ID: PMRREP21301| 210 Pages | 5 Jan 2026 | Format: PDF, Excel, PPT* | Food and Beverages

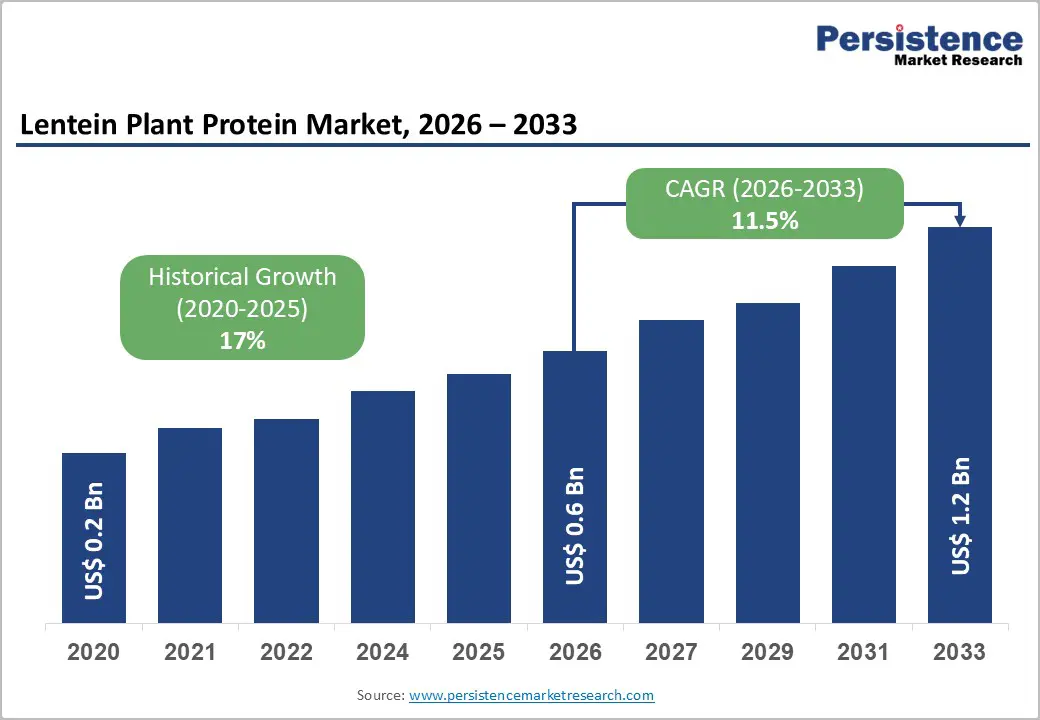

The global lentein plant protein market size is likely to be valued at US$ 0.6 billion in 2026, and is projected to reach US$ 1.2 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2026 - 2033.

This represents a dynamic and rapidly expanding segment within the broader plant-based protein sector, driven by accelerating consumer demand for sustainable protein alternatives and rising health consciousness across global markets. The market's trajectory reflects a fundamental shift in dietary preferences, with flexitarian and vegan populations increasingly adopting lentein-based products due to their superior amino acid profile, environmental sustainability advantages, and functional food applications. Technological advancements in extraction and processing methodologies have significantly enhanced product quality and versatility, expanding addressable market opportunities across food and beverages, nutritional supplements, animal feed, and pharmaceutical applications.

| Key Insights | Details |

|---|---|

| Lentein Plant Protein Market Size (2026E) | US$ 0.6 Bn |

| Market Value Forecast (2033F) | US$ 1.2 Bn |

| Projected Growth (CAGR 2026 to 2033) | 11.5% |

| Historical Market Growth (CAGR 2020 to 2024) | 17% |

The rapid expansion of the nutritional supplement industry and rapid innovation in functional foods are reshaping how consumers manage daily health and performance. The market is experiencing strong momentum in plant-based formulations as more individuals prioritize holistic wellness, digestive comfort, and ethical consumption. Within this landscape, lentein stands out for its exceptional nutritional density and balanced profile of macro- and micronutrients. Its rich protein content, favorable fatty acid composition, and role in supporting energy metabolism and muscle recovery make it highly suitable for sports nutrition, meal replacement products, and next-generation functional beverages. Manufacturers can leverage lentein to develop differentiated offerings that align with evolving consumer expectations around performance, satiety, and long-term health.

Regulatory validation has further strengthened lentein position as a credible and versatile ingredient. Recognition from leading food safety authorities has lowered barriers to formulation and commercialization, enabling its use in a wide range of finished products across global markets. At the same time, consumer preferences are shifting decisively toward clean label offerings, where ingredients are minimally processed, transparently sourced, and easy to understand. Lentein aligns well with these expectations, supporting brand narratives built around natural origin, sustainability, and nutritional integrity. This convergence of regulatory support, functional performance, and evolving consumer values creates a strong foundation for the long-term growth of lentein-based nutritional solutions.

Production capacity constraints remain a significant structural challenge for the lentein plant protein market growth. Global supply is currently concentrated among a small number of commercial-scale producers, limiting flexibility for large-volume buyers and slowing broader market penetration. Developing new cultivation and processing sites involves long lead times and substantial upfront investment, which discourages smaller players and delays diversification of the supplier base. As a result, buyers have limited options for strategic sourcing, and reliance on a few key producers heightens both operational and commercial risk.

The specialized nature of water lentil cultivation further compounds these constraints. Producers must manage tightly controlled environmental conditions and rely on proprietary processing technologies, which narrows the pool of qualified operators and makes technology transfer more complex. Supply chain fragmentation and the absence of mature, standardized distribution networks for lentein-based ingredients create procurement and logistics challenges for food and nutrition manufacturers. Coordination across growers, processors, and distributors remains underdeveloped, adding complexity to long-term contracting and capacity planning. Until additional infrastructure is built and supply chains become more integrated, these constraints are likely to slow the pace of market expansion and limit manufacturers’ ability to scale lentein-based product portfolios.

Lentein is emerging as a promising ingredient beyond traditional food and nutritional supplement applications, particularly in pharmaceutical formulations and cosmetic products. Its rich antioxidant content, anti-inflammatory properties, and highly bioavailable nutrient profile make it well suited for products that support skin health, tissue repair, and overall cellular protection. These attributes enable potential use in specialized formulations such as wound care products, dermal treatments, and therapeutic nutrition developed for patients with heightened recovery or immune support needs. As formulators increasingly seek multifunctional ingredients, lentein offers a compelling combination of efficacy, natural origin, and functional versatility.

The pharmaceutical and cosmetic industries are placing greater emphasis on natural, plant-derived ingredients that enhance both product performance and consumer appeal. This shift is driving demand for innovative protein sources with high purity, consistent quality, and clearly defined functional characteristics. Lentein can meet these requirements by serving either as a core active ingredient or as a complementary functional component in advanced formulations. Strategic collaborations between lentein producers and pharmaceutical or cosmetic manufacturers can accelerate validation, optimize delivery systems, and shorten product development timelines. Such partnerships also support premium positioning in high-value niches, reinforcing lentein's role in next-generation therapeutic and cosmetic solutions.

The powder form of lentin plant protein is forecasted to be the leading segment with an approximate 65% of the market revenye share in 2026. Powder formulations offer strong versatility for manufacturers, enabling incorporation into protein supplements, meal replacement shakes, baked goods, and fortified food products. The segment also benefits from extended shelf life, cost-efficient storage and transportation, and high consumer familiarity with powdered protein formats, which lowers adoption barriers for new lentein-based launches. From a technical standpoint, powder forms support precise dosing, reliable batch-to-batch consistency, and excellent solubility when properly processed, making them well-suited for both dry blends and reconstituted beverages. Their compatibility with a wide range of flavors, sweeteners, and functional additives further simplifies formulation across sports nutrition, clinical nutrition, and mainstream food applications.

The liquid form is likely to be the fastest-growing segment during the 2026-2033 forecast period. Growth drivers include increasing consumer demand for ready-to-drink protein beverages, convenience-oriented nutrition solutions, and premium functional beverage categories. Liquid lentein formulations deliver enhanced bioavailability and simplified consumption experiences, particularly appealing to time-constrained urban consumers and fitness enthusiasts. Manufacturers are investing in innovative liquid protein products, including plant-based protein waters, fortified coffee beverages, and meal replacement drinks, driving segment expansion and premiumization trends.

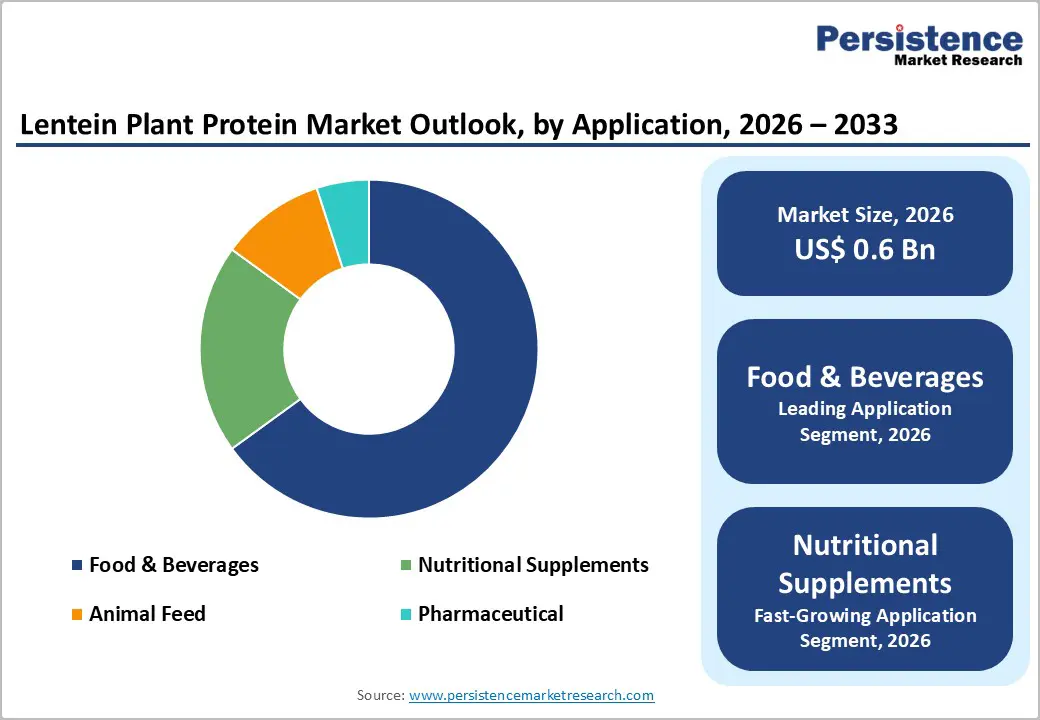

Food & beverage applications are slated to dominate with an estimated 60% of the lentein plant protein market revenue share in 2026. Applications span plant-based meat alternatives, protein-enriched snacks, bakery and confectionery products, dairy alternatives, and functional beverages, allowing manufacturers to address multiple consumption occasions and price points. The segment also benefits from the rapid expansion of plant-based food categories, ongoing reformulation efforts focused on improving protein quality and reducing artificial additives, and growing consumer demand for clean-label, minimally processed ingredients. Major food manufacturers are beginning to incorporate lentein into both new and existing product lines to differentiate their offerings, support sustainability and environmental, social, & governance (ESG) commitments, and enhance nutritional profiles without compromising taste, texture, or overall sensory performance.

Nutritional supplement is expected to be the fastest-growing application area throughout the 2026-2033 period. Its growth catalysts include rising participation in sports and active lifestyles, an aging population with higher protein needs, and increased use of specialized medical nutrition to support recovery and the management of chronic conditions. Lentein’s complete amino acid profile, high digestibility, and valuable micronutrient content make it well-suited for performance-focused formulations, healthy aging products, and clinically oriented nutrition solutions where both efficacy and tolerance are critical. The segment also attracts substantial innovation investment as brands look to differentiate beyond commodity plant proteins, allowing lentein-based products to command premium pricing and support value-added positioning in both retail and healthcare channels.

Supermarkets are anticipated to possess a commanding 70% of the market revenue share in 2026. Traditional retail channels provide essential consumer visibility, facilitate product trial through in-store promotions and sampling, and offer convenient access for shoppers who prefer to purchase groceries in physical stores. These outlets also help normalize lentein-based products by shelving them alongside established protein and other health-focused categories, which reinforces trust and familiarity among mainstream consumers. However, growth rates in traditional retail are gradually moderating as purchasing patterns shift toward online platforms and specialty health and wellness retailers, where product assortment and education are often more extensive.

Online stores are set to display the highest CAGR from 2026 to 2033. E-commerce platforms provide direct consumer access, enable detailed product education, facilitate subscription-based purchasing models, and reduce distribution costs for emerging brands. The channel particularly appeals to younger, digitally-native consumers seeking specialized nutrition products and sustainable food options. Direct-to-consumer (D2C) strategies through branded websites and third-party marketplaces enable manufacturers to capture higher margins while building customer relationships and gathering consumer insights.

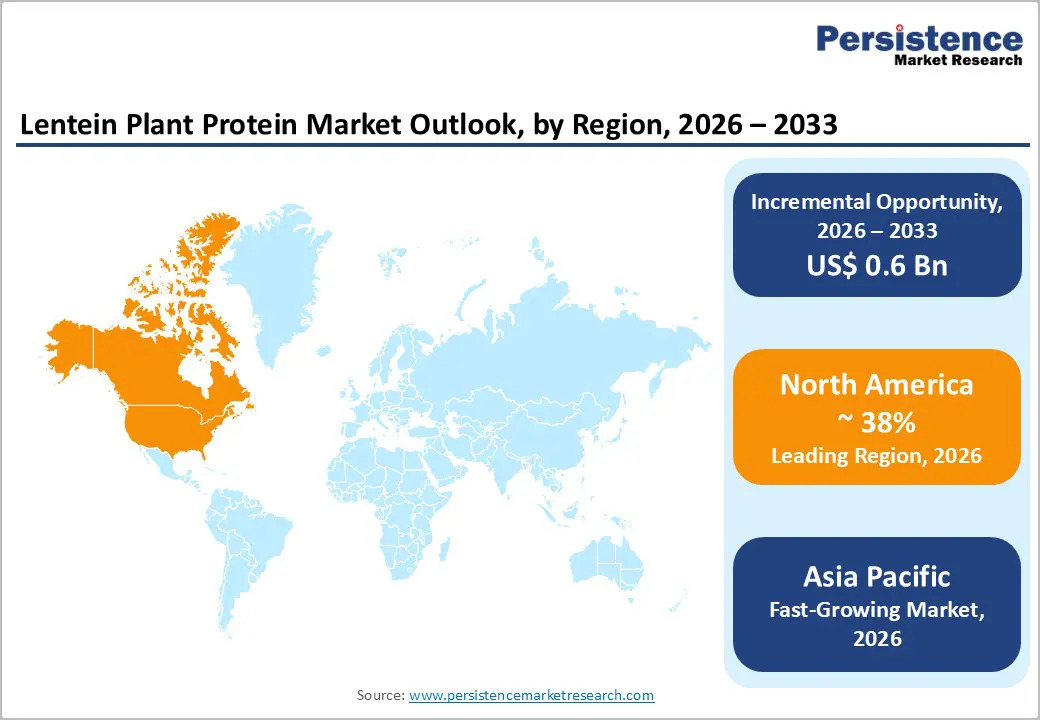

North America is set to command a significant portion of the lentein plant protein market share at approximately 32.5% in 2026, supported by a mature plant-based food ecosystem, a well-developed sports nutrition industry, and high levels of consumer health awareness. The United States leads regional consumption, underpinned by strong retail and e-commerce penetration for plant-based products and a favorable environment for premium nutrition brands. The region is expected to sustain healthy growth over the medium term as lentein increasingly features in plant-based meat alternatives, ready-to-drink beverages, and performance nutrition products.

A supportive regulatory environment for novel food ingredients, with clear safety recognition, helps streamline both formulation and commercialization activities in the region. North America also benefits from strong venture capital and corporate investment in alternative protein technologies, advanced food technology infrastructure, and extensive distribution networks for specialty and functional nutrition products. The competitive landscape includes established nutrition and consumer packaged goods brands integrating lentein into existing portfolios, alongside agile direct-to-consumer players that position it as a premium, sustainable protein source. Strategic collaborations between ingredient suppliers and major food manufacturers, combined with continued investment in capacity expansion and consumer marketing, reinforce North America’s role as the primary innovation hub for the global lentein market development.

Europe represents the second-largest regional market for lentein plant protein, supported by stringent sustainability regulations, high adoption of plant-based foods, and strong consumer awareness of environmental issues. The region’s growth outlook is reinforced by mature demand in countries such as Germany, the United Kingdom, France, and Spain, which together form the core consumption base for lentein-enriched foods and nutritional products. These markets are characterized by sophisticated retail infrastructure, well-established health and wellness segments, and consumers who are receptive to premium, innovative protein ingredients that align with ethical and ecological values.

Policy frameworks plays crucial role in shaping market development for lentein in Europe. The Novel Food legislation of the European Union (EU) provides more predictable approval pathways for new protein ingredients, helping to shorten commercialization timelines and lower regulatory barriers for manufacturers. Initiatives such as the European Green Deal and the Farm to Fork Strategy offer clear strategic support for sustainable protein alternatives, with several countries adopting procurement preferences and fiscal incentives that favor low-impact food solutions. Within this policy environment, competitive activity is driven by European plant-based pioneers, global ingredient suppliers expanding their alternative protein portfolios, and North American firms entering the region. Success increasingly depends on local production partnerships, compelling sustainability narratives, clear, clean-label positioning, and transparent supply chain communication that reinforces trust among highly informed consumers.

Asia Pacific is anticipated to emerge as the fastest-growing market for lentein plant protein. Market growth in Asia Pacific is being driven by large population bases, rising middle-class incomes, and increasing health awareness across China, India, and ASEAN markets. Growth dynamics also reflect rapid urbanization, shifting dietary patterns toward higher protein intake, and government initiatives that promote food security and agricultural sustainability. China’s focus on alternative protein development within national food strategies is creating a supportive policy environment and stimulating infrastructure investment, while Japan’s aging population is driving demand for high-quality, easily digestible protein solutions aligned with healthy aging objectives. In equivalent, India’s sizable vegetarian population and strong cultural acceptance of plant-based diets provide a natural fit for premium plant protein ingredients such as lentein.

Manufacturing advantages further strengthen region’s strategic role in the lentein value chain. The region benefits from relatively lower production costs, established aquaculture and agricultural infrastructure that can be adapted to water lentil cultivation, and proximity to large, fast-growing consumer markets. Regional ingredient manufacturers are forming partnerships with international technology providers to build local lentein production capabilities through joint ventures, technology transfer agreements, and new manufacturing facilities that serve both domestic and export demand. Distribution strategies emphasize online channels, health food retailers, and modern trade formats targeting urban middle-class consumers, while successful market penetration increasingly depends on tailoring products to local taste preferences, maintaining competitive pricing relative to established plant proteins, and investing in consumer education to communicate lentein’s distinctive nutritional and functional benefits.

The global lentein plant protein marketstructure is moderately consolidated, with major players such as Cargill, Kerry Group, Parabel, Archer Daniels Midland Company (ADM), and DuPont de Nemours, Inc. leading the industry. This competitive landscape blends established ingredient suppliers with agile emerging brands, all vying for share in a rapidly expanding category driven by rising consumer interest in sustainable nutrition. Intense rivalry pushes companies to innovate and clearly differentiate their value propositions, moving beyond basic protein claims to emphasize specific advantages such as digestibility, complete amino acid profiles, and environmental sustainability.

To reinforce market presence and broaden application coverage, leading participants are prioritizing new product development, strategic alliances, and targeted mergers & acquisitions (M&A). Firms are also ramping up investment in research & development (R&D) to enhance the taste, texture, and nutritional profile of their offerings, ensuring they align closely with evolving consumer expectations around functionality and sensory experience. This strategic focus on product refinement allows manufacturers to integrate lentein into diverse formats, ranging from beverages to meat alternatives, thereby expanding its commercial viability. Organizations looking to capitalize on this trend should evaluate partnership opportunities that grant access to advanced formulation technologies, as these collaborations often accelerate time-to-market for high-quality, next-generation plant protein solutions.

The global lentein plant protein market is projected to reach US$ 0.6 billion in 2026.

Rising demand for sustainable, plant-based, high-quality protein ingredients across food, beverage, and nutritional supplement applications is driving the market.

The market is poised to witness a CAGR of 11.5% from 2026 to 2033.

Key market opportunities include functional foods, sports and clinical nutrition, and expansion into high-growth regions where plant-based and clean-label products are gaining rapid consumer acceptance.

Cargill, Kerry Group, Parabel, Archer Daniels Midland Company and DuPont de Nemours are some of the key players in the market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Form

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author