ID: PMRREP10765| 176 Pages | 23 Sep 2025 | Format: PDF, Excel, PPT* | Consumer Goods

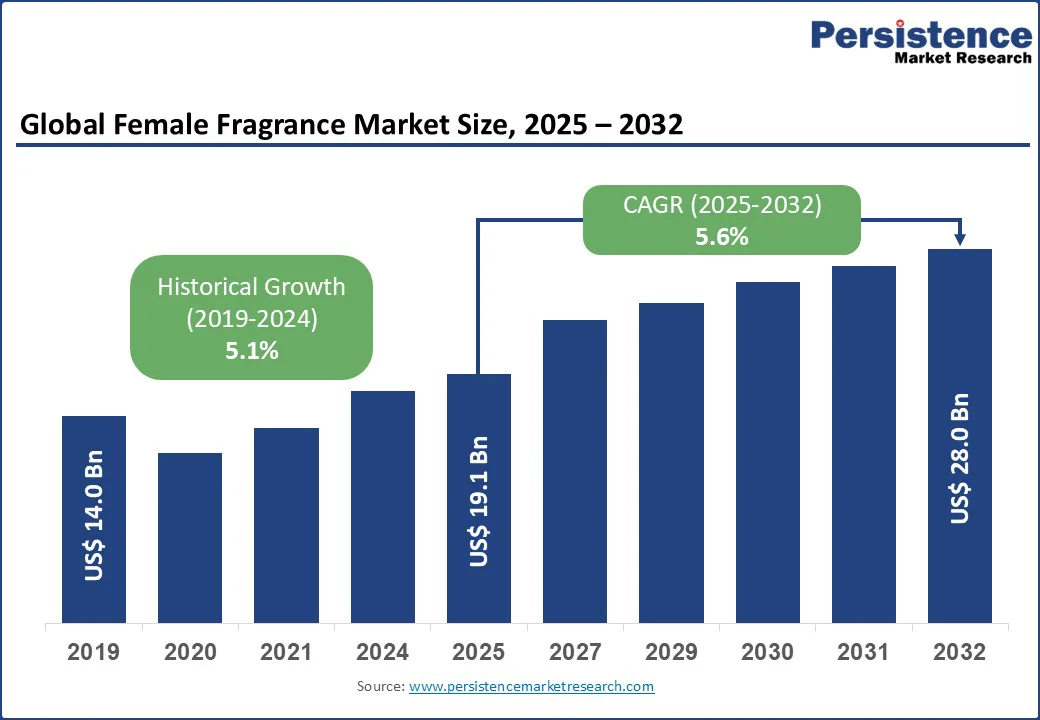

The global female fragrance market size is likely to be valued at US$ 19.1 Bn in 2025 and forecasted to reach US$ 28.0 Bn by 2032, with growing a CAGR of 5.6% during the forecast period from 2025 to 2032.

The female fragrance market size reflects increasing demand for personalized, high-quality fragrances driven by evolving consumer preferences, rising disposable incomes, and the growing influence of beauty and lifestyle trends.

Key Industry Highlights:

| Key Insights | Details |

|---|---|

| Female Fragrance Market Size (2025E) | US$ 19.1 Bn |

| Market Value Forecast (2032F) | US$ 28.0 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.6% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.1% |

Rising disposable incomes, particularly in emerging markets, have significantly boosted consumer spending on premium and luxury fragrances. Women across age groups are increasingly investing in high-quality scents as a form of self-expression and status, driving demand for brands such as Chanel and Gucci.

The global luxury goods market has witnessed strong growth, with fragrances being a key category due to their accessibility compared to other luxury items. In urban areas, where disposable incomes are higher, women are drawn to premium fragrances for professional and social settings, enhancing market growth.

Celebrity endorsements and influencer marketing further amplify consumer interest, with brands leveraging social media to create aspirational appeal, particularly among young adults seeking luxe and special occasion fragrances.

The female fragrance market faces challenges due to the high costs associated with sourcing premium ingredients, such as rare floral extracts and essential oils, which increase production expenses for luxury brands. Regulatory restrictions on certain fragrance ingredients, imposed by bodies such as the International Fragrance Association (IFRA), limit formulation options and raise compliance costs, particularly for brands operating globally.

These regulations, aimed at ensuring safety and environmental sustainability, require extensive testing and reformulation, delaying product launches and increasing costs. Smaller brands and new entrants struggle to compete with established players due to these financial and regulatory barriers, limiting market accessibility.

The growing consumer demand for eco-friendly and sustainable products presents significant opportunities for the women’s fragrance market. Environmentally conscious consumers, particularly younger demographics, are seeking fragrances made with natural, organic, and ethically sourced ingredients. Brands are responding by developing eco-friendly formulations, biodegradable packaging, and cruelty-free products, aligning with global sustainability trends.

Companies such as Hermès and Balmain are launching organic fragrance lines, appealing to eco-conscious consumers, and creating new revenue streams. The shift toward refillable fragrance bottles and sustainable supply chains offers brands a chance to differentiate themselves and capture market share in this rapidly growing segment.

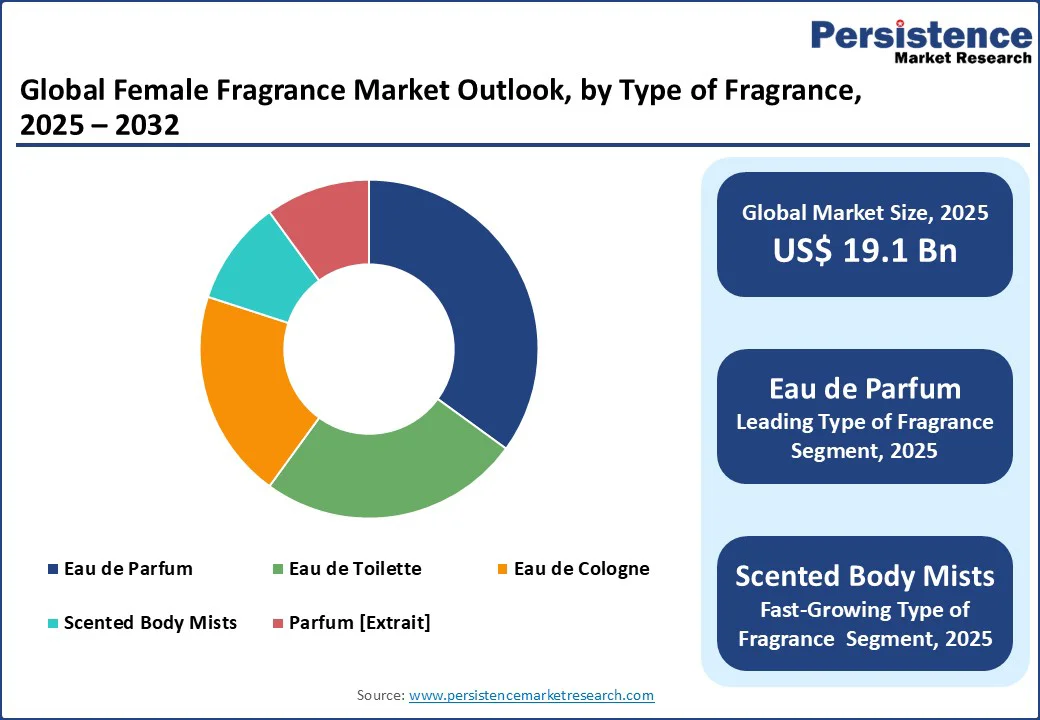

Eau de Parfum dominates the women’s scent market, holding a 35% share in 2025. Its leadership is driven by its high concentration of fragrance oils, offering long-lasting scent profiles that appeal to consumers seeking premium, enduring fragrances for professional and special occasions. Brands such as Chanel and Gucci lead this segment, with products such as Chanel No. 5 and Gucci Bloom being top sellers due to their rich, sophisticated compositions.

Scented body mists is the fastest-growing segment, driven by their affordability, versatility, and appeal to younger consumers. Body mists, offered by brands such as Victoria’s Secret and Bath & Body Works, are popular for casual and everyday use, with refreshing and lightweight formulations attracting teens and young adults seeking budget-friendly options.

Young Adults (20-35 years) dominate the market, holding a 40% share in 2025, driven by their high purchasing power and interest in fragrances as a form of self-expression. This demographic is drawn to trendy, versatile scents for professional and casual settings, with brands such as L'Oréal and Coty targeting them through influencer-driven campaigns and innovative packaging.

Teens (13-19 years) are the fastest-growing segment, fueled by their increasing engagement with beauty trends and social media. Affordable options such as scented body mists and eau de toilette resonate with this group, with brands such as Revlon and Fifth & Pacific launching youth-oriented campaigns to capture this dynamic market.

Casual/Everyday leads the lifestyle segment, accounting for 35% of market revenue in 2025, driven by the demand for versatile, all-day fragrances that suit various occasions. Brands such as Elizabeth Arden and Shiseido offer accessible scents that appeal to consumers seeking practical yet appealing options for daily use.

Eco-friendly/Organic is the fastest-growing lifestyle segment, with a positive CAGR in the forecast period driven by rising consumer awareness of sustainability. Brands such as Hermès and Balmain are introducing organic and cruelty-free fragrances, appealing to environmentally conscious consumers, particularly in Europe and North America.

Floral dominates the fragrance family segment, holding a 30% share in 2025, due to its timeless appeal and versatility across age groups and occasions. Iconic floral fragrances such as Chanel No. 5 and Lancôme La Vie Est Belle continue to drive sales, appealing to consumers seeking elegant, feminine scents.

Citrus is the fastest-growing fragrance family, driven by its fresh, uplifting profiles that appeal to younger and active consumers. Citrus-based fragrances, offered by brands such as Jo Malone and Bulgari, are gaining popularity for their versatility in sporty and casual settings, particularly in Asia Pacific.

North America holds a 30% share in 2025, driven by a strong beauty and personal care culture and high consumer spending on premium fragrances. The U.S. leads the region, with a robust demand for luxe and special occasion fragrances, supported by major retailers like Sephora and Ulta Beauty.

The region’s growth is fueled by the popularity of celebrity-endorsed and designer fragrances, with brands such as Coty and Revlon dominating through innovative marketing and e-commerce strategies. The rise of eco-friendly fragrances is also gaining traction, with consumers increasingly seeking sustainable options.

The region’s advanced retail infrastructure and digital marketing campaigns, leveraging social media influencers, further drive market expansion, particularly among young adults and middle-aged consumers seeking premium scents.

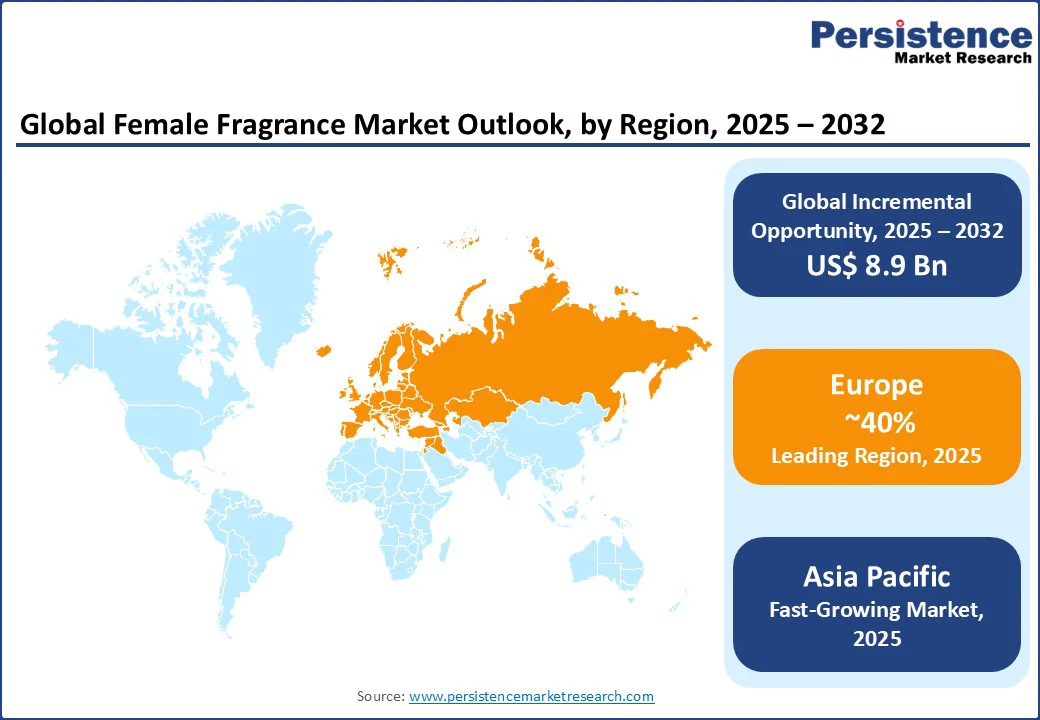

Europe dominates the female fragrance market, holding a substantial share in 2025, led by France, Italy, and the U.K. France, the global hub for luxury fragrances, drives demand through iconic brands such as Chanel, Dior, and Hermès, with Paris’s heritage in perfumery fostering a culture of premium scent consumption.

Italy’s fashion-forward consumer base supports demand for designer fragrances from brands such as Gucci and Versace, particularly for luxe and special occasion use.

The regional market growth is driven by a strong emphasis on craftsmanship and innovation, with niche and artisanal fragrances gaining traction among affluent consumers.

Regulatory support for sustainable practices, such as EU guidelines on eco-friendly packaging, encourages brands to adopt green formulations, boosting the eco-friendly/organic segment. Europe’s advanced retail networks and cultural affinity for fragrances ensure its leadership in the global market.

Asia Pacific is the fastest-growing region, with a 25% market share in 2025, driven by rising disposable incomes, rapid urbanization, and growing beauty consciousness. China leads the region, with a booming middle class driving demand for premium and designer fragrances from brands such as Lancôme and Shiseido. India’s expanding beauty market, fueled by a young, urban population, supports demand for affordable and trendy options such as scented body mists.

Japan’s preference for subtle, citrus, and floral scents, combined with South Korea’s K-beauty influence, drives innovation in fragrance formulations and packaging. The region’s growth is supported by e-commerce expansion and social media marketing, with platforms such as Tmall and Flipkart enabling brands to reach diverse consumers.

Government initiatives promoting consumer goods and rising female workforce participation further fuel demand for professional and casual fragrances.

The global female fragrance market is highly competitive, with Procter & Gamble, Chanel, Coty, Elizabeth Arden, Gucci, Gianni Versace, Fifth & Pacific, L'Oréal, Puig Beauty & Fashion, Revlon, Bulgari, Shiseido, Hermès, and Balmain holding over 65% of the market share.

These companies dominate through premium branding, innovative formulations, and strong global distribution networks. Chanel and Hermès lead in luxury fragrances, while Coty and L'Oréal excel in mass-market and celebrity-endorsed scents. Key players focus on innovation and sustainability to maintain competitiveness.

The global female fragrance market is projected to reach US$ 19.1 Bn in 2025.

Rising disposable incomes, personalization trends, and social media marketing drive market growth.

The female fragrance market is expected to grow at a CAGR of 5.6% from 2025 to 2032.

Eco-friendly fragrances and niche artisanal offerings present significant growth potential.

Chanel, L'Oréal, Coty, Hermès, and Shiseido are among the key players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Type of Fragrance

By Consumer Age Group

By Lifestyle

By Fragrance Family

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author