ID: PMRREP13630| 240 Pages | 16 Feb 2026 | Format: PDF, Excel, PPT* | Chemicals and Materials

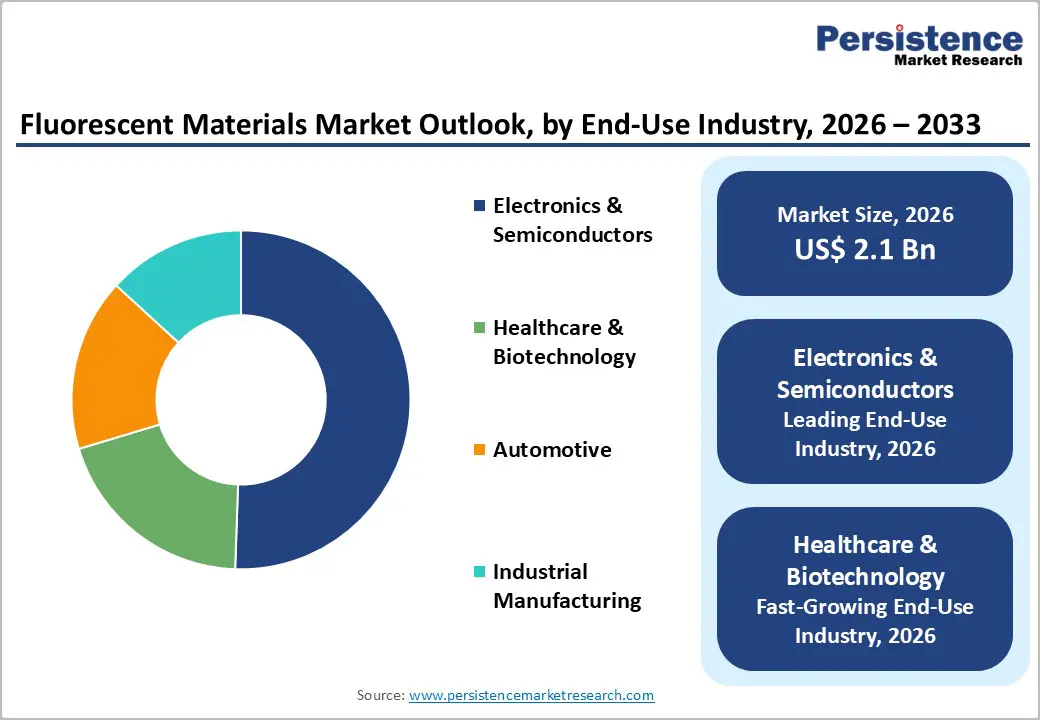

The global fluorescent materials market size is likely to be valued at US$ 2.1 billion in 2026, and is projected to reach US$ 3.4 billion by 2033, growing at a CAGR of 7.1% during the forecast period 2026–2033. Market growth is primarily fueled by the increasing adoption of fluorescent materials in light-emitting diodes (LEDs) and advanced display technologies, which enhance color rendering, brightness, and energy efficiency. The expanding applications in life-science imaging, including fluorescence microscopy, molecular diagnostics, and biomedical research, are driving demand for high-performance organic and hybrid fluorescent compounds.

The electronics and semiconductor sectors also contribute significantly, as fluorescent materials are essential for wafer inspection, defect detection, and precision manufacturing processes. Substantial public and private investments in photonics and advanced materials research, combined with regulatory support for energy-efficient lighting solutions and diagnostic innovations, are reinforcing long-term market stability and enabling continuous technological advancement.

| Global Market Attributes | Key Insights |

|---|---|

| Fluorescent Materials Market Size (2026E) | US$ 2.1 Bn |

| Market Value Forecast (2033F) | US$ 3.4 Bn |

| Projected Growth (CAGR 2026 to 2033) | 7.1% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.6% |

Expansion of Energy-Efficient Lighting and Display Applications

Fluorescent materials form the backbone of phosphor-converted LEDs and display backlighting systems, offering superior luminous efficiency, vibrant color rendering, and durability for modern lighting and display units. Governments worldwide are actively phasing out incandescent and halogen lighting in favor of solid-state lighting, thereby reinforcing the role of fluorescent materials in next-generation illumination. In late 2024 and early 2025, the U.S. Department of Energy awarded targeted grants to accelerate the deployment of LED lighting in public infrastructure, underscoring ongoing policy support for energy-efficient lighting transitions.

In mid-2025, a research team led by Dr. Sakthivel Gandhi at SASTRA Deemed University reported the development of a bluish-green-emitting phosphor in the study “Silica nanoparticles assisted Ba-Si: Eu², a bluish-green emitting remote phosphor for white light application”, demonstrating enhanced luminescence intensity and thermal stability. This breakthrough highlights continued progress in phosphor performance optimization, signaling broader material utilization in high-intensity lighting and displays. Combined with the industry’s shift toward micro-LED and OLED-hybrid displays, these advancements reinforce the growing strategic importance of fluorescent materials in modern lighting and display applications.

The life-science imaging sector is a major growth driver, relying on organic and hybrid fluorescent materials for fluorescence microscopy, molecular diagnostics, and high-contrast cellular visualization. Government and academic initiatives have recently accelerated this trend. In 2025, Yale School of Medicine launched a Biomedical Imaging Institute to develop innovative imaging technologies, integrating optical imaging and data analysis for improved disease diagnostics. The U.S. National Institutes of Health (NIH) and other public research programs have expanded grant funding for advanced fluorescence-based imaging projects, thereby driving sustained demand for high-purity fluorescent dyes in biomedical research and drug discovery workflows.

The semiconductor manufacturing increasingly incorporates fluorescent tracers and optical inspection technologies to enhance wafer-level defect detection, yield, and process control. The commercialization of photoluminescence inspection systems for micro-LED and advanced display production highlights the growing reliance on fluorescent materials for high-precision applications. These materials improve performance in sub-micron fabrication processes and support quality assurance in complex semiconductor architectures. Together, advances in imaging and semiconductors continue to expand the market footprint and solidify the strategic role of fluorescent materials in scientific and industrial domains.

Advanced fluorescent materials, particularly rare-earth-based inorganic phosphors and bio-compatible organic dyes, require multi-stage synthesis, purification, and strict quality control, which leads to significantly higher production costs. The price volatility of rare-earth elements, such as terbium, dysprosium, and europium, introduces procurement risk and uncertainty for manufacturers. In late 2025, China expanded export controls on rare-earth materials, including processed compounds critical for phosphor production, thereby creating global supply-chain bottlenecks and further increasing costs.

These complex synthesis requirements also demand specialized equipment, precise environmental conditions, and skilled labor, making production challenging for smaller suppliers. Persistent rare-earth supply constraints are expected to continue into 2026, resulting in elevated lead times and increased operational expenditure. Together, high material costs and intricate production processes restrict adoption among price-sensitive industries, such as textiles, consumer goods, and mid-range electronics, limiting penetration beyond premium market segments and constraining overall scalability. These factors also force manufacturers to prioritize strategic sourcing and production efficiency to maintain profitability.

Regulatory and Environmental Compliance Challenges

Fluorescent materials are subject to stringent chemical safety and environmental regulations, including REACH in Europe, TSCA in the U.S., and RoHS directives globally. Compliance requires extensive documentation, testing, and reporting, increasing operational costs and extending time-to-market. The European Union reinforced its Critical Raw Materials Act, embedding stricter oversight on the extraction, processing, and recycling of rare-earth materials, which indirectly affects fluorescent material production and sourcing.

Governments are also actively monitoring supply and environmental compliance elsewhere. For instance, South Korea launched a Resource Security Control Tower to manage critical mineral supply chains, increasing regulatory scrutiny and requiring additional reporting from manufacturers. These regulatory and environmental obligations are particularly challenging for small and mid-sized suppliers, increasing compliance costs and slowing product innovation. Navigating evolving standards while ensuring sustainability and safety continues to constrain market growth and competitiveness. Manufacturers must continually update protocols, training, and monitoring systems to comply with global regulatory expectations.

Hybrid fluorescent materials, which combine the flexibility of organic compounds with the stability of inorganic phosphors, offer superior photostability, tunable emission spectra, and enhanced processability. Their adoption is increasing across next-generation displays, biomedical imaging, and diagnostic sensors, driven by growing demand for high-performance, versatile optical materials. Academic-industry collaborations and global photonics forums, including the Asia Photonics Expo and associated technology summits, have accelerated innovation in photonics and hybrid materials, reinforcing their commercial scalability.

Researchers are actively developing novel fluorescent indicators for advanced biomedical imaging, enabling high-precision cellular visualization and enhancing diagnostic capabilities. For example, a 2025 study from the University of Osaka demonstrated advanced fluorescent probes for real-time monitoring of cellular processes. Such innovations expand demand for hybrid fluorescent materials in next-generation displays and biomedical applications, positioning suppliers to capture high-value opportunities in premium electronics, medical diagnostics, and advanced imaging markets.

Regional Manufacturing Expansion and Functional Applications

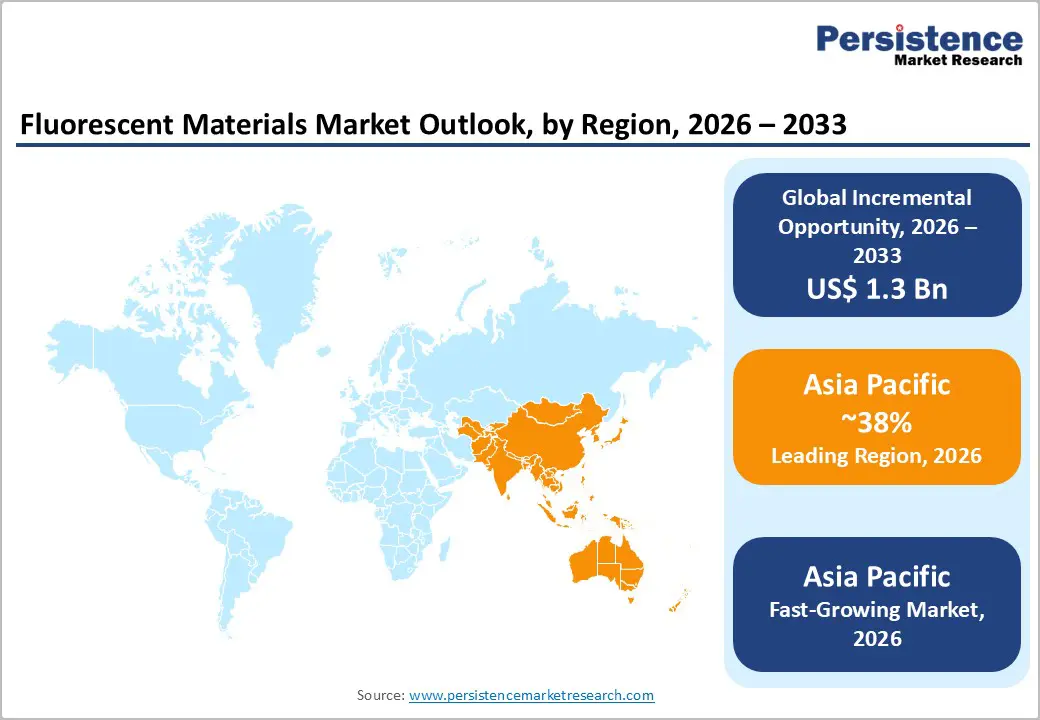

Asia-Pacific, particularly China, India, and the ASEAN economies, continues to attract electronics, automotive, and textile manufacturing investments, thereby creating demand for locally sourced fluorescent materials. Government-backed initiatives, such as India’s rare-earth mineral corridors and China’s advanced materials roadmap, are strengthening regional supply chains and promoting local production of high-performance materials. These policies encourage cost-optimized manufacturing, long-term supplier contracts, and a stronger market presence for producers of fluorescent materials.

The rising demand for functional fluorescent materials in smart textiles, security printing, and anti-counterfeiting solutions further expands market opportunities. Governments and regional collaborations have supported rare-earth and magnet manufacturing initiatives in Southeast Asia, ensuring critical input availability and stable production ecosystems. These developments, combined with growing integration of fluorescence into consumer electronics and packaging, allow suppliers to deliver differentiated, high-value products while capitalizing on regional manufacturing growth and technology-driven applications.

Inorganic fluorescent materials are projected to account for approximately 48% of the revenue share in 2026, driven by their high thermal stability, extended operational life, and reliability in high-intensity LED and display applications. These materials remain preferred for large-scale, regulated lighting infrastructure due to their robust performance under elevated temperatures and consistent luminous output. Recent research has also highlighted efforts to diversify inorganic phosphor compositions, such as exploring manganese-activated phosphors as sustainable alternatives to rare-earth systems for white light generation, pointing toward potential cost and supply advantages in future LED production.

Hybrid fluorescent materials, which combine organic flexibility with inorganic backbone stability, are projected to grow at the fastest CAGR of 8.2% through 2033, supported by innovations in tunable emission and multifunctional performance. Their adaptability enables broad end-use acceptance across cutting-edge displays and diagnostic tools. Academic and industry collaborations are increasingly focusing on dynamic hybrid material systems that offer adjustable emissive properties and enhanced device integration, positioning these materials as strategic differentiators in premium electronics and advanced imaging platforms.

Electronics and semiconductor manufacturing are set to command around 46% of the fluorescent materials revenue share in 2026, reflecting the critical role of fluorescent materials in wafer inspection, defect detection, and display fabrication. The maturity and scale of this industry ensure consistent demand for high-performance materials that support quality assurance processes and device functionality. Recent technology trends integrating advanced imaging and fluorescence-based inspection systems are improving in-line process control, further embedding fluorescent materials into manufacturing workflows.

Healthcare and biotechnology are projected to grow at the fastest CAGR of 8.7% through 2033, driven by fluorescence-enabled diagnostic tools, microscopy techniques, and molecular assays that require specialized probes and reagents. Developments in fluorescent probe design, including rationally engineered NIR probes with enhanced stability and selectivity for biological targets, highlight ongoing efforts to refine imaging performance for clinical research and personalized medicine. These advanced materials contribute to deeper biological insights and support precision healthcare applications.

In North America, the market benefits from strong adoption of fluorescent materials in LEDs, displays, and diagnostic imaging, supported by a well-established innovation ecosystem. Federal initiatives accelerate the commercialization of advanced materials, providing funding, infrastructure support, and regulatory guidance. For example, U.S. investment and policy efforts focused on diversifying critical mineral supply chains, including rare-earth processing capacity, with new separation and refining facilities under development in Louisiana and Ontario anticipated to come online in 2026. These efforts improve the availability of high-quality raw materials essential for the production of inorganic and hybrid fluorescent compounds.

These developments strengthen North America’s upstream supply of core inputs for fluorescent phosphors and related compounds used in high-performance lighting, displays, and semiconductor inspection processes. At the same time, strategic government policies aim to reduce reliance on external sources and foster a more resilient industrial base. The combination of federal support, investment in supply infrastructure, and robust R&D capabilities ensures that North America remains a stable and innovation-focused market for fluorescent materials, supporting sustained growth and technology advancement across multiple high-value sectors.

The Europe market stands to gain from the extensive deployment of fluorescent materials in automotive lighting, medical diagnostics, and industrial applications, with Germany, the U.K., France, and Spain as key contributors. The region is navigating significant supply chain shifts, as evidenced by the European Union (EU)’s RESourceEU initiative launched in 2025, a € 3 billion strategy to strengthen supply chains for rare earths and other critical minerals, including investments in extraction, processing, and recycling infrastructure across member states. These efforts stabilize material supply and encourage innovation in sustainable production processes, directly impacting the availability of inputs essential for fluorescent material manufacturing.

In parallel, EU multilateral agreements with China to establish dedicated channels for rare-earth exports help secure critical materials for European industries, reflecting active diplomatic engagement to stabilize supply flows. These policies, combined with strong regulatory enforcement under REACH and Ecodesign directives, support the adoption of advanced fluorescent materials. Continuous investment in sustainable production, chemical safety compliance, and technology-driven innovation ensures that Europe remains a mature, resilient market for both standard and high-performance fluorescent applications, supporting long-term industrial growth and competitiveness.

Asia-Pacific is projected to account for approximately 38% of the fluorescent materials market in 2026, and the region is likely to grow at the fastest CAGR of 9% through 2033, supported by electronics manufacturing expansion and government-backed incentives in China, Japan, South Korea, and India. The region benefits from cost-efficient production, skilled labor, and government incentives, which attract fluorescent material suppliers and support localized supply chains. For example, China updated its national green factory standards in late 2025 to promote low-carbon, resource-efficient manufacturing, advancing clean production processes while aligning industrial growth with sustainability objectives.

In addition, India plans to significantly expand its incentive programs for rare earth and critical minerals, positioning itself as a diversified manufacturing hub for materials used in LEDs, displays, and advanced electronics. These initiatives reduce reliance on imports and build domestic refining and magnet production capacity. Combined with strong demand for consumer electronics, infrastructure modernization, and regulatory momentum toward advanced material adoption, Asia Pacific offers compelling investment and growth opportunities for fluorescent material producers, driving both volume expansion and technological advancement in the global market.

The global fluorescent materials market structure is moderately consolidated, with leading players such as Osram, Nichia, Samsung SDI, and Everlight Electronics controlling a significant portion of the market revenue. These established companies leverage their deep technological expertise, proprietary material formulations, and strong relationships with electronics, display, and healthcare manufacturers. They continue to invest heavily in R&D for high-efficiency phosphors, hybrid fluorescent compounds, and next-generation display and biomedical imaging solutions, maintaining a competitive edge in both performance and reliability.

Meanwhile, regional and niche competitors, including Tronox, LG Innotek, and Toyoda Gosei, are focusing on specialized material types or geographic strongholds, such as inorganic phosphors for industrial LEDs or hybrid materials for biomedical applications. Barriers such as complex synthesis processes, regulatory compliance, and stringent quality-control standards deter new entrants, but the growth of customized hybrid materials and specialty dyes is enabling smaller, innovation-focused companies to participate through collaborations and co-development projects. Market consolidation is expected to grow gradually as global leaders acquire smaller suppliers or form strategic partnerships to expand their technology portfolios and regional reach, while software-assisted production and process optimization further enhance competitive positioning.

Key Industry Developments

The global fluorescent materials market is projected to reach US$ 2.1 billion in 2026.

Widening adoption in LEDs and displays, expanding life-science imaging, and electronics manufacturing demand are driving the market.

The market is poised to witness a CAGR of 7.1% from 2026 to 2033.

Opportunities include hybrid materials, smart consumer products, and advanced manufacturing hubs in Asia Pacific.

Osram, Nichia, Samsung SDI, Everlight Electronics, LG Innotek, and Toyoda Gosei are a few among the key players.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By Application

By End-Use Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author