ID: PMRREP35828| 191 Pages | 5 Nov 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

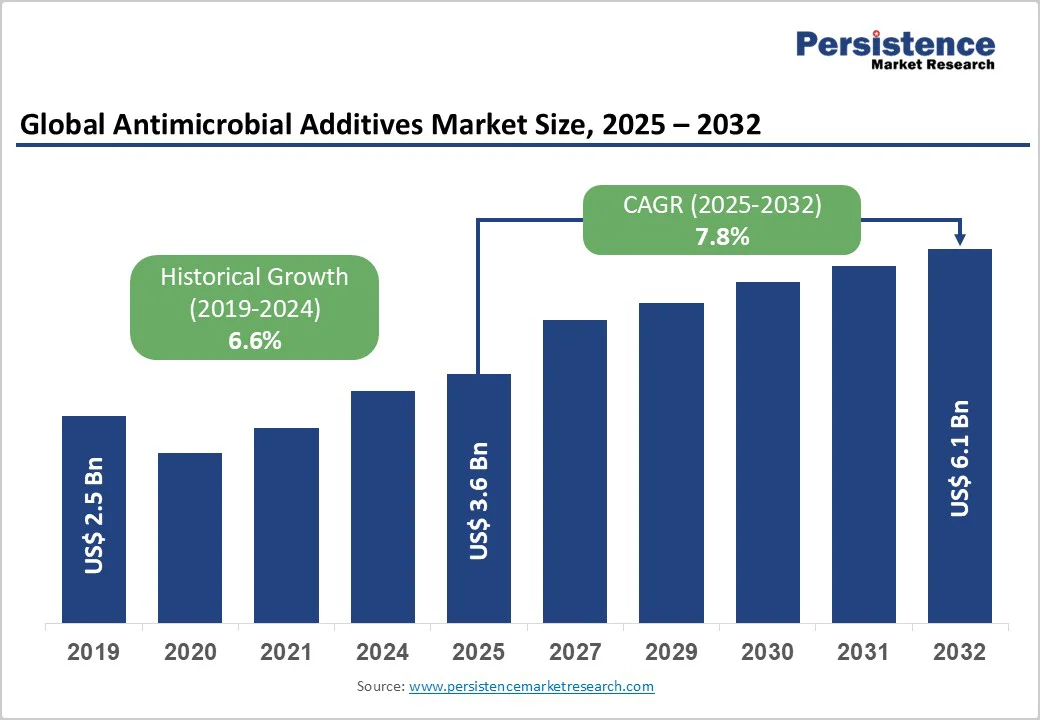

The global antimicrobial additives market size is likely to value at US$ 3.6 billion in 2025 and is projected to reach US$ 6.1 billion by 2032, growing at a CAGR of 7.8% between 2025 and 2032.

Rising concern over healthcare-associated infections, amplified hygiene regulations in food and packaging industries, and increased antimicrobial usage in plastics and coatings are driving expansion.

Regulatory mandates on antimicrobial efficacy, combined with advances in nanotechnology, are enhancing additive performance and adoption across various end-use industries.

| Key Insights | Details |

|---|---|

| Antimicrobial Additives Market Size (2025E) | US$ 3.6 Bn |

| Projected Market Value (2032F) | US$ 6.1 Bn |

| Global Market Growth Rate (CAGR 2025 to 2032) | 7.8% |

| Historical Market Growth Rate (CAGR 2019 to 2024) | 6.6% |

Hospitals and clinics worldwide are intensifying efforts to curb the incidence of healthcare-associated infections (HAIs), which not only compromise patient safety but also inflate treatment costs by up to US$ 45,000 per case. This urgency has propelled medical device manufacturers to integrate antimicrobial agents, most notably organic silver and copper-based compounds, into high-touch surfaces, catheter coatings, and surgical textiles.

Clinical studies have demonstrated that surfaces embedded with silver nanoparticles can reduce bacterial counts by over 99% within hours, aligning with CDC and WHO recommendations for infection control. Such proven efficacy is fostering wider adoption across the Healthcare segment, where regulatory bodies now recommend or require validated antimicrobial performance as part of product approval protocols.

The global surge in fresh and minimally processed foods has intensified demand for packaging solutions that extend product shelf life while ensuring safety. In 2024, the U.S. meat and poultry sector processed over 50 billion pounds of product, with consumer expectations driving manufacturers to seek active-packaging technologies that inhibit microbial growth.

Antimicrobial additives, particularly zinc pyrithione and organic silver formulations, are being incorporated into polymer films and coatings, delivering continuous protection against spoilage organisms such as Listeria and E. coli.

This trend intersects with the Agricultural Microbial Market, where research on bio-based antimicrobial systems is advancing synergistic performance in bioplastic packaging. Regulatory frameworks from the FDA for antimicrobial food-contact materials further validate efficacy requirements, encouraging brands to adopt such innovations to differentiate on safety and freshness.

The U.S. EPA and European Biocidal Products Regulation (BPR) impose rigorous testing and registration requirements for novel antimicrobial chemistries, extending time-to-market by 12–18 months and increasing compliance costs by up to 20%. Manufacturers of nanosilver and other emerging agents face complex data demands, including ecotoxicity, human health risk assessments, and environmental fate studies.

Smaller formulators often lack the resources to navigate these protocols, resulting in market consolidation around established chemical majors. Even after registration, label claims and usage levels remain tightly controlled, limiting formulators’ flexibility to tailor additive concentrations for diverse applications.

Key antimicrobial ingredients such as silver and copper are subject to global commodity market fluctuations. In early 2025, silver spot prices surged by 25% due to mine disruptions and speculative trading, significantly increasing costs for product formulators. This volatility forces manufacturers to either absorb margin pressure or raise prices for end users in sensitive markets like medical devices and consumer goods.

Some companies have begun exploring alternative chemistries, such as zinc-based and organic biocides, to mitigate reliance on precious metals, but these substitutes often exhibit lower efficacy or compatibility challenges, constraining widespread adoption.

The antimicrobial car care products market is creating new avenues for additive suppliers. Consumers increasingly demand in-vehicle hygiene solutions, sprays, coatings, and interior treatments, that can neutralize bacteria and viruses on high-contact surfaces.

Formulators can capitalize by offering specialized antimicrobial masterbatches and coatings compatible with automotive-grade plastics, textiles, and composites. Partnerships with OEMs and aftermarket brands to develop custom formulations for cabin air filters and touchpoints present significant revenue potential.

Sustainability imperatives are driving the development of closed-loop recovery systems for precious-metal antimicrobials. Recent studies indicate that pyrolysis and electrochemical processes can reclaim over 90% of silver from end-of-life polymer products, enabling manufacturers to reduce virgin silver usage by 50% without compromising antimicrobial performance.

Such innovations align with ESG requirements and circular-economy frameworks, appealing to environmentally conscious customers and investors. Leading players are collaborating with recycling firms and academic institutions to commercialize cost-effective recovery technologies, positioning themselves as providers of both antimicrobial additives and sustainable material-management solutions.

Inorganic antimicrobial additives, including OBPA, DCOIT, and Triclosan, command 57% of market value in 2025, owing to their exceptional thermal stability, broad-spectrum efficacy, and compatibility with a wide range of polymer matrices. Applications in marine coatings, outdoor textiles, and injection-molded plastics benefit from the long-term durability and rapid microbial kill rates of these chemistries.

Regulatory acceptance under EPA and EU BPR frameworks further entrenches their use in infrastructure and industrial goods, where routine sanitization is impractical. Their performance consistency at elevated temperatures and in harsh chemical environments continues to justify premium pricing, reinforcing market leadership.

The plastics segment holds a 32% share, propelled by antimicrobial masterbatches and additives for medical disposables, food-contact films, and high-touch consumer products. Embedding antimicrobials during compounding ensures homogeneous distribution and sustained efficacy, crucial for products such as IV tubing, catheter components, and single-use packaging.

The ongoing shift toward sustainable polymers has prompted formulators to tailor additive chemistries compatible with biodegradable and bio-based plastics, meeting both performance and environmental mandates. This convergence with the Agricultural Microbial Market underscores cross-sector innovation in active packaging solutions.

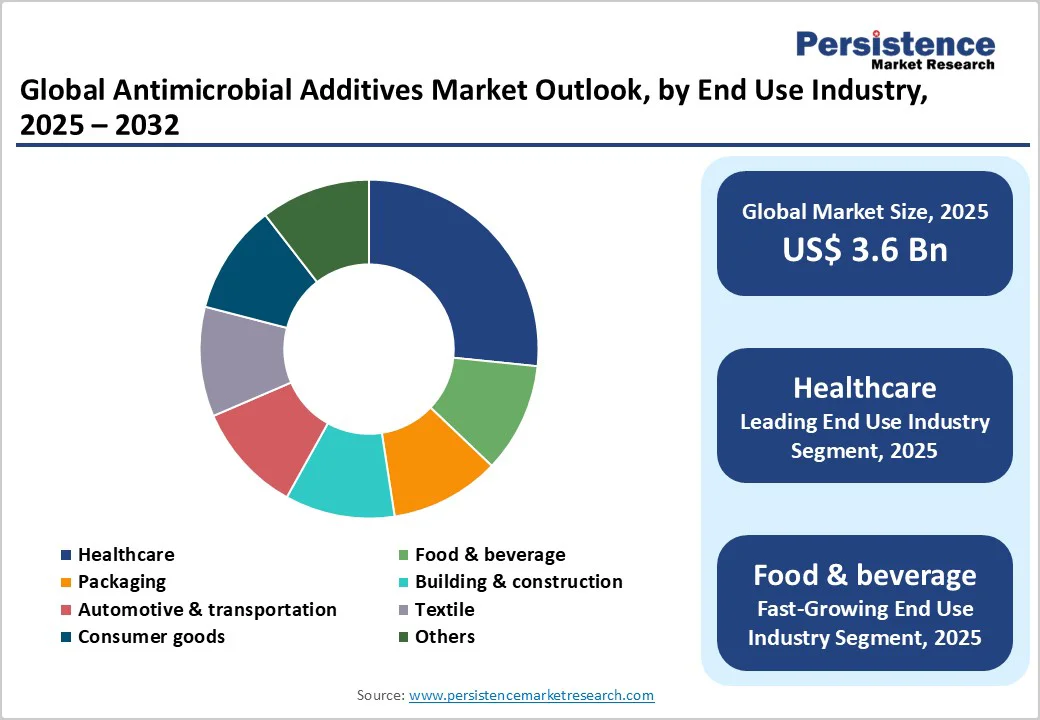

The Healthcare segment accounts for 24% of market value, reflecting extensive integration of antimicrobial additives into hospital equipment, surgical textiles, and wound-care dressings.

Rising HAI rates have prompted hospital systems to mandate antimicrobial surfaces and device components, driving formulators to develop low-leach, high-efficacy additives compliant with FDA and ASTM standards. Innovations in silver nanoparticle stabilization and controlled-release systems are delivering multi-day protection on surfaces and textiles, further boosting adoption in long-term care and outpatient facilities.

North America is witnessing significant growth in antimicrobial additives, supported by stringent infection-control regulations and a mature healthcare infrastructure. The FDA’s 2024 guidance on antimicrobial food-contact materials has accelerated innovations in film and coating formulations, while the EPA’s conditional registration of new nanosilver products in mid-2025 has broadened approved applications to include textiles, sportswear, and household linens.

Active R&D clusters across the U.S. are developing next-generation nano-enabled additives with tailored release profiles, optimizing particle size and surface chemistry to maximize microbial inhibition.

Europe’s market growth is driven by regulatory alignment under EU BPR and REACH, which standardize biocidal approval processes across member states. Germany, France, the U.K., and Spain are at the forefront, integrating antimicrobial pigments and masterbatches into industrial coatings, building materials, and automotive interiors to meet hygiene certifications.

Collaborative initiatives among chemical manufacturers and coating formulators are exploring hybrid copper–silver systems to achieve synergistic efficacy and reduced metal content, aligning with the region’s sustainability goals.

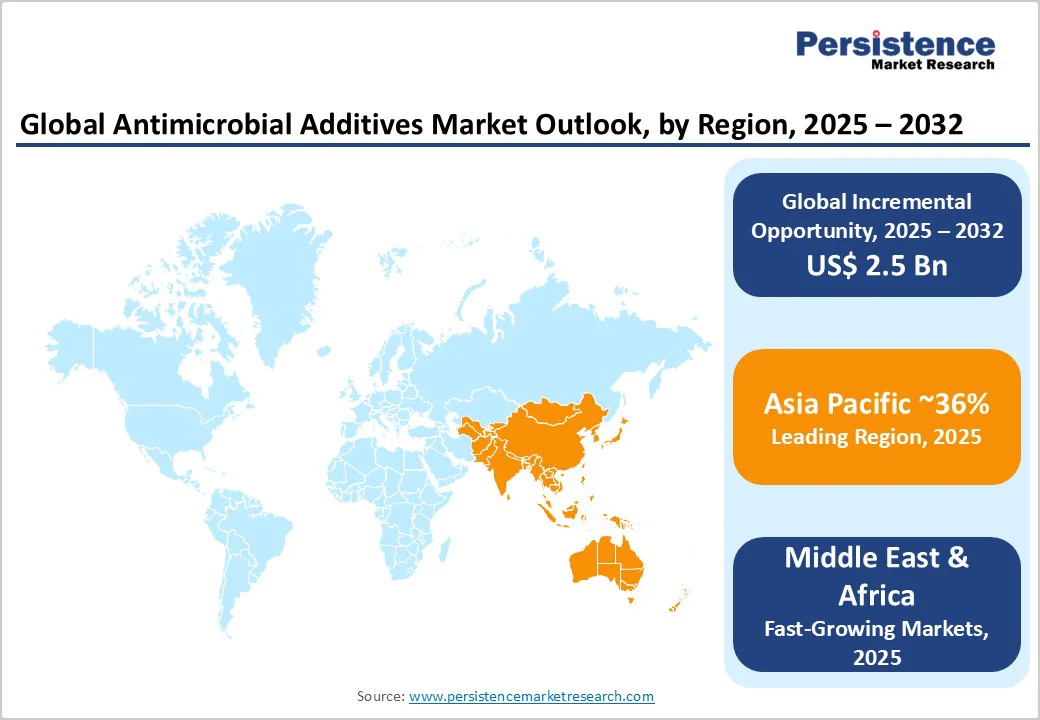

Asia Pacific is the leading region in antimicrobial additive consumption, accounting for over 36% of global volume by 2025. Rapid infrastructure development in China and India, along with government-led initiatives to combat antimicrobial resistance in agriculture, is driving strong demand for additives in food packaging, textiles, and consumer goods.

ASEAN countries are expanding local polymer compounding capacities, enabling cost-competitive antimicrobial masterbatches. Additionally, public–private partnerships in China are fostering research on bio-based antimicrobial systems, positioning the region as a key hub for scale-up and export to mature markets.

The antimicrobial additives market is moderately fragmented, with major chemical conglomerates, such as BASF SE, Clariant AG, and Dow Inc., competing alongside specialized technology providers such as Microban International and BioCote Limited.

Key differentiators include proprietary nanoparticle synthesis, controlled-release coatings, and integrated regulatory support services. R&D alliances with academic institutions and cross-industry collaborations on sustainability and recycling further enhance competitive positioning. Companies are also pursuing capacity expansions in Asia to reduce lead times and improve cost efficiencies for global customers.

The antimicrobial additives market is expected to reach US$ 6.1 Bn by 2032, up from US$ 3.6 Bn in 2025.

Key drivers include prevention of HAIs, stringent food-packaging regulations, and rising hygiene awareness in consumer products.

Inorganic additives lead with 57% share due to thermal stability, broad-spectrum efficacy, and regulatory acceptance.

North America leads adoption, driven by advanced healthcare infrastructure and robust regulatory frameworks.

Implementing circular economy recovery methods for silver and copper to reduce raw-material usage and support ESG goals.

Leading companies include BASF SE, Microban International, and Clariant AG, recognized for extensive portfolios and technical expertise.

| Report Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2032 |

| Historical Data Available | 2019 to 2024 |

| Market Analysis |

|

| Key Regions Covered |

|

| Key Market Segments Covered |

|

| Key Companies Profiled in the Report |

|

| Report Coverage |

|

By Product Type

By Application

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author