ID: PMRREP35399| 190 Pages | 9 Jun 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

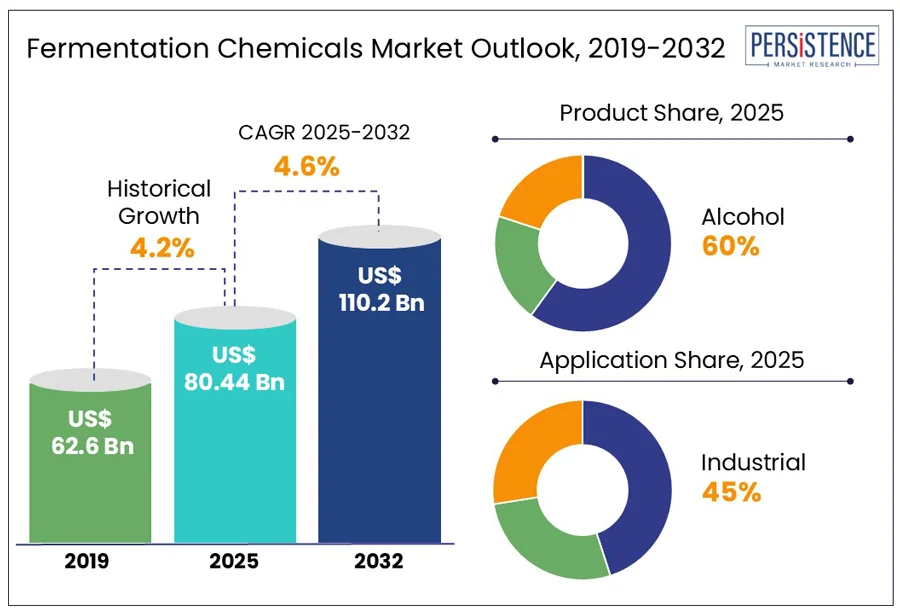

The global fermentation chemicals market size is projected to rise from US$ 80.44 bn in 2025 to US$ 110.20 bn by 2032. The market is further anticipated to register a CAGR of 4.6% during the forecast period from 2025 to 2032. According to the Persistence Market Research report, market growth is driven by the increasing demand for bio-based feedstock in the food & beverages and pharmaceutical industries.

Fermentation chemicals are bio-based products obtained through controlled processes involving microbes such as bacteria and yeasts. These microbes degrade biomass to produce useful chemicals, including ethanol, methanol, citric acid, and lactic acid. Fermentation chemicals are petroleum-free and environmentally friendly, with several applications across diverse domains. Lactic acid is utilized in food preservation as well as in the manufacture of bioplastics; ethanol in fuels, solvents, and alcoholic drinks; and citric acid to produce cleaning products and cosmetics. Though a huge initial capital investment is required for fermentation technologies, they offer savings in the long-term due to reduced raw material input costs and increased sustainability. This confluence of green and economic benefits positions fermentation chemicals as the game changers of green chemistry.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Fermentation Chemicals Market Size (2025E) |

US$ 80.44 Bn |

|

Market Value Forecast (2032F) |

US$ 110.20 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.6% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.2% |

The growing awareness of various health benefits of green food products is driving consumers toward natural fermentation chemicals comprising organic acids, enzymes, bacteriocins, and bioactive compounds. Fermentation process yields chemicals such as lactic acid, citric acid, and ethanol, integral in the making of yogurt, cheese, bread, pickles, sauces, alcoholic beverages, and plant-based products. For instance, lactic acid plays an important role as both preservative and a pH regulator in dairy and fermented vegetable products, while citric acid enhances flavors and acts as a preservative in beverages and confectionery. The fermentation process is employed to produce enzymes that improve the product quality. Baking, brewing, dairy, and fruit processing functions make wide use of enzymes such as amylases, proteases, lipases, and cellulases.

In baking, enzymes enable the conversion of starches into sugars, stimulate dough rising, improve gluten structure, and enhance bread softness. In the brewing industry, enzymes increase the efficiency of starch breakdown and fermentation, thereby improving clarity and flavor. In dairy, enzymes including rennet and lactase aid in cheese production, making lactose-free products and increasing market reach among lactose-intolerant consumers. Companies, such as Chr. Hansen and Ajinomoto are building portfolios of natural and fermentation-derived ingredients to address these needs.

Fermentation operations are expensive, as raw materials (sugars or starches) account for the largest share of the cost. Energy expense is also significant as bioreactors and downstream equipment, including centrifuges and filtration units, are power-intensive. Labor expense also adds up, especially in processes that require manual inspection or frequent contamination control. Downstream processing that involves cleaning and recovery of the end product can be more than half of the overall cost of production, owing to the complex machinery involved and the degree of operational complexity. Capital costs in industrial facilities, regulatory activities, and continued research to produce the most possible yield and prevent wasting materials lead to further expenses, making fermentation an exorbitant process.

The rising demand for organic and fermentation-derived products, especially in the food and biopharmaceutical industries, is straining supply chains with raw material prices, especially crop feedstocks such as grains, fruits, and vegetables, being extremely volatile driven by geopolitical instability. Despite these realities, green chemical production and high-end biopharmaceuticals via fermentation provide long-term cost savings through substituting petroleum-based inputs with renewable inputs.

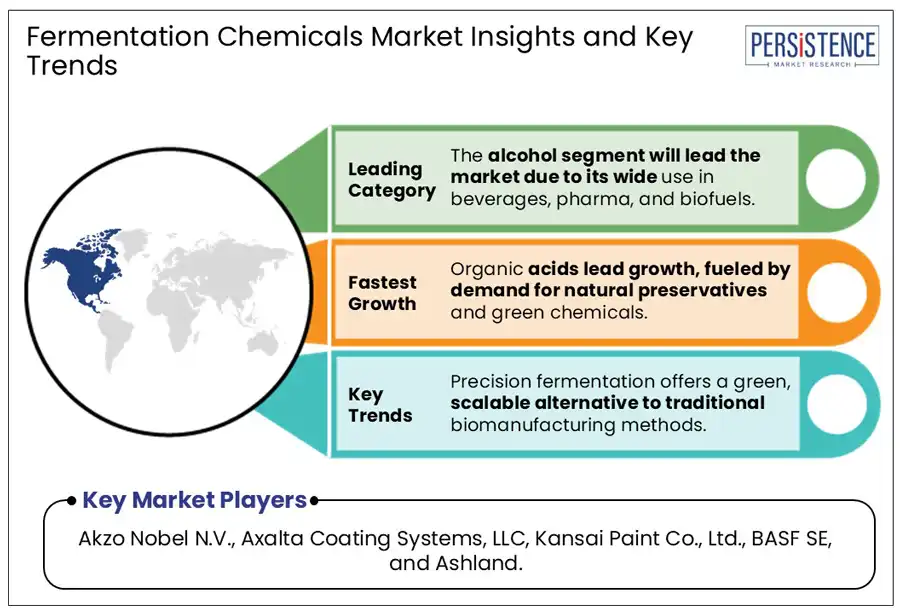

Precision fermentation is a revolutionary concept in the bio-manufacturing industry, providing an environmentally sustainable and scalable alternative to the conventional method of fermentation. Through the use of genetically modified microbes as a source of valuable bio-chemicals, materials, and ingredients, this technique is much broader than the traditional applications such as beer or cheese production. It aids in decreasing the dependence on environmentally expensive raw materials and moves toward sustainable feedstocks. Though most producers still rely on sugarcane or corn sugars, new-generation start-ups are transforming their feedstock model. Businesses such as Hyfe convert sugary wastewater into microbe feed, saving costs and reducing resource wastage, while Fibenol employs forest residues to yield biofuel and pharma fermentable sugars. Colipi utilizes CO?-feeding yeasts to produce palm oil substitutes, illustrating how carbon-negative production methods are possible.

At the same time, renewable production of bioethanol from non-food lignocellulosic biomass, including agricultural residues and forestry crops, holds a very promising route to sustainable energy. These biomass resources are abundant and use advanced enzymic and fermentation technologies to convert them into bioethanol. Despite limitations on pretreatment and processing efficiency, continuous innovation in bioprocessing and separation technologies continues to improve yield and fuel quality. Utilizing circular feedstocks such as food waste, CO?, and lignocellulosic biomass, the food, cosmetics, materials, and energy sectors can transition toward a low-carbon, resource-efficient future.

The alcohol segment is projected to dominate the fermentation chemicals market, holding 60% of the market share in 2025. The market is fueled by its widespread uses in leading industries, including beverages, pharmaceuticals, biofuels, and industrial solvents. Alcohol fermentation, which involves the process of decomposing sugars by yeast to produce ethanol and carbon dioxide, is an essential process in manufacturing alcoholic drinks such as beer, wine, and cider. It is also critical in making bread, whereby the carbon dioxide helps in the rise and texture of the bread. It is also employed in the production of bioethanol, a sustainable fuel, as well as in the manufacture of antibiotics, chemicals, and flavoring agents.

The organic acids segment is expected to be the fastest-growing segment over the forecast period due to the rising demand for natural food preservatives and green chemical production. Organic acids, which are characterized by pKa greater than or equal to three (typically carboxylic or phenolic), e.g., lactic acid, fumaric acid, citric acid, and tartaric acid, find widespread applications in the food industry to ensure increased shelf life and suppress bacterial growth. They are sought-after chemicals with diverse applications in varied domains such as food storage, pharmaceuticals, cosmetics, textiles, and bioplastics. The use of low-cost substrates, coupled with recombinant DNA technology and metabolic engineering advances, improves microbial productivity, thereby making large-scale commercial production of organic acids more feasible. The demand for natural preservation techniques to improve product durability is also driving market growth, especially in processed meat products and foods. Organic acids are hence becoming core ingredients of health-oriented and clean-label products.

The industrial application segment is anticipated to hold the largest share of the fermentation chemicals market, accounting for over 45% of revenue in 2025. The dominance is due to the widespread applications of chemicals obtained from fermentation in various industrial operations, such as the manufacture of solvents, detergents, bio-based polymers, and other key intermediates. The transition to green chemistry, coupled with growing regulatory stipulations toward eco-friendly practices, has made fermentation technology popular in all industry segments. Ethanol, citric acid, and acetic acid are now produced on a large scale by employing microbial fermentation by bacteria, fungi, and eukaryotic cells, providing environmentally safer alternatives than petrochemical-based raw materials. Increased spending on R&D and biotechnology, and emphasis on green raw materials, further drive the segment growth.

The food & beverages sector is expected to grow fastest over the forecast period owing to the increase in research activities, improvement in biotechnological operations, and increased worldwide demand for food due to population growth. Microbial fermentation plays an essential role in food manufacturing, whereby carbohydrates are converted into useful products through yeasts, bacteria, and molds. The method has traditionally been used to produce bread, beer, wine, yogurt, cheese, kefir, sour cream, tofu, soy sauce, pickles, coffee, and fermented meats such as salami and pepperoni.

New fermentation methods, such as solid-state fermentation and precise microbial engineering, have transformed the production process, thereby enabling greater safety, consistency, and scale in food production. The segment is further driven by the increasing demand for probiotic, plant-based, and nutrition-fortified foods, the majority of which are dependent on fermentation for shelf life and development.

North America is expected to lead the market with approximately 45% revenue share, driven by the increasing consumption of alcohols, enzymes and organic acids in various industries including food & beverages, cosmetics, and pharmaceuticals. Increased personal awareness toward grooming and cleanliness, cosmetics, and toiletries over the past few years is a major driver. Climatic variation has increased, leading to increased skin and dermatological problems, creating a humongous market opportunity for cosmetic use. These fermented skincare products usually contain herbs, yeast, and fruits that offer anti-inflammatory as well as other soothing benefits to the skin.

The FDA’s stringent regulations on fermentation chemicals used in pharmaceuticals, cosmetics, and food items also steer the growth of products with organic ingredients. North America is also home to cosmetic manufacturing firms such as Estée Lauder Companies, L'Oréal USA, Coty Inc., Procter & Gamble (P&G), and Revlon.

The U.S. is poised to experience the highest growth during the forecast period, supported by growing demand for bio-based products as greener alternatives to petrochemicals due to the rising environmental concerns and consumer demand for organic and natural food. Advances in the field of biotechnology have also enhanced fermentation efficiency. Favorable government policies and incentives are further spurring the transition toward green manufacturing and innovations.

Asia Pacific is estimated to witness a fast growth over the forecast period, owing to the presence of a large manufacturing base, particularly in countries such as China and India. The leading position of Asia Pacific is due to its growing food & beverage sector and rising investments in industrial biotechnology and biopharmaceuticals. Increasing industrialization, increasing disposable incomes, high consumption of processed foods & beverages, and increased investments in the pharma & biotechnology industry spur this growth. Additionally, favorable government policies for the induction of bio-based industries and augmented implementation of sustainable applications are fueling growth in this geography.

China is the major producer of amino acids, organic acids, enzymes, starch sugar, yeast, vitamins, and antibiotics. The nation is ahead of the world in terms of lysine, sodium glutamate, citric acid, enzyme preparations, and starch sugar production. It is a leader in vitamin and antibiotic production with over 80% and 90% of world production, respectively.

Europe is anticipated to witness substantial growth in the market from 2025 to 2032. Robust healthcare spending, higher drug production, and expansion in the food & beverages sector are expected to fuel the demand for fermentation chemicals in the region. The higher demand for biofuels in the region is also expected to drive the market. There is a considerable demand for fermented food & beverages in France and Germany. The U.K. also sees an increased demand in the expanding alcoholic drink industry. Abcam plc and Eurofins Scientific are the dominant players in the market.

Germany holds the largest share in the fermentation chemicals market. Germany has a well-developed healthcare infrastructure and a strong biopharmaceutical sector, driving market growth. It is also the largest market for food & beverages in Europe. Major players in the market are Hoffmann-La Roche and Ab Enzymes GmbH.

The global fermentation chemicals market is highly competitive, with global and domestic players offering a wide range of products and competing for a higher market share. Companies are investing in R&D and adopting growth strategies such as product innovations, strategic partnerships, and acquisitions.

The global market is projected to be valued at US$ 80.44 Bn in 2025.

The industry is driven by the increasing demand for biobased feedstock in the food & beverages and pharmaceutical industries.

The market is poised to witness a CAGR of 4.6% from 2025 to 2032.

Precision fermentation is a revolutionary concept in the biomanufacturing industry, providing an environmentally sustainable and scalable alternative to the conventional method of fermentation.

Major players in the Fermentation Chemicals Market include BASF SE, Novozymes, DuPont Danisco, DSM, Amano Enzymes USA Co., Ltd., and AB Enzymes.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author