ID: PMRREP32785| 191 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

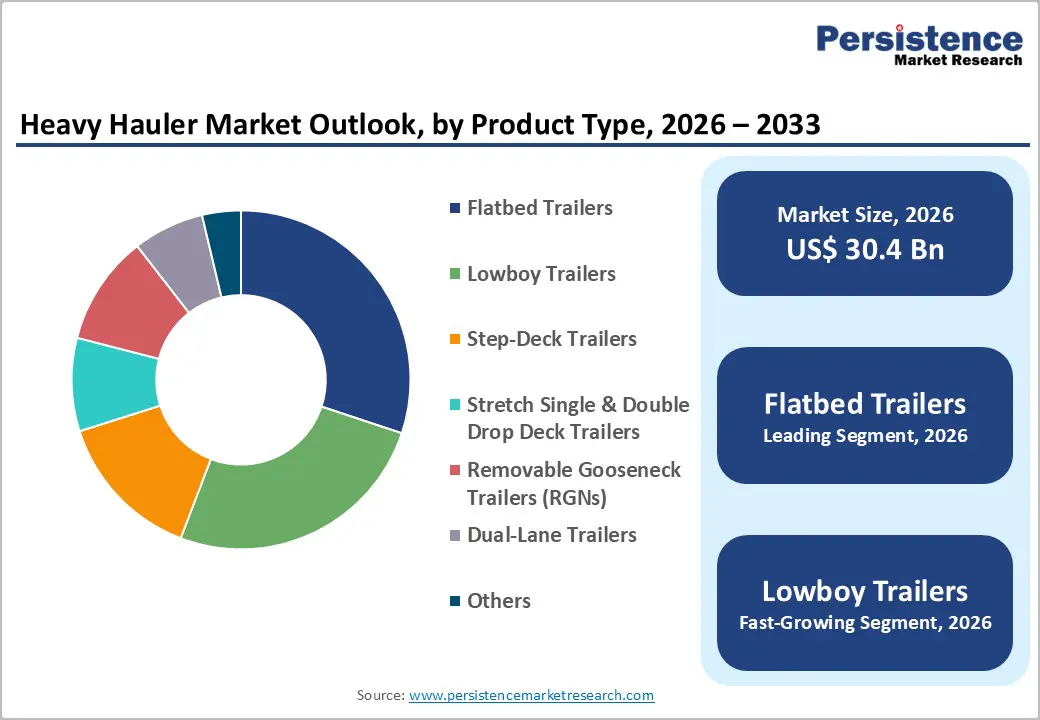

The global Heavy Hauler Market size is anticipated at US$ 30.4 Billion in 2026 and is projected to reach US$ 49.7 Billion by 2033, growing at a CAGR of 7.3% between 2026 and 2033. Market expansion is driven by infrastructure investment across construction, mining, and renewable energy requiring specialized heavy transport, accelerating cross-border industrial trade and relocations in emerging Asia boosting demand for high-capacity trailers, and advances in modular designs, digital fleet monitoring, and electrification improving efficiency.

| Key Insights | Details |

|---|---|

| Heavy Hauler Market Size (2026E) | US$ 30.4 billion |

| Market Value Forecast (2033F) | US$ 49.7 billion |

| Projected Growth CAGR (2026-2033) | 7.3% |

| Historical Market Growth (2020-2025) | 6.5% |

Infrastructure Development and Construction Expansion Driving Equipment Transport Demand

Infrastructure development investments and construction expansion systematically drive heavy hauler demand, with construction applications commanding 35% market share through transportation infrastructure projects, commercial facility development, and industrial plant construction requiring specialized heavy-duty trailers for prefabricated structures, oversized equipment, and building materials. Global infrastructure investment expansion sustains volumes across regions, while urban redevelopment and rural connectivity programs accelerate project pipelines. Prefabricated structure transportation and construction equipment hauling ensure repeat utilization. Project-driven demand consistency improves fleet visibility. Integrated logistics partnerships with construction firms enhance utilization rates, while equipment standardization and modular trailer adoption enable scalability, cost efficiency, predictable replacement cycles, and volume.

Renewable Energy Projects and Industrial Equipment Expansion Creating Specialized Transport Needs

Renewable energy projects and industrial equipment expansion systematically drive specialized heavy hauler demand, with wind turbine blade transportation and solar facility installation equipment requiring lowboy and flatbed trailers capable of handling oversized loads exceeding 200 tons, creating a high-value segment for customized transport beyond standard weight limits. Wind turbine blade transportation grows at 7.8% CAGR for specialized trailers, while solar farm equipment hauling and industrial machinery relocation sustain utilization. Large-scale equipment transport accelerates adoption of above-200-ton capacity vehicles, the fastest-growing segment at 8% CAGR, encouraging customized trailer development aligned closely with accelerating renewable sector investment pipelines globally across emerging markets

Complex Regulatory Framework and Weight Limitation Compliance Challenges

Heavy hauler market expansion is constrained by complex regulatory environments with federal, state, and international weight limitations including federal bridge formula limits (80,000-84,000 lbs gross weight) and state-specific variations requiring specialized permit acquisition for oversized loads exceeding 102 inches width, creating significant compliance burden and operational delays affecting logistics planning and increased administrative costs particularly for cross-border or multi-state operations. Federal weight limit constraints. State variation complexity. Oversized load permitting delays. Compliance documentation requirements. Route planning restrictions. Administrative cost elevation. Operational timing uncertainties.

High Capital Investment and Supply Chain Complexity

Heavy hauler market expansion is constrained by substantial capital investment requirements with specialized trailer manufacturing demanding advanced fabrication capabilities, custom chassis development, and high-strength material sourcing combined with complex supply chain coordination for component availability and production scheduling creating significant barriers particularly for emerging regional manufacturers limiting market entry and competitive expansion. Manufacturing capital requirements (high tooling costs). Custom chassis development investment. Supply chain coordination complexity. Component sourcing challenges (specialized materials). Production scaling difficulties. Quality assurance expenses. Aftermarket support network development.

Emerging Market Industrial Expansion and Government Infrastructure Investment

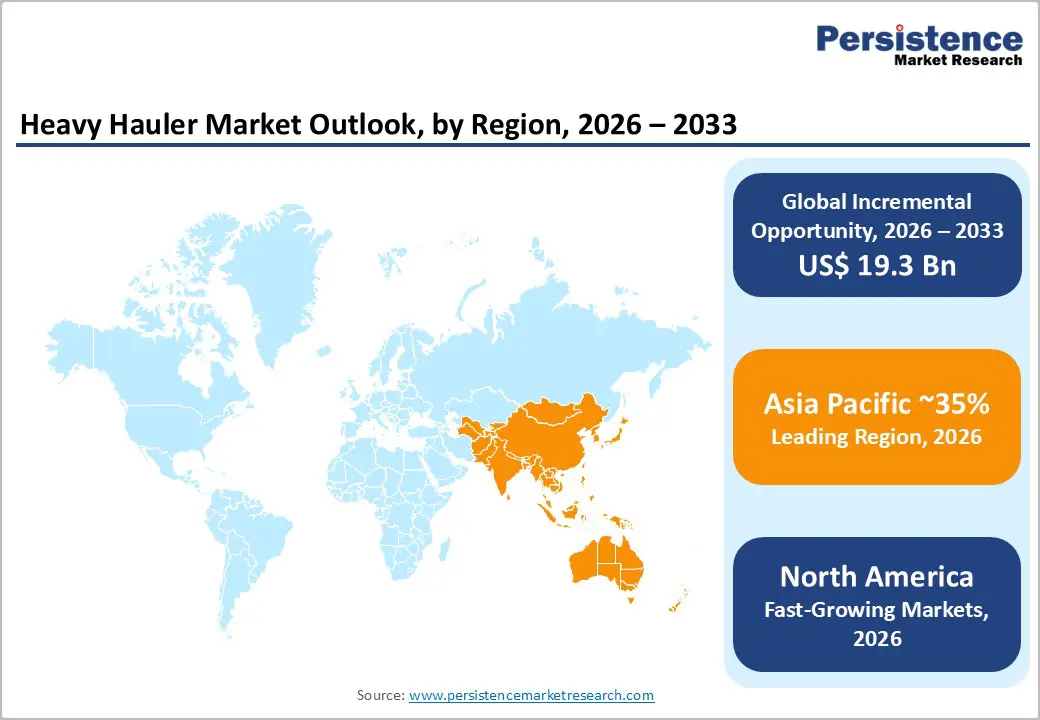

Emerging market industrial expansion and government infrastructure investment create substantial opportunity, with Asia Pacific commanding 35% market share as India expands at 8.8% CAGR and China at 6.5% CAGR, driven by industrial relocations, port expansions, and mining projects supporting demand for heavy hauler solutions. India’s infrastructure momentum sustains project pipelines, while China’s manufacturing relocation accelerates oversized transport needs. Port development projects increase equipment flows. Manufacturing facility relocations require specialized trailers. Mining operations expand hauling intensity. Regional OEM partnerships improve access and localization. Market penetration accelerates through cost competitiveness, regulatory alignment, fleet modernization, digital integration, financing availability, and scalable capacity deployment.

Sea Freight and Logistics Channel Expansion with Port Infrastructure Development

Sea freight and logistics channel expansion represents an opportunity, with sea freight logistics growing at 7.6% CAGR driven by port infrastructure development, container terminal expansion, and cross-border trade growth supporting demand for specialized port-to-inland heavy haulers enabling logistics-hub focused business models. Port infrastructure expansion projects increase cargo throughput, while container terminal growth accelerates oversized equipment movements. Cross-border trade momentum strengthens inland distribution hub development. Specialized port equipment transportation requires high-capacity trailers. Logistics partnership opportunities expand with terminal operators and freight forwarders. Focus on terminal efficiency improvement encourages fleet modernization, digital scheduling, faster turnaround times, and integrated multimodal connectivity across ports.

Flatbed trailers command 30% of market share, representing dominant product type with open-deck versatility enabling irregular load accommodation, multiple-angle loading capability, and cost-effective operation supporting broad applicability across construction, mining, and equipment transport sectors. Open-deck versatility. Irregular load accommodation. Multiple loading angle capability. Cost-effective operation. Construction industry standard. Mining equipment transport. Proven reliability positioning.

Lowboy trailers expand as fastest-growing product category at 7.8% CAGR, driven by specialized low-profile design enabling tall equipment transport with improved road clearance and bridge passage capability supporting emerging demand for renewable energy equipment (wind turbine blades) and industrial machinery exceeding standard height limitations. Low-profile design advantage. Tall equipment transport capability. Wind turbine blade specialization. Bridge passage optimization. Renewable energy alignment. Height limitation elimination. Premium market positioning.

51 to 100-ton capacity trailers command 30% of market share, representing dominant mid-range segment with versatility supporting construction equipment, mining machinery, and industrial component transport across diverse industries and geographic markets enabling volume production and cost-efficient operations. Construction equipment transport. Mining machinery hauling. Industrial component movement. Volume production efficiency. Cost-effective operation. Diverse application support. Market dominance positioning.

Above 200-ton capacity trailers expand as fastest-growing segment at 8% CAGR, driven by large-scale industrial equipment, wind turbine components, and oversized machinery transport requiring specialized engineering and custom configurations supporting emerging high-value market niche for mega-capacity specialized transport solutions. Large-scale industrial equipment transport. Wind turbine component hauling. Oversized machinery specialization. Custom engineering requirements. Premium market segment. Specialized capabilities differentiation. Growth trajectory acceleration.

Construction applications command 35% of market share, driven by large-scale infrastructure projects, commercial development, and industrial plant construction requiring systematic heavy-hauler deployment for prefabricated structures, equipment placement, and material transport supporting consistent volume demand. Infrastructure projects scale. Commercial development growth. Industrial plant construction. Prefabricated structure transport. Equipment placement logistics. Material transport volume. Market consistency anchor.

Sea freight and logistics expands as fastest-growing segment at 7.6% CAGR, driven by port infrastructure expansion, inland distribution hub development, and cross-border trade growth supporting emerging demand for specialized port-to-warehouse heavy-hauler solutions enabling specialized logistics positioning. Port expansion projects. Container terminal growth. Cross-border trade momentum. Inland distribution hub development. Port-to-warehouse logistics. International commerce alignment. Logistics channel growth.

North America maintains 28% market share representing largest established market driven by substantial construction activity, mining operations, renewable energy projects, and established OEM partnerships supporting technology leadership and operational maturity. Construction dominance (38% of applications). Mining operations scale. Renewable energy focus (wind turbine transport). OEM partnership ecosystem. Regulatory compliance expertise. Technology innovation leadership. Mature supply chain networks.

North American market characterized by stringent FMCSA safety regulations, federal bridge formula weight compliance requirements, and state-specific variations driving specialized logistics expertise. Strong emphasis on operational efficiency and cost optimization through fleet standardization and digital monitoring systems. Established infrastructure supporting rapid deployment and comprehensive aftermarket support networks enabling competitive advantage. Partnership ecosystems enabling innovation particularly in electrification and hydrogen fuel cell technology development.

Europe commands 19% market share expanding at 6.6% CAGR, driven by harmonized regulatory environment, high specialization in abnormal load transport, and advanced technology integration supporting premium market positioning and environmental compliance emphasis. Regulatory harmonization advantage. Abnormal load specialization (UK 4.3% CAGR). Environmental compliance focus. Advanced technology integration. Cross-border transport logistics. Specialized expertise positioning. Premium market segment.

European market characterized by rigorous safety standards, bridge load restrictions requiring modular multi-axle trailers, and specialized routing expertise for abnormal load transport. Strong emphasis on sustainability driving electrification adoption and carbon footprint reduction. Technical expertise in custom solutions and high-value specialized services. Established networks enabling efficient cross-border movement with compliance coordination and route planning optimization.

Asia Pacific commands 35% market share, driven by rapid industrial expansion with China expanding at 6.5% CAGR through large-scale industrial relocations and mining projects, and India expanding at 8.8% CAGR through infrastructure and construction investment supporting fastest regional growth momentum. China industrial relocation (6.5% CAGR). India infrastructure expansion (8.8% CAGR). Mining projects acceleration. Port development momentum. Manufacturing growth trajectory. Regional OEM concentration. Cost advantage positioning.

Asia Pacific market characterized by rapid industrialization with emerging large-scale manufacturing relocations and mining operations creating sustained heavy-hauler demand. India's infrastructure modernization program and China's industrial consolidation driving specialized transport solutions development. Cost-competitive production enabling rapid fleet expansion. Growing domestic OEM capacity supporting supply chain localization and reduced lead times enabling regional competitive advantage.

Market leaders employ technology differentiation through modular designs and digital integration, geographic expansion through emerging market partnerships and regional manufacturing development, cost optimization improving affordability and market penetration, regulatory compliance leadership ensuring market access, specialization focus for high-value segments, and sustainability positioning through electrification programs. Multinational manufacturers emphasizing comprehensive systems and global distribution networks. Regional specialists leveraging local expertise and cost advantages. Custom fabricators serving specialized high-value segments. Equipment suppliers advancing component technology and integration capabilities.

The global Heavy Hauler Market is anticipated at US$ 30.4 Billion in 2026 and is projected to reach US$ 49.7 Billion by 2033.

Market growth is driven by infrastructure construction dominance (35% share), rapid expansion of renewable energy equipment transport, and mining demand accounting for 30% share requiring ultra-high-capacity haulers.

The market is projected to expand at a 7.3% CAGR between 2026 and 2033.

Key opportunities lie in Asia Pacific infrastructure investments, electrification and hydrogen-powered heavy haul solutions, and sea freight-linked logistics expansion growing at 7.6% CAGR.

The market is led by Wabash National, Great Dane, and Fontaine Specialized, with players advancing modular platforms, digital fleet monitoring, and alternative-fuel technologies to strengthen competitive positioning.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author