ID: PMRREP12433| 198 Pages | 9 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

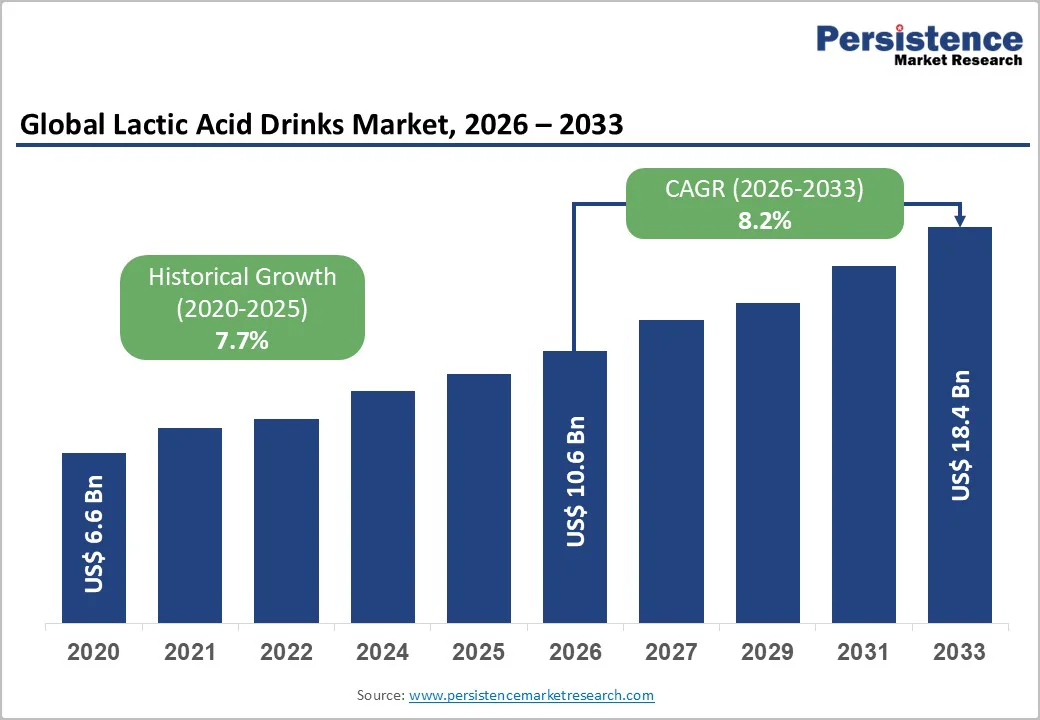

The global lactic acid drinks market size is likely to be valued at US$10.6 billion in 2026 and is expected to reach US$18.4 billion by 2033, growing at a CAGR of 8.2% during the forecast period from 2026 and 2033, driven by increasing consumer awareness of health and wellness, rising demand for functional beverages promoting gut health, and expanding distribution channels including online retail.

Proliferation of probiotic-fortified formulations appeals to immunity-conscious consumers amid post-pandemic trends. Innovation in flavors, low-sugar variants, and plant-based options further accelerates adoption among millennials and Gen Z, who seek convenient, natural alternatives to sugary drinks.

| Key Insights | Details |

|---|---|

| Lactic Acid Drinks Size (2026E) | US$10.6 Bn |

| Market Value Forecast (2033F) | US$18.4 Bn |

| Projected Growth CAGR (2026 - 2033) | 8.2% |

| Historical Market Growth (2020 - 2024) | 7.7% |

Growing consumer focus on preventive health and wellness is a major driver for the lactic acid drinks market, as individuals increasingly seek beverages that support digestive health, immunity, and overall well-being. Lactic acid drinks, rich in probiotics and essential nutrients, have gained strong traction among health-conscious adults who prefer functional beverages over sugary or carbonated options.

Consumers are increasingly seeking clean-label, natural, and gut-friendly options.

Growing awareness of digestive health, supported by educational health campaigns and endorsements from nutritionists, is expanding the consumer base across all age groups. Product innovation, such as fortified formulations, low-sugar variants, plant-based ingredients, and enhanced flavors, is making lactic acid drinks more appealing and accessible. Online retail and health-focused specialty stores are also amplifying product visibility and availability.

Flavor and taste acceptance challenges remain a significant restraint in the lactic acid drinks market, as consumers can be highly sensitive to the naturally tangy or sour profile of these beverages. While flavored variants dominate overall consumption, a considerable portion of potential buyers still hesitate to adopt products that deviate from familiar sweet or mild taste preferences.

This issue is more pronounced in emerging markets, where traditional beverage choices tend to favor sugary or neutral-tasting drinks.

Unflavored lactic acid drinks face even greater acceptance barriers, especially among younger consumers who prioritize taste variety and indulgence. Overcoming this restraint requires continuous product innovation, including advanced flavor-masking technologies, improved fermentation processes, and the development of region-specific taste adaptations. Manufacturers also face challenges in maintaining flavor consistency across batches, especially in natural or minimally processed formulations.

The growing emphasis on sustainability and environmental responsibility is creating strong opportunities for lactic acid drink manufacturers to differentiate through eco-friendly packaging solutions. Brands adopting recyclable bottles, biodegradable materials, and reduced-plastic formats are gaining favor among consumers who prioritize responsible consumption.

This shift is especially impactful in markets where regulations and retailer expectations increasingly promote sustainable packaging standards.

Health-focused marketing is unlocking new growth potential by aligning lactic acid drinks with rising interest in digestive wellness, immunity support, and functional nutrition. Positioning products around probiotics, microbiome health, and natural ingredients resonates strongly with modern consumers seeking daily wellness solutions.

Targeted, science-backed messaging and clean-label positioning tailored to fitness users, professionals, and older consumers are widening appeal across all age groups.

Flavored lactic acid drinks are anticipated to lead the lactic acid drinks market, capturing around 65% of total revenue share in 2026, driven by strong consumer preference for palatable, refreshing, and nutritionally enhanced beverages. This segment has benefited from rapid flavor diversification, such as fruit blends, herbal infusions, and low-sugar variants tailored to appeal to both adults and younger consumers.

Continuous innovation, including fortified formulations with added vitamins, probiotics, and functional botanicals, has broadened its reach across retail channels. For example, brands such as Yakult and Danone have expanded fruit-flavored probiotic drink portfolios to target the mainstream retail segment, increasing visibility and repeat purchases among health-conscious consumers.

Unflavored lactic acid drinks are likely to be the fastest-growing product type, driven by rising interest in clean-label, minimally processed, and probiotic-rich formulations. This segment appeals strongly to health-oriented consumers seeking functional benefits without added flavors, colors, or sweeteners.

Demand is especially pronounced among older demographics and individuals with sensitivities to artificial additives. As scientific awareness of gut health increases, unflavored variants are gaining traction in hospitals, specialty nutrition centers, and premium wellness retail channels.

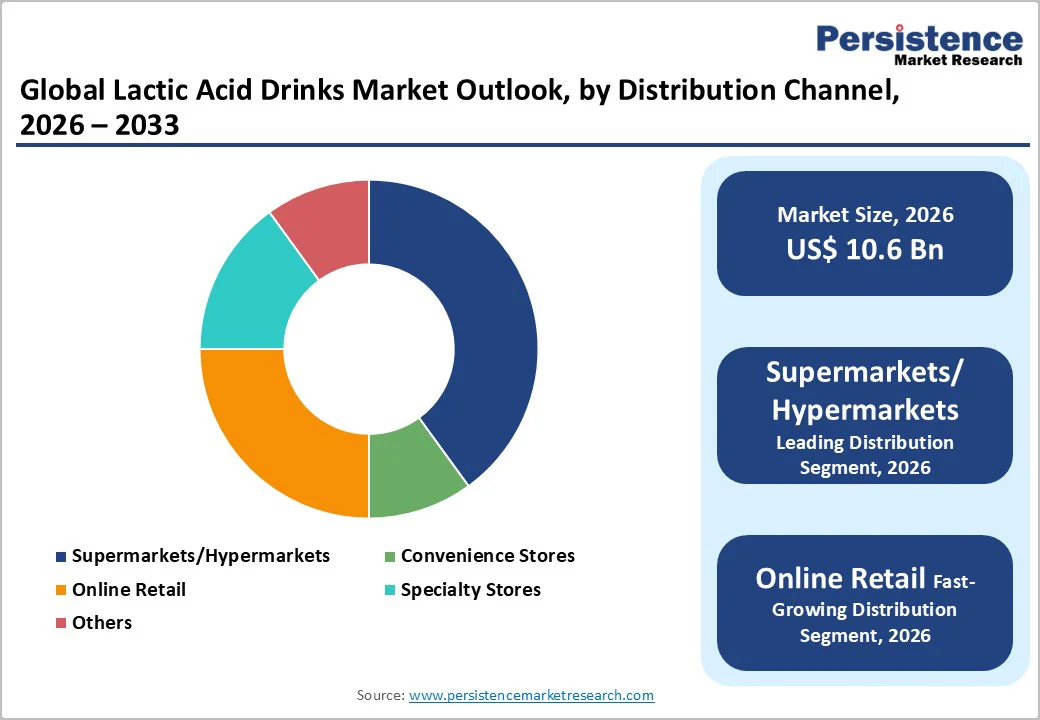

Supermarkets and hypermarkets are estimated to lead the market, capturing around 40% of total revenue, supported by their extensive geographic presence, strong product visibility, and the ability to promote multiple brands through attractive shelf placement. These channels cater to mass-market consumers seeking convenience, variety, and competitive pricing.

For example, major retail chains in North America and Europe regularly feature lactic acid drinks in dedicated refrigerated sections, boosting accessibility and trial purchases for health-focused beverages. Their role in shaping purchasing behavior remains strong, particularly in urban areas where functional beverages and probiotic drinks are part of regular grocery routines.

Online retail distribution channel represents the fastest-growing product type, driven by rising digitalization, mobile commerce penetration, and shifting consumer preference for doorstep delivery. E-commerce platforms allow brands to offer wider flavor assortments, subscription models, and health-focused bundles tailored to niche consumer groups.

For example, direct-to-consumer websites and e-grocery platforms are increasingly enabling consumers to select custom packs of lactic acid drinks, improving convenience and supporting targeted promotions for health-conscious shoppers. Direct-to-consumer strategies are allowing manufacturers to personalize marketing, gather real-time consumer insights, and optimize logistics.

Adults are likely to be the leading end-user segment, accounting for 50% of the market share, driven by increasing health consciousness among millennials and middle-aged consumers. This demographic values probiotic beverages for digestive wellness, immunity support, and overall metabolic health.

Lactic acid drinks are increasingly integrated into daily nutrition routines as healthier alternatives to sugary soft drinks. Adults also drive demand for functional, low-calorie, and fortified variants marketed for fitness, work-life balance, and lifestyle enhancement.

The elderly population segment is likely to be the fastest-growing end-user segment, fueled by awareness of age-related digestive issues and immune health. Seniors increasingly turn to lactic acid drinks for their easy digestibility, mild taste, and clinically supported probiotic benefits.

Manufacturers are introducing specialized formulations focused on bone health, reduced sugar content, and enhanced microbiome balance, which are particularly appealing to older consumers.

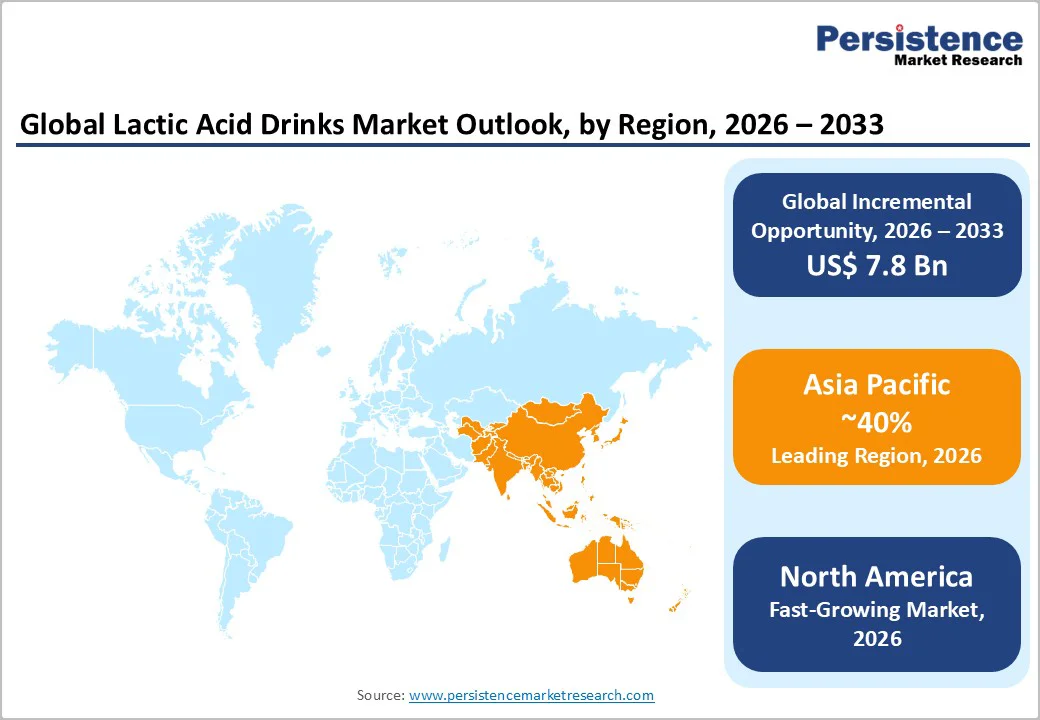

North America is estimated to be the fastest-growing region in the lactic acid drinks market, driven by strong consumer interest in digestive health, immunity support, and functional nutrition. The area benefits from a highly aware population that actively seeks probiotic-rich beverages, including lactic acid drinks, kefir-based products, and fermented dairy alternatives.

Demand is further supported by the shift toward clean-label, low-sugar, and natural formulations, which align with evolving preferences among health-conscious millennials and middle-aged consumers.

North America is also experiencing rapid growth in premium and innovative product lines, with manufacturers introducing fortified, flavored, and functional variants tailored to specific wellness needs such as gut health, energy, and immunity. Online retail and direct-to-consumer channels are expanding quickly, fueled by digital shopping trends and subscription-based delivery models.

Retailers in the U.S. and Canada are expanding shelf space for probiotic drinks, while brands marketing focused on science-backed benefits and everyday wellness.

Europe remains a significant market, supported by long-established dairy and fermented-beverage consumption traditions. Consumers across countries such as Germany, France, and the U.K. continue to embrace probiotic yogurt drinks, kefir, and other fermented beverages for gut health, immunity support, and everyday wellness driven by rising health awareness and preference for functional, clean-label nutrition.

The region is witnessing the steady adoption of science-backed probiotic strains, with regulatory bodies ensuring strict compliance with health claims, thereby enhancing product credibility. Growing interest in digestive wellness and lifestyle-focused nutrition continues to support premium product categories, including organic and fortified drinkable yogurts.

Europe is shifting toward clean-label, natural, and functional formulations. There is a growing popularity of low-sugar, probiotic-fortified, and even non-dairy/plant-based variants to accommodate dietary preferences and lactose intolerance. Retailers in supermarkets and health-food outlets are expanding shelf space for these beverages, while consumer interest in digestive health and immune-supportive drinks is driving regular consumption.

Brands are increasing investments in sustainable packaging, portion-controlled formats, and convenient on-the-go bottles to align with evolving consumer expectations. Innovation in fermentation techniques and the introduction of region-specific flavors are further diversifying the market.

Asia Pacific is the leading region in the lactic acid drinks market, with around 40% share, driven by rising health consciousness, growing demand for gut-healthy and functional beverages, and large populations with increasing disposable incomes, particularly in China, India, Japan, and Indonesia.

Urbanization and changing lifestyles are shifting consumers toward convenient, ready-to-drink fermented or probiotic beverages rather than traditional dairy, supporting strong demand for lactic-acid drinks and drinkable yogurts. Strong cultural familiarity with fermented foods and beverages in markets such as Japan, Korea, and China helps accelerate adoption.

Rapid expansion of cold-chain logistics and improved retail availability are further strengthening market penetration.

The distribution and product-innovation landscape in the Asia Pacific is evolving rapidly. E-commerce and modern retail channels are expanding access, enabling a wider reach across urban and semi-urban consumers. Manufacturers are innovating with new probiotics, shelf-stable formulations, flavored variants, and clean-label or low-sugar options to cater to diverse preferences and rising health awareness.

Asia Pacific’s lactic acid drinks market is seen as both large in volume and dynamic in growth. Strong investment from regional dairy leaders, partnerships with global probiotic suppliers, and the introduction of localized flavors are enhancing product differentiation.

The global lactic acid drinks exhibit a moderately fragmented structure, driven by a wide range of local and international producers from large multinationals to regional dairy specialists, all competing to capture growing demand for gut-health and functional beverages.

With key leaders including Yakult Honsha Co., Ltd., Danone S.A., Nestlé S.A., Morinaga Milk Industry Co., Ltd., and Fonterra Co-operative Group Limited, the market’s top players, the competitive dynamics are shaped by strong brand equity, extensive distribution networks, and robust research and development in probiotic strains and product formulations.

These players compete through continuous product innovation new flavors and probiotic formulations), diverse distribution strategies supermarkets, online retail, specialty stores, and marketing based on scientifically backed health claims and clean-label positioning.

Firms also push geographic expansion, portfolio diversification, including dairy-free or low-sugar variants, and enhanced supply-chain efficiency to adapt to evolving consumer preferences and regulatory requirements.

The lactic acid drinks market is valued at US$10.6 billion in 2026 and expected to reach US$18.4 billion by 2033, reflecting robust growth.

Key drivers include rising health consciousness, expanding distribution channels like online retail, and innovations in flavor and functional formulations.

Flavored lactic acid drinks are likely to lead with about 65% market share in 2026, due to better consumer acceptance and diverse offerings.

Asia Pacific dominates with over 40% market share, driven by urbanization, increasing disposable incomes, and health awareness.

Key opportunity lies in specialty formulations targeting children, adults, and the elderly with health-specific benefits and in sustainable packaging innovations.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Distribution Channel Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author