ID: PMRREP22303| 199 Pages | 21 Nov 2025 | Format: PDF, Excel, PPT* | Healthcare

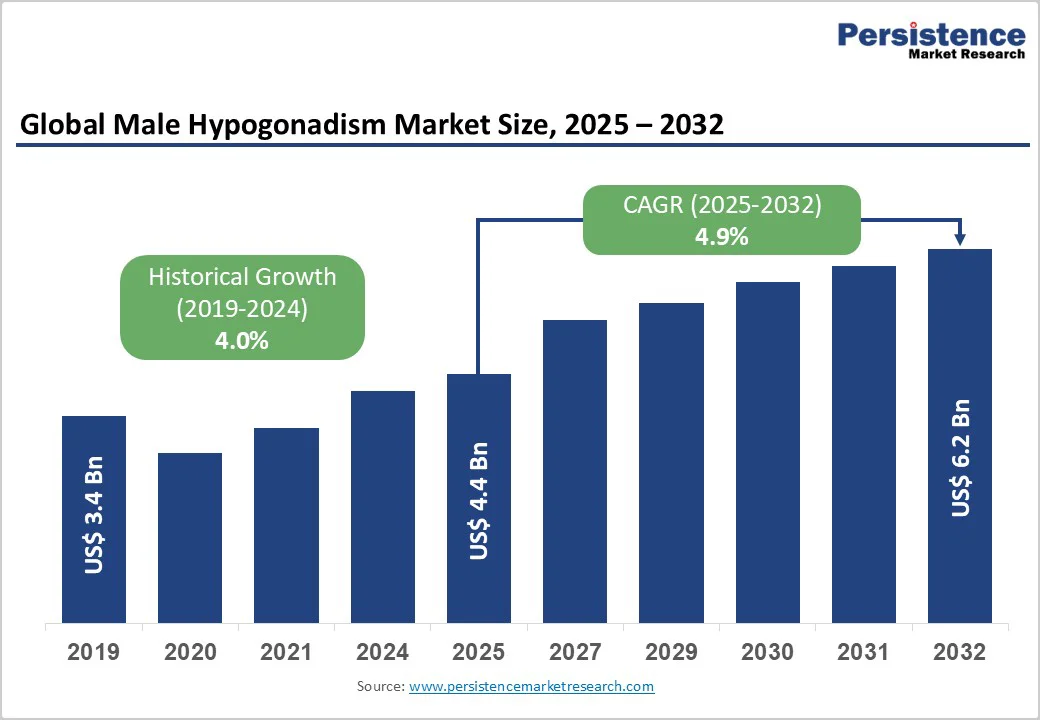

The global male hypogonadism market size is estimated to likely to value US$ 4.4 billion in 2025 and is projected to reach US$ 6.2 billion at a CAGR of 4.9% during the forecast period from 2025 to 2032. The growing prevalence of testosterone deficiency, rising awareness of men’s health, and continuous advancements in testosterone delivery technologies indicate the need for therapy.

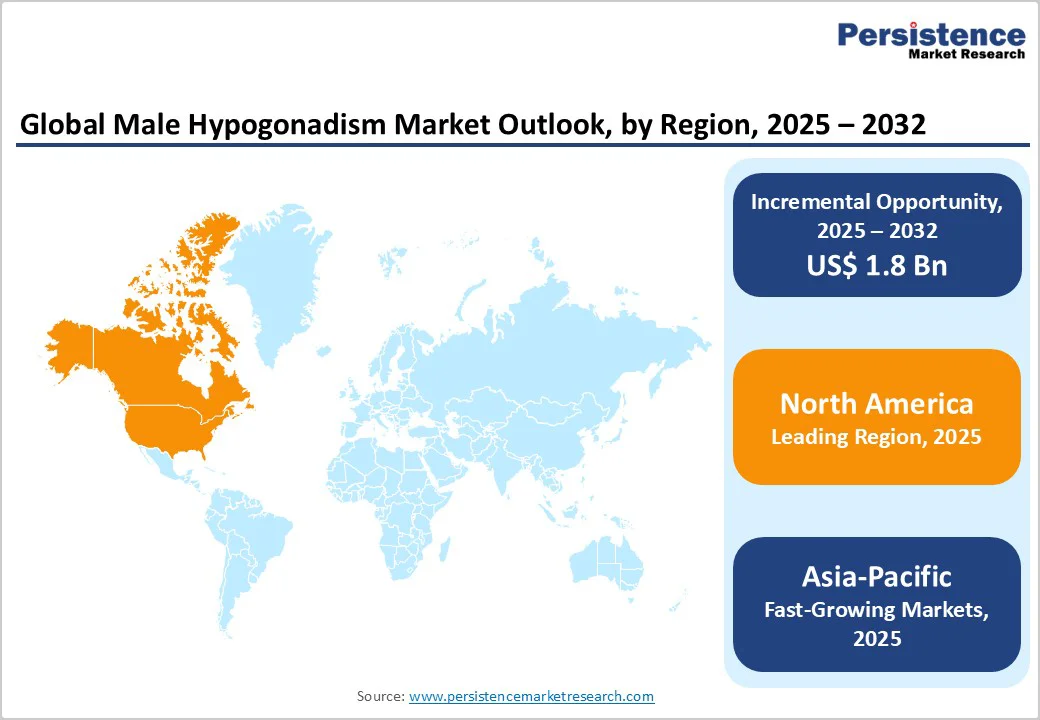

North America leads the market owing to strong diagnostic infrastructure, established reimbursement systems, and high treatment adoption rates, while Asia Pacific is the fastest-growing region, supported by increasing healthcare expenditure, a growing aging male population, and improving access to endocrinology and urology care services.

| Key Insights | Details |

|---|---|

| Global Male Hypogonadism Market Size (2025E) | US$ 4.4 Bn |

| Market Value Forecast (2032F) | US$ 6.2 Bn |

| Projected Growth (CAGR 2025 to 2032) | 4.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.0% |

Growing awareness of men’s health and hormonal disorders is a meaningful driver for the male hypogonadism market. According to data from the Endocrine Society, approximately 35% of men over the age of 45 and between 30-50% of men with obesity or type 2 diabetes are estimated to have hypogonadism. In the U.S., the nationally-representative NHANES III study projected that nearly 6.0-8.4 million men aged 40+ may have low total testosterone levels.

Despite these prevalence figures, a UK community survey found that 55% of men were unfamiliar with symptoms of testosterone deficiency, and only about 5% had been formally diagnosed, though approximately 26-31% reported characteristic symptoms such as low libido or erectile issues.

This gap between prevalence and awareness underscores the growing market opportunity for better screening, diagnostic tools, and therapy adoption driven by increasing recognition of men’s hormonal health issues.

Safety concerns around testosterone therapy pose a significant restraint for the male hypogonadism market. The Food and Drug Administration (FDA) and other regulatory bodies have repeatedly issued warnings: in 2014, the FDA communicated a possible increased risk of heart attack, stroke, and death with testosterone products, especially when used off-label for age-related low testosterone.

Real-world data from the FDA’s Adverse Event Reporting System found 3,057 cases of major adverse cardiovascular events (MACE) among testosterone users from 2004 to 2022, with a reporting odds ratio for myocardial infarction (MI) as high as 9.46 (95 % CI: 3.08) in some analyses.

While a large randomized trial (the TRAVERSE trial) later indicated no increased composite cardiovascular risk (7.0% vs 7.3% placebo) in men aged 45-80, clinicians are still cautioned over elevated blood-pressure signals and possible thromboembolic events. These safety uncertainties reduce physician willingness to prescribe, increase monitoring burdens, and slow uptake, impacting the overall market growth.

The emergence of oral testosterone formulations represents a significant opportunity in the male hypogonadism market. For example, the JATENZO (testosterone undecanoate) was approved by the U.S. Food & Drug Administration in March 2019, with 87% of hypogonadal men in a Phase III study achieving normal testosterone levels.

In August 2022, another oral product, KYZATREX, gained FDA approval, providing a further option for adult males with testosterone deficiency. Oral delivery addresses limitations of injectables (e.g., injections, clinic visits) and topical gels (e.g., skin transfer risks) and may improve patient adherence.

Moreover, academic literature notes that male hypogonadism affects 10-30% of the male population and remains under-treated. Given these factors, the arrival of oral formulations is poised to expand the treatment-eligible population, improve convenience, and penetrate markets where injectable or topical access is limited.

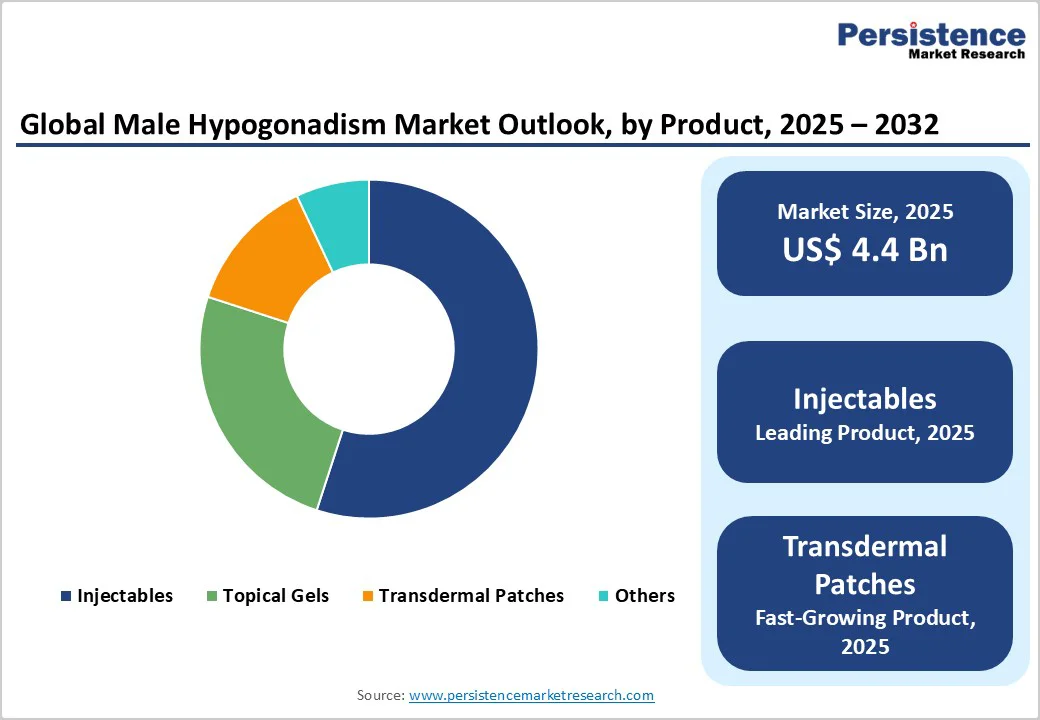

The reagents & consumables dominate with a 54.4% share in 2025, because they deliver reliable, long-acting testosterone levels and are supported by long-standing clinical use. According to the review in StatPearls, injectable TRT “is the most prescribed formulation in the USA healthcare market.” The U.S. Food & Drug Administration (FDA) also noted that men aged 40-74 comprise over 80% of TRT users, and that injectables account for the majority of annual prescriptions.

As injectables are generic, widely available, cost-effective and allow dosing intervals (often every 1-3 weeks) they pose fewer administration hurdles compared to daily gels or patches. This convenience and cost-structure drive their strong market share and explain why they remain the dominant product type.

The dominance of Testosterone Replacement Therapy (TRT) in the male hypogonadism market is grounded in both regulatory approval and recorded usage patterns. According to the U.S. Food & Drug Administration (FDA), testosterone products are only approved for men who have low testosterone levels caused by specific medical conditions (such as testicular failure or hypothalamic/pituitary disorders).

Between 2003 and 2013 in the United States, the rate of TRT use in men aged 18-45 increased from 29.2 to 118.1 per 10,000 person-years a four-fold rise. That steep growth reflects how TRT has become the primary therapeutic route once hypogonadism is diagnosed. Because TRT addresses the hormone deficiency directly and is the only approved broad-therapy category, it logically commands the largest share in the market.

North America dominates the global market with a 41.2% share in 2025, because it combines high prevalence, robust healthcare infrastructure, and strong treatment uptake. A U.S. study found that among men ≥45 years, the prevalence of testosterone levels <300 ng/dL was 38.7% in clinical practice settings.

Between 2018 and 2022, testosterone therapy prescriptions in the U.S. rose by 120% among those aged ≤24, and by 86% among those 25-34, demonstrating swift uptake. Advanced diagnostics, awareness of men’s hormone health, and reimbursement frameworks further support the region’s leadership. For example, reports indicate North America holds about 40% of the global market share for hypogonadism treatments.

Europe represents a key region in the male hypogonadism market for several reasons. First, age-related testosterone decline is evidenced by the European Male Ageing Study (EMAS), which reported a prevalence of symptomatic hypogonadism of 2.1% in men aged 40-79 years (ranging from 0.6% in men 50-59 to 5.1% in men 70-79).

Second, physician awareness is relatively strong: in a survey of endocrinologists and urologists across France, Germany, Italy, and Spain, 86.5% recognized testosterone deficiency syndrome as a clinical entity, estimating prevalence at 10-15% of the male population.

Third, the region has well-developed healthcare systems, enabling diagnosis, treatment, and monitoring essential for market uptake. Thus, while prevalence is modest, Europe’s aging population, combined with established endocrine infrastructure and growing physician awareness, makes it an important growth region for hypogonadism therapies.

Asia Pacific is the fastest-growing region in the male hypogonadism market due to several converging factors. Epidemiological data from a large Chinese study of 5,980 men aged 40-79 found that late-onset hypogonadism prevalence rose from 0.9% in the 40-49 age group to 24% in men aged 75-79.

In Taiwan, 24.1% of men over 40 had androgen deficiency (TT < 300 ng/dL), and 12.0% had symptomatic androgen deficiency. At the same time, lifestyle changes-such as rising obesity rates in Asia (China’s male overweight/obesity rate grew from ~28.9% in 2002 to 45.3% in 2010) increase risk for hypogonadism, thereby expanding the addressable patient pool.

Healthcare infrastructure in many APAC countries is improving, raising diagnosis and treatment access. Together, greater disease burden + better access = rapid regional growth.

Leading companies in the male hypogonadism market are focusing on product innovation, regulatory approvals, and strategic collaborations to enhance treatment options.

Key players are investing in advanced testosterone formulations, including oral and long-acting injectables, while expanding their global presence through mergers and acquisitions. These strategies aim to improve patient compliance, ensure safety, and meet the growing demand for effective testosterone replacement and hormonal balance therapies worldwide.

The global male hypogonadism market is projected to be valued at US$ 4.4 bn in 2025.

Rising prevalence of testosterone deficiency, aging male population, lifestyle disorders, growing awareness of men’s health, and advancements in testosterone replacement therapies drive the global Male Hypogonadism Market.

The global male hypogonadism market is poised to witness a CAGR of 4.9% between 2025 and 2032.

Emergence of oral testosterone formulations, digital hormone monitoring, personalized therapies, and expanding diagnosis in Asia Pacific present major growth opportunities.

AbbVie, Eli Lilly, Pfizer, Endo International, Teva Pharmaceutical Industries, Grünenthal, Merck KGaA.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product

By Therapy Type

By Indication

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author