ID: PMRREP35957| 220 Pages | 17 Dec 2025 | Format: PDF, Excel, PPT* | Packaging

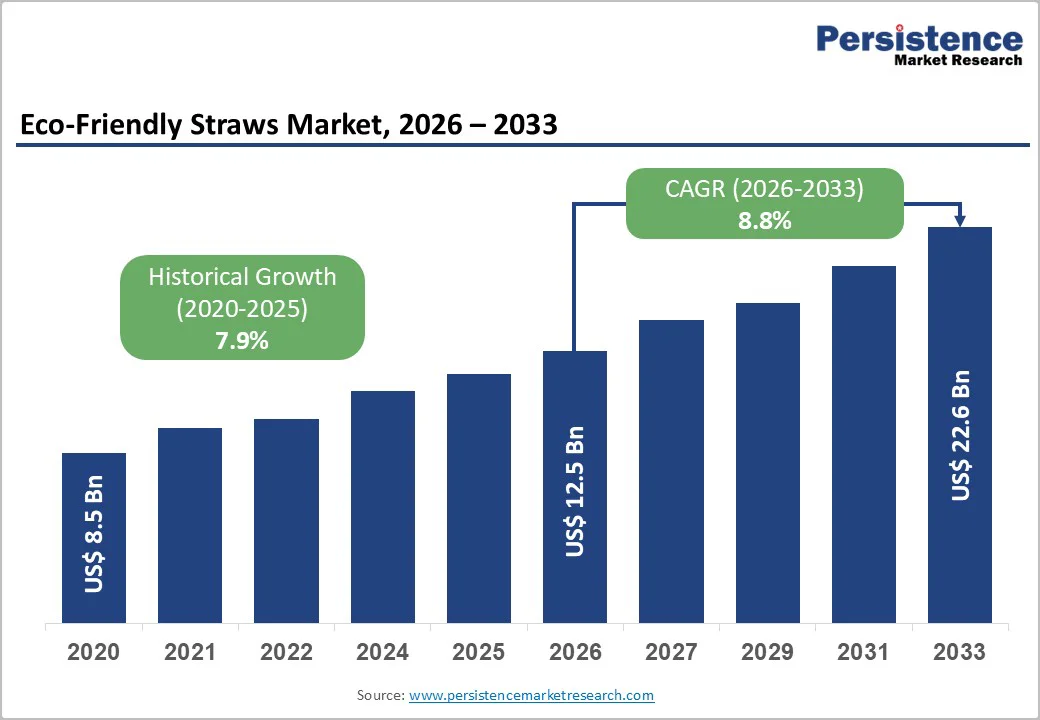

The global eco-friendly straws market size is likely to be valued at US$12.5 billion in 2026 and is expected to reach US$22.6 billion by 2033, growing at a CAGR of 8.8% between 2026 and 2033, driven by regulatory bans on single-use plastic straws, shifting consumer preferences toward sustainable packaging, and improving cost competitiveness of alternative materials.

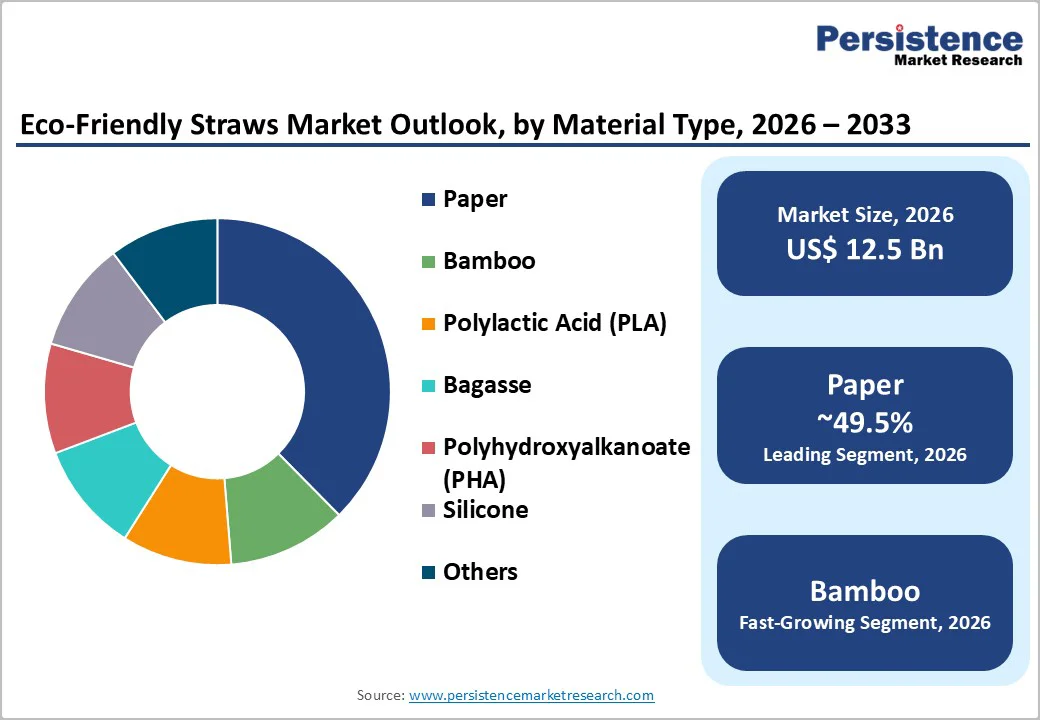

Paper straws currently dominate demand, while PLA, PHA biopolymers, and bamboo are gaining momentum as manufacturers scale production and certification frameworks mature. Environmental policy consistency and long-term supply-chain investments will play a decisive role in shaping competitive advantage.

| Key Insights | Details |

|---|---|

| Eco-Friendly Straws Market Size (2026E) | US$12.5 Bn |

| Market Value Forecast (2033F) | US$22.6 Bn |

| Projected Growth (CAGR 2026 to 2033) | 8.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 7.9% |

Governments and regional authorities continue to restrict single-use plastics through bans, phased reductions, and public procurement mandates, directly accelerating demand for eco-friendly straws. Regulations prohibiting the placement of plastic straws in foodservice channels have eliminated low-cost plastic options in many markets, forcing substitution with paper, compostable, and reusable alternatives.

Public institutions, hospitality operators, and large foodservice chains have responded by revising procurement specifications to prioritize certified sustainable materials. These policies increase price tolerance for alternatives and provide volume certainty, encouraging manufacturers to invest in capacity expansion and automation.

Over time, regulatory pressure has transformed eco-friendly straws from a niche offering into a standard procurement requirement across multiple commercial channels.

Corporate sustainability targets and evolving consumer behavior are reshaping purchasing decisions across foodservice and packaged beverage segments. Operators increasingly evaluate packaging suppliers based on environmental credentials, including compostability certifications and responsible sourcing claims.

Consumers, particularly in urban and premium segments, demonstrate a higher willingness to pay for visible sustainability attributes, supporting margin expansion for compliant products.

Foodservice contracts that explicitly include sustainability criteria have increased in number, driving double-digit growth in paper straw volumes across multiple chains. Corporate sustainability initiatives also encourage collaboration between material suppliers and converters, accelerating product development, improving manufacturing efficiency, and reducing per-unit costs through scale.

Advances in material science and processing technologies have significantly improved the functional performance of eco-friendly straws. Enhanced paper coatings, improved biopolymer formulations, and growing commercial availability of PLA and PHA resins have narrowed the performance gap with plastic alternatives.

These innovations support a wider product range, including flexible and jumbo straws, while maintaining durability in hot and cold beverages. As production capacity expands and supply chains become more vertically integrated, economies of scale are reducing cost premiums. This shift is improving competitiveness in price-sensitive channels and supporting broader market adoption.

Eco-friendly straws differ significantly in disposal requirements depending on material type and local waste infrastructure. Industrial compostability, home composting, recyclability, and marine biodegradability vary widely, creating confusion among buyers and consumers.

In regions lacking appropriate collection or composting facilities, certain materials may fail to deliver intended environmental benefits, increasing reputational risk. These inconsistencies complicate procurement decisions and can slow adoption, particularly where clear end-of-life pathways cannot be guaranteed at scale.

Despite cost improvements, many eco-friendly straws still command a premium compared to conventional plastic options. Fragmented supplier bases, especially among small regional converters, result in inconsistent quality, certification standards, and lead times.

Large foodservice operators increasingly favor suppliers capable of delivering uniform products across geographies, raising entry barriers for smaller producers. In low-volume purchasing scenarios, price premiums can range from moderate to substantial, limiting rapid substitution in highly price-sensitive applications without regulatory enforcement or further scale efficiencies.

Rapid growth in foodservice, delivery platforms, and urban café culture across Asia Pacific presents significant incremental demand for eco-friendly straws. As urbanization accelerates and plastic restrictions expand, high-volume foodservice operators will increasingly require compliant alternatives.

If substitution rates reach meaningful penetration levels in major QSR channels, emerging markets could account for a substantial share of incremental global market value by 2033. Establishing local manufacturing capacity and certification partnerships will be critical to securing early procurement contracts and long-term customer relationships.

Premium hospitality, aviation, and event catering segments increasingly prioritize durability, aesthetics, and brand alignment. Reusable silicone and high-grade biopolymer straws enable higher margins through branded merchandising and recurring replacement demand.

Over the forecast period, premium reusable formats are expected to represent a growing share of total market value. Differentiation through design, service contracts, and co-branding initiatives can reduce exposure to commodity pricing and enhance long-term revenue stability.

Paper straws are anticipated to lead with approximately 44.2% of the total revenue share, supported by broad global availability, relatively low unit costs at scale, and clear end-of-life communication compared with many biopolymer alternatives. Their dominance is most pronounced in North America and Europe, where regulatory pressure on single-use plastics and long-standing consumer familiarity with paper-based packaging have driven rapid substitution.

Large quick-service restaurant chains, cafés, and event caterers have widely adopted paper straws for cold beverages, valuing their ease of procurement and compatibility with the existing waste streams. From a supply perspective, paper straws benefit from established pulp and paper infrastructure, allowing manufacturers to expand capacity quickly and meet high-volume foodservice contracts.

Investments in improved coatings and multi-layer paper designs have enhanced durability in carbonated and iced drinks, addressing early performance concerns. These advancements have reinforced paper’s position as the default eco-friendly option for mass-market foodservice applications.

Bamboo straws are likely to be the fastest-growing, particularly within premium cafés, eco-focused retail outlets, and direct-to-consumer channels. Demand is driven by strong consumer appeal for natural, reusable, and visually distinctive products, which align well with sustainability-oriented branding and lifestyle marketing.

Bamboo straws are frequently sold as part of reusable straw kits, often bundled with cleaning brushes and storage pouches, supporting higher per-unit pricing. Growth is further supported by e-commerce platforms, which enable small and mid-sized suppliers to reach global consumers without relying on traditional foodservice distribution.

While higher labor requirements, supply seasonality, and quality variability remain challenges, ongoing investments in standardized sourcing, treatment processes, and quality control are improving consistency. As these processes mature, bamboo straws are expected to expand beyond niche applications into select hospitality and specialty foodservice environments.

The foodservice segment accounts for approximately 49.5% of the total market demand, driven by high consumption volumes across restaurants, cafés, hotels, catering services, and institutional dining. Regulatory exposure and corporate sustainability commitments make foodservice operators early adopters of eco-friendly straws, particularly in regions with plastic restrictions.

Long-term procurement contracts with national and regional chains provide stable, repeat demand, enabling manufacturers to invest in automation, quality standardization, and large-scale production. Examples include chain-wide rollouts of paper or compostable straws by quick-service restaurants and beverage retailers, as well as hospitality groups specifying certified sustainable straws in supplier agreements.

Foodservice buyers prioritize consistency, certification, and reliable logistics, reinforcing the position of suppliers capable of meeting high-volume and multi-location requirements.

Household demand is expanding rapidly, supported by rising awareness of plastic waste and growing interest in reusable and sustainable everyday products. Growth is concentrated in reusable straw kits made from silicone, bamboo, and stainless steel, as well as premium disposable alternatives for home entertaining.

Online marketplaces and specialty retail stores play a central role, allowing brands to target environmentally conscious consumers with curated product sets and educational packaging. Lifestyle branding, gift-oriented packaging, and influencer-driven promotion have contributed to higher margins and repeat purchase behavior, particularly for replacement accessories such as cleaning brushes or travel cases.

This segment also acts as a testing ground for design innovation and new materials, enabling manufacturers to diversify revenue streams beyond traditional foodservice procurement cycles.

North America is projected to hold approximately 31% of the market in 2026, with the U.S. acting as the primary demand and innovation hub. Market leadership is supported by strong corporate sustainability commitments, early adoption of plastic-reduction policies at the state and municipal level, and a higher penetration of premium beverage formats that rely on single-use accessories.

Cities such as Seattle, San Francisco, and New York were among the earliest to restrict plastic straws, creating long-term demand signals for compliant alternatives across foodservice chains.

Major foodservice brands, including Starbucks and McDonald’s, have played a central role in normalizing paper and alternative straws through large-scale rollouts across U.S. and Canadian outlets. These initiatives influenced supplier investment decisions, accelerating capacity expansion among North American paper straw converters and biopolymer processors.

While federal policy direction has shown variability, private procurement standards and ESG-driven sourcing requirements continue to sustain demand. Investment activity remains concentrated in biopolymer supply chains, compostable coatings, and automated converting equipment, reinforcing North America’s role as both a leading consumption and innovation market.

Europe benefits from regulatory harmonization under the EU Single-Use Plastics Directive, coupled with well-established waste management and recycling infrastructure.

Countries such as Germany, the U.K., France, and Spain represent core demand centers, driven by public procurement mandates, hospitality sector compliance, and consumer preference for certified sustainable packaging. Clear labeling standards and enforcement mechanisms have reduced uncertainty for suppliers, enabling cross-border trade and standardized product specifications.

Several European packaging groups have expanded or upgraded paper straw production to address regional demand. For example, Huhtamaki and Stora Enso have invested in fiber-based foodservice packaging innovations, including enhanced paper solutions designed to improve liquid resistance and usability.

In parallel, regional converters have increased automation and high-speed converting capacity, allowing them to serve multinational foodservice clients operating across multiple EU markets. These developments strengthen Europe’s position as a technologically mature market where performance improvements, rather than basic substitution, are the primary growth lever.

Asia Pacific is the fastest-growing regional market, supported by a combination of manufacturing scale advantages, expanding foodservice sectors, and progressively tightening plastic regulations. China plays a central role as a production hub, supplying paper and alternative-material straws to both domestic and export markets.

The country’s phased restrictions on single-use plastics have accelerated adoption within large urban foodservice networks, prompting investments in local converting capacity and material innovation.

India and Southeast Asia represent significant long-term growth opportunities, driven by rising café culture, quick-service restaurant expansion, and increasing regulatory scrutiny of plastic waste. Brands such as Tata Consumer Products and regional QSR chains have begun incorporating paper and compostable straws into sustainability initiatives, influencing supplier qualification standards.

Countries such as Vietnam and Thailand are emerging as manufacturing bases for bamboo and paper straws, supported by export-oriented production and improving certification capabilities. Localized manufacturing, cost efficiency, and alignment with international sustainability standards will be critical to capturing sustained growth across the region.

The global eco-friendly straws market remains moderately fragmented, with a mix of global packaging groups and regional specialists. Leading suppliers command institutional foodservice contracts, while smaller producers serve localized and niche segments. Consolidation is gradually increasing through partnerships, vertical integration, and selective acquisitions.

Market leaders prioritize innovation, vertical integration, and geographic expansion. Differentiation is achieved through certified environmental claims, cost efficiency at scale, and value-added services such as custom branding and logistics support.

The global market is estimated to be valued at US$12.5 billion in 2026.

By 2033, the eco-friendly straws market is projected to reach US$22.6 billion.

Key trends in the eco-friendly straws market include the growing shift from plastic to paper-based alternatives, the rising use of biopolymer straws such as PLA and PHA, and the increasing popularity of reusable bamboo and silicone straws in both household and premium markets.

By material type, paper straws are likely to be the leading segment, accounting for approximately 44.2% of total market value, due to cost competitiveness, scalability, and clear end-of-life communication.

The eco-friendly straws market is expected to grow at a CAGR of 8.8% between 2026 and 2033.

Major players include Huhtamaki, Vegware, World Centric, Aardvark Straws, and Eco-Products.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Material Type

By Product Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author