ID: PMRREP32976| 199 Pages | 29 Aug 2025 | Format: PDF, Excel, PPT* | IT and Telecommunication

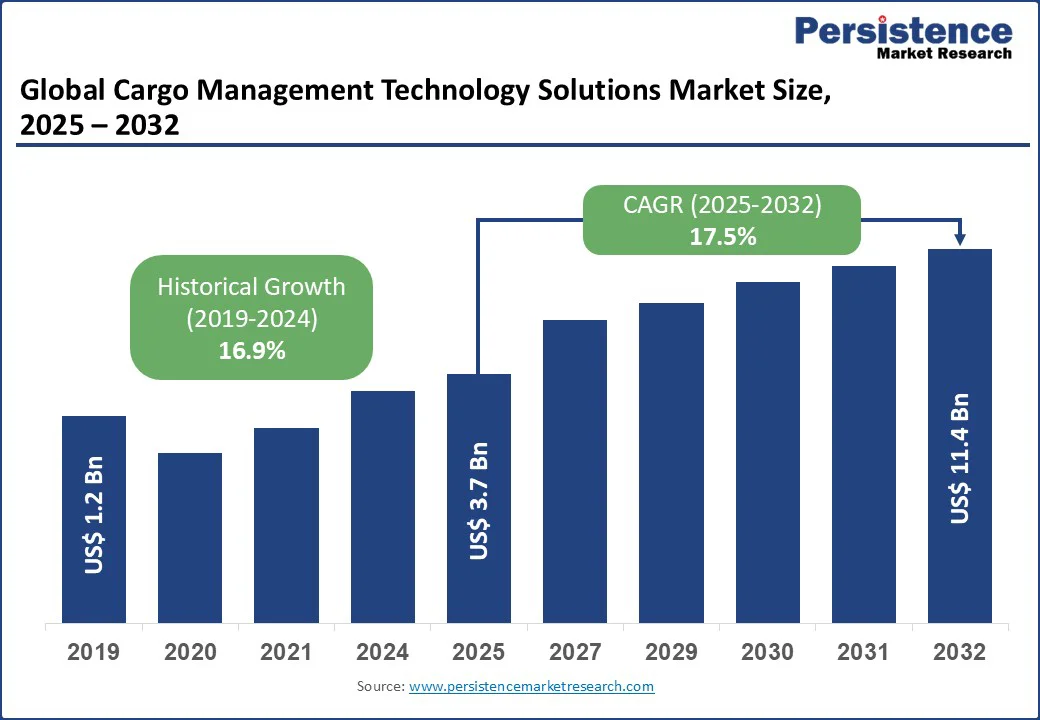

The global cargo management technology solutions market size is expected to be valued at US$3.7 billion in 2025. It is estimated to reach US$11.4 billion by 2032, growing at a CAGR of 17.5% during the forecast period.

The cargo management technology solutions industry is driven by the rapid expansion of e-commerce and increasing global trade, which are fueling demand for efficient logistics and cargo handling systems that can manage large order volumes and ensure timely deliveries.

Businesses are increasingly adopting solutions that provide end-to-end supply chain visibility and real-time tracking, which enhances operational efficiency and customer satisfaction. The integration of AI, automation, and predictive analytics is another major growth driver, enabling route optimization, demand forecasting, and intelligent decision-making.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Cargo Management Technology Solutions Market Size (2025E) |

US$ 3.7 Bn |

|

Market Value Forecast (2032F) |

US$11.4 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

17.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

16.9% |

The Cargo Management Technology Solutions Market is propelled by the surge in global e-commerce and supply chain digitalization, significantly boosting demand for logistics technology, shipping software, and transport management. The logistics sector, with 80% of companies adopting supply chain management software, relies on automated cargo management platforms for the supply chain to enhance efficiency.

AI-powered cargo management software for real-time visibility saw 15% adoption, enabling end-to-end cargo visibility tools to reduce delivery times by 25%. Accenture PLC reported 12% revenue growth from digital freight platforms, driven by the use of AI in logistics management and automated cargo documentation.

The rise of multi-modal transportation platforms, with 30% adoption in courier & delivery services, supports shipping optimization tools, positioning the market for exponential growth across manufacturing and trading sectors.

The cargo management technology solutions market faces challenges due to high implementation costs and integration complexities for logistics technology and cargo handling systems. Deploying supply chain management software costs between US$100,000 and US$1 million for large enterprises, which limits its adoption by SMEs, with only 20% adoption.

Integrating smart cargo systems with legacy systems requires a 30% higher IT investment, which impacts the scalability of digital freight platforms. In emerging markets, 25% of logistics firms cited integration barriers for AI in logistics management, slowing end-to-end cargo visibility tools adoption, particularly in travel & tourism and other segments.

Ensuring seamless data synchronization across multiple platforms-such as ERP systems, transportation management systems (TMS), and warehouse management systems (WMS)-is complex and time-consuming.

The cargo management technology solutions market is poised for growth due to the adoption of blockchain in freight solutions and IoT, creating opportunities for smart cargo systems and shipping optimization tools. In 2025, IoT adoption in logistics reached 45%, driving a 15% increase in demand for digital cargo tracking and monitoring solutions. Blockchain, with 20% adoption in logistics, enhances automated cargo documentation and reduces fraud by 30%.

Emerging markets, with US$50 billion in logistics tech investments, are boosting AI-powered cargo management software and multimodal transportation platforms. IBS Software Services reported 10% growth in last-mile delivery management systems. The rise of e-commerce, with a 25% growth in the Asia Pacific, presents opportunities for end-to-end cargo visibility tools that support courier & delivery services.

Cloud-based deployment holds a 50% market share in 2025, driven by digital freight platforms. It supports shipping and tracking software and AI in logistics management. Cloud solutions support shipping and tracking software, enabling real-time visibility of cargo movement and automated updates for shippers and customers.

The integration of AI in logistics management within cloud environments enhances predictive analytics, demand forecasting, and route optimization. This reduces delays and improves operational efficiency, especially in global supply chains.

Smart cargo systems fuel Hybrid Deployment. It enhances multi-modal transportation platforms and end-to-end cargo visibility tools. They power end-to-end cargo visibility tools, which integrate IoT sensors, GPS tracking, and analytics dashboards for comprehensive shipment monitoring.

By bridging cloud capabilities with localized infrastructure, hybrid deployment ensures resilience, real-time insights, and optimized operational workflows, making it a strategic choice for enterprises dealing with complex global supply chains.

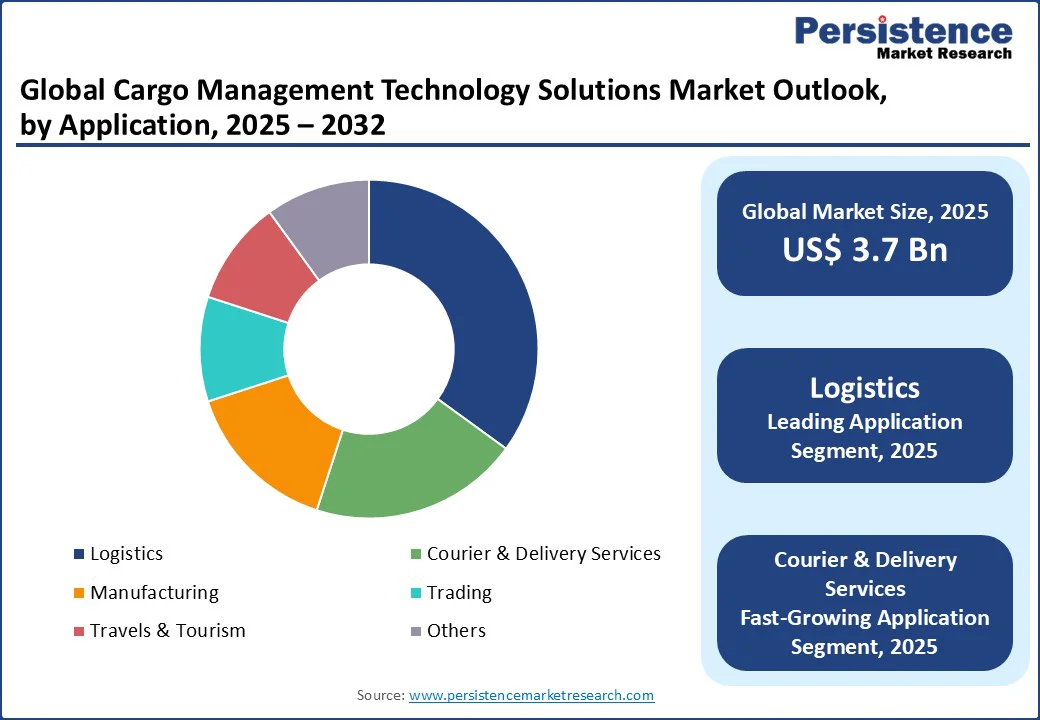

Logistics commands a 35% market share in 2025, driven by supply chain management software. it relies on shipping optimization tools and cargo handling systems. The increasing complexity of global trade, combined with the need for real-time visibility and predictive analytics, is pushing logistics providers to adopt digital platforms and AI-driven solutions.

These technologies enable enhanced fleet management, inventory tracking, and compliance with international trade regulations, ultimately driving the segment's strong performance.

Last-mile delivery management systems fuel courier & delivery services. Courier & delivery services are supporting AI-powered cargo management software, which allows automated route planning, dynamic delivery scheduling, and real-time tracking of parcels. With the surge in on-demand delivery services and the gig economy, courier companies are investing heavily in smart routing, contactless delivery solutions, and predictive maintenance for delivery fleets.

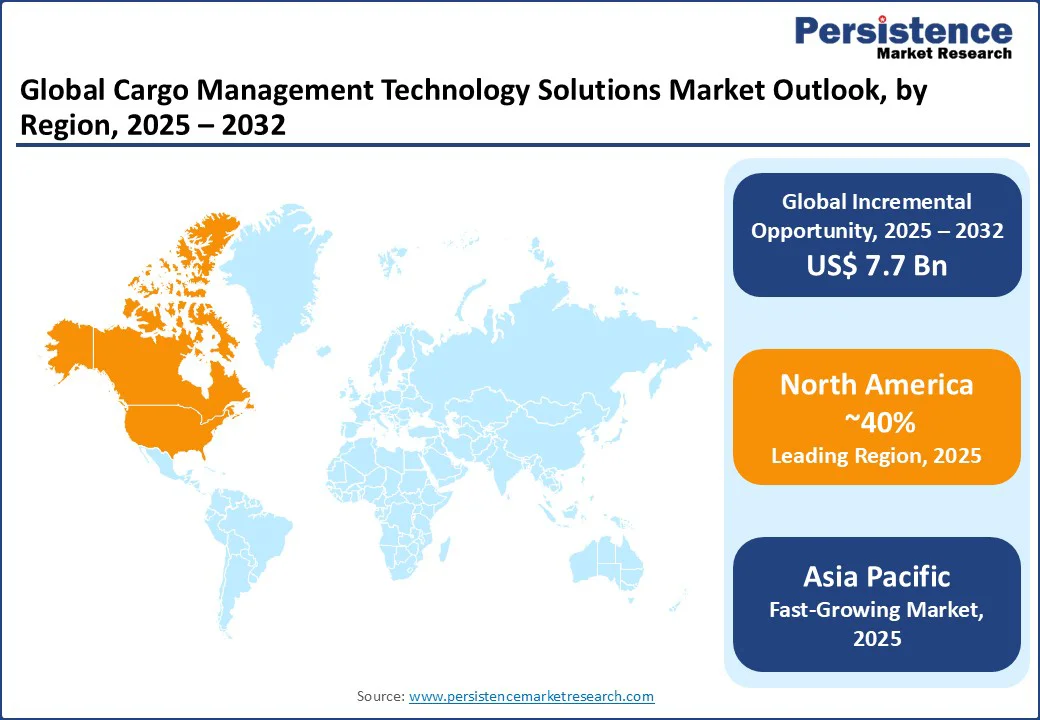

North America holds a 40% global market share in 2025, with the U.S. leading due to its advanced logistics technology infrastructure, generating US$1.48 Bn in sales. The U.S. market driven by transport management, with 65% of logistics firms adopting digital freight platforms. Key drivers include a 25% increase in e-commerce, reaching US$1.2 Tn, boosting AI-powered cargo management software for real-time visibility and shipping, and tracking software.

The logistics sector, with 30% adoption of automated cargo documentation, supports supply chain management software. Accenture PLC holds a 15% regional share, leveraging smart cargo systems, with 50% of logistics firms using their solutions. The rise of last-mile delivery management systems, with 20% growth, drives end-to-end cargo visibility tools.

Europe accounts for a 30% global share, led by Germany, the UK, and France, driven by robust logistics networks and the adoption of technology. Germany’s market propelled by shipping software, with 55% of logistics firms adopting cargo handling systems. The logistics sector, contributing €1.2 Tn to the economy, drives 15% growth in digital freight platforms.

The UK market is driven by multi-modal transportation platforms, with 45% of firms adopting AI in logistics management. EU regulations, with €300 million in digitalization funding, boost supply chain management software.

Emerging supply chain technologies, including AI-driven “control tower” platforms, provide enhanced situational awareness across multimodal networks, although achieving full upstream-downstream visibility remains a challenge. France witnessed 10% growth in courier & delivery services, with a 20% adoption of last-mile delivery management systems, supported by Damco’s smart cargo systems.

Asia Pacific is the fastest-growing region, with a CAGR of 19.0%, led by China, Japan, and India, driven by e-commerce and industrialization. China holds a 50% regional share, fueled by US$ 200 Bn in logistics investments, boosting shipping optimization tools and digital cargo tracking and monitoring solutions.

The logistics sector, with 25% growth in e-commerce, drives 20% demand for AI-powered cargo management software. India’s market propelled by 30% growth in courier & delivery services, with 35% adoption of last-mile delivery management systems.

Government initiatives such as Digital India, with US$ 15 Bn in funding, enhance logistics technology. Japan’s market witnessed a 12% growth in automated cargo management platforms for supply chain, driven by 15% adoption in manufacturing. IBS Software Services expands with blockchain in freight solutions, capturing 10% of the regional market, per company reports.

The global cargo management technology solutions market is highly competitive, with Damco, IBS Software Services, Camelot 3PL Software, Awery Aviation Management System, Bitmetric Technologies, Jada Management Systems, Catapult International, LeanLogistics, Accenture PLC, Hyundai Merchant Marine, Agility, and Sabre focusing on logistics technology, shipping software, and transport management.

Strategic R&D investments in smart cargo systems and partnerships drive supply chain management software, addressing automated cargo documentation and last-mile delivery management system needs. For example, IBS Software has partnered with Singapore Airlines (SIA) and Cargo Community Network (CCN) to co-develop a shipment record solution aligned with IATA’s ONE Record standards.

They have completed the first phase, enabling digitized, shared shipment records across airlines, ground handlers, and other stakeholders using CCN’s CUBEforall platform to enhance transparency and integrate legacy systems.

The cargo management technology solutions market is projected to reach US$ 3.7 Bn in 2025, driven by logistics technology and shipping software.

E-commerce growth, fuels digital cargo tracking and monitoring solutions and AI in logistics management.

The cargo management technology solutions market grows at a CAGR of 17.5% from 2025 to 2032, reaching US$11.4 Bn by 2032.

Blockchain and IoT adoption, with 20% growth in smart cargo systems, offers opportunities for end-to-end cargo visibility tools.

Key players include Accenture PLC, IBS Software Services, Damco, Sabre, and Agility.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author