasks. As these technologies continue to advance and become more cost-effective, they can reduce the reliance on thermal imaging in specific rugged use cases.

AI-powered thermal imaging systems are revolutionizing surveillance by enabling automated detection, classification, and response to potential threats or irregularities without the need for constant human monitoring. These smart systems can analyze heat signatures, recognize movement patterns, and differentiate between objects such as people, vehicles, or animals with high accuracy. In rugged environments where visibility is limited and conditions are extreme, such as military zones, industrial sites, or remote borders, AI integration significantly enhances operational efficiency. The ability to process data in real-time not only accelerates decision-making but also reduces response latency. This technological evolution is opening new frontiers in intelligent, resilient surveillance.

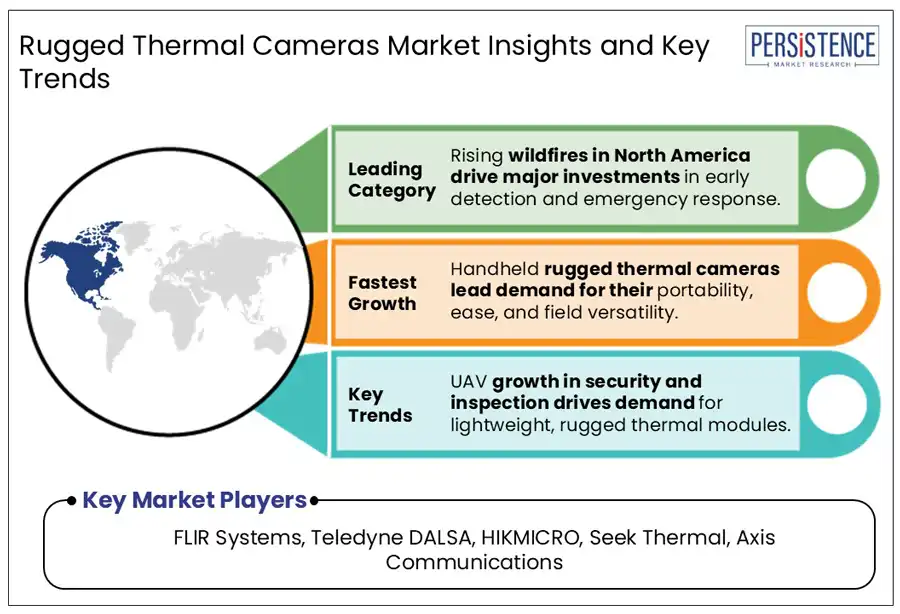

Handheld rugged thermal cameras dominate market demand owing to their portability, ease of use, and versatility in critical field applications. In firefighting, these devices helps the cavalry navigate smoke-filled environments, locate hotspots, and rescue victims by detecting heat signatures in low-visibility conditions. In industrial inspections, such as electrical, HVAC, and mechanical maintenance, handheld thermal cameras allow technicians to identify equipment faults, overheating components, or energy leaks quickly and safely. Their rugged design ensures reliable operation in harsh environments, including extreme temperatures, dust, and moisture. The convenience and immediate visual feedback they offer make them essential tools across emergency response and maintenance sectors.

In industrial inspection and manufacturing, rugged thermal cameras help detect overheating, insulation failures, mechanical stress, and energy loss. These cameras are widely used in predictive maintenance to prevent costly equipment failures and unplanned downtime. Their ability to function in hot, dusty, or corrosive environments makes them ideal for inspecting machinery, electrical panels, and production lines. By offering non-contact, real-time thermal analysis, they enhance operational safety and efficiency.

Rugged designs ensure longevity and performance even in high-vibration or outdoor industrial settings, while integration with AI and analytics enables more accurate fault detection and maintenance scheduling across manufacturing plants and facilities.

The increasing frequency and severity of wildfires have prompted significant investments in early detection and emergency response infrastructure. Rugged thermal cameras play a vital role in wildfire management, offering real-time heat detection even through smoke, darkness, and dense vegetation. Deployed via drones, towers, or mobile units, these cameras enable rapid identification of hotspots and accurate assessment of fire spread. Their durability ensures continuous operation in harsh outdoor environments. In July 2024, the Biden-Harris Administration expanded the use of NOAA's GOES-R satellites for early wildfire detection. This collaboration aims to provide real-time data to track wildfires, enhancing the responsiveness of the Interior and Agriculture Departments.

Governments and agencies across the U.S. and Canada are integrating rugged thermal imaging into wildfire surveillance networks, driving widespread adoption of these devices as essential tools for proactive disaster response.

In Europe, stringent regulations aimed at protecting critical infrastructure, such as power grids, substations, and energy plants, are significantly boosting demand for rugged thermal cameras. The RESISTO initiative integrates rugged thermal imaging into European power grids for real-time monitoring of transformer temperatures. It helps operators predict failures and ensure infrastructure resilience against both physical and cyber disruptions.

These devices enable continuous monitoring of electrical and mechanical systems, detecting overheating, insulation faults, and potential fire risks before they escalate. Their ability to perform in extreme weather and industrial conditions makes them ideal for utility environments. European energy directives and cybersecurity standards increasingly require real-time, non-intrusive monitoring solutions. As a result, utilities and energy providers are investing in rugged thermal imaging systems to enhance operational resilience, reduce downtime, and comply with safety and risk management regulations.

In Asia Pacific, the deployment of UAV-mounted thermal cameras is rapidly expanding, driven by growing demand for efficient industrial inspection and enhanced border surveillance. Countries such as China, India, and South Korea are leveraging drone-based thermal imaging for infrastructure maintenance, power line inspection, and oil and gas facility monitoring.

Rising geopolitical tensions and border security needs are prompting defense agencies to adopt UAV-mounted thermal systems for real-time threat detection in remote or rugged terrains. The combination of advanced imaging technology with mobility and cost-efficiency makes these systems highly attractive across both commercial and government sectors in the region. Japanese drone manufacturer ACSL integrated thermal camera payloads into its commercial UAVs for industrial use cases such as plant inspections and infrastructure monitoring. This expands the use of UAV-mounted thermal systems in APAC's industrial sector.

The global rugged thermal cameras market is moderately consolidated with a mix of established imaging technology providers and emerging players that focuses on niche applications. Competition is driven by innovation in sensor resolution, AI integration, and rugged design suitable for harsh environments. Players differentiate through product durability, advanced analytics, and cross-platform compatibility with drones, vehicles, and handheld systems. Strategic partnerships, defense contracts, and expansion into industrial and public safety sectors further intensify market rivalry. With growing demand across military, infrastructure, and utility applications, companies are investing in R&D and regional presence to strengthen their position in this dynamic, technology-driven market.

The global rugged thermal cameras market is projected to value at 2.6 bn in 2025.

The rugged thermal cameras market is driven by the Rising need for advanced situational awareness in military and border security operations.

The rugged thermal cameras market is poised to witness a CAGR of 8.7% between 2025 and 2032.

Integration of AI and real-time analytics in rugged thermal cameras is the key market opportunity.

Major players in the rugged thermal cameras market include FLIR Systems, Teledyne DALSA, HIKMICRO, Seek Thermal, Axis Communications, and others.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Technology

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author