ID: PMRREP33122| 220 Pages | 20 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

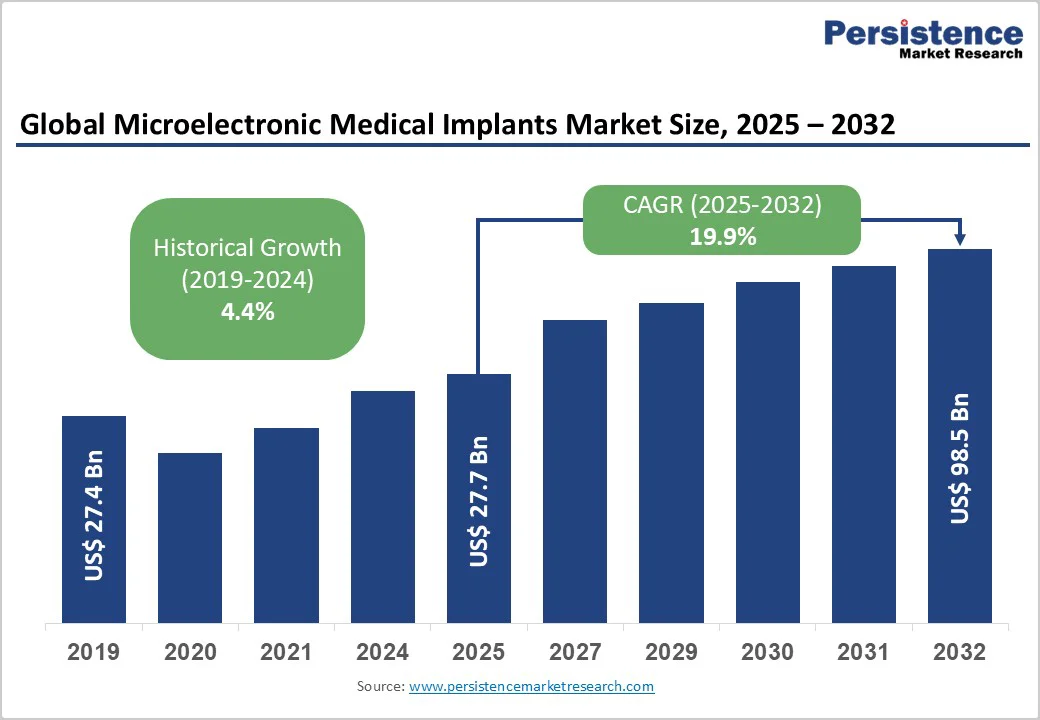

The global microelectronic medical implants market size is likely to be valued at US$27.7 billion in 2025, and is estimated to reach US$98.5 billion by 2032, growing at a CAGR of 19.9% during the forecast period 2025−2032, driven by technological breakthroughs, patient demographics, and widening applications in chronic disease management and digital health.

Key growth drivers include device miniaturization, wireless connectivity, favorable regulations, and an aging population that relies on medical implants. Strong R&D, bioelectronic medicine, and converging industry verticals further boost growth, prompting companies to target high-tech, high-growth segments.

| Key Insights | Details |

|---|---|

|

Microelectronic Medical Implants Market Size (2025E) |

US$27.7 Bn |

|

Market Value Forecast (2032F) |

US$98.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

19.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.4% |

Microelectronic medical implants are gaining immensely from advancements in wireless power transfer and next-generation biosensor technologies, making minimally invasive delivery the default for new product launches. Recent data from the U.S. Food & Drug Administration (FDA) show a tangible increase in the approval of sensor-based digital health technology (SDHT) devices, including some that are implantable, signifying a rapid shift from battery-reliant, invasive interventions to externally managed and energy-harvested devices.

Leading regulatory bodies, such as the European Medicines Agency EMA), are also providing favorable pathways for wireless device approvals, reducing technical review timelines relative to conventional devices. The result is a material decline in post-operative complications and device replacement rates. For manufacturers, these trends mean both increased product differentiation and the ability to address new therapy areas, most notably wireless cardiac monitors, closed-loop neurostimulators, and biosensor-integrated drug pumps.

Medical device manufacturers are having to contend with intricate, regionally varied, and frequently evolving regulatory frameworks, especially as technologies outpace legislation. The regulatory burden associated with next-generation implantable devices, such as biosensor-rich products, involves not only extensive pre-clinical validation but also evidence generation for cybersecurity, data interoperability, and device lifecycle management. For example, the newly introduced European Union (EU) Medical Device Regulations (MDR) require, as of 2022, that digital and connected medical devices undergo stringent clinical evaluation and post-market surveillance. In the U.S., the FDA’s increasing emphasis on Unique Device Identification and mandatory device tracking adds layers of compliance cost, with industry estimates suggesting that regulatory preparation for a single new PMA (premarket approval) implant can cost several million dollars.

The burden is particularly acute for small and medium enterprises (SMEs) and emerging-market entrants lacking compliance infrastructure, thereby constraining diversity in device innovation and market entry. These complex frameworks, while critical for safety and efficacy, create structural bottlenecks to rapid product commercialization and make business-case planning for next-gen device launches increasingly conservative.

A high-value market opportunity lies in wait for market players in the synergy between microelectronic medical implants and the rapidly evolving digital therapeutics (DTx) ecosystem, underscored by regulatory acceptance of remote monitoring solutions. Notably, the U.S. Centers for Medicare & Medicaid Services (CMS) expanded reimbursement coverage for remote physiological monitoring (RPM) in 2024, enabling physicians and health systems to bill for data collected from connected implants.

This convergence is allowing device manufacturers to move beyond hardware sales towards service-driven, subscription-based models, resulting in improved patient engagement, earlier intervention, and tangible reductions in hospital readmission costs. As of late 2025, leading U.S. and European health systems are starting to pilot fully managed device + platform care models, creating new revenue streams and competitive differentiators for market entrants proficient in cloud interoperability and patient-centric software design.

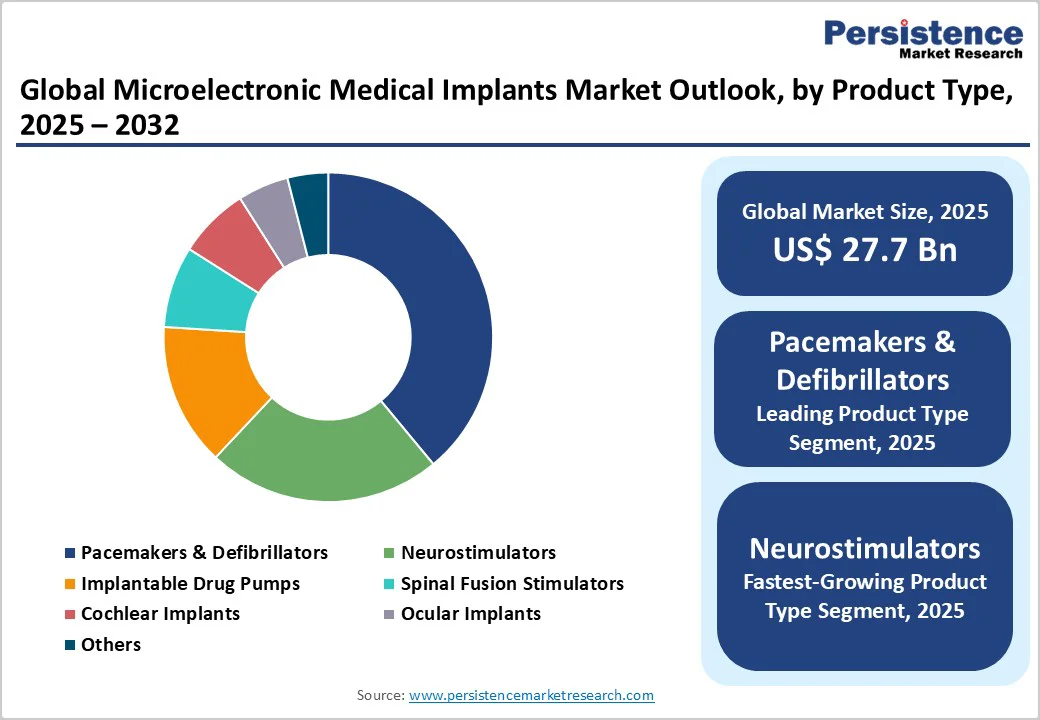

Pacemakers and defibrillators are maintaining their commanding position in the microelectronic medical implants market for 2025, with an estimated 39% revenue share. This segment’s primacy is rooted in high clinical effectiveness, broad applicability in the aging population, and well-established reimbursement pathways across North America, Europe, and Japan. The adoption is facilitated by robust clinical guidelines, decades of outcomes data, and regular product enhancements, such as leadless designs and MRI-compatibility, driving procedural volume growth in both developed and emerging healthcare markets. The result is consistent revenue visibility for market incumbents and a defensible position against short-term competitive threats, even as the growth rate of these devices stabilizes due to saturation in key developed markets.

Neurostimulators are set to be the fastest-growing product segment through 2032. This performance is underpinned by the rapid expansion of indications such as chronic pain, movement disorders, and refractory depression, improvements in closed-loop and adaptive stimulation algorithms, and a soaring demand for minimally invasive neuromodulation alternatives to pharmaceutical therapy. The segment growth is further accelerated by the entrance of agile mid-market suppliers and regional innovators, especially in Asia Pacific, who are leveraging cost and regulatory advantages to commercialize next-generation, patient-adaptive platforms.

RF communication remains the technological backbone of implantable device connectivity in 2025, accounting for an estimated 42% of the microelectronic medical implants market revenue. This dominance is the result of international harmonization of medical RF frequencies, combined with real-world reliability in everything from cardiac arrhythmia monitoring to neurostimulation feedback. Top device manufacturers continue to invest in proprietary RF telemetry platforms to ensure secure, bidirectional data flow and compliance with GDPR and HIPAA standards. These investments translate to improved clinical workflows, enhanced patient safety, and growing utility in post-implant care management.

Wireless power transfer (WPT) is the fastest-growing over the 2025-2032 period. WPT overcomes traditional battery constraints, enabling miniaturization and supporting the development of fully implantable or even bioresorbable devices. Pilot commercialization in implantable neurostimulators and advanced glucose monitors is already accelerating, supported by regulatory acceptance in the U.S., Germany, and Japan. For device developers, WPT unlocks entirely new form factors, creates differentiation, and raises the competitive bar for chronic care and multi-year implant technologies.

Metals, especially titanium and platinum, will continue to drive the microelectronic implant materials market in 2025, accounting for about 55% of usage in core system components and electrodes. Their widespread deployment is due to proven biocompatibility, high strength-to-weight ratios, and demonstrated longevity in both cardiac and neurostimulation applications, making them the de facto choice for FDA- and CE-cleared product portfolios globally.

Medical-grade polymers, including silicone, polyimide, and parylene, are projected to outpace metals from 2025 to 2032. Their accelerated adoption is attributable to advances in flexible electronics, improved device hermeticity, and new surgical delivery techniques. Polymeric materials are especially vital for next-gen, flexible implants, enabling ultrathin cardiac monitors and soft neurostimulation electrodes. The shift toward biointegrated and even degradable polymer systems further positions this segment at the forefront of innovation, offering cost, safety, and performance benefits that align with evolving regulatory and physician preferences.

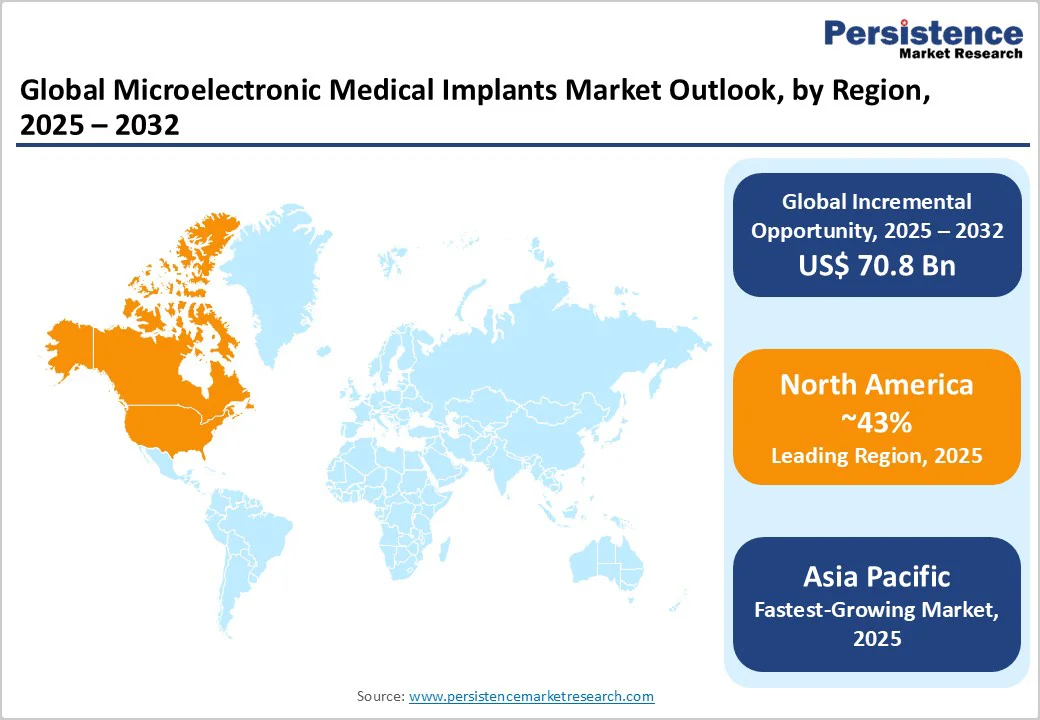

North America is poised to play a leading role in 2025, commanding around 43% of the microelectronic medical implants market share 2025. The sustained strength of the U.S. medical innovation ecosystem, robust venture capital and strategic M&A flows, and a regulatory regime that is simultaneously rigorous and efficient, following the FDA’s “Breakthrough Devices” policy, are the foremost factors favoring the region's leadership. Across North America, adoption rates for pacemakers, defibrillators, and, increasingly, cloud-connected neurostimulators are among the highest, driven by CMS reimbursement for remote monitoring.

Canada is also emerging as a hub for AI-enabled health devices, while Mexico is capturing cross-border supply chain investments. Regulatory harmonization and investment in digital health infrastructure are facilitating cross-sector partnerships and direct-to-patient engagement models previously nonviable. The U.S. remains a testing ground for digital therapeutics integrated with implantable devices, supported by hospital systems with embedded clinical research. The substantial growth forecast of the regional market is on account of continuous innovation and the entrenchment of connected and adaptive implants in chronic disease management protocols.

Europe is expected to grow moderately, driven by a blend of high per capita healthcare expenditure, universal coverage models, and established leadership in cardiovascular and neurostimulation clinical research. Germany, the U.K., and France are the largest markets, benefiting from well-capitalized health systems and significant R&D tax incentives. Regulatory harmonization is advancing under the European MDR. For SMEs, entering the market and scaling operations is hindered by the requirement for extensive clinical evidence and post-market surveillance, often delaying product launches by 12–18 months.

Europe is a crucible for digital health-implant integration, with innovative cross-border consortia, such as those in the Nordics, facilitating rapid iteration of smart orthopedic and cardiac implant platforms. Reimbursement expansion for neurostimulators and next-gen cochlear implants in Spain and Scandinavia is accelerating market fragmentation and enabling pan-European contract manufacturing.

Asia Pacific is projected to deliver the highest CAGR through 2032, making it the focus for both new product launches and global pilot programs for remote and home-based implantable solutions. China is rapidly transitioning from manufacturing engine to market demand leader, driven by state-backed investments in medical device innovation, such as in Suzhou’s biotech parks, and targeted reforms by the National Medical Products Administration (NMPA) that have cut approval times considerably over the last few years.

India has launched its own medtech incentivization programs and is nurturing device original equipment manufacturers (OEM) clusters in Maharashtra and Gujarat, facilitating dual capture of domestic and export demand. Japan’s PMDA is fast-tracking multifunctional digital implants, resulting in higher-than-average growth rates in the adoption of digital therapeutics-linked devices. ASEAN economies, notably Singapore and Malaysia, have become regional supply chain hubs and co-development partners for U.S. and European multinationals. Cross-border joint ventures (JVs), local R&D partnerships, and government procurement contracts are primary vehicles for market entry and outsized returns in the region.

The global microelectronic medical implants market landscape is stratified, with the top six players accounting for ~61% of the share in 2025, reflecting a trend toward moderate consolidation that is intensifying with increased product complexity and cost of R&D. Medtronic plc, Boston Scientific, and Abbott Laboratories set both the innovation pace and pricing benchmarks. A second tier of companies, including LivaNova, BIOTRONIK, and MicroPort, is leveraging portfolio breadth and regulatory agility to secure regional dominance or specialty leadership, mainly in neuro and cardiac monitors.

Start-ups and mid-sized companies are exerting disruptive pressure in wireless power and the convergence of digital therapeutics and implant technology, forcing incumbents to accelerate acquisition and partnership activity. The increasing importance of digital health partnerships, advanced manufacturing assets, and cross-platform integration is driving a wave of vertical integration and ecosystem-based competition.

The global microelectronic medical implants market is projected to reach US$27.7 Billion in 2025.

Technological breakthroughs, patient demographics, and widening applications in chronic disease management and digital health are driving the market.

The microelectronic medical implants market is poised to witness a CAGR of 19.9% from 2025 to 2032.

Rapid miniaturization and wireless connectivity of devices, favorable regulations, an aging global population increasingly relying on active medical implants for life-quality improvement and disease prevention, and the emergence of bioelectronic medicine are key market opportunities.

Medtronic plc, Boston Scientific Corporation, and Abbott Laboratories are some of the top players in the market.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Technology

By Material

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author