ID: PMRREP35715| 198 Pages | 13 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

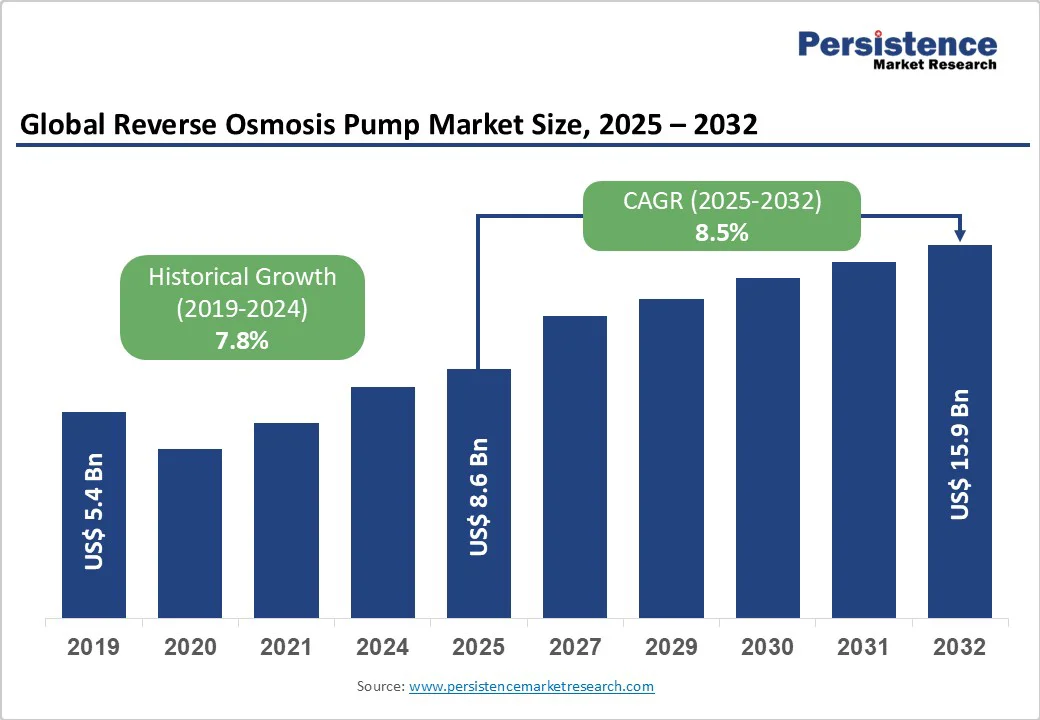

The global reverse osmosis pump market size is likely to be valued at US$8.6 billion in 2025 and is projected to reach US$15.9 billion by 2032, growing at a CAGR of 8.5% between 2025 and 2032.

The market growth stems primarily from escalating global water scarcity, which is accelerating investments in desalination and water treatment facilities worldwide.

Increasing urbanization and industrialization are amplifying demand for efficient water purification systems across residential, commercial, industrial, and municipal sectors.

| Key Insights | Details |

|---|---|

| Reverse Osmosis Pump Market Size (2025E) | US$8.6 billion |

| Market Value Forecast (2032F) | US$15.9 billion |

| Projected Growth CAGR (2025-2032) | 8.5% |

| Historical Market Growth (2019-2024) | 7.8% |

Water scarcity has intensified dramatically, with an expanding global population expected to reach 9.7 billion by 2050-and, and worsening freshwater depletion. Desalination has become a strategic solution, particularly in arid and water-stressed regions like the Middle East, North Africa, and parts of Asia.

Globally, desalination capacity is expected to exceed 100 million cubic meters per day by 2024, with numerous new plants under development or planned expansions. This surge drives demand for high-pressure reverse osmosis pump systems that can withstand saline corrosion and operate continuously.

Efficient and reliable centrifugal and positive displacement pumps are increasingly specified due to their adaptability and energy-saving capabilities, exerting upward pressure on associated market revenues.

Global and regional governments have implemented stringent water quality regulations to safeguard public health and ecosystems. Prominent frameworks, such as the European Union Drinking Water Directive, the US Safe Drinking Water Act, and the World Health Organization’s Guidelines for Drinking-water Quality, have raised the standards for contaminants and impurities permissible in drinking and industrial water.

Municipal authorities and industrial operators respond by upgrading or installing reverse osmosis pump systems to comply with these thresholds, which frequently require sub-parts-per-billion levels of filtration. This regulatory environment fosters a steady pipeline of equipment procurement, replacement, and service contracts, reflecting year-on-year demand growth exceeding 10% in some mature markets.

The total cost of ownership for reverse osmosis pump systems includes substantial upfront capital expenses. Purchase and installation costs can range from $ 50,000 to $ 250,000, depending on the capacity, materials, and complexity.

Small municipalities and developing countries often face budget constraints that hinder their ability to deploy advanced RO pumping solutions, despite potential operational savings. Cost sensitivity remains a barrier for market penetration in these regions, although financing options and governmental incentives are gradually mitigating this issue.

Energy costs form the largest portion of operational expenditure for RO pumps, often accounting for over 60% of total lifecycle costs. This is especially problematic in regions with high or fluctuating electricity prices.

Although energy recovery devices and variable frequency drives improve efficiency, integration costs and technical complexity sometimes limit adoption, particularly in price-sensitive sectors and emerging markets. High energy demand also contributes to concerns about carbon footprint, pressuring manufacturers and users to prioritize energy-efficient pump designs and renewable energy-powered operations.

Technological advancements are rapidly transforming the RO pump market, especially in the implementation of variable speed drives (VSD) and permanent magnet motors. These features optimize pump operation by matching speed to system demand, enabling energy savings up to 25%, which translate into substantial cost reductions-e.g., up to US$ 150,000 annually at large-scale desalination plants.

Leading manufacturers allocate significant research and development budgets toward these innovations, improving pump durability, corrosion resistance, and digital connectivity for predictive maintenance. This technology-driven evolution represents an expanding avenue for market growth and competitiveness.

Asia Pacific is witnessing infrastructure transformation, propelled by government initiatives such as India’s Jal Jeevan Mission and China’s Belt and Road desalination projects. Regional investments are projected to exceed US$ 3 billion by 2030 for water treatment pump procurement.

Rapid urbanization, industrialization, and agricultural intensification increase water demand, fostering adoption of modular RO systems and associated pumping equipment. Growing middle classes and water scarcity further reinforce regional growth drivers. Manufacturers targeting localized production and service in these emerging economies can capture growing share and build competitive advantages.

Among product types, Booster Pumps dominate with an estimated 40% market share in 2024. Their popularity reflects the ability to provide effective pressure boosting with simpler construction and lower costs compared to proportional and permeate pump types.

Booster pumps are widely deployed in residential, commercial, and industrial RO applications due to their versatile performance profiles and ease of integration. The segment’s growth is further supported by expanding small and medium residential water filtration systems and irrigation projects employing booster pump technology within Asia Pacific and Latin America.

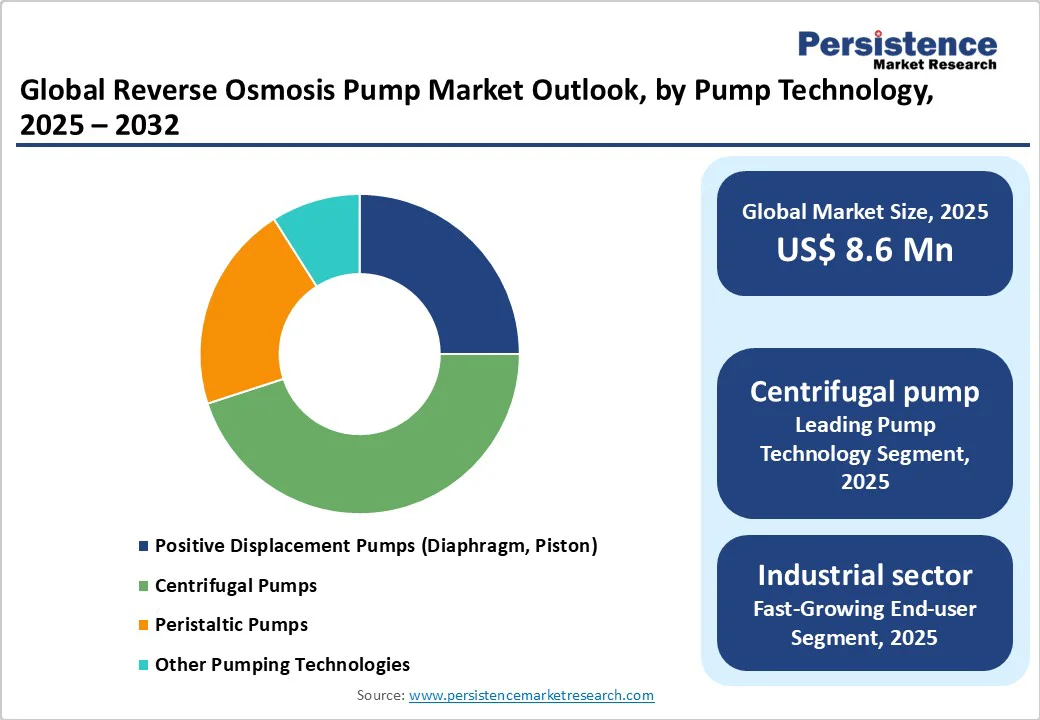

In terms of pump technology, Centrifugal Pumps hold the leading position with approximately 45% share in 2025. Their widespread adoption results from cost effectiveness, capability for high flow rates, and proven reliability under continuous operation.

Centrifugal pumps cater especially well to large-capacity desalination and industrial water treatment facilities requiring scalable, robust, and maintenance-friendly solutions. The ongoing drive toward impeller and casing design refinement, as well as materials innovation with duplex stainless steel and corrosion-resistant alloys, further enhance performance and lifespan advantages in this segment.

The 500 - 1000 GPD (gallons per day) capacity segment leads with a 35% share, favored for medium-scale commercial and industrial RO installations. This flow capacity offers an ideal balance between throughput and energy efficiency for numerous applications, making it a preferred choice in manufacturing plants, municipal treatment systems, and commercial water suppliers. Additionally, regulatory trends fostering decentralized water treatment elevate demand for modular systems within this flow band, often paired with integrated pump and membrane units.

The Industrial sector represents the largest end-use segment at approximately 38% share in 2025. This dominance is driven by stringent water purity requirements across chemical, food & beverage, pharmaceuticals, and electronics manufacturing.

Continuous-operation demands, necessity for precision water quality management, and regulatory compliance underpin the sector’s high RO pump adoption levels. Municipal water developers and agricultural irrigation systems also contribute robust demand, although at a slightly lower volume share compared to industrial users.

Desalination stands as the leading application segment, comprising nearly 42% of pump shipments. Its preeminence arises from the rise in freshwater scarcity and the resulting expansion of seawater and brackish water desalination projects globally, with the Middle East, North Africa, and Asia Pacific as the key growth hubs. Wastewater treatment and recycling are growing applications due to increasing water reuse policies, while food & beverage processing assumes a solid secondary position requiring high-quality water for production and hygiene.

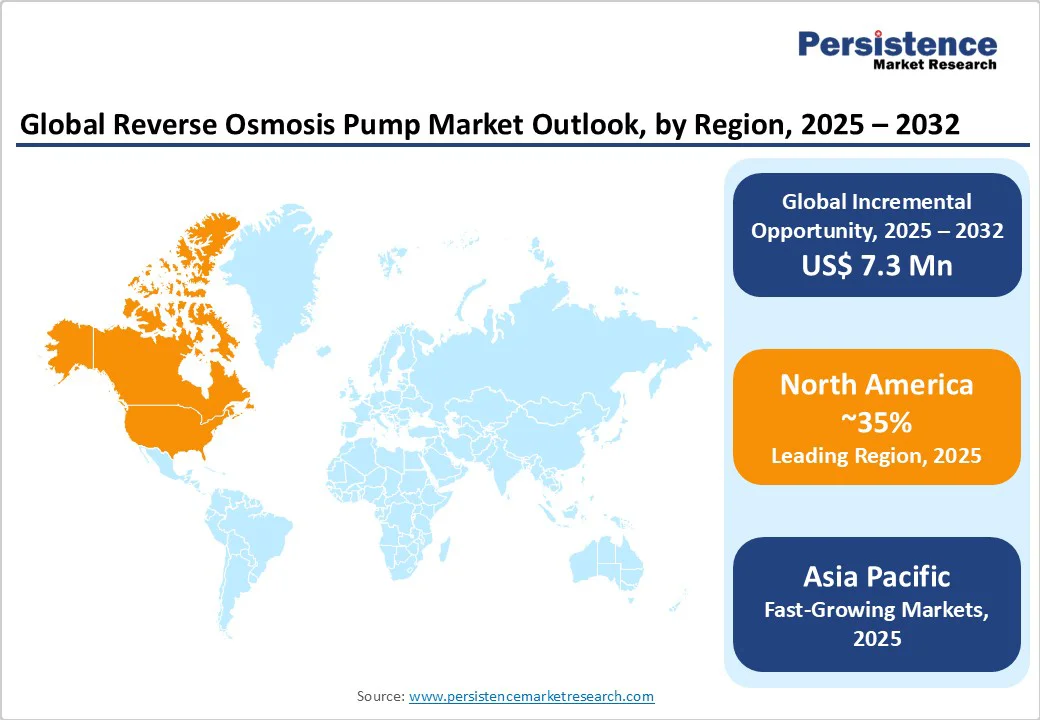

North America leads through a mix of advanced infrastructure, regulatory rigor, and innovation ecosystems. Government funding initiatives-such as those from the US Department of Energy favoring energy-efficient water tech-stimulate adoption of VSD-enabled RO pumps and advanced materials.

Regional states like California enforce the Water Resilience Portfolio, mandating upgrades to existing desalination and recycling plants. Additionally, software- and sensor-driven digital monitoring systems, spearheaded by Silicon Valley innovators collaborating with pump OEMs, are improving predictive maintenance capabilities, reducing downtime, and optimizing energy use. This combination sustains a technology-forward, mature market with steady growth in public and private sectors.

Europe’s market benefits from regulatory alignment under the EU Water Framework Directive and harmonized potable water standards promoting uniform pump quality and performance. Germany, the UK, France, and Spain lead in industrial and municipal RO water treatment projects, supported by robust environmental policies and multi-million-euro grants for eco-friendly water infrastructure.

Public-private partnerships emphasize desalination technology expansions, particularly coastal desalination in Spain and France, and increasingly focus on wastewater recycling initiatives. Europe’s drive toward a circular water economy stimulates business-model innovation with integration of water reuse and resource recovery, where RO pumps play a central role.

Asia Pacific is the fastest-growing region due to intense water stress, accelerated urbanization, and governmental investments. China’s Belt and Road projects integrate large RO desalination plants, while India’s Jal Jeevan Mission promotes decentralized clean water access employing modular pump-membrane systems.

ASEAN markets are expanding industrial parks and agriculture, requiring reliable water treatment infrastructure, which boosts demand for RO pumps especially in mid-size flow capacities. Local manufacturers are increasingly partnering or entering joint ventures with global pump firms to leverage manufacturing advantages, labor cost benefits, and regional subsidies, thereby expanding market competitiveness.

The global reverse osmosis pump market is moderately consolidated, with the top manufacturers commanding over 60% of revenues globally. Industry leaders emphasize expansive research and development investments in energy-efficient pumps, digitalization, and new corrosion-resistant materials to differentiate their portfolios.

Acquisition and strategic partnerships are common to broaden geographic reach and build aftermarket service networks. Emerging business models include predictive maintenance contracts, IoT-enabled remote monitoring, and pay-per-use schemes, providing recurring revenues and closer client relationships. Key differentiators include customization capabilities, fluid dynamics expertise, and local serviceability, enabling responsive solutions tailored to diverse industry needs.

The reverse osmosis pump market size was valued at US$ 8.6 billion in 2025.

Drivers include rising desalination capacity, stringent water quality regulations, and advancements in energy-efficient pump technologies.

Booster pumps lead with approximately 40% market share due to their versatile pressure-boosting capabilities.

North America is the dominant region, supported by infrastructure funding, strict regulations, and a mature innovation ecosystem.

Expanding municipal and industrial water infrastructure in emerging economies, especially in Asia Pacific, presents the fastest growth opportunity.

Top companies include Flowserve Corporation, Grundfos, and Xylem Inc., known for broad portfolios and technological leadership.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis |

|

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Pump Technology

By Flow Rate Capacity

By End-use

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author