ID: PMRREP35388| 194 Pages | 2 Jun 2025 | Format: PDF, Excel, PPT* | Food and Beverages

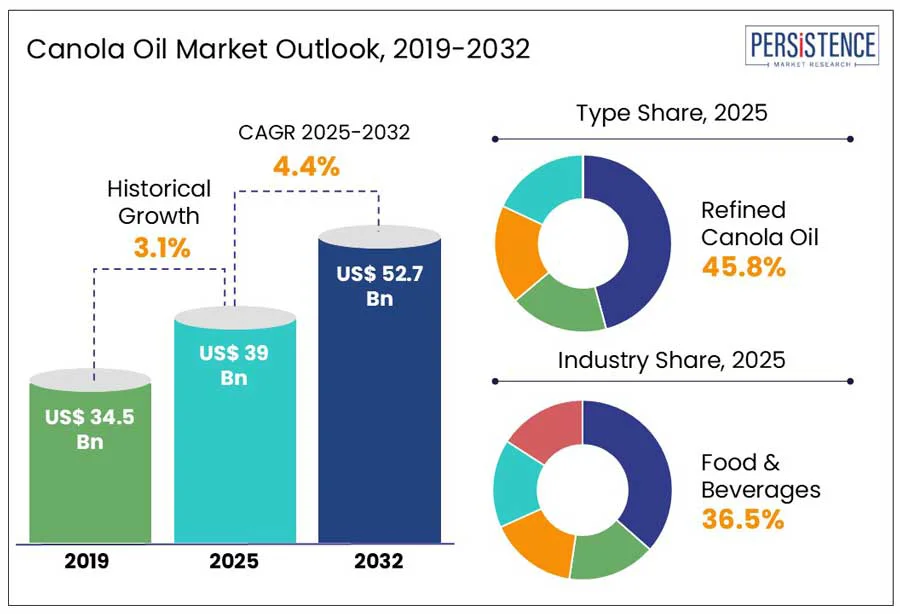

The global canola oil market size is projected to grow from US$ 39.0 billion in 2025 to US$ 52.7 billion by 2032, achieving a CAGR of 4.4% during this period. According to the Persistence Market Research report, the canola oil industry (Rapeseed Oil Market) has experienced steady growth, driven by increasing consumer demand for healthier cooking oils and sustainable agricultural practices. Known for its low saturated fat content, high levels of omega-3 fatty acids, and neutral flavor, canola oil is widely used in various culinary applications, including home cooking, food processing, and the restaurant industry. It is often regarded as a heart-healthy alternative to traditional oils such as palm and soybean oil.

In addition to its nutritional benefits, the market for canola oil is also influenced by the rising popularity of plant-based diets, as it is a staple ingredient in many plant-based food products due to its versatility and health advantages. Furthermore, canola oil's role in sustainable agriculture, which has a reduced environmental impact compared to other oil crops, has enhanced its global appeal. As consumer awareness regarding health and sustainability continues to rise, the canola oil market is expected to remain a significant player in the global edible oils industry.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Canola Oil Market Size (2025E) |

US$ 39.0 Bn |

|

Market Value Forecast (2032F) |

US$ 52.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

4.4% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.1% |

Global demand for canola oil has been increasingly driven by the growing preference for healthier cooking oils. Its low saturated fat content and high omega-3 fatty acids have made it an attractive option for health-conscious consumers. As awareness of heart disease and lifestyle-related health issues rises, canola oil’s appeal continues to expand. Recognized for supporting a balanced diet while maintaining a neutral flavor, it is widely used in various culinary applications. This shift towards healthier alternatives is significantly influencing the canola oil market.

In 2024, Jivo Wellness Pvt. Ltd. launched its cold-pressed canola oil, emphasizing its health benefits to meet the growing demand among health-conscious consumers. The product, marketed as having the lowest saturated fat content among common vegetable oils and being rich in omega-3 fatty acids, aligns with consumer preferences for natural, non-GMO, and chemical-free cooking oils. This strategic move highlights Jivo Wellness’s commitment to providing nutritious and versatile cooking options.

The canola oil market faces significant restraints due to the rising concerns over environmental sustainability and the increasing demand for alternatives. The use of genetically modified (GMO) canola seeds in oil production is a key factor affecting consumer perception, with many consumers preferring non-GMO or organic oils.

The environmental impact of large-scale canola farming, including soil depletion and pesticide use, is drawing attention from environmentally conscious buyers and regulatory bodies. Fluctuations in the price of canola seeds, driven by unpredictable weather conditions and market forces, are contributing to the instability of oil production costs. These challenges are limiting the market's growth potential and influencing the purchasing decisions of both consumers and manufacturers.

The growing shift toward plant-based diets has created a significant opportunity for expanding the use of canola oil in food products, driven by its neutral flavor and heart-healthy nutritional profile. As consumers increasingly seek plant-based alternatives, canola oil is being incorporated into meat substitutes, dairy-free products, and snacks due to its low saturated fat and high omega-3 content. These attributes align with health-conscious trends and have made canola oil a preferred ingredient in plant-based food innovation.

In 2024, ADM’s plant-based food concepts were recognized at FoodBev’s Plant-Based Taste Awards, reflecting industry efforts to meet evolving dietary preferences. A standout example was ADM’s Plant-Based Protein Bar, which utilizes rapeseed lecithin, a byproduct of canola oil processing, to improve texture and mouthfeel. This innovation showcases the versatility of canola oil derivatives in enhancing the appeal of plant-based products. Through such advancements, canola oil is playing an increasingly important role in supporting nutritious and sustainable food choices.

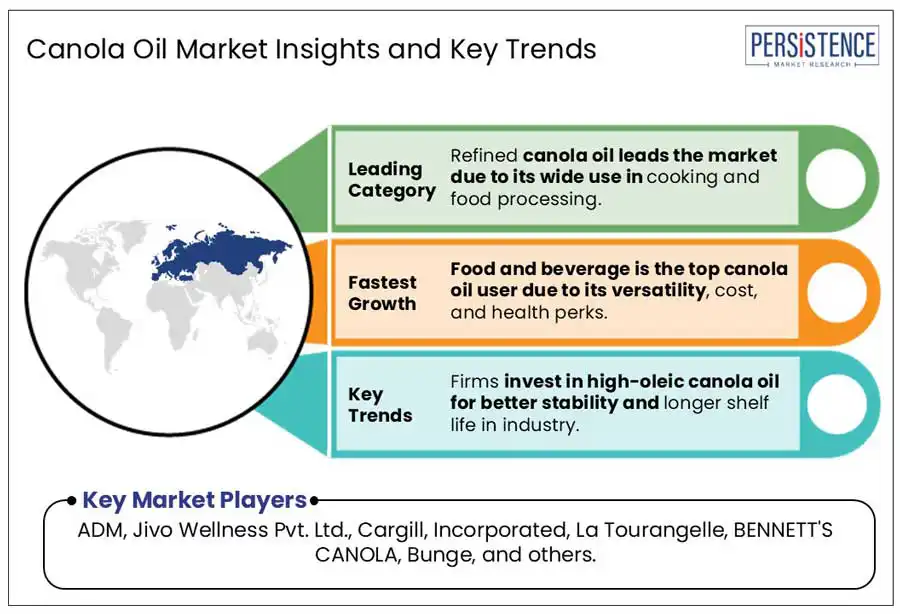

The Refined Canola Oil segment holds the largest market share in the canola oil market, primarily due to its extensive use in food processing and everyday cooking. Preferred for its neutral flavor, versatility, and stability at high temperatures, refined canola oil is ideal for both home kitchens and commercial establishments. The refining process removes impurities, resulting in a higher shelf life and improved quality, making it suitable for mass consumption.

In 2025, Bunge's commitment to producing refined canola oil is demonstrated through its RBD (Refined, Bleached, and Deodorized) offerings. These products are manufactured across multiple facilities in Canada, including Hamilton, Harrowby, Altona, and Nipawin, ensuring consistent quality and supply. The refining process enhances oil stability and extends shelf life, making it suitable for various culinary applications. Bunge’s adherence to GRAS (Generally Recognized As Safe) and HACCP (Hazard Analysis Critical Control Point) certifications highlights its dedication to producing high-quality refined canola oil that meets industry demands.

The food and beverage industry has been recognized as the primary end-users for canola oil, owing to its versatility, cost-effectiveness, and health benefits. Extensively utilized in cooking, frying, and processed food manufacturing, canola oil is favored for its neutral flavor, low saturated fat content, and affordability compared to alternatives such as palm oil or butter. These attributes have reinforced its widespread use in products ranging from fast food to packaged snacks and beverages. Its status as a healthier oil option has aligned with consumer preferences for nutritious ingredients, driving its integration across diverse food applications.

In April 2023, Cargill announced a US$50 million investment to upgrade and expand its oilseed crushing facilities in Newcastle, Narrabri, and Footscray, Australia. This investment will enable Cargill to meet the growing demand for canola and cottonseed products from customers and provide Australian farmers with greater access to global markets. The expansion enhances Cargill's ability to supply high-quality canola oil, which is widely used in various food products due to its health benefits and versatility. This strategic move highlights the importance of the food and beverage industry as a primary consumer of canola oil.

In North America, the growing preference for heart-healthy oils has significantly boosted the adoption of canola oil, driven by its low saturated fat content and high omega-3 fatty acids. Emphasized by health experts for its cardiovascular benefits, canola oil has become a favored option among consumers aiming to make healthier dietary choices. Its light flavor and adaptability across various recipes have further supported its widespread use in both households and foodservice settings.

In 2024, Cargill launched a hybrid high-oleic canola oil that contains 4.5% or less saturated fat, achieving a 35% reduction compared to earlier varieties. This advanced formulation maintains high fry and shelf-life performance while preserving freshness and taste, thereby aligning with consumer expectations for healthier, yet functional, cooking oils. Such innovations underscore the ongoing commitment to improving oil quality in response to North America’s health-focused market trends and dietary shifts.

In Europe, the increasing preference for rapeseed oil (canola) has been driven by its recognized nutritional benefits and alignment with sustainable agricultural practices. Valued for its high omega-3 fatty acid content, low saturated fat, and beneficial antioxidants, rapeseed oil has gained popularity among health-conscious consumers. Its mild taste and favorable fatty acid profile, endorsed by the German Nutrition Society, have further enhanced its appeal. Simultaneously, the oil's production through environmentally friendly farming methods has resonated with the region's growing demand for locally sourced, eco-friendly products.

In 2024, rapeseed oil regained its position as Germany’s most popular cooking oil, with approximately 78 million liters consumed in 2023. This trend reflects broader consumer values prioritizing both health and sustainability. A 50% decline in rapeseed oil imports in the European Union during the 2024/25 marketing year underscored the shift towards domestic oilseed production, reinforcing rapeseed oil’s role in the region’s evolving dietary and agricultural landscape.

In Asia Pacific, the adoption of canola oil has been steadily driven by rising health awareness and evolving dietary patterns. Embraced for its light texture, neutral taste, and nutritional benefits, including low saturated fat and high omega-3 fatty acids, canola oil has been increasingly applied in daily cooking, processed foods, and foodservice, especially in urban areas with a growing health-conscious consumer base. Its affordability compared to some premium oils has also made it a practical and healthier alternative. These trends have been reinforced by increasing imports and localized refining.

In 2024, the region demonstrated a significant shift towards canola oil adoption, with China, India, and Japan collectively accounting for 88% of the total consumption. China consumed 5.4 million tons, valued at approximately US$9.5 billion, while India and Japan consumed three million tons (US$6.7 billion) and 914,000 tons (US$2 billion), respectively, reflecting the growing demand for nutritious cooking oils.

The competitive landscape of the canola oil market features a combination of global and regional players, with key companies concentrating on product innovation, sustainability, and expanding their market presence. Major companies such as Cargill, ADM, and Bunge Limited dominate the industry through extensive distribution networks, production facilities, and diversified product offerings. These firms provide various options, including refined, cold-pressed, and organic canola oils, to cater to different consumer preferences, particularly health-conscious individuals looking for heart-healthy oils. In addition to these large corporations, smaller regional players contribute to the market by emphasizing local production and sourcing practices.

They focus on sustainability and address the growing demand for organic and non-GMO options. The increasing preference for plant-based and minimally processed oils has prompted companies to innovate by introducing high-oleic, low-saturated-fat canola oil alternatives. Sustainability remains a key priority, with many companies adopting eco-friendly production practices and promoting canola oil's role in reducing environmental impact. Furthermore, partnerships and acquisitions are common strategies employed to strengthen market positions.

The global Canola Oil Market is projected to be valued at 39.0 Bn in 2025.

The Canola Oil Market is driven by health-conscious consumers are increasingly driving global demand for canola oil due to its low saturated fat and high omega-3 content.

The Canola Oil Market is poised to witness a CAGR of 4.4% from 2025 to 2032.

Expanding the use of canola oil in plant-based food products offers a key opportunity for companies amid shifting dietary preference is the key market opportunity.

Major players in the Canola Oil Market include ADM, Jivo Wellness Pvt. Ltd., Cargill, Incorporated, La Tourangelle, BENNETT'S CANOLA, Bunge, and others.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn, Volume: Unit |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Distribution Channel

By Nature

By Packaging Type

By Type

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author