ID: PMRREP32724| 190 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

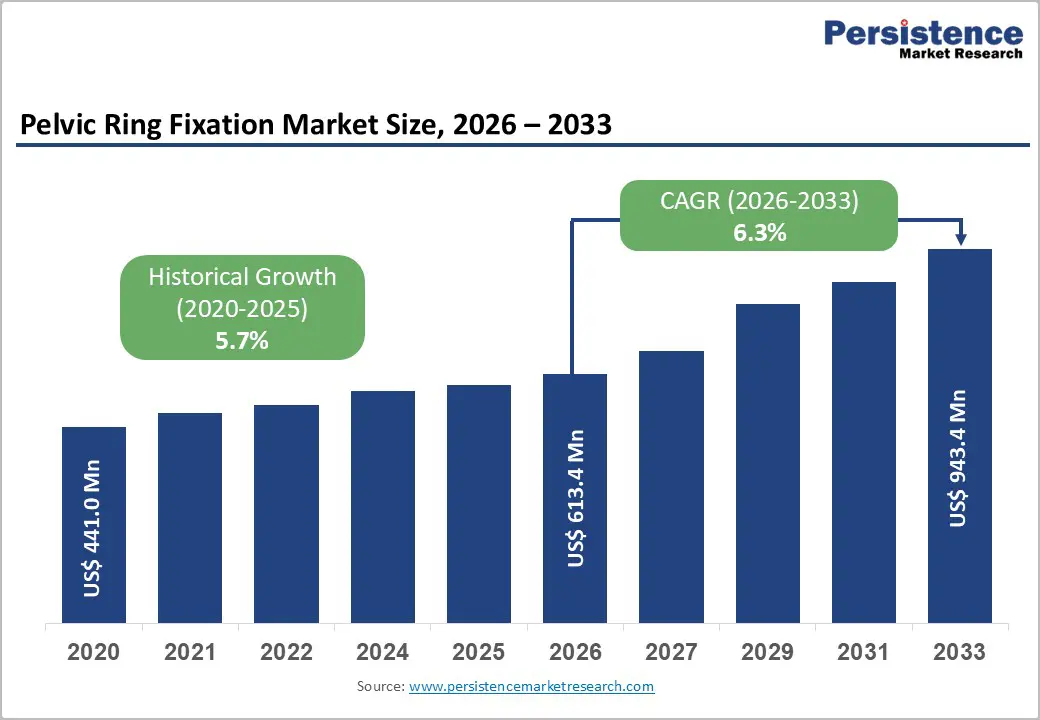

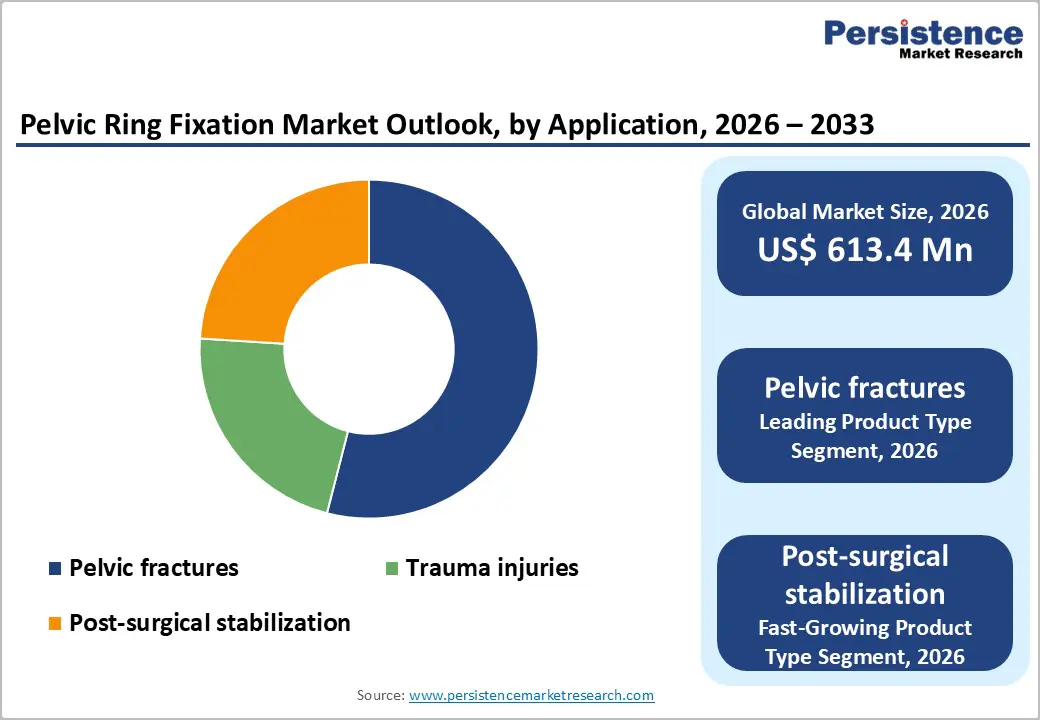

The global pelvic ring fixation market size is expected to be valued at US$ 613.4 million in 2026 and projected to reach US$ 943.4 million by 2033, growing at a CAGR of 6.3% between 2026 and 2033.

Rising incidence of pelvic fractures, rapid population aging, and the expanding adoption of advanced internal and external fixation systems are driving this upward trajectory. Increasing road traffic injuries, sports trauma, and fragility fractures in older adults are translating into higher surgical volumes, while continuous innovation by leading companies such as DePuy Synthes, Stryker, Zimmer Biomet, and Orthofix Medical supports wider availability of anatomically contoured plates, iliosacral screws, and external frames that improve fixation stability and patient outcomes in complex pelvic ring injuries.

| Report Attribute | Details |

|---|---|

|

Pelvic Ring Fixation Market Size (2026E) |

US$ 613.4 million |

|

Market Value Forecast (2033F) |

US$ 943.4 million |

|

Projected Growth CAGR (2026-2033) |

6.3% |

|

Historical Market Growth (2020-2025) |

5.7% |

Market Growth Drivers

Rising pelvic fracture burden in aging and trauma populations

The pelvic ring fixation market is strongly driven by the growing burden of pelvic fractures in both elderly and high-energy trauma patients. Studies show that low-energy pelvic ring fractures are increasingly common in older adults, with mean ages often above 80 years and one year mortality rates for fragility pelvic fractures reported between 18–23%, underscoring the clinical need for stable fixation and early mobilization. At the same time, road traffic accidents, industrial injuries, and sports trauma contribute significantly to high-energy pelvic fractures in younger populations, leading to complex, unstable injuries that require surgical stabilization. As health systems across North America, Europe, and the Asia Pacific strengthen trauma networks and prioritize timely operative management of unstable pelvic ring injuries, demand for internal and external fixation devices continues to expand.

Advances in minimally invasive and technology-assisted pelvic fixation

Technological innovation in pelvic ring fixation, particularly minimally invasive and robotic-assisted techniques, is a major growth catalyst. Recent research highlights the combination of 3D printing, preoperative planning, and orthopedic surgical robots to achieve precise percutaneous screw placement in unstable pelvic fractures, reducing operative time, radiation exposure, and complication risks. New minimally invasive systems, such as sacroiliac joint locking plates and percutaneous posterior pelvic ring fixation approaches, have demonstrated superior biomechanical stability and improved functional outcomes versus traditional open procedures. These advances align with broader trends in trauma device use, in which internal fixation dominates because it provides stable fixation and early mobilization, encouraging hospitals and trauma centers to invest in modern pelvic fixation platforms and associated navigation technologies.

Market Restraints

High cost of advanced fixation procedures and devices

One key restraint is the high cost associated with advanced pelvic ring fixation procedures and implants. Internal trauma fixation devices, particularly specialized pelvic plates, sacroiliac screws, and robot-assisted systems, are significantly more expensive than conventional hardware, placing pressure on hospital budgets and payers, especially in low and middle-income settings. Reimbursement frameworks in several countries do not fully differentiate between complex pelvic procedures and premium implants, leading to cost-containment policies and more conservative adoption of cutting-edge fixation technologies. As a result, despite clear clinical benefits, some hospitals delay upgrades or limit use of advanced pelvic fixation systems to select cases, slowing overall market penetration.

Surgical complexity, complication risks, and limited specialist capacity

Pelvic ring fixation is technically demanding, and this complexity itself acts as a barrier to wider adoption. Precise screw placement through narrow osseous corridors carries risks of neurovascular injury, malreduction, and hardware failure, particularly when intraoperative imaging and navigation are suboptimal or when surgeons lack specific pelvic trauma training. Many regions report shortages of fellowship-trained orthopedic trauma surgeons, and elderly low-energy pelvic fracture patients often fall into a care “grey zone” where they may not meet clear criteria for surgical admission, complicating management pathways. These factors can lead to variability in treatment decisions, underutilization of operative fixation in some populations, and institutional reluctance to invest heavily in specialized pelvic fixation programs, restraining market growth.

Market Opportunities

Post-surgical stabilization and rehabilitation-focused solutions

There is a significant opportunity to develop and scale solutions focused on post-surgical stabilization and rehabilitation in pelvic fracture patients. As minimally invasive internal fixation enables earlier weight bearing, patients increasingly transition quickly from acute hospital care to rehabilitation facilities or home-based recovery, where optimized external supports, braces, and adjunctive stabilization devices can enhance outcomes. Evidence suggests that early mobilization in elderly patients with low-energy pelvic ring fractures helps prevent deconditioning and reduce long-term functional decline, underscoring the need for integrated stabilization and physiotherapy pathways. Companies that design lightweight, adjustable external supports, integrate digital monitoring or tele-rehabilitation tools, and partner with rehabilitation centers and home care providers can unlock a growing revenue stream linked to postoperative management rather than solely to intraoperative implants.

Product Type Analysis

Within Product Type, internal fixation devices are the leading segment, supported by trends in broader trauma fixation markets, where internal fixators account for roughly 65% of revenue in key geographies such as North America. Internal pelvic fixation using plates, screws, and rods provides rigid stabilization, facilitates early mobilization, and reduces long term complications compared with prolonged external fixation, which aligns with modern trauma guidelines emphasizing operative stabilization for unstable pelvic ring injuries. Hospitals and trauma centers increasingly favor percutaneous internal fixation techniques to shorten intensive care stays and enable earlier rehabilitation, especially in elderly and polytrauma patients. Major companies, including DePuy Synthes, Stryker, Zimmer Biomet, Smith & Nephew, Medtronic, and B. Braun Melsungen, market comprehensive internal trauma portfolios that integrate pelvic plates, sacroiliac screws, and navigation-compatible instrumentation, reinforcing internal fixation’s dominant share in the pelvic ring fixation market.

Application Analysis

In the application, pelvic fractures represent the leading segment, accounting for approximately 54% market share in 2025, as indicated in the scope. Pelvic ring fixation is most frequently indicated in unstable pelvic fractures arising from high-energy trauma, falls from height, and fragility fractures in elderly individuals, making direct fracture management the core clinical driver of device utilization. Global epidemiological data showing millions of new pelvic fracture cases annually and age-dependent increases in fracture risk underscore the centrality of fracture fixation relative to secondary uses such as general trauma injuries or post-surgical stabilization. Guidelines from orthopedic trauma societies emphasize early stabilization of unstable pelvic fractures to control hemorrhage, maintain alignment, and support organ function, ensuring that pelvic fracture fixation continues to command the largest share of procedural volumes and implant consumption.

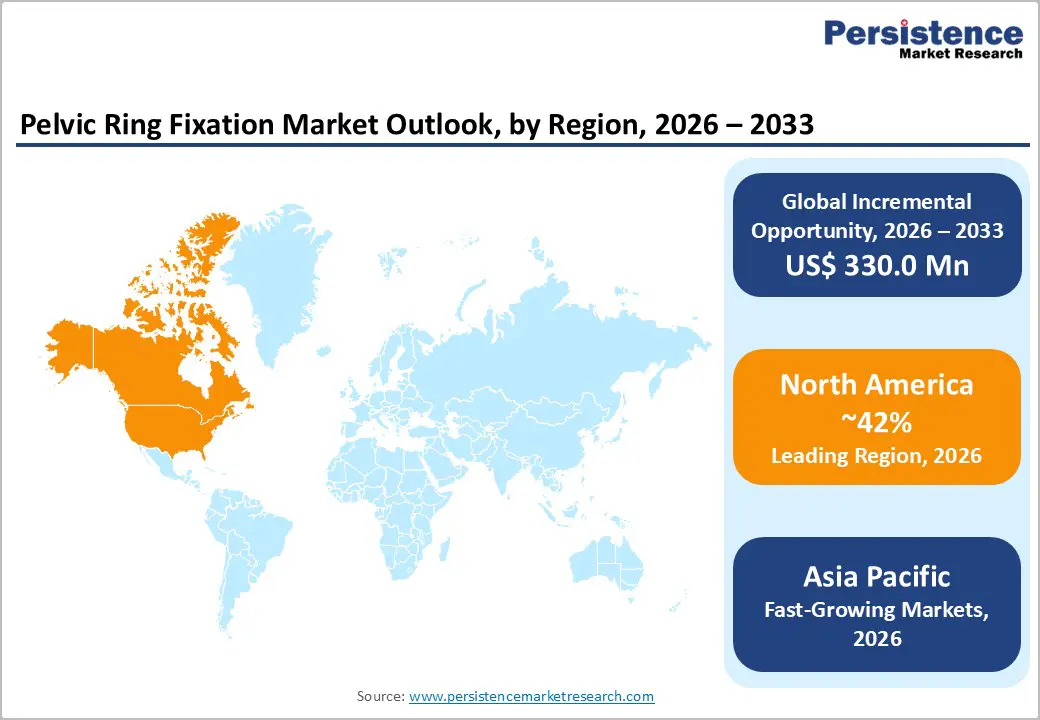

North America Pelvic Ring Fixation Market Trends and Insights

North America is the leading region in the pelvic ring fixation market, with an estimated share of around 42% in 2025, reflecting the region’s dominance in the broader trauma fixation and orthopedic devices landscape. The U.S. market benefits from high per capita healthcare expenditure, a dense network of Level I and II trauma centers, and robust adoption of advanced implants and minimally invasive techniques in pelvic fracture management. Regulatory oversight by the U.S. Food and Drug Administration (FDA) ensures rigorous evaluation of pelvic fixation systems, while periodic approvals for novel low-profile and percutaneous devices, such as curved intramedullary systems designed to fix challenging pelvic fractures, drive continuous product innovation and surgeon interest.

In addition, favorable reimbursement structures for trauma surgeries through public and private payers, combined with a high incidence of road traffic injuries, sports trauma, and osteoporotic fractures in older adults, sustain demand for pelvic ring fixation. Major global companies, including DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet, Smith & Nephew, Medtronic, Globus Medical, and Orthofix Medical, maintain strong commercial footprints, surgeon training programs, and clinical research collaborations across the region, reinforcing North America’s leadership in technology adoption, procedural volumes, and clinical evidence generation for pelvic fixation solutions.

Asia Pacific Pelvic Ring Fixation Market Trends and Insights

Asia Pacific is the fastest-growing regional market for pelvic ring fixation, driven by a combination of demographic expansion, rapid urbanization, and evolving trauma epidemiology in China, Japan, India, and ASEAN countries. Global burden of disease studies highlight notable increases in pelvic fracture incidence and disability across parts of Asia, with aging populations and increased life expectancy amplifying the prevalence of fragility fractures. At the same time, high rates of road traffic accidents, industrial injuries, and construction-related trauma contribute significantly to pelvic fracture caseloads, pushing governments and private providers to upgrade trauma care capacity and surgical capabilities.

Asia Pacific’s manufacturing advantages, including lower production costs, expanding orthopedics clusters, and supportive industrial policies, are encouraging both global MedTech firms and regional companies to localize pelvic fixation device production. Domestic players in China and India are increasingly collaborating with multinational companies such as DePuy Synthes, Stryker, Zimmer Biomet, Globus Medical, and Auxein Medical to offer competitively priced internal and external fixation systems tailored to price-sensitive markets. As health insurance coverage broadens, surgical training programs expand, and tertiary trauma centers proliferate in major cities, the Asia Pacific is expected to post the highest CAGR in pelvic ring fixation procedures and device consumption through 2033.

The pelvic ring fixation market is moderately consolidated, with a core group of global orthopedic and trauma device manufacturers holding substantial shares alongside regional specialists. Key strategies include continuous R&D in low-profile implants and minimally invasive instrumentation, acquisitions of niche trauma firms, expansion into high-growth regions such as the Asia Pacific, and integration of digital tools, such as navigation and 3D planning, to differentiate offerings. Smaller players focus on cost-competitive solutions and region-specific product lines.

Key Market Developments

The global Pelvic Ring Fixation market is expected to reach US$ 613.4 million in 2026, supported by rising pelvic fracture incidence, aging populations, and wider adoption of advanced internal and external fixation systems.

A major demand driver is the increasing global burden of pelvic fractures, exceeding 4.5 million incident cases annually, particularly among elderly patients who require stable fixation to enable early mobilization and reduce complications.

North America leads the Pelvic Ring Fixation market with an estimated share of about 42%, underpinned by advanced trauma centers, high healthcare spending, strong reimbursement, and rapid adoption of innovative trauma fixation technologies.

A key opportunity lies in Asia Pacific, where demographic aging, urbanization, and expanding trauma infrastructure in China, India, Japan, and ASEAN nations are driving demand for cost‑effective pelvic fixation and post‑surgical stabilization solutions.

Key players include DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet, Smith & Nephew, Medtronic, B. Braun Melsungen, Orthofix Medical, GlobusMedical, Acumed, PelvicBinder, Lineage Medical, and Auxein Medical, alongside several regional trauma device manufacturers.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis Units |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

Product Type

Application

End User

Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author