ID: PMRREP35660| 182 Pages | 25 Sep 2025 | Format: PDF, Excel, PPT* | Healthcare

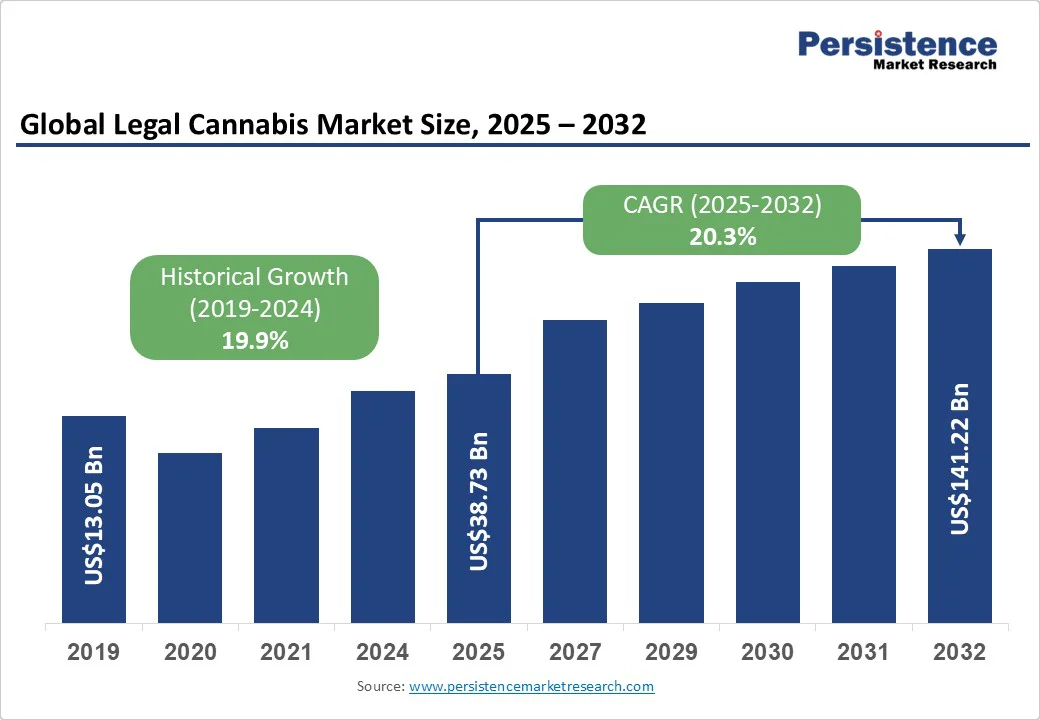

The global legal cannabis market size is likely to be valued at US$38.73 Bn in 2025 and is expected to reach US$141.22 Bn by 2032, growing at a CAGR of 20.3% during the forecast period from 2025 to 2032, driven by expanding legalization for both medical and recreational use.

Growing acceptance of cannabis-based therapies for chronic pain, neurological disorders, and mental health conditions has accelerated demand, while shifting consumer attitudes and regulatory reforms across North America, Europe, and parts of Asia are opening new revenue streams.

| Key Insights | Insights |

|---|---|

| Legal Cannabis Market Size (2025E) | US$38.73 Bn |

| Market Value Forecast (2032F) | US$141.22 Bn |

| Projected Growth (CAGR 2025 to 2032) | 20.3% |

| Historical Market Growth (CAGR 2019 to 2024) | 19.9% |

The legal cannabis market is being shaped by increasing emphasis on precision formulation and cannabinoid-targeted therapeutics, where companies are moving beyond generic products to develop specific THC:CBD ratios, terpene combinations, and minor cannabinoid blends tailored for distinct medical conditions.

This push toward pharmaceutical-grade formulations is a response to regulatory requirements for consistency and safety, as well as growing physician demand for reliable alternatives to conventional therapies. For example, in Germany, recent reforms have allowed manufacturers to provide multiple extract formulations, enabling healthcare providers to choose more precise treatments for patients with epilepsy or chronic pain.

The industry is advancing through technological innovation in cultivation, quality assurance, and supply chain traceability. Methods such as vertical farming, hydroponics, and selective breeding are enhancing yield and efficiency, while advanced extraction and testing techniques ensure compliance with strict safety standards on pesticide residues and potency levels. The integration of blockchain and AI tools for seed-to-sale tracking is further strengthening transparency, meeting the stringent regulatory frameworks in mature markets.

The legal cannabis market faces persistent challenges linked to inconsistent product quality standards and fragmented traceability systems. Many producers must adapt to varying seed-to-sale tracking platforms that differ across jurisdictions, which creates duplication of effort and raises the likelihood of compliance errors.

Packaging and labeling regulations also add another layer of complexity, often requiring costly adjustments such as child-resistant containers and detailed health warnings. Smaller cultivators, in particular, struggle to absorb these operational pressures, which can delay product launches and erode competitiveness in fast-moving markets.

Access to mainstream financial services and secure payment infrastructure remains a significant structural barrier. Despite legalization in many regions, a large number of cannabis operators continue to be excluded from banking, credit, and insurance services due to the industry’s classification as high-risk.

Reliance on cash transactions not only increases security risks but also complicates tax reporting and auditing. Limited acceptance of digital payments and elevated transaction fees discourage customer adoption and hinder retail growth. This exclusion from traditional financial systems restricts investment opportunities, leaving smaller businesses with limited pathways to scale their operations or fund innovation.

Opportunities in the legal cannabis market are growing with nano-formulation delivery systems that improve cannabinoid absorption and bioavailability. Techniques such as nanoemulsions and polymer-based nanocapsules enhance bioavailability, stability, and controlled release, enabling new formats, such as sprays, soft gels, and dissolvable strips, that appeal to both medical and wellness consumers seeking consistency. As clinical research validates these technologies, companies that invest in advanced delivery systems will be able to differentiate their products in highly competitive segments.

The market is also witnessing strong potential in pet therapeutics and biosynthetic cannabinoids. Demand for hemp-derived CBD products targeting pet wellness, such as chewables or oils for pain, anxiety, and inflammation, is rising steadily, offering opportunities in a less saturated niche compared to human medical cannabis. Biosynthetic production of minor cannabinoids such as CBG and CBN through engineered yeast or microbes is emerging as a scalable, cost-efficient solution to overcome supply shortages of naturally rare compounds.

The dried flower segment dominates the global market with a share of 51% in 2025. The dominance is tied to consumer familiarity, cultural acceptance, and the established supply chain infrastructure that prioritizes cultivation and retail distribution of flower products.

The comparatively lower cost of production and the straightforward nature of consumption also reinforce its leadership. Consumers value dried flower for its versatility, whether through smoking or vaporizing, making it the default entry point for both medical and recreational users.

Cannabis oils and concentrates are emerging as the fastest-growing product type. These products are gaining ground in both medical and adult-use markets because they provide higher potency, precise dosing, and more discreet consumption options. Medical cannabis programs in particular encourage the use of standardized oils and tinctures for patients who prefer alternatives to smoking. At the same time, edibles and beverages are quickly expanding, especially in recreational markets, as they align with broader lifestyle and wellness trends.

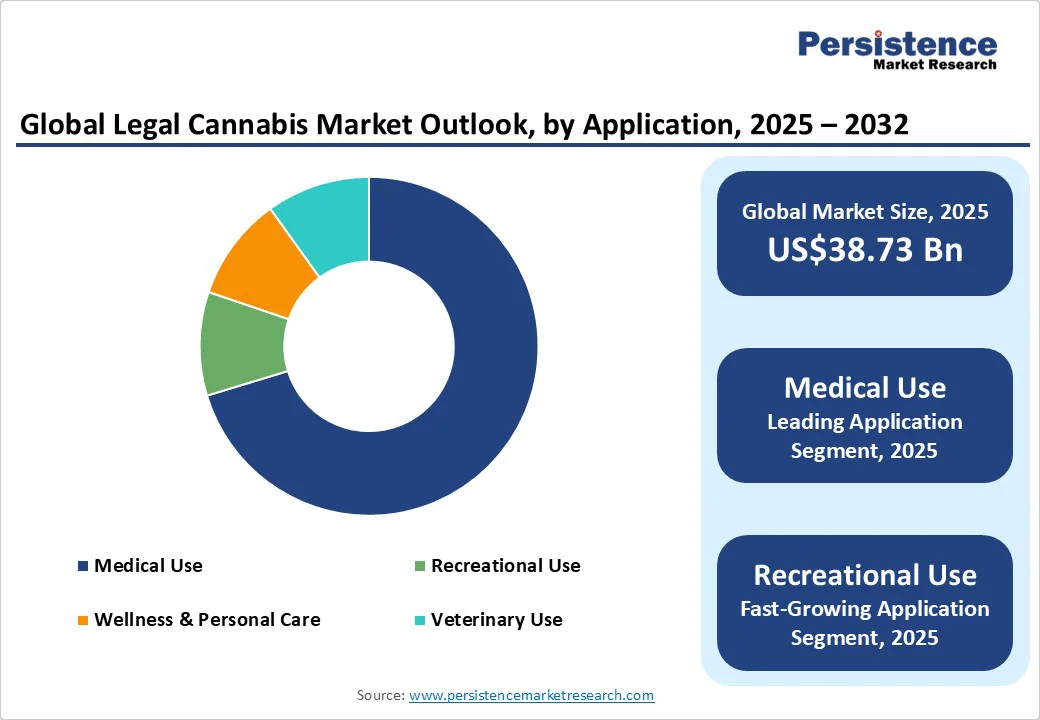

The medical application segment is projected to represent the largest market share, accounting for around 71% of the revenue in the most recent estimates. Its size is explained by the fact that many countries initially legalized cannabis strictly for medical use, creating a well-defined regulatory pathway.

Medical cannabis also commands higher value per unit through pharmaceutical-grade products and formulations tailored for chronic conditions such as pain, epilepsy, and multiple sclerosis. Healthcare integration, including insurance reimbursements in some jurisdictions, further secures medical cannabis as the largest contributor to market revenue.

In contrast, the recreational and wellness applications are expanding at the fastest pace. Recreational cannabis is experiencing rapid growth as more jurisdictions move toward legalization, unlocking entirely new consumer bases.

Wellness and personal care applications, such as cannabis-infused skincare, supplements, and functional beverages, are also gaining traction, with projected growth rates outpacing traditional segments. These categories appeal to consumers seeking plant-based solutions for stress relief, sleep improvement, or general well-being without the stigma of medical or high-potency use.

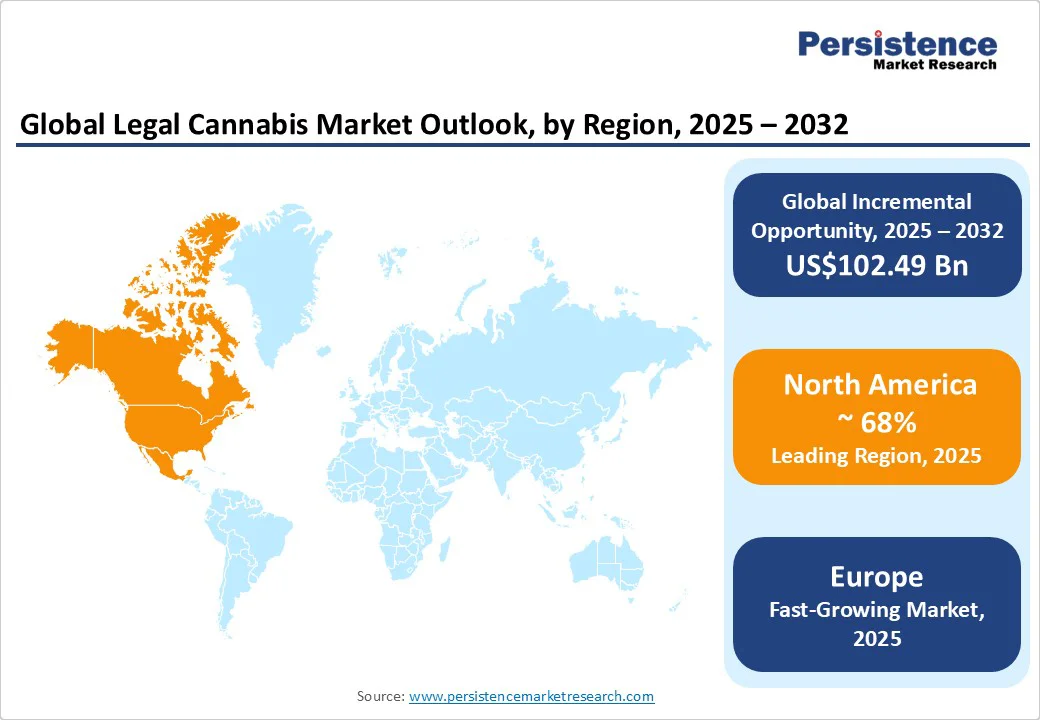

North America is anticipated to remain the largest and most established market, contributing nearly 68% of the market share in 2025. The U.S. leads growth through state-level legalization, rising adoption of medical cannabis, and a surge in innovative product formats such as beverages and concentrates.

A notable development is California’s decision in 2025 to temporarily cut cannabis excise taxes to help licensed operators compete with the illicit market, signaling how policymakers are working to stabilize the sector. Meanwhile, New York plans to more than double its licensed dispensaries by the end of 2025, reflecting the state’s effort to scale legal access and reduce unregulated sales.

Canada is one of the earliest adopters of nationwide legalization and continues to expand its domestic market while building capacity for exports. The country is witnessing a steady growth in edibles and concentrates as consumers diversify beyond dried flower.

Licensed producers are also investing in sustainable cultivation practices and pharmaceutical-grade formulations to meet higher quality standards. With both the U.S. and Canada moving toward regulatory refinement and product diversification, North America is expected to retain its leadership role in the global legal cannabis landscape.

Asia Pacific is still in the early stages of legalization, but developments in select countries are creating strong momentum. On June 25, 2025, the Ministry of Public Health issued a notice reclassifying cannabis buds as a controlled herb, effectively banning recreational sales and consumption.

Under the new framework, cannabis can only be sold to individuals with a valid medical prescription from licensed healthcare professionals, including doctors, dentists, pharmacists, and traditional medicine practitioners. The government is now shifting toward tighter control, requiring medical certificates for purchases and drafting a more formal cannabis law. This illustrates the region’s balancing act between rapid market expansion and regulatory oversight.

Australia has adopted a more structured path, with medical cannabis prescriptions rising sharply and new cultivation licenses being granted to meet demand. The country is also positioning itself as an exporter, leveraging its agricultural strengths and reputation for high-quality production. At the same time, consumer interest in wellness and CBD products is accelerating, supported by regulatory adjustments that make non-prescription formats more accessible.

Europe is the fastest-growing region as several countries shift from medical-only frameworks to partial or full recreational legalization. Germany has become a focal point since legalizing recreational cannabis in April 2024. Adults are now permitted limited possession and home cultivation, while medical use continues to expand rapidly, patient numbers grew almost fourfold in a year.

Imports have also surged, highlighting the country’s role as a major destination for global cannabis supply. The rollout of Cannabis Social Clubs has faced criticism for complexity, underscoring the challenges of balancing liberalization with regulatory control.

In contrast, the U.K. has not legalized recreational cannabis but is seeing robust growth in its medical market. Patient numbers are increasing steadily, with sales estimated at around €240 Mn (US$260 Mn) in 2024. Despite the absence of insurance coverage, consumption per patient remains high, driven by private demand and specialized medical providers.

The global legal cannabis market is becoming increasingly competitive, shaped by established multinationals, regional leaders, and emerging start-ups focused on niche categories. Major players such as Canopy Growth Corporation, Tilray Brands, Aurora Cannabis, Curaleaf Holdings, and Green Thumb Industries dominate through vertically integrated operations, large cultivation capacity, and extensive retail networks.

At the same time, U.S. multistate operators (MSOs) are aggressively expanding into newly legalized states, while Canadian companies are targeting international markets, particularly Germany and Australia, through EU-GMP certified production.

Innovation is a key differentiator, with firms investing in edibles, beverages, pharmaceutical-grade formulations, and wellness products to capture diverse consumer segments. Partnerships with pharmaceutical companies, acquisitions of craft growers, and cross-industry collaborations with beverage and wellness brands are further intensifying competition, creating a landscape where scale, product differentiation, and regulatory adaptability determine market leadership.

The legal cannabis market is estimated to reach US$38.73 Bn in 2025.

The legal cannabis market is projected to grow to US$141.22 Bn by 2032.

Key trends include the rising adoption of edibles and beverages, growth in medical cannabis applications, THC/CBD product innovation, and expansion of wellness and personal care cannabis products. Regulatory reforms in North America and Europe are further driving growth.

By product type, dried flower remains the largest segment globally.

The legal cannabis market is expected to grow at a CAGR of 20.3% from 2025 to 2032.

The key players include Canopy Growth Corporation, Tilray Brands, Curaleaf Holdings, Aurora Cannabis, and Green Thumb Industries.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Compound Type

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author