ID: PMRREP35786| 197 Pages | 28 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

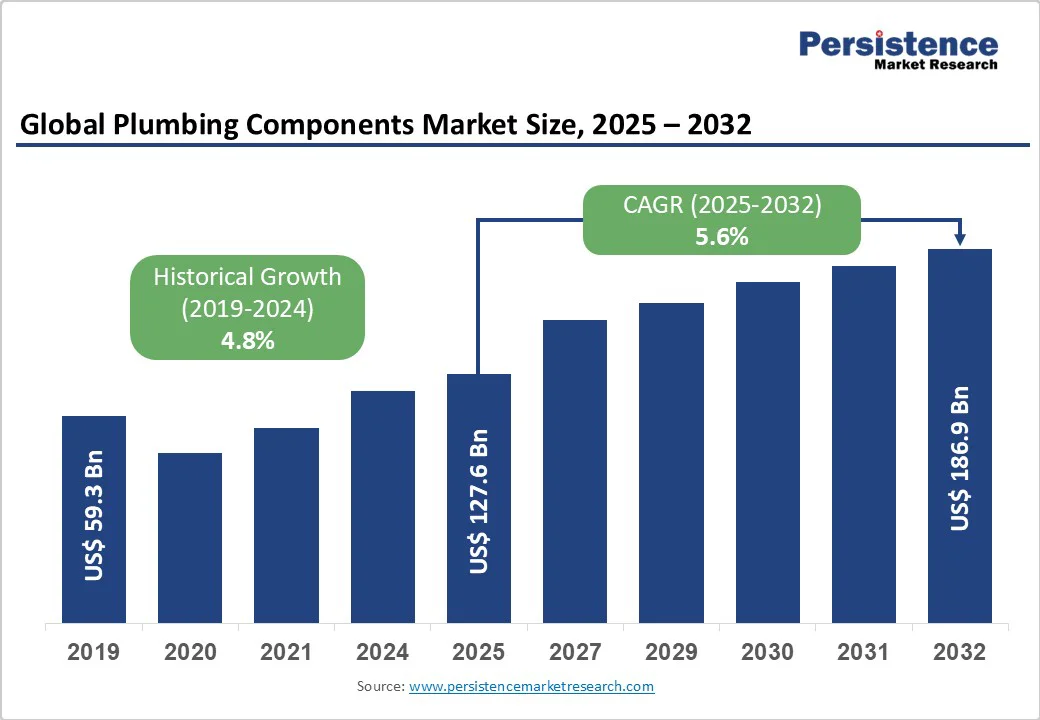

The global plumbing components market size was valued at US$127.6 billion in 2025 and is projected to reach US$186.9 billion by 2032, growing at a CAGR of 5.6% between 2025 and 2032, driven by infrastructure development initiatives, modernization of aging water systems, and regulatory mandates promoting water conservation and energy efficiency through advanced plumbing technologies.

| Key Insights | Details |

|---|---|

| Plumbing Components Market Size (2025E) | US$127.6 Bn |

| Market Value Forecast (2032F) | US$186.9 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.8% |

Rapid urbanization across developing economies drives substantial demand for plumbing components, with the World Bank reporting that 68% of the global population will live in urban areas by 2050. According to the United Nations, urban population growth worldwide will require the construction of 96,000 new buildings daily through 2030, creating sustained demand for plumbing infrastructure.

China's infrastructure investment program, valued at nearly US$1 trillion as announced in August 2022, exemplifies large-scale construction initiatives generating significant plumbing component requirements. Government initiatives, including India's Jal Jeevan Mission and Smart Cities Mission, further amplify market demand by supporting comprehensive water supply and sanitation infrastructure development.

The integration of Internet of Things (IoT) technology and smart home systems transforms traditional plumbing components into connected, intelligent solutions, enabling real-time monitoring and optimization. Smart plumbing systems incorporating sensors, automated valves, and leak detection capabilities represent a rapidly growing market segment, with compound annual growth rates exceeding 8% through 2032. Advanced manufacturing technologies, including 3D printing and precision molding, enable the production of customized plumbing components with enhanced performance characteristics.

The development of antimicrobial coatings, corrosion-resistant materials, and modular connection systems addresses evolving consumer demands for durability, hygiene, and ease of installation. Industry investment in research and development continues to expand, with major manufacturers allocating 3-5% of revenues to innovation initiatives focused on smart technologies and sustainable materials.

The plumbing components industry faces significant challenges from fluctuating raw material costs, particularly copper, steel, and plastic resins, which can impact production costs by 15-25% annually. Copper prices surged 30% in 2022, directly affecting manufacturing costs for pipes, fittings, and fixtures made with copper-based materials.

Global supply chain disruptions, including semiconductor shortages affecting smart plumbing components, create delivery delays and inventory management challenges for manufacturers and distributors. The concentration of manufacturing capabilities in specific geographic regions, particularly the Asia Pacific, creates vulnerability to localized disruptions, including natural disasters, trade disputes, and pandemic-related restrictions affecting global supply chains and market stability.

The plumbing industry faces persistent skilled labor shortages, with vacancy rates exceeding 15% in developed markets, limiting installation capacity for new plumbing systems and advanced technologies. The complexity of modern plumbing systems, particularly those incorporating smart technologies and specialized materials, requires extensive technical training and certification that many installation professionals lack.

Labor shortage constraints can delay project completion times by 10-20%, affecting market growth, particularly in regions experiencing rapid construction expansion. The aging workforce in developed markets, combined with limited vocational training programs, exacerbates skill gaps and increases installation costs for end-users seeking plumbing upgrades or new construction projects.

Developing economies in the Asia Pacific, Latin America, and Africa present substantial growth opportunities, with collective infrastructure investment requirements exceeding US$2.5 trillion through 2030. Countries including India, Indonesia, and Nigeria are implementing national water supply programs requiring comprehensive plumbing infrastructure development. Government-backed financing programs and funding from international development banks create favorable conditions for plumbing component demand in emerging markets.

The expanding middle class in developing regions, with disposable incomes increasing 6-8% annually, drives residential construction and plumbing modernization projects. Market penetration rates for modern plumbing systems remain below 40% in many emerging economies, representing significant expansion potential for component manufacturers and distributors.

The existing building stock in developed markets creates substantial opportunities for plumbing component replacement and upgrades, with over 40% of residential buildings in the United States exceeding 40 years of age. Renovation spending in residential markets reached US$472 billion in the U.S. in 2023, with plumbing improvements representing 12-15% of total renovation expenditures.

Commercial building retrofit programs, driven by energy-efficiency mandates and sustainability targets, create additional demand for advanced plumbing components. The average lifespan of plumbing systems ranges from 15 to 50 years, depending on materials and installation conditions, ensuring consistent replacement demand across mature markets.

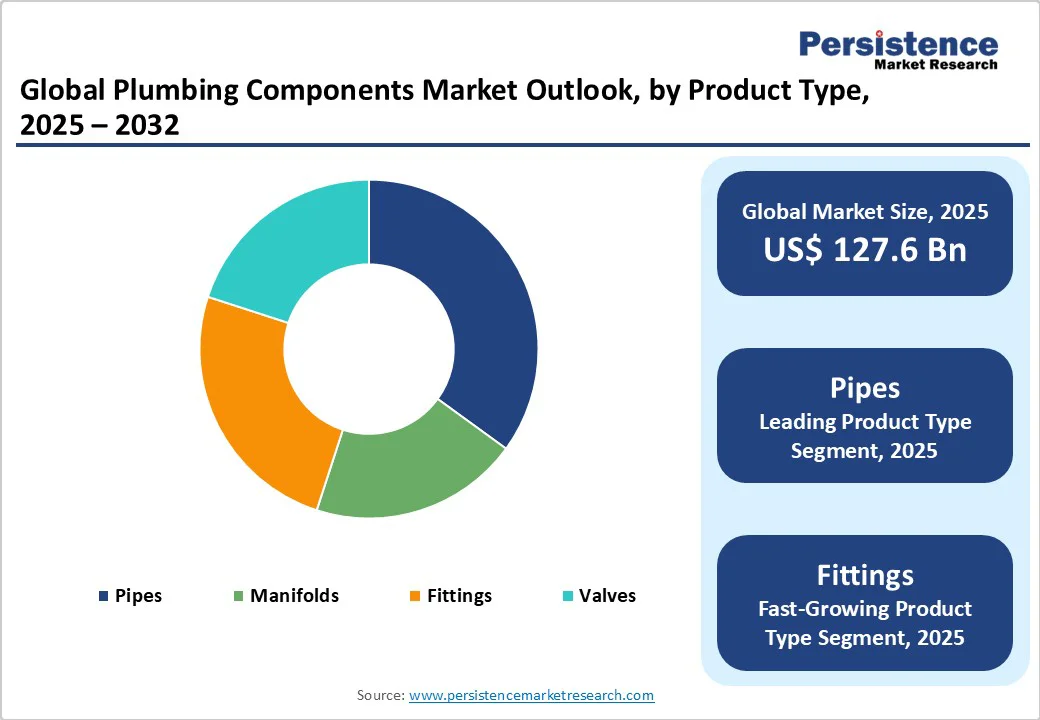

Pipes are anticipated to dominate the market with a 32.4% share in 2025, driven by essential infrastructure requirements across residential, commercial, and industrial sectors. Continuous replacement demand from aging water networks, such as frequent U.S. main breaks, fuels growth, while modern materials such as PVC, CPVC, PEX, and HDPE enhance durability and ease of installation. The segment spans water supply, drainage, and specialty applications such as radiant heating.

Fittings represent the fastest-growing segment, projected to expand at a 7.3% CAGR through 2032, supported by increasing system complexity and modular installation trends. Innovations such as push-to-connect and press fittings improve installation efficiency, reduce labor costs, and boost profitability, making fittings a key growth driver for both OEM and replacement markets.

Bathtubs are projected to dominate the application segment with a 42.1% market share in 2025, driven by substantial material and component requirements, including specialized drainage, overflow systems, and installation accessories.

The segment covers alcove, freestanding, and spa-style tubs, each requiring 15-20 plumbing components such as fittings, valves, and drain assemblies, resulting in higher per-unit revenue. Growing residential renovation activities and demand for luxury bathroom experiences sustain its leadership.

Showerheads represent the fastest-growing segment, driven by water-efficiency regulations mandating low-flow fixtures and consumer preference for enhanced showering experiences. Advancements in smart shower systems offering temperature control, flow optimization, and personalized settings are driving premium demand. This segment’s rapid growth reflects broader trends in water conservation, bathroom modernization, and wellness-oriented home improvement.

The residential sector is anticipated to lead the market with a 61.3% share, supported by steady new home construction, renovation activity, and maintenance demand across single- and multi-family housing. High home-ownership rates in developed regions and rising disposable incomes in emerging economies are fueling continued growth. This segment benefits from consumer-driven decisions emphasizing aesthetics, quality, and long-term value, with extensive component usage across kitchens, bathrooms, and utility areas.

The non-residential sector represents the fastest-growing end-user segment, propelled by expanding commercial, institutional, and infrastructure projects. Office complexes, healthcare facilities, and educational institutions require advanced plumbing systems that are both durable and compliant with regulatory requirements. Project-based purchasing patterns, high transaction values, and demand for specialized components such as backflow preventers and pressure-control valves support strong segment expansion.

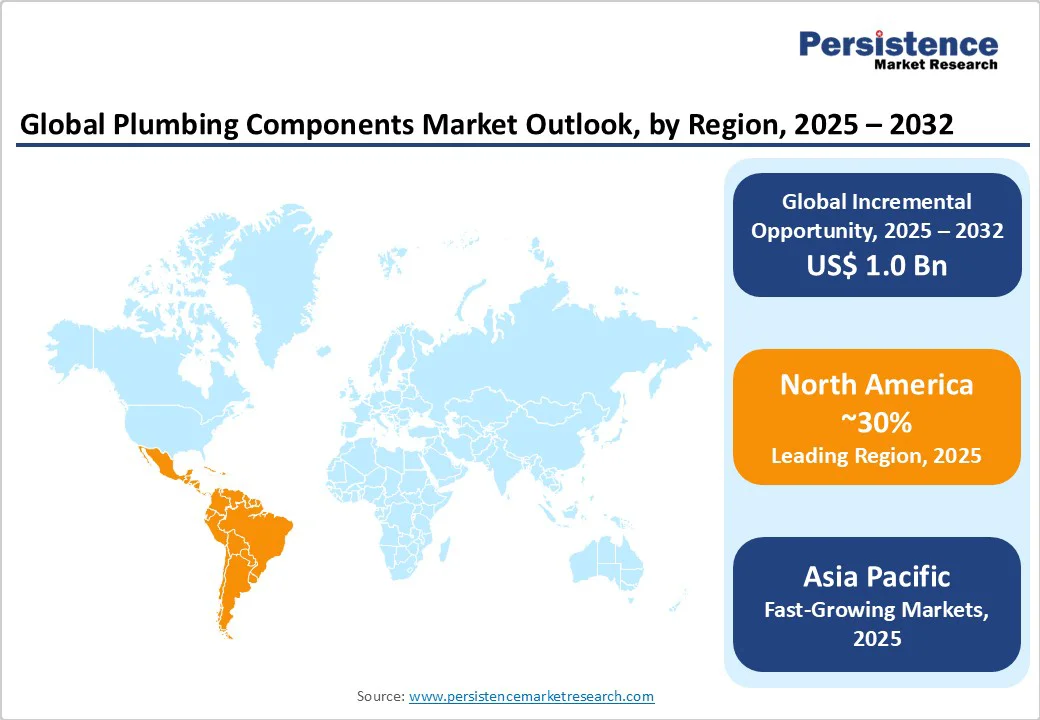

North America dominates the market with a 30% share, valued at US$38.3 Billion in 2025 and projected to reach US$56.1 Billion by 2032. The U.S. drives regional growth through mature infrastructure, high construction spending, and strict regulatory frameworks. With residential construction exceeding US$900 Billion and commercial renovation surpassing US$200 Billion annually, the region sustains robust demand across diverse applications.

Regulations emphasizing water efficiency, lead-free compliance, and safety standards encourage ongoing innovation in materials and design. The Infrastructure Investment and Jobs Act, allocating US$55 Billion for water infrastructure, further strengthens market expansion.

A mix of global leaders and regional specialists fuels competition, while investments in smart plumbing systems, eco-friendly materials, and automated manufacturing enhance efficiency and maintain North America’s market leadership.

Europe accounts for 25% of the market share, valued at US$31.9 Billion in 2025 and projected to reach US$46.7 Billion by 2032, driven by stringent environmental regulations and sustainable construction initiatives. Leading markets such as Germany, the U.K., and France spearhead adoption through robust building codes, energy efficiency mandates, and water conservation programs.

The EU’s carbon neutrality target for 2050 propels demand for energy-efficient plumbing systems, including heat recovery, smart thermostats, and low-flow fixtures. Growth is further supported by building renovation programs, district heating modernization, and green construction projects.

A strong regulatory framework emphasizing harmonized standards and environmental compliance fosters innovation. European manufacturers focus on circular economy principles, recycled materials, and energy-efficient production, ensuring long-term competitiveness and sustainability-driven market leadership.

Asia Pacific stands as the fastest-growing region, projected to grow at a 6.8% CAGR through 2032. Growth is fueled by rapid industrialization, urbanization, and large-scale infrastructure development across China, India, and ASEAN countries. The region benefits from cost-efficient manufacturing, a vast population base, and government-backed infrastructure investments, creating strong market momentum.

China’s construction sector, expanding at 9.3% (2023 - 2025), and India’s Smart Cities Mission with over US$1 Trillion infrastructure spending, drive robust component demand across sectors. National initiatives promoting water supply, sanitation, and sustainable building standards further accelerate adoption.

The market features both global manufacturers expanding local production and regional players capitalizing on cost advantages. Investment priorities focus on manufacturing capacity expansion, technology partnerships, and localized product innovation to serve diverse regional needs.

The global plumbing components market exhibits moderate concentration with leading players maintaining significant positions through comprehensive product portfolios, established distribution networks, and technological capabilities. Kohler Co., Moen Incorporated, LIXIL Corporation, and Geberit AG command substantial market shares through international presence, brand recognition, and innovation leadership across multiple product categories.

The market structure includes multinational corporations, specialized component manufacturers, and regional players competing across different price segments and application areas. Market concentration analysis reveals opportunities for consolidation as companies seek scale advantages, geographic expansion, and technology integration capabilities.

The plumbing components market size is estimated to be valued at US$127.6 Billion in 2025.

The plumbing components market is driven by rising global construction and renovation, supported by rapid urbanization, infrastructure upgrades, and growing demand for smart, water-efficient, and stylish bathroom and kitchen fixtures.

In 2025, North America is projected to dominate the plumbing components market, accounting for over 30% of the total revenue.

Among product types, pipes hold the highest preference, capturing beyond 32.4% of the market revenue share in 2025.

The key players in the plumbing components market are Aalberts N.V., Central States Industrial, Finolex Industries Ltd., and McWane Inc.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-users

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author