ID: PMRREP18646| 193 Pages | 5 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

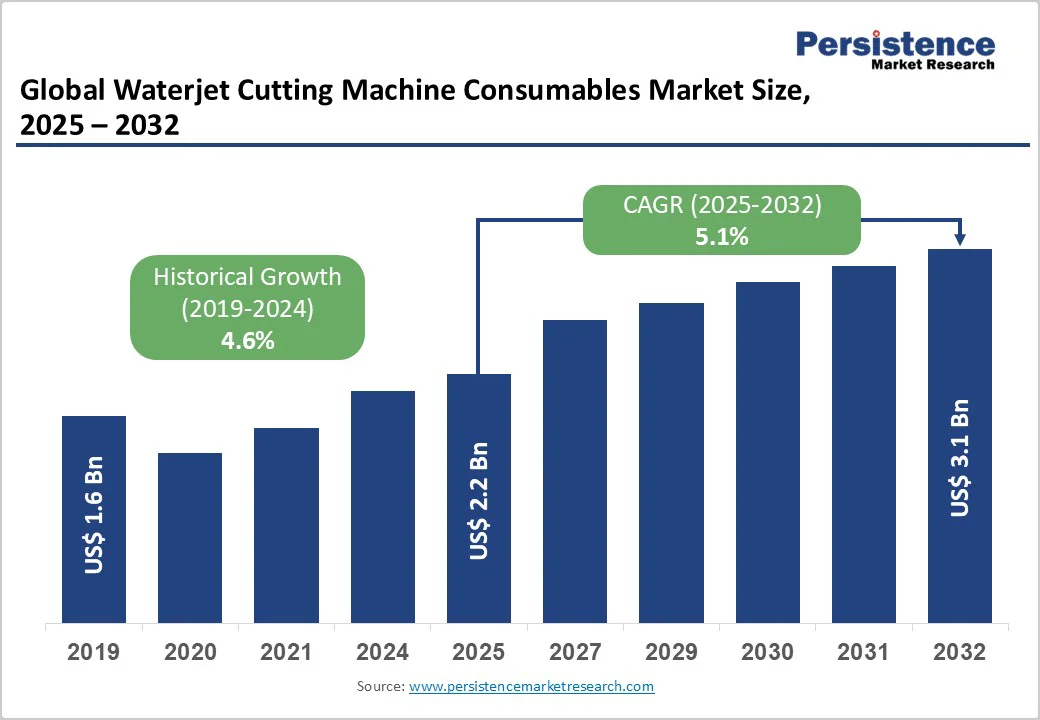

The global waterjet cutting machine consumables market size was valued at US$2.20 Billion in 2025 and is projected to reach US$3.11 Billion by 2032, growing at a CAGR of 5.1% during the forecast period from 2025 to 2032, driven by stringent quality requirements in automotive and aerospace manufacturing, growing metal fabrication activities globally, and the integration of automation technologies enabling efficient consumable utilization and reduced operational costs.

| Key Insights | Details |

|---|---|

| Waterjet Cutting Machine Consumables Market Size (2025E) | US$2.20 Bn |

| Market Value Forecast (2032F) | US$3.11 Bn |

| Projected Growth (CAGR 2025 to 2032) | 5.1% |

| Historical Market Growth (CAGR 2019 to 2024) | 4.6% |

Global manufacturing output growth creates substantial demand for high-precision cutting solutions, with the Organization for Economic Cooperation and Development (OECD) reporting that G20 economies, representing 85% of global GDP, demonstrated augmented manufacturing output in 2022 compared to 2015.

According to industry data, economies including Turkey, Russia, India, South Korea, and Indonesia exhibited growth of 46%, 21.2%, 18.9%, 17%, and 13.9%, respectively, in manufacturing output during this period. The U.S. manufacturing sector's contribution to GDP stood at approximately US$2.3 Trillion in 2022, highlighting the significance of efficient cutting solutions within industrial production.

Waterjet cutting technology's ability to process materials without thermal distortion or heat-affected zones makes it indispensable for industries requiring precision, including aerospace component manufacturing, automotive parts production, and electronics assembly operations.

Technology’s versatility in cutting diverse materials, including metals, composites, glass, ceramics, and stone, without compromising structural integrity, drives consistent consumable demand across manufacturing applications.

Global emphasis on environmental sustainability and eco-friendly manufacturing processes significantly drives waterjet cutting adoption due to its clean, non-toxic operation without hazardous waste generation. Unlike thermal cutting methods that produce fumes, slag, and heat-affected zones, waterjet technology utilizes water and natural abrasives, aligning with increasingly stringent environmental regulations across manufacturing industries.

The automotive industry's focus on sustainability to improve fuel efficiency, reduce operating costs, and minimize manufacturing waste creates favorable conditions for waterjet technology adoption.

According to the U.S. Department of Commerce, the global waterjet cutting market was projected to grow at a 7.5% CAGR from 2021 to 2028, driven by the versatility and eco-friendliness of waterjet technology. The recyclability of abrasive materials significantly contributes to cost savings and environmental compliance, with studies showing that garnet abrasives can be reused at rates of 81% after the first cut, 49% after the second, and 26% after the third.

Waterjet cutting systems and associated consumables require substantial initial investments and ongoing operational expenses that constrain adoption among small and medium enterprises. High-quality consumables, including precision nozzles, focus tubes, and premium abrasive materials, can represent 35-45% of total operational costs for waterjet cutting operations.

The cost of abrasives and nozzles has increased significantly due to rising raw material prices and extensive R&D investments by manufacturers developing advanced performance materials.

Energy consumption associated with operating high-pressure waterjet systems accounts for up to 30% of operational costs, creating economic pressure, particularly in regions with elevated energy prices. The requirement for specialized maintenance, consumable replacement frequency, and technical expertise adds ongoing expenses affecting the total cost of ownership and limiting market penetration in price-sensitive industrial segments.

The proliferation of low-cost, inferior quality consumables in aftermarket channels creates significant challenges for end-users regarding performance consistency, equipment protection, and operational reliability. Manufacturing companies express concerns about additional investment required for quality assurance and testing when sourcing consumables from non-OEM suppliers.

Counterfeit and substandard consumables can cause premature equipment wear, inconsistent cutting quality, and increased downtime, negatively impacting production efficiency and profitability.

The lack of standardization across consumable specifications and compatibility variations among different waterjet system brands complicates procurement decisions and inventory management for users operating multi-vendor equipment fleets. Supply chain vulnerabilities, including raw material availability fluctuations and geographic concentration of specialized consumable manufacturing, create potential disruption risks affecting market stability and customer confidence.

Developing economies in Asia Pacific, Latin America, and the Middle East regions present substantial growth opportunities, with governments implementing infrastructure programs and industrial development initiatives requiring advanced manufacturing capabilities. Countries including India, China, Indonesia, and Brazil are establishing manufacturing hubs and expanding automotive, aerospace, and fabrication sectors, driving waterjet consumable demand.

For instance, McCain, a global food and beverage company, invested US$600 Million in 2023 to double production capacity at its Alberta-based facility, exemplifying large-scale industrial projects requiring precision cutting solutions.

The rapid urbanization and industrialization in emerging markets, combined with government support for domestic manufacturing capabilities, create favorable conditions for waterjet technology adoption and consumable market expansion. Market penetration rates for waterjet cutting technology remain below 30% in many emerging economies, representing approximately US$800 Million in additional consumable opportunity through 2032.

The increasing use of advanced composites, exotic alloys, and engineered materials in aerospace, automotive, and electronics manufacturing creates demand for specialized consumable products optimized for challenging cutting applications. Material innovation focusing on enhanced durability, improved cutting efficiency, and extended service life represents significant differentiation opportunities for consumable manufacturers.

The development of hybrid cutting systems, combining waterjet technology with other processes, requires specialized consumables designed for multi-material applications and complex geometries.

The growing adoption of 3D waterjet cutting systems, which accounted for 52.52% of the waterjet equipment market share in 2022, necessitates advanced nozzles and control systems supporting precision multi-axis cutting operations. The specialty consumables segment, including diamond-coated nozzles, engineered ceramics, and premium garnet formulations, offers premium pricing opportunities valued at approximately US$400 Million by 2032.

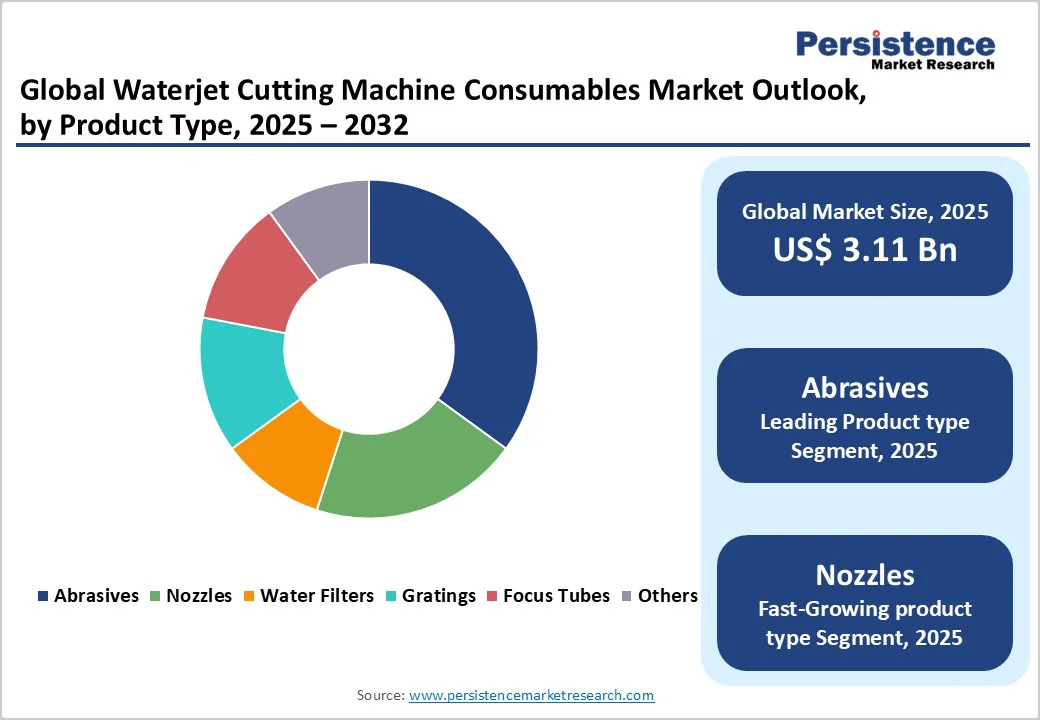

Nozzles dominate the waterjet cutting machine consumables market with a 32% share, serving as the core component responsible for generating high-pressure water streams and precise cutting performance.

Variants such as diamond, sapphire, and tungsten carbide nozzles, capable of handling pressures up to 90,000 psi, enable clean, accurate processing across metals, composites, and ceramics. Their recurring replacement demand, with typical lifespans of 80-200 hours, sustains steady market growth.

Focus tubes emerge as the fastest-growing segment, driven by advances in material science and extended durability. Modern ceramic and engineered tubes offer longer service life, ensuring superior wear resistance, reduced downtime, and consistent cutting precision. Their adoption is expanding in high-performance sectors such as aerospace, automotive, and electronics manufacturing.

The automotive sector holds a 31.4% market share in the waterjet cutting machine consumables market, fueled by its use in component fabrication, interior trim cutting, gasket shaping, and composite processing.

Automakers rely on waterjet technology for precision cutting of glass, seals, and body panels without thermal distortion, aligning with lightweighting trends and stringent quality requirements. Consistent performance and durability of consumables such as nozzles and abrasives are critical for maintaining OEM-level production standards.

Metal fabrication represents the fastest-growing end-user segment, driven by rapid infrastructure development and diversified manufacturing. Its adoption is expanding in structural steel, machinery, and custom metalwork applications due to waterjet cutting’s ability to process hardened and exotic alloys without heat effects, ensuring high precision, reduced waste, and improved operational efficiency.

Abrasive waterjet cutting accounts for 85.6% of the market share in 2025, driven by its ability to process rigid materials such as metals, ceramics, composites, and stone with exceptional precision.

By using garnet or similar abrasives, these systems efficiently cut hard materials such as aluminum, titanium, and inconel without thermal distortion, maintaining dimensional accuracy and surface integrity. The segment benefits from versatility across industries and recurring consumable demand, with abrasive applications comprising over 94% of equipment installations in 2022.

Pure waterjet cutting records the fastest growth, fueled by demand from industries processing soft or hygiene-sensitive materials such as food, rubber, textiles, and paper. Its contamination-free operation, clean cutting performance, and suitability for precision applications in automotive interiors and electronics manufacturing drive increasing adoption across diverse production environments.

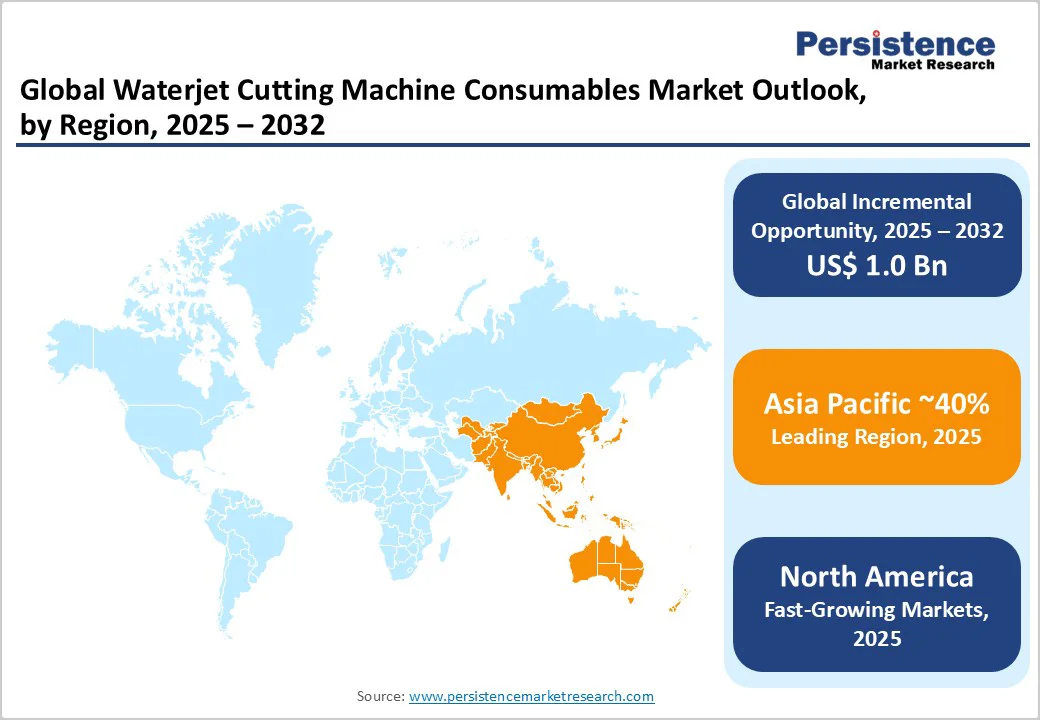

Asia Pacific leads with 40% of the market share, valued at US$880-990 Million in 2025 and projected to reach US$1.24-1.40 Billion by 2032. Regional growth is fueled by robust manufacturing ecosystems, expanding automotive and aerospace sectors, and government-backed industrialization programs. Major economies, including China, Japan, India, and South Korea, are driving adoption through precision manufacturing and large-scale production capacity.

The competitive environment combines international manufacturers with regional leaders, leveraging cost efficiency and local expertise. Rising investments in technology localization, abrasive recycling, and consumable product customization cater to diverse industrial needs. Initiatives such as Made in China 2025 and Make in India further accelerate industrial modernization and demand for precision waterjet cutting consumables, establishing Asia Pacific as the global growth hub for the market.

North America accounts for 20% of the waterjet cutting machine consumables market, valued between US$550-616 Million in 2025 and projected to reach US$777-870 Million by 2032.

The U.S. dominates regional demand, driven by its robust aerospace, automotive, and metal fabrication industries requiring high-precision cutting capabilities. The region benefits from technological innovation, early adoption of advanced waterjet systems, and a strong emphasis on manufacturing quality and operational efficiency.

Regulatory frameworks promoting environmental compliance, workplace safety, and energy efficiency further encourage the transition from thermal cutting to waterjet technologies. The market features strong participation from both global and regional suppliers, with investments focusing on automation, digital connectivity (Industry 4.0), and sustainable production processes, ensuring steady growth and competitive technological advancement.

Europe accounts for approximately 25% of the market, valued at US$484-550 Million in 2025 and projected to reach US$683-778 Million by 2032. Growth is driven by advanced manufacturing expertise, stringent environmental regulations, and strong adoption across automotive, aerospace, and metal fabrication sectors.

Countries such as Germany, the U.K., and France lead the regional demand through precision engineering and high-quality production standards.

The EU’s sustainability policies promoting energy efficiency, waste reduction, and non-thermal cutting processes further accelerate waterjet technology adoption. The competitive landscape includes established European manufacturers and global suppliers focusing on abrasive recycling, energy-efficient cutting systems, and circular economy principles, ensuring continued innovation and environmentally responsible market expansion.

The global waterjet cutting machine consumables market exhibits moderate fragmentation with leading players maintaining significant positions through comprehensive product portfolios, established distribution networks, and technological capabilities. KMT Waterjet Systems, Inc. and Flow International Corporation command substantial market shares through innovation leadership, global manufacturing presence, and comprehensive service networks supporting diverse industrial applications.

Hypertherm, Inc., OMAX Corporation, and Jet Edge, Inc. maintain strong positions through specialized technologies, application expertise, and customer service excellence across regional markets. The market structure includes multinational corporations, specialized consumable manufacturers, and regional suppliers competing across different technology segments, price points, and geographic markets through differentiated product offerings and value-added services.

The waterjet cutting machine consumables market size is estimated to be valued at US$2.20 Billion in 2025.

The key demand driver for the waterjet cutting machine consumables market is the growing adoption of precision cutting technologies across automotive, aerospace, and metal fabrication industries.

In 2025, the Asia Pacific region will dominate the market with an exceeding 40% revenue share in the waterjet cutting machine consumables market.

Among the product types, nozzles hold the highest preference, capturing over 32.2% of the revenue share in 2025.

The key players in waterjet cutting machine consumables are Kennametal Inc., OMAX Corporation, CERATIZIT S.A., GMA Garnet Pty. Ltd., and Wardjet Inc.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author