ID: PMRREP2796| 200 Pages | 25 Nov 2025 | Format: PDF, Excel, PPT* | Packaging

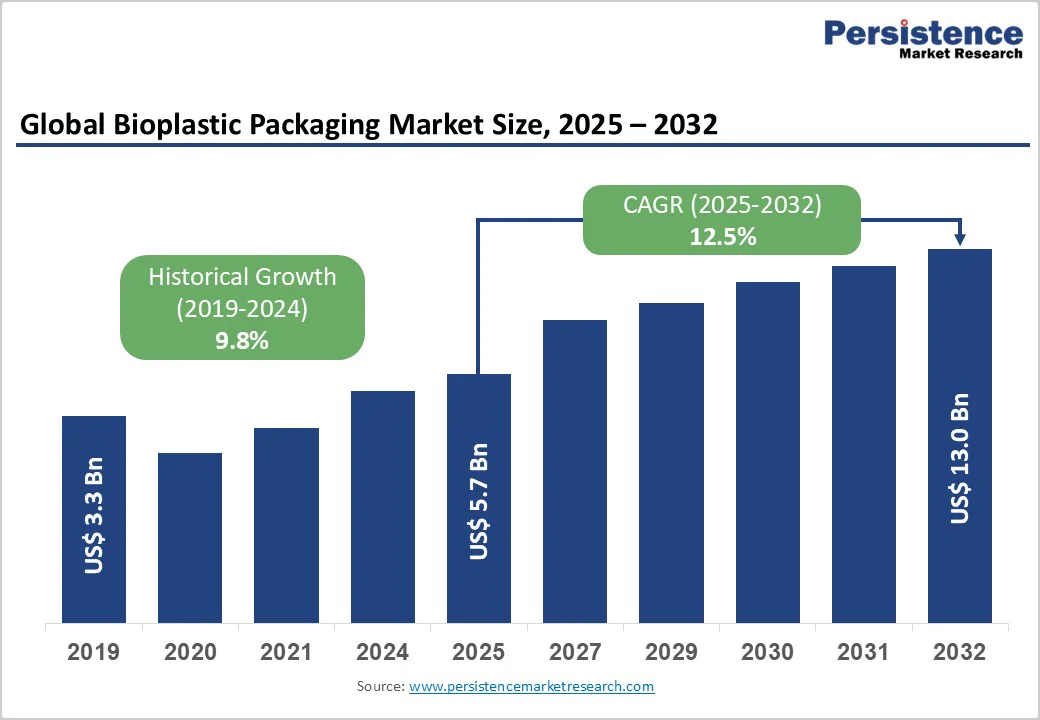

The global bioplastic packaging market size is likely to be valued at US$ 5.7 billion in 2025, and is projected to reach US$ 13.0 billion by 2032, growing at a CAGR of 12.5% during the forecast period 2025 - 2032.

The market is mainly driven by the stringent implementation of environmental regulations in the European Union (EU) through the Packaging and Packaging Waste Regulation (PPWR), the U.S., and emerging economies targeting single-use plastic elimination. Accelerating corporate sustainability commitments and demonstrated consumer willingness to engage with eco-friendly packaging formats are the other prominent factors fueling the market.

The transition reflects mounting awareness of plastic pollution's devastating impact on marine ecosystems and terrestrial environments, coupled with proven viability of bio-based alternatives across diverse packaging applications from flexible films and pouches to rigid containers and thermoformed components.

| Key Insights | Details |

|---|---|

| Bioplastic Packaging Market Size (2025E) | US$ 5.7 Bn |

| Market Value Forecast (2032F) | US$ 13.0 Bn |

| Projected Growth CAGR (2025 - 2032) | 12.5% |

| Historical Market Growth (2019 - 2024) | 9.8% |

Governments worldwide are enforcing stringent regulations to reduce plastic waste and foster circular economy practices. For example, the EU’s Single-Use Plastics Directive prohibits certain single-use plastics and mandates compostable packaging to comply with EN 13432 certification. In the U.S., California, New York, and Washington require biodegradable products to meet ASTM D6400 certification standards.

Canada, too, is phasing out single-use plastics, while Australia has launched comprehensive plans to eliminate problematic plastic materials. China’s nationwide plastic ban in 2025 and Japan’s 2050 carbon neutrality goals further boost biodegradable packaging adoption.

Similarly, India’s Plastic Waste Management (Amendment) Rules 2024 introduced extended producer responsibility (EPR) with mandatory recycled content and reuse targets, driving faster transitions to sustainable packaging.

Consumer awareness and corporate environmental commitments are also fueling the demand for bioplastic packaging. Leading companies are incorporating bioplastics into their products to meet environmental, social, & governance (ESG) goals and reduce carbon footprints.

For example, Coca-Cola has deployed recycled plastic bottles across Canada aligned with its World Without Waste campaign aiming for 50% recycled content by 2030. The packaging industry accounts for around 38% of global bioplastics use, with rapid innovations in bio-based PET bottles, compostable films, and starch-based laminates.

Suntory Group, for instance, distributes millions of bio-PET bottles annually in Japan, while Bacardi Limited plans to shift to fully biodegradable, plant-based packaging, reflecting the alignment of consumer demand and corporate sustainability strategies.

The bioplastic packaging market growth faces significant challenges primarily due to higher manufacturing costs compared to conventional plastics. These costs stem from emerging production technologies, limited economies of scale, and complexities in sourcing feedstock. Conventional plastics benefit from mature, optimized supply chains, whereas bioplastics require specialized processes such as fermentation and polymerization.

PLA, the most commercialized biopolymer, carries premium pricing that restricts its use in price-sensitive and developing markets. Fluctuations in agricultural commodity prices have further impacted bio-based feedstock availability and cost, adding supply chain uncertainties.

Widespread bioplastic adoption is also constrained by inadequate end-of-life processing infrastructure globally. Industrial composting facilities, necessary for properly decomposing biodegradable bioplastics, are concentrated in developed regions, leaving large areas in Asia, Latin America, and Africa underserved.

Unlike recycled polymers such as polyethylene and PET, biodegradable plastics require controlled conditions for decomposition, usually unavailable in most municipal waste systems. Poor waste segregation and mixed waste streams further contaminate bioplastic batches, reducing recycling efficiency and economic viability.

Overcoming these hurdles requires coordinated public-private investment in composting infrastructure and robust regulations for material collection and sorting.

Pharmaceutical packaging offers a high-margin opportunity for bioplastic manufacturers through the development of blister packs, drug delivery devices, and specialized containment solutions that combine biocompatibility with sustainability. For instance, Bayer and Liveo Research introduced PET bioplastic blister packaging that reduces package weight by 18% compared to PVC, using significantly less water and energy in production.

PLA-based materials, such as BIOVOX’s MedEco ICB and MedEco IGH grades, provide high mechanical strength, transparency for visual inspection, and stiffness suitable for precision devices such as autoinjectors and inhalers.

Pharmaceutical-grade bioplastics also demonstrate excellent biocompatibility and are being explored for advanced drug delivery systems using PLA and PLGA nanoparticles, enhancing shelf-life and targeting accuracy while reducing dosages. Emerging nanomedicine applications utilizing bioplastic nanoparticles represent a frontier growth segment, offering improved drug delivery efficacy with fewer side effects.

The rapid expansion of e-commerce and direct-to-consumer shipping is driving strong demand for compostable protective packaging made from bioplastics. The sustainable packaging market related to compostable materials is projected to grow significantly, supported by logistics providers adopting biodegradable air pillows, mailers, and void-fill alternatives in response to consumer sustainability preferences.

In India, Pakka Limited secured substantial funding to establish the country’s first compostable flexible packaging plant in 2024. Minimalist packaging trends favor lightweight bioplastic mailers and cushioning materials, aligning with efforts to reduce material use and delivery weight. EPR regulations are also motivating logistics companies worldwide to invest in compostable packaging alternatives.

The bio-based biodegradable segment dominates with 73% market share in 2025, driven by strong PLA demand across packaging applications. PLA, the most utilized biopolymer, is favored for its biodegradability, renewability, and U.S. Food and Drug Administration (FDA) GRAS certification for food contact applications.

The material's excellent odor and flavor barrier properties and thermal shrink capabilities make it suitable for single-use food containers, cups, trays, wrappers, bottles, and films. Starch-containing polymers and polybutylene adipate terephthalate (PBAT) complement applications in agricultural mulching films and compostable bags.

The bio-based non-biodegradable segment projected to grow at 14% CAGR through 2032, on account of expanding adoption in beverage packaging and flexible films.

The flexible packaging segment leads with 62% market share in 2025, driven by widespread adoption across food, beverage, and consumer goods sectors. Flexible formats including pouches, bags, films, sachets, and cups offer superior cost-effectiveness and reduced material consumption.

Compared to HDPE bottles, flexible packaging pouches reduce package weight by up to 90% and achieve 65% reduced carbon impact through material efficiency. The segment benefits from strong demand in the Flexible Plastic Packaging Market projected to reach US$ 258.8 billion by 2032.

Flexible packaging dominates food applications addressing contamination concerns from organic residues complicating recycling. Food and beverage packaging drives flexible format adoption for vegetable wraps, snack packaging, coffee pouches, and produce bags. TIPA Corporation, for example, develops compostable films emulating conventional plastic properties with up to two-thirds bio-sourced content.

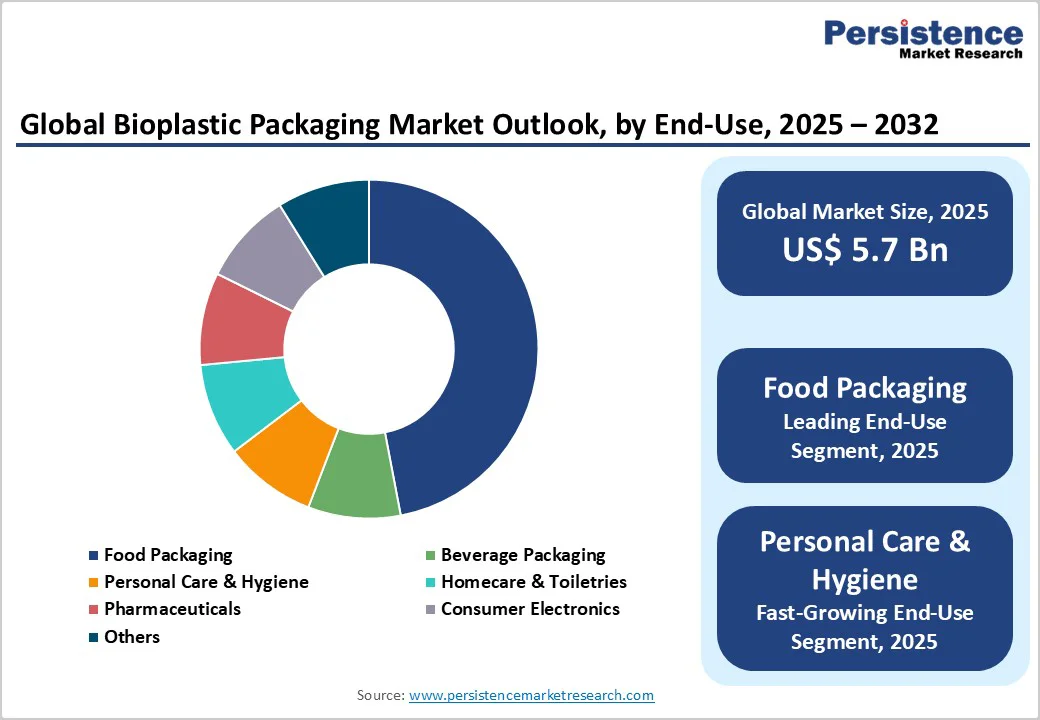

Food packaging maintains leadership with around 47% of the bioplastic packaging market revenue share in 2025, reflecting fundamental importance of consumer protection and regulatory scrutiny in food safety applications. PLA, extensively approved for food contact applications including beverage bottles, deli container liners, and film wraps, demonstrates established market acceptance and manufacturing scale supporting cost competitiveness.

Beverage packaging applications including bio-PET bottles address ambitious brand commitments to sustainability, with Coca-Cola implementing 30% recycled content beverage bottle portfolios incorporating bio-based polyethylene terephthalate.

Personal care & hygiene applications are likely to expand at 14% CAGR through 2032, boosted by the sustainability stance of the cosmetics industry and premium brand differentiation. Compostable bioplastic components in deodorant dispensers, shampoo bottle closures, and protective packaging shells satisfy luxury market segments willing to accept cost premiums for environmental credentials.

Pharmaceutical packaging represents an emerging opportunity, leveraging bioplastic biocompatibility for implant encapsulation, suture materials, and surgical device components.

North America is the second-largest regional market for bioplastic packaging, backed by stringent FDA regulatory frameworks that establish clear approval pathways for bioplastic materials and strong corporate sustainability commitments from major brand owners and retailers.

The U.S. hosts significant production capacity, including NatureWorks’ Nebraska facility, which produces up to 150,000 tons annually of Ingeo biopolymer. Beverage giants such as Coca-Cola and PepsiCo are pushing aggressive plastic reduction goals, aiming for 30% bioplastic content in their bottle portfolios by 2030, which supports investment in secure feedstock supply chains.

State-level policies such as California’s Advanced Clean Energy and Sustainability Standards further drive bioplastic adoption by mandating compostable packaging use in food service and banning retail single-use checkout bags. Retail consolidation around industry giants such as Walmart, Target, and Amazon creates procurement power that encourages suppliers to implement bioplastic packaging standards throughout extended supply chains.

Amazon’s sustainability pledge to eliminate single-use plastic packaging in fulfillment centers has sped up the adoption of compostable mailers and void-fill materials. Innovation hubs in California’s San Francisco Bay Area, the Pacific Northwest, and Boston foster collaboration among researchers, waste management tech companies, and consumer goods manufacturers, accelerating bioplastic packaging advancements.

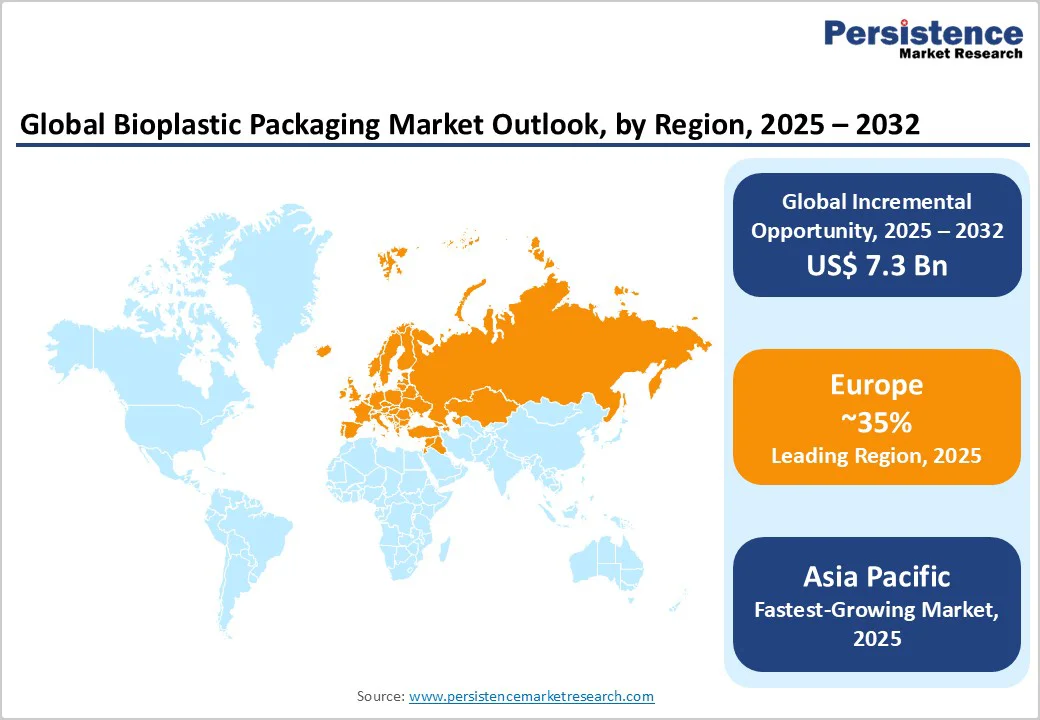

Europe dominates with a commanding 35% of the bioplastic packaging market share in 2025, reflecting comprehensive regulatory architecture, mature composting infrastructure, and advanced circular economy policy implementation.

The EU’s Single-Use Plastics Directive elimination of specific single-use items, combined with EPR schemes establishing manufacturer accountability for end-of-life waste management costs, creates powerful economic incentives for bioplastic substitution across standardized packaging formats.

Germany, the U.K., France, and Spain emerge as regional market leaders, with Germany demonstrating particular market sophistication on the back of the DSD (Duales System Deutschland) certification infrastructure supporting product recyclability verification and consumer compliance communication.

Annual industrial composting capacity across Europe has reached approximately 40 million tons, concentrated in Netherlands, Denmark, and Belgium, which are implementing high-collection-rate waste segregation systems.

French luxury cosmetics and premium food sectors lead bioplastic adoption, with Unilever French subsidiaries implementing comprehensive portfolio transitions to Novamont Mater-Bi certified compostable packaging. U.K. retailers including Sainsbury's and Marks & Spencer implement producer-financed composting facility partnerships, establishing guaranteed bioplastic end-of-life processing pathways supporting supply chain stability.

Asia Pacific is the fastest-growing regional market for bioplastic packaging, fueled by rapid urbanization, rising consumer incomes, and strict waste management regulations in China, Japan, and India.

The region is becoming a major global production center, with significant PLA biopolymer manufacturing capacity coming online to support regional packaging needs. India's emerging bioplastic sector benefits from abundant agricultural feedstocks such as sugarcane and corn for polylactic acid production, with domestic manufacturers developing export capabilities alongside growing domestic demand.

China is expanding bioplastic capacity through strategic partnerships targeting its nationwide single-use plastic elimination goals, while Japan leads in composting infrastructure development that supports integration into municipal waste management systems.

Regional trade initiatives establish standardized specifications and quality benchmarks that facilitate cross-border bioplastic commerce within Southeast Asian countries, reducing trade barriers.

Consumer demand for sustainable packaging varies across the region, with developed markets such as Singapore, Australia, and New Zealand showing stronger preference for bioplastic solutions compared to emerging economies, reflecting differences in waste management infrastructure and environmental awareness.

Despite these differences, strong government support for circular economy initiatives, rapid infrastructure development, and growing corporate sustainability commitments across Asia Pacific ensure market expansion through 2032.

The global bioplastic packaging market structure is moderately consolidated, led by vertically integrated multinational corporations such as BASF SE, Braskem S.A., NatureWorks LLC, TotalEnergies Corbion, Novamont S.p.A, and Dow Inc. These entities hold significant production capacities and invest heavily in research and development, focusing on enhancing material performance, reducing carbon footprints, and sourcing certified sustainable feedstock.

Emerging regional manufacturers such as Metabolix Inc., Wileap, Kingfa, and SABIC are targeting niche applications and underserved geographic markets, emphasizing vertical integration from feedstock cultivation through packaging conversion. Regional expansion, particularly in China, and collaboration across value chains involving brand owners, converters, and waste management providers are shaping competitive dynamics and market growth.

The global bioplastic packaging market is projected to reach US$ 5.7 billion in 2025.

Stringent environmental regulations, single-use plastic bans, and growing corporate sustainability commitments are the primary drivers.

The market is poised to witness a CAGR of 12.5% from 2025 to 2032.

Smart bioplastic packaging integrating IoT/NFC for freshness and traceability, and compostable e-commerce protective formats for parcel logistics that offer premium value via waste reduction and compliance automation are key market opportunities.

Major market players include BASF SE, Braskem S.A., NatureWorks LLC, and TotalEnergies Corbion.

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis Units | Value: US$ Bn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author