ID: PMRREP30431| 199 Pages | 21 Aug 2025 | Format: PDF, Excel, PPT* | Industrial Automation

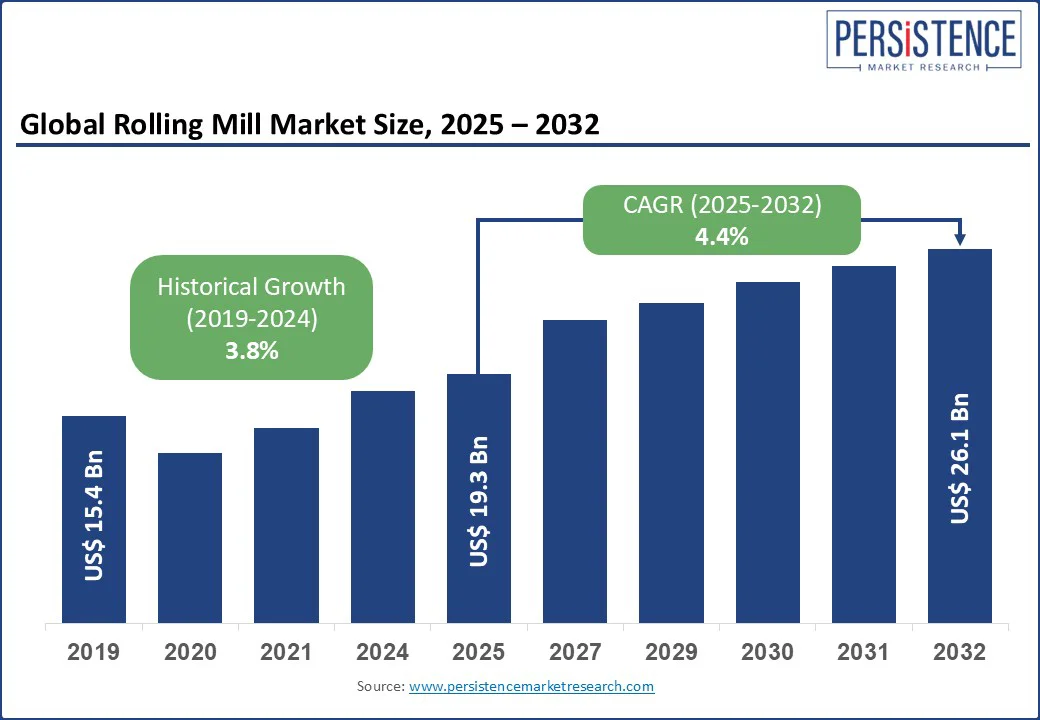

The global rolling mill market size is likely to be valued at US$ 19.3 Bn in 2025 and reach US$ 26.1 Bn by 2032, registering a CAGR of 4.4% during the forecast period 2025 - 2032. The rolling mill market is experiencing steady expansion, driven by surging global steel demand, rapid infrastructure development, and increasing adoption of advanced rolling technologies for efficient production. These factors, combined with technological advancements in automation and sustainable practices, are fueling consistent growth across flat, long, and tubular product segments.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Rolling Mill Market Size (2025E) |

US$ 19.3 Bn |

|

Market Value Forecast (2032F) |

US$ 26.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.8% |

The global surge in steel demand, particularly for infrastructure and automotive applications, is a primary driver of the Rolling Mill Market. Construction and automotive sectors remain leading segments, with increasing infrastructure projects and vehicle production driving the need for high-quality steel products. In China, steel production has grown steadily in recent years, according to the World Steel Association, necessitating advanced rolling mills to meet quality and volume requirements. The growing volume of steel processing in emerging markets has further amplified the demand for efficient rolling equipment.

Technological advancements in rolling mill design and automation are significantly propelling market growth. Modern systems, such as Primetals Technologies’ automated rolling solutions, offer enhanced precision, reduced production times, and improved material quality. A study by the International Journal of Advanced Manufacturing Technology found that automated rolling mills reduce material defects compared to traditional methods. The integration of real-time monitoring, IoT connectivity, and energy-efficient designs further supports adoption in high-volume production environments.

Government initiatives promoting industrial growth and sustainable manufacturing are also driving market expansion. In India, policies such as the Production Linked Incentive (PLI) scheme for steel and the Make in India initiative encourage the adoption of advanced rolling technologies, boosting demand for rolling mills. In North America, incentives for modernizing manufacturing infrastructure have led to increased investments in automated rolling systems, further supporting market growth.

The high cost of advanced rolling mill equipment remains a significant barrier to widespread adoption, particularly in emerging markets. Sophisticated mills, equipped with features such as automation, IoT integration, and energy-efficient systems, require substantial upfront investment. Beyond initial costs, ongoing expenses for maintenance, energy consumption, and operator training add to the total cost of ownership. For small and medium-sized enterprises (SMEs) in regions such as South Asia and Latin America, these financial constraints limit access to cutting-edge rolling solutions, even as steel demand rises.

The shortage of skilled personnel to operate and maintain complex rolling mill systems further restricts market growth. Operating advanced mills requires specialized training, yet many regions face a significant gap in certified industrial professionals. For example, a report by the International Labour Organization highlights a notable shortage of skilled manufacturing workers in developing markets. Combined with high training costs, this skills gap slows the adoption of advanced rolling technologies, constraining overall market expansion.

The development of automated and IoT-enabled rolling mills presents significant growth opportunities, particularly for applications in smaller facilities, remote operations, and flexible production scenarios. These advanced systems address the limitations of traditional mills by offering improved efficiency, precision, and scalability. For example, SMS group’s smart rolling platform integrates real-time analytics and automation, enabling seamless production and reduced energy consumption. As industries prioritize efficient and responsive production, demand for digital rolling solutions continues to rise, especially in regions with expanding manufacturing sectors.

The rise of sustainable production practices, particularly for green steel, offers substantial growth potential for the Rolling Mill Market. Advanced mills equipped with energy-efficient technologies and precise control systems minimize emissions and waste, aligning with global sustainability goals. Industry research indicates that automated rolling systems can significantly reduce energy consumption compared to conventional methods, making them highly attractive to manufacturers and regulators.

The increasing adoption of eco-friendly steel production, driven by initiatives such as the EU’s Green Steel Deal, further strengthens this trend. As sustainability becomes a priority, the demand for high-precision rolling equipment tailored to low-carbon processes is expected to drive continued investment and market expansion.

The growing adoption of digital platforms for remote monitoring and production optimization also enhances market potential. Companies such as ABB are integrating IoT-based control systems into their rolling mills, enabling proactive maintenance and minimizing downtime. This trend supports market growth by addressing operational challenges and improving accessibility in both urban and rural manufacturing settings.

The global rolling mill market is segmented into hot rolling mill, cold rolling mill, reversing mill, continuous mill, combination mill, and others. Hot Rolling Mill dominates, holding approximately 47.3% of the Rolling Mill market share in 2025, due to its critical role in processing large volumes of metal for industries such as construction and automotive. Advanced hot rolling mills, such as those from Mitsubishi Heavy Industries, are widely adopted for their efficiency and compatibility with diverse materials.

Continuous Mill is the fastest-growing segment, driven by increasing demand for seamless, high-volume production in industries such as steel and aluminum manufacturing. Innovations in continuous rolling technologies, such as SMS group’s systems, enhance productivity and material quality, boosting adoption in large-scale facilities.

The global rolling mill market is divided into flat products, long products, tubular products, and others. Flat Products lead with a 45.2% share in 2025, driven by their high global demand in construction and automotive, with billions of tons of flat steel produced annually. Rolling mills are essential for ensuring the quality and precision of these products.

Long Products are the fastest-growing segment, fueled by rising infrastructure development and machinery manufacturing needs in emerging markets such as India and Southeast Asia. The increasing demand for bars, rods, and rails drives the need for specialized rolling mills in advanced production facilities.

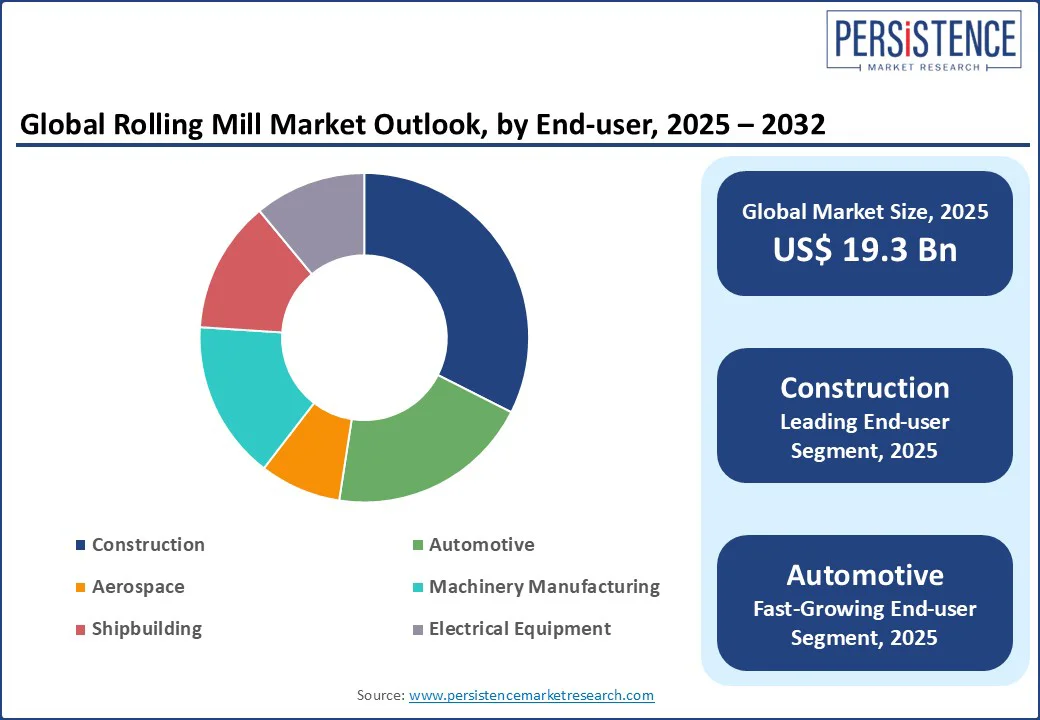

The global rolling mill market is segmented into automotive, construction, aerospace, machinery manufacturing, shipbuilding, electrical equipment, and others. Construction dominates with a 32.5% share in 2025, driven by high demand for steel products in infrastructure projects worldwide. Large manufacturers, particularly in North America and the Asia Pacific, rely on efficient rolling mills for high-volume production.

Automotive is the fastest-growing segment, fueled by the increasing adoption of lightweight materials and electric vehicle (EV) production. The need for high-strength, precision-rolled steel for EV components drives the adoption of advanced rolling mills in this sector.

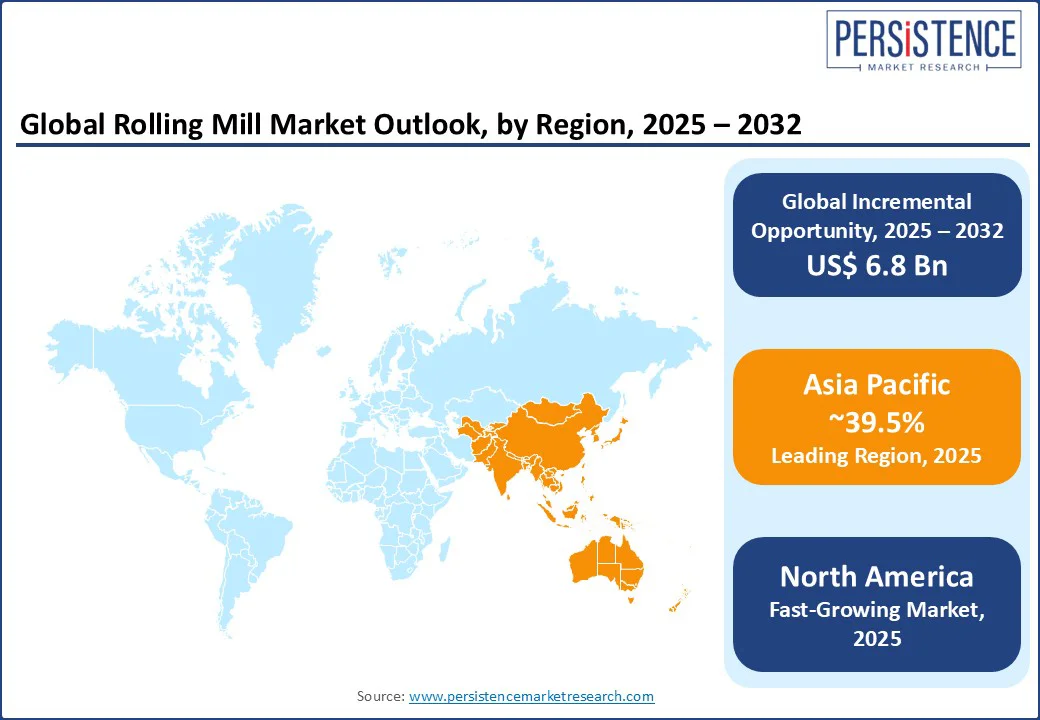

In North America, the U.S. holds a significant share of the global Rolling Mill Market, driven by robust industrial output and advanced manufacturing infrastructure. The Rolling Mill market is witnessing steady growth, fueled by increasing demand for automated rolling mills and sustainable production systems in automotive and construction applications. Leading brands such as ABB and Robert Bosch are introducing innovative solutions to meet the evolving needs of manufacturers.

Consumer preferences are shifting toward digital and energy-efficient rolling systems, with companies such as Hitachi integrating AI-enabled monitoring to enhance production efficiency and sustainability. Stringent environmental regulations promote the use of compliant, high-quality equipment, particularly in automotive manufacturing. Supportive policies for industrial modernization, especially in the automotive and construction sectors, encourage manufacturers to invest in advanced rolling mills, driving market expansion.

Europe’s market is led by Germany, the U.K., and France, driven by regulatory support and high industrial volumes. Germany holds a significant share, supported by strong sales from leading brands such as SMS group and ThyssenKrupp. The EU’s Green Steel Deal fosters innovation and compliance, encouraging the adoption of energy-efficient rolling mills and real-time monitoring systems across major production facilities.

In the U.K., market growth is driven by rising demand for sustainable steel production, particularly for automotive and construction applications. Products such as Andritz’s energy-efficient rolling mills are gaining popularity for their precision and environmental benefits. France is witnessing increased demand for aerospace-grade rolling solutions, with companies such as Primetals Technologies offering specialized systems for high-strength materials. Regulatory support for sustainable manufacturing practices across Europe further enhances market prospects.

Asia Pacific dominates the global rolling mill market, holding a 39.5% market share in 2025, led by China, India, and Japan. In China, large-scale steel manufacturing and infrastructure development drive demand for advanced rolling mills. Companies such as Mitsubishi Heavy Industries lead with fully automated systems tailored for flat and long products.

In India, rising industrial output and government initiatives such as Make in India and the PLI scheme for steel boost the adoption of cost-effective, semi-automated rolling systems. JTEKT Corporation holds a strong presence by offering affordable solutions suited to the price-sensitive market. Japan emphasizes high-precision rolling mills for premium applications, with Hitachi gaining momentum in the automotive and machinery segments. Across the region, increasing investments in steel production, adoption of advanced technologies, and the rise of digital procurement platforms are accelerating market expansion, positioning Asia Pacific as the global leader in the Rolling Mill Market.

The Rolling Mill Market is highly competitive, with global and regional players competing on innovation, pricing, and sustainability. The rise of automated and eco-friendly rolling systems intensifies competition, as companies aim to meet stringent efficiency and environmental standards. Strategic partnerships, mergers, and regulatory approvals are key differentiators in this market.

The Rolling Mill Market is projected to reach US$ 19.3 Bn in 2025.

Rising steel demand, technological advancements in automation, and supportive government industrial initiatives are the key market drivers.

The Rolling Mill market is poised to witness a CAGR of 4.4% from 2025 to 2032.

Innovation in automated and sustainable rolling systems, particularly for green steel production, is the key market opportunity.

ABB Ltd., SMS group GmbH, and Primetals Technologies Ltd. are among the key market players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

|

By Rolling Mill Type

By Product Type

By End-user Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author