ID: PMRREP33570| 195 Pages | 23 Dec 2025 | Format: PDF, Excel, PPT* | Consumer Goods

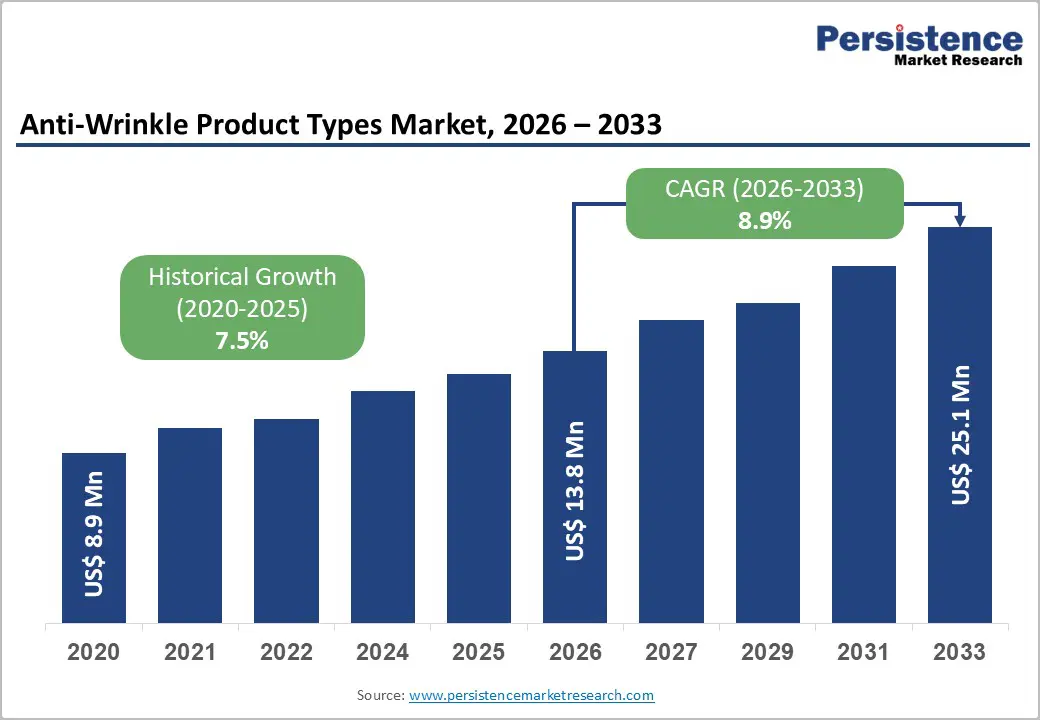

The global anti-wrinkle products market size is projected to reach US$ 13.8 billion in 2026 and grow to US$ 25.1 billion by 2033, reflecting a strong CAGR of 8.9% from 2026 to 2033. This growth is fueled by rising awareness of premature aging, increasing adoption of preventive skincare routines among younger consumers, and continuous advancements in bioactive ingredient delivery technologies.

Higher disposable incomes in developing regions, combined with cultural preferences for youthful appearance, especially in the Asia Pacific, further accelerate market uptake. Moreover, major skincare brands are investing heavily in clinical research and advanced formulations, strengthening product credibility and boosting consumer trust. These factors collectively position the market for sustained long-term expansion.

| Key Insights | Details |

|---|---|

|

Anti-Wrinkle Products Market Size (2026E) |

US$ 13.8 Billion |

|

Market Value Forecast (2033F) |

US$ 25.1 Billion |

|

Projected Growth CAGR(2026-2033) |

8.9% |

|

Historical Market Growth (2020-2025) |

7.5% |

The anti-wrinkle products market is witnessing remarkable momentum as Gen Z and Millennials shift from corrective to preventive skincare practices. Consumers now begin anti-aging routines in their early to mid-20s, marking a major behavioral transition in the beauty landscape. Studies indicate that 43% of users actively follow a preventive skincare regimen, while 62% prioritize high-quality ingredients. This early-adoption mindset, popularly termed “prejuvenation,” has significantly expanded the market beyond traditionally mature consumer groups.

The trend is especially strong in the Asia Pacific, where younger consumers show a high interest in serums, retinol, and peptide-based formulations. Capitalizing on this shift, brands such as L’Oréal, Estée Lauder, and emerging innovators are focusing on clinically validated formulations designed to address early-stage aging. Their strategic advancements are strengthening product credibility and accelerating category growth.

A rapidly aging global population continues to generate strong demand for anti-wrinkle products across both developed and emerging economies. Europe’s median age reached 44.7 years in 2024, while the 65+ population in China accounts for 15.6% of the total demographic, forming a sizable consumer base seeking effective anti-aging solutions. This expanding elderly segment is actively adopting advanced formulations to manage fine lines, wrinkles, and age-related skin concerns.

At the same time, rising disposable incomes, particularly in India and China, are enabling higher consumer spending on premium skincare. Anti-wrinkle solutions are increasingly perceived as essential wellness investments rather than luxury items. As a result, consumers are more willing to pay for dermatologist-backed, scientifically advanced products. This demographic and economic convergence supports consistent market expansion across global regions.

Premium anti-wrinkle products often carry high price points due to costly clinical research, advanced ingredient sourcing, and comprehensive safety validation processes. The introduction of the FDA’s Modernization of Cosmetics Regulation Act of 2022 (MoCRA) has further intensified operational burdens by imposing stricter requirements for safety documentation, adverse event reporting, and facility registration. Similarly, European regulators enforce rigorous compliance protocols that require extensive dermatological testing and ingredient verification, increasing product development costs.

These heightened regulatory complexities create notable barriers to entry for smaller or emerging brands seeking to establish a presence in the market. As compliance costs increase, retail prices rise, making premium anti-wrinkle products less accessible to price-sensitive consumers. This affordability gap can limit adoption rates and slow market expansion in cost-conscious regions, despite increasing interest in anti-aging solutions.

Certain widely used anti-wrinkle ingredients, such as retinoids and alpha-hydroxy acids (AHAs), can trigger irritation, photosensitivity, and adverse reactions in individuals with sensitive skin. Heightened consumer awareness of potential side effects, including redness, peeling, and dermatitis, often creates hesitation among first-time users. This concern can limit product trials and slow market penetration, particularly among demographics that lack prior exposure to active skincare ingredients.

Product misuse, insufficient skincare education, and contradictory ingredient advice circulating on social media intensify safety-related apprehensions. These challenges compel brands to invest in clearer usage guidelines, dermatologist-backed communication, and consumer education campaigns. While necessary, these efforts raise marketing and compliance costs for companies and may reduce spontaneous or impulse-driven purchases, ultimately moderating market growth.

The e-commerce segment is the fastest-growing distribution channel for anti-wrinkle products, with online platforms capturing a rapidly expanding share of global beauty sales. Social commerce drives 68% of international purchases, while TikTok ranks as the eighth-largest beauty retailer in the U.S., with most users likely to buy after engaging with content. Direct-to-consumer (DTC) models allow brands to reduce intermediaries, strengthen customer relationships, and implement subscription-based revenue models that increase loyalty and lifetime value.

In China, 87% of skincare transactions occur online, highlighting the maturity of digital retail channels. Brands leveraging AI-driven skin diagnostics, virtual try-on tools, and personalized routines via e-commerce and social media are achieving accelerated growth and gaining market share, creating significant opportunities for expansion and consumer engagement worldwide.

Innovation in next-generation active ingredients is reshaping the anti-wrinkle market. Patented compounds targeting specific aging mechanisms, such as Beiersdorf’s GLYCOSTOP™, addressing sugar-induced skin aging, demonstrate the industry’s focus on advanced efficacy. Brands are increasingly combining peptides, hyaluronic acid, and advanced delivery systems to tackle multiple aging concerns simultaneously, enhancing product performance and consumer trust.

Sustainability is also a key growth driver. Rising demand for clean-label and eco-friendly products is prompting brands to reformulate responsibly. Europe issued 210 EU Ecolabel-certified cosmetics in 2024, reflecting regulatory support. Companies delivering clinically validated, sustainable, and aesthetically appealing products are well-positioned to capture growing market share across both premium and mass-market segments.

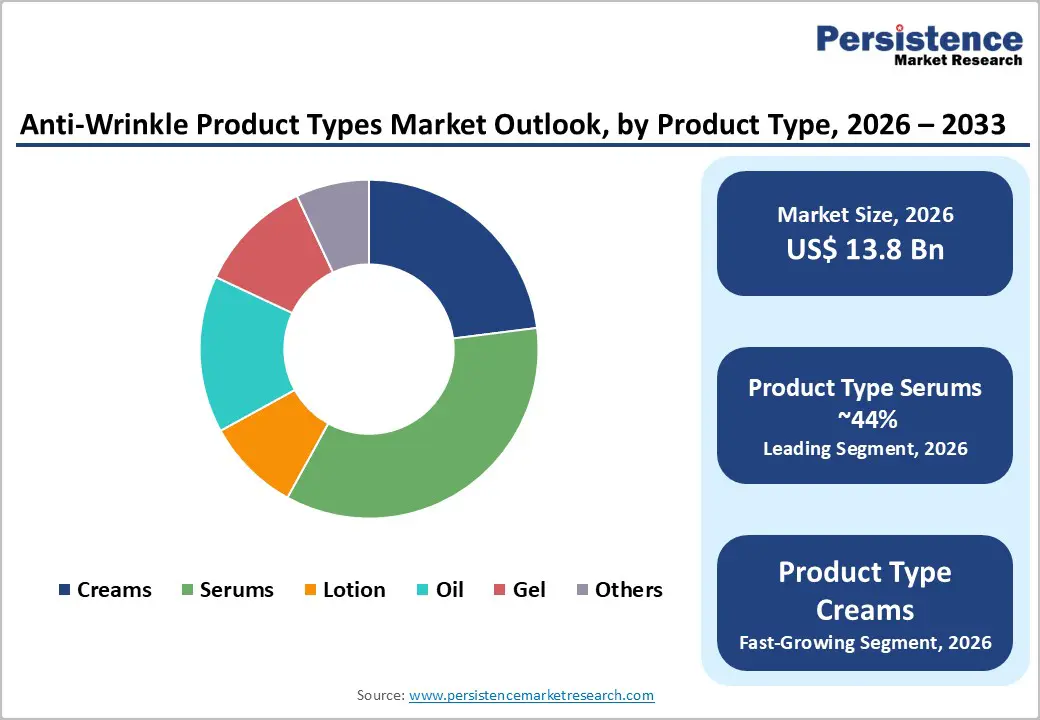

Serums are the fastest-growing and most dominant product category in the anti-wrinkle market, commanding approximately 44% of market share in 2025. Their leadership is driven by consumers’ preference for high-concentration active ingredient formulations that deliver targeted and visible results faster than traditional creams or lotions. Lightweight texture, rapid absorption, and premium positioning allow serums to command higher prices and generate stronger revenue per unit.

Brands like Estée Lauder, SkinCeuticals, and L’Oréal have positioned serums as clinically validated, dermatologist-endorsed products. The popularity of multi-step skincare routines, particularly in the Asia Pacific, along with ampoules and single-use serum formats, further accelerates the category’s prominence. While creams and lotions remain significant due to familiarity and comprehensive skincare benefits, serums continue to lead in innovation, premium positioning, and revenue contribution.

Retinoids and retinol formulations dominate the active ingredient landscape, holding approximately 42% of market share in 2025. Their sustained leadership is due to clinically proven efficacy in reducing wrinkles and fine lines, and in photoaging through accelerated skin renewal and collagen production. Retinol creams and lotions account for a significant share of retinol-specific product sales, reflecting strong consumer trust and dermatologist validation.

Complementary ingredients such as niacinamide, hyaluronic acid, Vitamin C, and peptides are gaining traction among consumers seeking multifunctional benefits. Brands that combine retinol with these actives provide comprehensive solutions that address multiple aging concerns simultaneously, enhancing overall product performance. These multifunctional formulations appeal to premium and discerning consumer segments looking for efficacy and convenience in a single product.

Women account for roughly 61% of the anti-wrinkle market, reflecting historical market penetration and purchasing behavior. They remain the primary consumer segment, consistently driving demand for anti-aging solutions due to established skincare routines and preferences.

The men’s segment is emerging as a key focus for brands, with growing awareness and adoption of skincare as part of self-care routines. Male consumers are increasingly interested in products addressing oil regulation, irritation reduction, and preventive aging. Brands targeting male-specific skin needs with tailored formulations, simplified routines, and gender-focused marketing are capturing this evolving demographic, expanding the market beyond traditional female-centric segments.

Specialty stores and pharmacies are the largest offline channels for anti-wrinkle products, collectively capturing approximately 35.6% of market revenue. Specialty retailers benefit from curated product selections, personalized skincare guidance, and access to diverse brands for varied skin types and aging concerns. Pharmacies maintain consumer trust and accessibility, providing recommendations and competitive pricing for skincare solutions.

E-commerce and online platforms are transforming distribution, especially in mature markets. Direct-to-consumer websites, social commerce platforms, and subscription models allow brands to engage directly with customers, provide personalized solutions, and strengthen loyalty. China’s online skincare ecosystem, where digital platforms dominate transactions, illustrates the significant potential for online channels to complement and enhance traditional retail distribution.

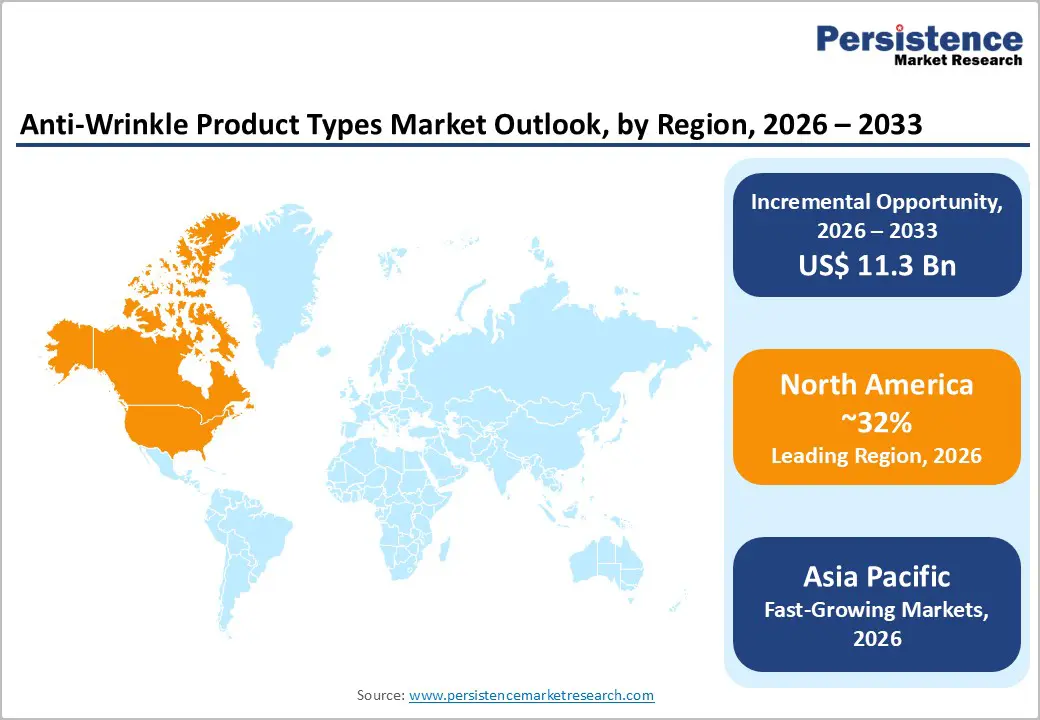

North America leads the global anti-wrinkle products market, holding approximately 32% of global market share, supported by high consumer awareness, robust regulatory frameworks, and an advanced innovation ecosystem. Specialty beauty stores, pharmacies, and e-commerce platforms ensure broad access to products. Premium brands such as Estée Lauder, Clinique, and SkinCeuticals maintain strong positions, backed by endorsements from dermatologists and high brand loyalty. Regulatory oversight through the FDA’s Modernization of Cosmetics Regulation Act of 2022 reinforces confidence in product safety and efficacy, driving continued spending on premium solutions.

Digital engagement and social commerce significantly influence consumer behavior, with platforms like TikTok and Instagram shaping product discovery and purchases. Preventive skincare among younger demographics and rising male grooming adoption are expanding the market beyond traditional aging segments, reflecting evolving attitudes toward skincare as a gender-neutral wellness practice.

Europe’s anti-wrinkle market is experiencing steady growth, expanding at a CAGR of approximately 7.5%, driven by an aging population with strong purchasing power and preference for natural, sustainable, and clinically validated ingredients. Established beauty cultures in Germany, France, the U.K., and Spain support premium pricing and market penetration. Harmonized EU regulations ensure ingredient transparency, product safety, and consumer protection. Clean-label products, natural extracts, and sustainable packaging resonate strongly with consumers, with 210 products achieving EU Ecolabel certification in 2024.

European consumers favor dermatologically tested, fragrance-free, and clinically validated formulations targeting specific aging concerns. Specialty retailers retain a strong presence while e-commerce channels continue to expand. Emphasis on sustainability, transparency, and efficacy drives brand positioning across premium and mass-market segments, shaping competitive dynamics in the region.

Asia Pacific is the fastest-growing region, accounting for approximately 29% of the global anti-wrinkle products market, led by China and India. China’s mature beauty culture, strong e-commerce ecosystem, and focus on advanced active ingredients support high market engagement, while India’s expanding middle class, urbanization, and rising beauty consciousness drive robust adoption. Digital-first platforms enable brands to reach tier-2 and tier-3 cities, increasing accessibility and market participation.

Consumers in the Asia Pacific favor serums, multifunctional formulations, and actives addressing climate-related skin concerns, including peptides, retinoids, and botanical extracts. Preventive skincare among younger demographics and social media-driven beauty trends further accelerate adoption. Brands like Shiseido, Amorepacific, and KAO Corporation leverage local insights, while international players invest in region-specific products and marketing to effectively capture market share.

The global anti-wrinkle products market is moderately consolidated, with dominant multinational players controlling significant shares while emerging direct-to-consumer and niche premium brands capture growing segments. Market leaders focus on extensive product portfolios, robust distribution networks, and strong R&D investments. Key strategies include clinical research validation, dermatologist partnerships, ingredient innovation, and omnichannel distribution combining traditional retail, specialty stores, pharmacies, and e-commerce.

Emerging differentiators driving competition include clean-label formulations, sustainable packaging, personalized skincare leveraging artificial intelligence, and influencer-driven marketing targeting younger consumers. Innovation in advanced delivery systems, peptide technologies, and multifunctional formulations addressing multiple aging concerns is creating a competitive edge for brands demonstrating clinically validated efficacy.

The global anti-wrinkle products market is valued at US$ 13.8 billion in 2026 and expected to reach US$ 25.1 billion by 2033, with an 8.9% CAGR.

Growth is driven by preventive skincare adoption among younger consumers, rising aging populations, and increasing disposable incomes, particularly in Asia Pacific.

Serums lead the market with approximately 44% share in 2025, fueled by high-concentration actives, lightweight formulations, and dermatologist-backed efficacy.

North America holds around 32% share and leads the market through strong consumer awareness, advanced retail infrastructure, robust regulatory frameworks, and premium brand positioning.

E-commerce and DTC channels, AI-driven personalized skincare, advanced actives, and sustainable formulations present major growth potential.

Market leaders include L'Oréal, Estée Lauder, Procter & Gamble (P&G), Unilever, Shiseido, Beiersdorf, Johnson & Johnson, KAO Corporation, and Amorepacific.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis |

Value: US$ Mn/Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Active Ingredients

By End-user

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author