ID: PMRREP35842| 188 Pages | 14 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

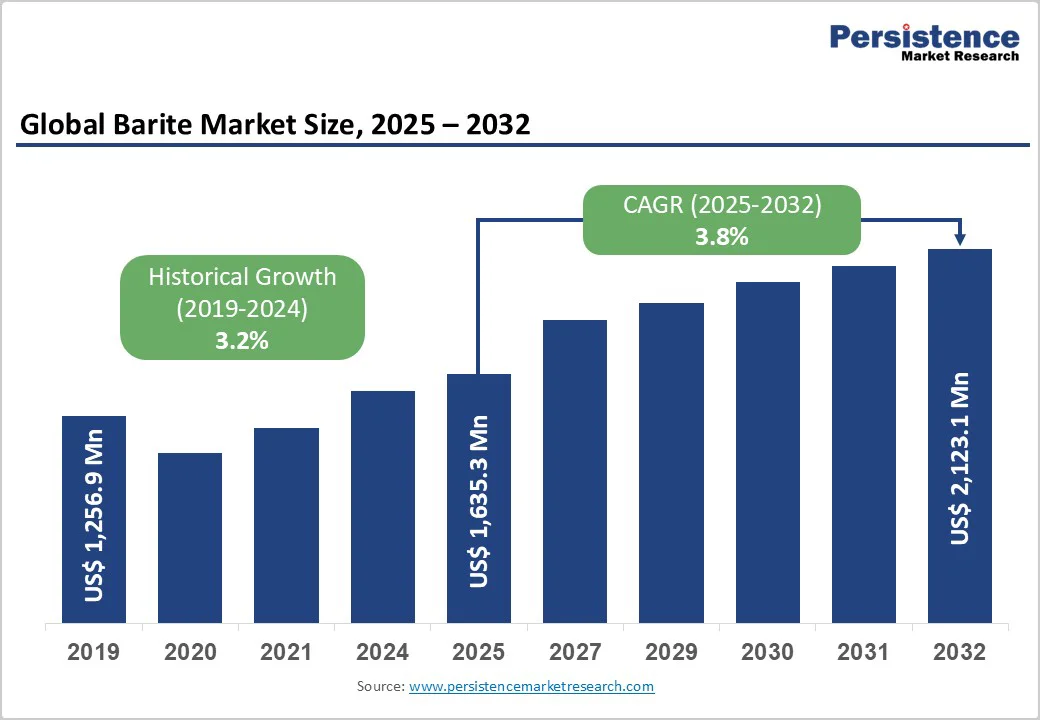

The global barite market size is likely to value at US$1,635.3 million in 2025 and is projected to reach US$2,123.1 million by 2032, growing at a CAGR of 3.8% between 2025 and 2032.

Sustained oil and gas exploration activities, particularly in unconventional resources and offshore drilling operations, where barite serves as an indispensable weighting agent in drilling fluids, have been the chief factor driving the demand.

| Key Insights | Details |

|---|---|

| Global Barite Market Size (2025) | US$1,635.3 million |

| Projected Market Value (2032F) | US$2,123.1 million |

| Global Market Growth Rate (CAGR 2025 to 2032) | 3.8% |

| Historical Market Growth Rate (CAGR 2019 to 2024) | 3.2% |

Barite demand is fundamentally tied to global drilling activity, with oil and gas accounting for over 75% of total consumption in 2025. Global rig counts, as per Baker Hughes, rose 15% in 2025 compared to 2023, underscoring the sector’s vitality.

According to the U.S. Geological Survey (USGS), as of October 2024, the world's annual average rig count, excluding the U.S., reached 1,169, up from 1,154 in 2023, representing modest growth in global drilling operations.

Despite the U.S. experiencing a decline from 622 active rigs in January 2024 to 585 by October 2024, barite sales increased due to the need for deeper wells requiring higher-density drilling fluids and extended drilling durations.

The IEA projects global oil demand to increase by 2.5 mb/d by 2030, while production capacity is forecasted to reach 114.7 mb/d by 2030, reinforcing barite’s role in pressure control and blowout prevention.

Technological advances in horizontal drilling and hydraulic fracturing have further intensified consumption per well, especially in North American shale basins and Middle Eastern HPHT environments.

The development of unconventional hydrocarbon resources, including shale gas, tight oil, and deepwater reserves, necessitates the use of high-density drilling fluids where barite plays an irreplaceable role.

According to the U.S. Energy Information Administration (EIA), U.S. oil production is projected to peak in 2027, creating sustained demand for API-specification barite with a specific gravity of 4.2 or higher.

Ultra-deepwater projects in Brazil, Mexico, and Guyana now require drilling fluids capable of withstanding water depths exceeding 2,500 meters and bottom-hole temperatures above 200°C, driving demand for premium-grade barite products.

The barite's ability to increase mud density up to 2,400 kg/m³ while maintaining chemical stability under extreme conditions makes it indispensable for these challenging drilling environments.

Barite consumption in industrial applications continues to expand, with the paints and coatings segment demonstrating robust growth due to increasing construction activities and infrastructure development globally. In the coatings industry, barite serves as a functional filler that enhances product volume, consistency, viscosity, and durability while providing excellent brightness and reflective values.

The mineral's chemical inertness and resistance to acids ensure coating longevity, particularly in automotive refinishing, marine protective coatings, and industrial paint systems.

Furthermore, barite's low oil absorption properties enable manufacturers to increase loading levels without adversely affecting viscosity, offering significant cost advantages by partially replacing expensive titanium dioxide pigments. In rubber and plastics manufacturing, barite improves hardness, wear resistance, and aging resistance while providing cost-effective density enhancement.

Supply Chain Vulnerabilities and Geopolitical Dependencies

The global barite market faces significant supply chain challenges stemming from concentrated production sources and geopolitical dependencies. The U.S., despite being a major consumer with annual demand over 2 million metric tonnes, imports approximately 85% of its barite supply, primarily from India (34%), China (20%), Morocco (18%), and Mexico (12%). This heavy reliance on imports creates vulnerability to trade tensions, export restrictions, and transportation disruptions.

China's position as both a major supplier and the world's largest producer, accounting for 30-35% of global supply, grants it substantial market influence. Transportation costs represent 25-40% of delivered costs, depending on origin and destination, with freight market volatility significantly impacting overall supply chain economics. The COVID-19 pandemic exposed these vulnerabilities when dry bulk vessel shortages and port disruptions caused significant delays and cost escalations throughout 2020-2021.

Environmental Regulations and Mining Constraints

Increasing environmental regulations surrounding barite mining operations present operational challenges and cost pressures across producing regions. Concerns about sulfate contamination in groundwater from mining activities have led to stricter compliance requirements and community opposition in several jurisdictions.

Most remaining barite reserves comprise low-grade deposits with complex mineral compositions and fine disseminated particle sizes, necessitating more intensive beneficiation processes that increase production costs.

In China, which accounts for approximately 42% of global production but only 9.25% of reserves, the depletion of high-grade, easily accessible deposits has accelerated the shift toward lower-grade resources.

Stringent environmental regulations can increase production costs by 10-20% and restrict mining operations, particularly affecting smaller producers lacking capital for advanced waste management and water treatment systems.

The medical imaging segment represents a high-growth opportunity for barite producers, with pharmaceutical-grade barium sulfate experiencing increasing demand for diagnostic procedures.

The medical barium sulfate-based contrast media market is likely to surpass US$450 million by 2032, demonstrating the segment's robust expansion potential. Barite's exceptional radiopacity makes it essential for X-ray imaging, CT scans, and gastrointestinal examinations, where it provides clear contrast for visualizing internal structures without toxicity risks.

The expansion of healthcare infrastructure in emerging economies, particularly in India and Southeast Asia, coupled with aging populations in developed markets, drives sustained growth in diagnostic imaging procedures requiring barium-based contrast agents.

Barite serves as the primary feedstock for producing various barium compounds, including barium carbonate (BaCO3), barium chloride (BaCl2), and barium hydroxide [Ba(OH)2], which find extensive applications in specialty chemicals, glass manufacturing, and materials science.

Through carbothermal reduction processes, barite is converted to barium sulfide, which then serves as the starting material for manufacturing a range of high-value barium chemicals used in lubricating greases, plasticizers, pigment manufacturing, and electronic materials.

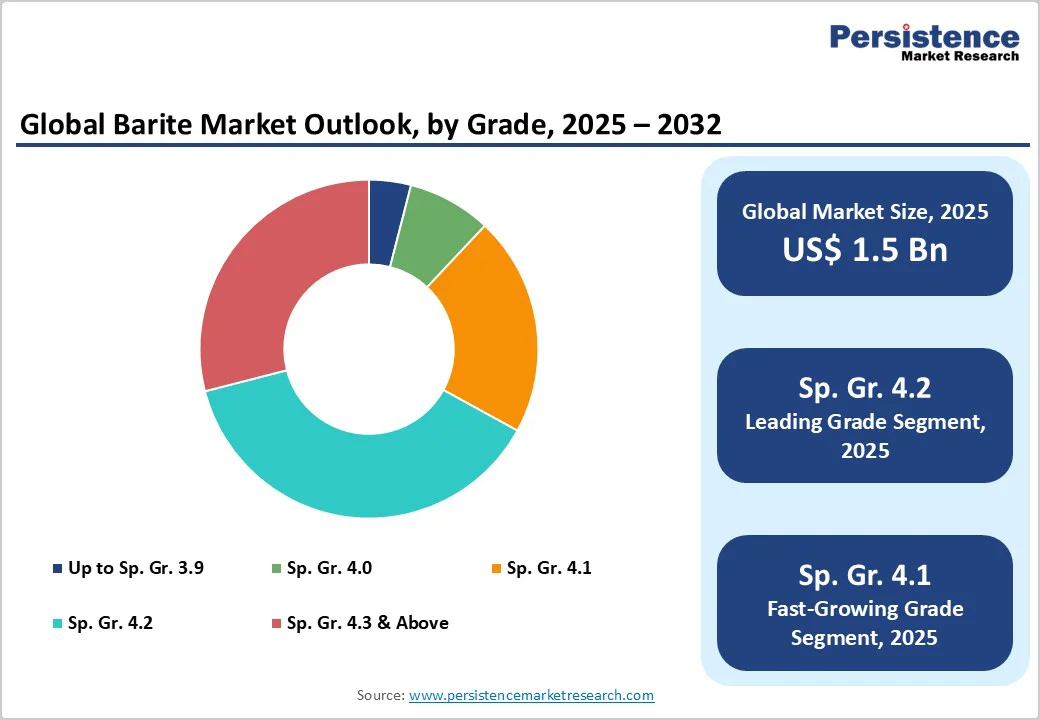

Sp. Gr. 4.2: Market Dominance Through Drilling Applications

The specific gravity 4.2 grade commands the dominant market position, holding over 35% market share in 2025, driven by its status as the API 13A specification standard for drilling-grade barite. This grade represents the industry benchmark for oil and gas drilling operations, where its optimal density-to-cost ratio makes it the preferred weighting agent for controlling wellbore pressures and preventing blowouts.

Major oilfield service companies, including Halliburton and Schlumberger, specify Sp. Gr. 4.2 barite for most onshore and offshore drilling operations globally. Pure barium sulfate possesses a specific gravity of 4.50, but drilling-grade barite typically achieves 4.2-4.3 due to natural impurities and processing characteristics.

The American Petroleum Institute's longstanding acceptance of this grade as the industry standard, combined with abundant global supply sources meeting these specifications, ensures its continued market leadership throughout the forecast period.

Sp. Gr. 4.1: Fast-Growing Segment Addressing Supply Challenges

The specific gravity 4.1 grade has emerged as the fastest-growing segment in the barite market, gaining traction following the American Petroleum Institute's 2010 approval of alternate specifications to address concerns about dwindling 4.2-grade reserves. This grade provides an effective solution for extending global barite resources while meeting operational requirements for less critical drilling applications.

The acceptance of 4.1-grade barite has enabled producers to utilize lower-grade ore deposits that previously lacked commercial viability, thereby expanding global supply capacity.

While initially adopted for non-critical operations, improved drilling fluid formulation technologies have progressively broadened their application scope. The grade offers cost advantages of 10-15% compared to 4.2-grade material while requiring only minor adjustments to mud system chemistry and volumes.

Drilling Mud: Commanding Over 75% Market Share

Drilling mud applications represent the dominant and driving force of the global barite market, accounting for over 75% market share in 2025. This overwhelming dominance stems from barite's unique combination of high density, chemical inertness, low abrasiveness, and cost-effectiveness as a weighting agent in drilling fluids.

In drilling operations, barite serves multiple critical functions: increasing hydrostatic pressure to control formation pressures, stabilizing wellbore walls to prevent collapse, suspending and transporting drill cuttings to the surface, and forming low-permeability filter cakes to minimize formation damage.

The mineral's ability to remain chemically stable under high temperatures and pressures, combined with its non-toxic nature and compatibility with both water-based and oil-based mud systems, makes it indispensable for modern drilling operations. Market growth in this segment directly correlates with global rig activity and drilling intensity, with deeper wells and extended-reach horizontal drilling requiring progressively higher mud densities and larger barite volumes per well.

Medical Imaging: Fast-Growing High-Value Segment

The medical imaging segment has emerged as the fastest-growing application for barite, driven by expanding healthcare infrastructure, aging populations, and increasing diagnostic imaging procedures worldwide.

Pharmaceutical-grade barium sulfate is increasingly used as a radiocontrast agent in X-ray, fluoroscopy, and CT examinations. Its high atomic number (56) enables strong X-ray absorption, while insolubility ensures safety.

Applications include diagnostics for gastroesophageal reflux, ulcers, and colorectal disorders, supporting robust growth through 2032.

Paints & Coatings: Industrial Filler and Extender Applications

The paints and coatings segment represents a significant industrial application for barite, where it functions as a high-performance filler and pigment extender in architectural, automotive, industrial, and marine coating formulations.

Barite enhances coating properties, including film thickness, mechanical strength, durability, gloss control, and scratch resistance, while providing cost optimization by partially replacing expensive titanium dioxide pigments. Its low oil absorption characteristics enable high loading levels without adversely impacting viscosity, and its chemical inertness ensures excellent resistance to acids, alkalis, and solvents.

The mineral's high specific gravity provides desirable "weight" that consumers associate with premium quality in architectural paints. Micronized barite grades with controlled particle distributions offer advantages in automotive refinishing, powder coatings, and high-gloss formulations where surface smoothness and optical properties are critical.

The North American barite market demonstrates mature market characteristics, with the U.S. barite market size predicted to reach US$534.2 million by 2032, representing over 95% of regional consumption, with oil & gas being the chief contributor.

The U.S. consumes more than 2.2 million tons of barite annually, with domestic production from Nevada and other states contributing only 15% of requirements, necessitating substantial imports primarily from India, China, Morocco, and Mexico.

The growth driver centers on unconventional resource development, particularly shale oil and gas operations in the Permian Basin, Eagle Ford, and Bakken formations, wherein horizontal drilling and multi-stage hydraulic fracturing demand high-volume barite consumption. Despite rig count fluctuations, with active units declining from 622 in January 2024 to 585 by October, barite sales increased due to deeper, more complex wells requiring higher-density drilling fluids and extended drilling durations.

The U.S. regulatory framework, characterized by stringent API specifications and environmental compliance requirements, supports quality standards and operational safety throughout the supply chain.

The mature market status reflects well-established oilfield services infrastructure, advanced drilling technologies, and diversified end-use applications spanning energy, industrial coatings, and pharmaceuticals.

Europe barite market size is valued at over US$300 million in 2025, with Germany, Norway, the U.K., and Russia leading regional demand owing to significant consumption in value-added segments, including chemical intermediates, paints and coatings fillers, and specialty industrial applications.

The region's mature market characteristics reflect limited domestic oil and gas exploration activity compared to global standards, with barite demand primarily driven by industrial manufacturing rather than drilling operations.

Germany's market grows at a 2.0% CAGR in the forecast period, fundamentally driven by steady industrial consumption across coatings, plastics, and rubber applications, pharmaceutical manufacturing requiring high-purity grades, and ongoing drilling activities supporting limited domestic energy production.

European markets, notably Norway and Russia, demonstrate strong consumption supported by ongoing oil and gas drilling activities, industrial consumption across coatings and plastics sectors, and pharmaceutical manufacturing utilizing specialty grades.

Norway's oil and gas industry is projected to invest a record 275 billion Norwegian crowns (US$24.68 billion) in 2025, representing a 4.3% increase from 263.7 billion crowns in 2024, directly stimulating barite consumption for drilling operations.

Russia accounted for a substantial share of the European barite market in 2025, accounting for over 40% of the barite demand in the region and is likely to surpass US$150 million by 2032. Oil and gas applications represent the largest revenue-generating segment, while fillers constitute the fastest-growing application segment during the forecast period in Russia.

The country's barite consumption is directly linked to its position as a major energy producer, with exploration and production activities in Siberian, Ural, and Far Eastern regions requiring drilling-grade barite for wellbore pressure control and blowout prevention in both conventional and unconventional hydrocarbon reservoirs.

Asia Pacific controls over 25% of global barite consumption in 2025, with China being the largest contributor and India representing a fast-growing market exhibiting a CAGR of over 5% between 2025 and 2032.

The regional growth is driven by industrial applications and consistent oilfield consumption despite production constraints. As the world's largest barite producer, accounting for 30-35% of global supply, China consumes substantial volumes domestically while maintaining significant export capacity.

However, concerns about reserve depletion, with Chinese reserves representing only 9.25% of the global total despite 42% of production, are driving industry consolidation and efficiency improvements.

India's barite market demonstrates exceptional growth momentum. This growth stems from accelerating oil and gas exploration, including offshore programs in the Bay of Bengal and Arabian Sea, expanding radiation shielding demand for nuclear facilities and diagnostic centers, and growing pharmaceutical manufacturing requiring high-purity grades.

ASEAN nations, including Thailand, Vietnam, and Indonesia, contribute to regional growth through infrastructure development and expanding industrial manufacturing. Japan maintains stable barite consumption focused on industrial applications and limited oil and gas operations.

The region benefits from proximity to major production sources, reducing transportation costs compared to Western markets, while offering substantial end-use market growth potential across energy, construction, and manufacturing sectors.

The Middle East & Africa region accounted for over 20% of global barite consumption in 2025, with Saudi Arabia leading the way and accounting for over 60% of regional demand, driven predominantly by intensive oil and gas drilling activities. The Middle East's dominance in global oil production, accounting for one-third of world output, creates substantial and sustained barite demand for drilling operations.

Saudi Arabia's annual oil production is forecasted to reach roughly 10 million barrels per day in 2025, representing 15% of global output, necessitates continuous drilling activity to maintain production levels and develop new fields.

Kuwait demonstrates strong growth prospects with a projected 5.5% CAGR from 2025 to 2032, supported by efforts to minimize non-productive drilling time and enhance reservoir targeting through optimized drilling fluid formulations.

Oman emerges as a competitive market with growth potential from oilfields, including Block 6 and Block 61, where tight and high-temperature formations necessitate specialized barite applications for wellbore pressure control. The region's barite consumption patterns directly correlate with OPEC production decisions, oil price dynamics, and exploration investment levels.

Africa's contribution, particularly from Morocco, Algeria, Nigeria, and Egypt, combines both production and consumption, with Morocco serving as a significant exporter to North American and European markets. The region's strategic importance in global energy markets, combined with ongoing field development projects and enhanced oil recovery programs, ensures sustained barite demand growth despite oil price volatility and geopolitical uncertainties.

The global barite market exhibits a fragmented structure characterized by the presence of numerous regional producers and several multinational corporations serving diverse geographic markets and application segments.

Market concentration remains moderate, with the top five players collectively controlling around 50% of global capacity, while numerous smaller regional producers serve local markets and niche applications.

The global barite market is expected to reach US$2,123.1 million by 2032, growing from US$1,635.3 million in 2025 at a CAGR of 3.8%.

Drilling mud applications dominate with over 75% market share in 2025, driven by oil and gas exploration activities requiring high-density drilling fluids for pressure control and wellbore stability.

The Middle East & Africa region represents the fast-growing market with a CAGR exceeding 5% between 2025 and 2032, driven by expanding oil and gas exploration.

The specific gravity 4.2 grade dominates with over 35% market share in 2025, serving as the API 13A specification standard for drilling operations worldwide.

Major challenges include concentrated production sources creating geopolitical dependencies, with the U.S. importing 85% of the supply; transportation costs representing 25-40% of delivered costs; and environmental regulations increasing production costs by 10-20%.

Medical imaging represents the fastest-growing application segment, with the medical barium sulfate contrast media market projected to surpass US$500 million by 2032, driven by expanding healthcare infrastructure and aging populations.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Grade

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author