ID: PMRREP22354| 201 Pages | 16 Apr 2025 | Format: PDF, Excel, PPT* | Packaging

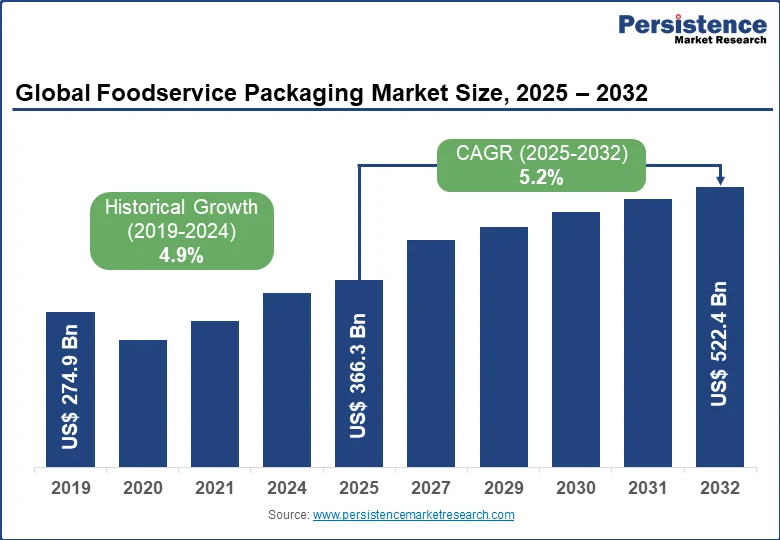

According to Persistence Market Research, the foodservice packaging market generated a revenue of US$ 366.3 Billion in 2025. The demand for foodservice packaging will accelerate, with the top market players holding a prominent share of the foodservice packaging market. The global market for foodservice packaging is expected to reach US$ 522.4 Billion by 2032, growing at a 5.2% CAGR from 2025 to 2032.

| Global Market Attribute | Key Insights |

|

Global Foodservice Packaging Market Size (2025E) |

US$ 366.3 Billion |

|

Projected Sales of Foodservice Packaging Market (2032F) |

US$ 522.4 Billion |

|

Value CAGR (2025 to 2032) |

5.2% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.9% |

According to different geographical locations, a number of trends are fuelling the expansion of the global packaging sector. In China, India, Brazil, Russia, and other emerging nations, rising urbanisation, housing and construction investment, the growth of retail chains, and the booming healthcare and cosmetics industries are driving packaging demand.

Food manufacturers are constantly searching for packaging that may provide customers more convenience and a longer shelf life at a cheaper cost than their current packaging, making the food service packaging market dynamic and fiercely competitive. The food industry is fully aware that consumer’s desire novelty and innovation, thus the packaging sector must advance or remain stagnant.

In emerging countries, rising living standards and individual disposable money encourage consumers to purchase a wide variety of items, which in turn drives up packaging demand.

Manufacturers in the fast-paced food and beverage sector must constantly not only meet rising consumer expectations, but also follow the newest patterns and provide new products to keep consumers interested. Customers prefer businesses and goods that use "clean-label" branding because it increases brand transparency and fosters consumer confidence. The term describes goods that are natural or organic and don't contain any artificial substances.

This messaging is being incorporated into packaging materials by brand owners, design studios, and packaging producers more frequently. Weight reduction and package recycling are now crucial due to the sustainability goal. Packaging needs to be flexible, varied, and complex.

Foodservice disposables' increased demand around the globe is also attributed to a number of practical qualities like its low cost, hygienic design, simple & convenient storage, and ready-to-use attributes. Companies involved in the foodservice industry provide a wide range of services to give clients an alternative. This is accelerating the expansion of the global foodservice packaging market as well as the market for foodservice disposables. These food consumption patterns are anticipated to become the "new normal" over the world due to an increase in the number of people working and urbanisation. Over the next five years, it is anticipated that this would dramatically increase demand for foodservice disposables.

Due to changing lifestyle trends, rising disposable income, and the rapid urbanisation of many nations, consumers' appetite for takeout or prepared foods is rising. Additionally, an increasing number of working people, particularly the younger generation, choose pre-packaged or on-the-go food, which is accelerating the growth of the foodservice packaging business. Over the course of the projection period, it is expected that the global market for foodservice packaging will grow at a CAGR of over 5.2%.

Globally, there is a rising demand for foodservice packaging solutions due to the increasing number of global QSRs, or quick service restaurants, like KFC and McDonald's. This enables these QSR chain owners and operators cut labour expenses and employ available resources for improving the quality of service and better offering customer assistance. These QSRs typically do not show any desire in investing in resources for maintenance and cleaning of business containers.

Similar business strategies are being adopted by several local and regional businesses all around the world, which is further boosting the demand for foodservice packaging solutions. In addition, the demand for food packaging solutions is increasing quickly due to global food industrialisation. Players have been able to develop and provide foodservice packaging solutions to a wide range of end users operating in the food sectors thanks to flexibility in production proficiencies.

How is the Foodservice Packaging Market Striving in the U.S.?

In the North America region US has emerged as one of the prominent market for foodservice packaging market, the market is expected to grow with a CARG of 6.5%, external threats exist in the United States and have an impact on investments in packing machinery. A weakening of the world economy, a strengthening of the dollar, and possible tightening of monetary policy are all potential dangers. However, overall growth will promote capital investments.

Additionally, as businesses look to lock in funding at reduced rates, the recent decline in interest rates has sparked an increase in capital investment. Some American and Canadian businesses have stated their intention to relocate their manufacturing operations to Mexico, where they can obtain duty-free goods and cheaper labour.

What is the State of Foodservice Packaging Market in China?

In the East Asia region China has emerged as one of the primary market for foodservice packaging the market is expected to grow with a CAGR value of 4.2%. Productivity gains will be necessary for China's economy to grow. In order to increase production, the Chinese government announced its intention to modernise the industrial sector with a focus on switching to sophisticated machinery.

The two biggest issues facing Chinese machinery makers right now are their continuous reliance on foreign technology and their inability to innovate. Small businesses will be shut down as part of the planned industry reorganisation in order to consolidate the machinery market. By providing tax benefits for the import of componentry, it also hastens the development of sophisticated machinery.

What is the Scope of Foodservice Packaging Market in India?

In the South Asia region, India has dominated the market of foodservice packaging, the market is expected to grow with a CAGR value of 5.2%. India's packaging industry is now rated 11th in the world. Packaged processed food has the largest market share in the packaging sector (48%), followed by personal care packaging (27%) and pharmaceutical packaging (6%).

The market for foodservice packaging is being driven by the rise in convenience food consumption. The food packaging market's two primary growth drivers are aesthetic appeal and practicality. The advancement of food processing has also increased the need for advancements in food packaging technology. Food packing is essential.

Why is Polyethylene Terephthalate Packaging Gaining Traction?

The desire for sustainable products is driving growth in the packaging business. PET's ability to be recycled will spur expansion in the packaging sector. This market sector has a predicted CAGR of about 6.3%. The world's most popular recycled plastic packaging at the moment is PET bottles. Food service packaging companies are using the shift toward recyclable materials to increase their market share and boost their growth prospects as worries about plastic waste grow.

In the Material Type Segment Which Category is expected to drive the Market?

In the material type segment, aluminium is expected to dominate the market, the market for aluminium is expected to grow with a CAGR of 6.5%. Aluminium is a popular choice for food packaging because of its greater recyclability and special physical and chemical properties which are suitable for food products, in place of other materials like plastics and glass.

It is infinitely recyclable in comparison to plastic and paper, while it is also studier and lighter. It is one of the most malleable and adaptable substances known to mankind, it can be easily molded, it is resistant to organic acids, and a great conductor of heat, which makes it the go-to material for packing food products. Additionally, it is one of the most abundant elements in the crust of the Earth, making it widely accessible.

How is Online Food Ordering Increasing at Rapid Rate?

The market for online food ordering is expected to grow with a CAGR value of 7.3%. The procedure of delivering meals has changed as a result of the development of digital technologies. Customers are now placing their orders online and through restaurant apps rather than physically coming to the establishment. Restaurants, for their part, guarantee convenience and openness in their services. The restaurant fulfils an online order by making sure the food is delivered to the customer's home.

In recent years, the food business has undergone a considerable upheaval. Customers may now quickly and simply buy food online, and it will be delivered to their houses as soon as feasible.

Players in the market employ a variety of tactics to maintain their competitiveness and grow their market shares in the sector, including collaborations, mergers and acquisitions, and the creation of new products.

For Instance:

The global foodservice packaging market reached a valuation of US$ 366.3 Billion at the end of 2025.

Between 2019 and 2024, global sales of foodservice packaging increased at 4.9% CAGR.

North America leads the global market and accounted for highest share in 2025.

Some of the leading manufacturers of Foodservice Packaging are Dart Container Corporation, Georgia-Pacific LLC, Anchor Packaging Inc., Pactiv LLC, D&W Fine Pack, Gold Plast SPA, Berry Global Group Inc., Dopla S.p.A., Smurfit Kappa Group, WestRock Company, Huhtamäki Oyj, New WinCup Holdings, Inc., Linpac Packaging Ltd, Graphic Packaging Holding Company among others.

The global market for foodservice packaging is expected to expand at 5.2% CAGR through 2032.

|

Attribute |

Details |

|

Forecast Period |

2025 - 2032 |

|

Historical Data Available for |

2019 - 2024 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As applicable |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Customization & Pricing |

Available upon Request |

By Product Type

By Material

By Fabrication Process

By End Use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author