ID: PMRREP4601| 200 Pages | 22 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

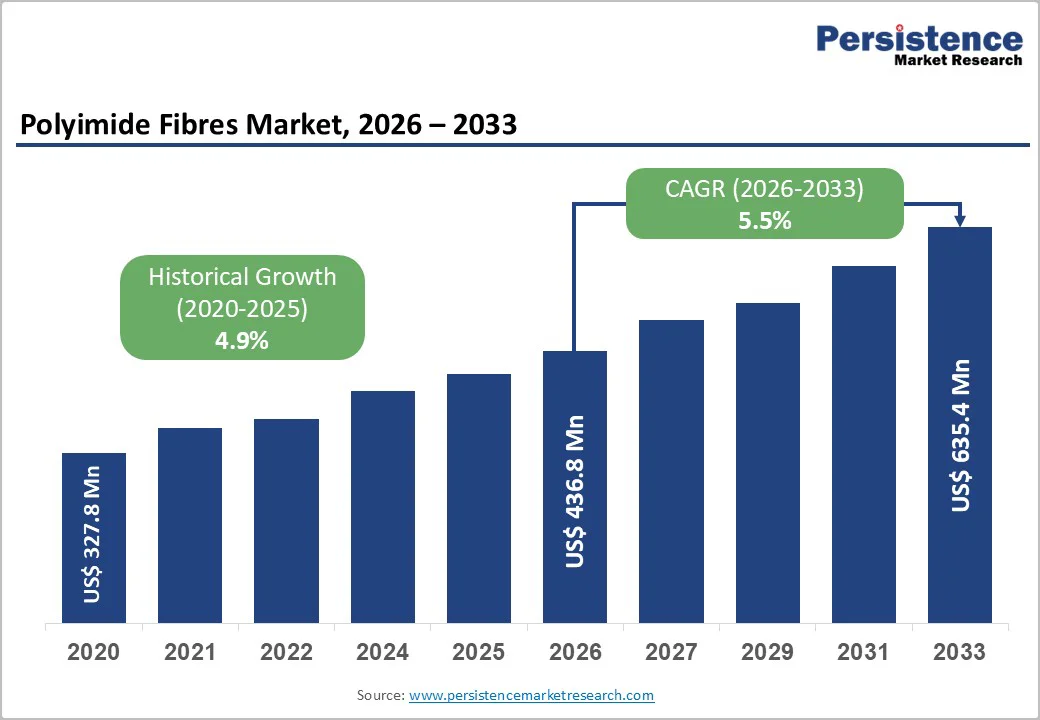

The global polyimide fibres market size is likely to be valued at US$ 436.8 million in 2026 and is projected to reach US$ 635.4 million by 2033, growing at a CAGR of 5.5% between 2026 and 2033. The primary driver of this growth is the surging demand for high-performance materials in demanding sectors like aerospace and electronics, where polyimide fibres provide exceptional thermal stability and lightweight properties essential for advanced applications.

| Key Insights | Details |

|---|---|

| Polyimide Fibres Market Size (2026E) | US$ 436.8 Mn |

| Market Value Forecast (2033F) | US$ 635.4 Mn |

| Projected Growth CAGR (2026 - 2033) | 5.5% |

| Historical Market Growth (2020 - 2025) | 4.9% |

The aerospace industry is expanding quickly, and this is strongly increasing the demand for polyimide fibres because of their unique ability to handle temperatures up to 400°C while remaining extremely lightweight. These fibres are used in aircraft insulation, thermal blankets, and spacecraft components that must survive extreme heat and pressure changes.

As global aerospace production grows, driven by more commercial air travel, rising satellite launches, and new space exploration missions, the need for reliable, high-performance materials becomes even more critical. Polyimide fibres help reduce overall aircraft or spacecraft weight by nearly 20% when used in composite structures, improving mission efficiency and fuel savings.

Their strong chemical stability also ensures a longer operational life in harsh environments. These factors make polyimide fibres essential to advanced aerospace innovation.

Growth in the electronics industry is accelerating the use of polyimide fibres, especially for products that require strong thermal stability and electrical insulation.

These fibres can function between -269°C and 400°C, making them ideal for flexible printed circuits, battery systems, and high-temperature wiring. With the rapid expansion of electric vehicles, 5G infrastructure, and compact consumer devices, manufacturers require insulation materials with extremely high resistance levels exceeding 10^16 Ω•cm to protect components from overheating and electrical failures.

Polyimide fibres also support the miniaturization trend in modern electronics by offering durability in tight and complex layouts. Their ability to resist chemicals, mechanical stress, and intense heat makes them suitable for semiconductor manufacturing and advanced automotive electronics. These qualities ensure their broader adoption as industries continue shifting toward high-performance, heat-resistant components.

Polyimide fibres are expensive to produce because their manufacturing process involves complex chemical reactions, controlled polymerization, and delicate drying steps to maintain fibre strength. As a result, they are typically 2-3 times more costly than other high-performance fibres such as aramids, which restricts their adoption in cost-sensitive industries.

Producers also require sophisticated equipment to prevent fibre collapse during ambient-pressure drying, increasing capital and operational expenditures.

Smaller manufacturers find it challenging to scale production due to these financial barriers, which limits market competitiveness. In industries like automotive, where price pressure is extremely high, companies often choose less expensive materials even if they offer lower performance. These cost challenges slow down widespread market adoption despite the proven technical advantages of polyimide fibres.

Polyimide fibre production faces strict environmental regulations, especially in regions with strong industrial safety and emissions laws. Manufacturers must invest heavily, often raising operating costs by up to 15%, to meet environmental compliance standards related to chemical handling, emissions control, and waste management.

Additionally, the industry depends on petrochemical-based raw materials, which face supply volatility with price fluctuations of about 15% per year. These uncertainties disrupt production planning and increase overall manufacturing risk.

Sustainability concerns also push customers to look for greener, lower-emission alternatives, especially in industries aiming for carbon-neutral operations. As regulatory requirements become tighter, companies producing polyimide fibres must balance compliance costs with competitive pricing. This environment slows market expansion and shifts preference toward materials that require fewer regulatory approvals.

The market is witnessing strong opportunities in eco-friendly polyimide fibres made from bio-based materials. These variants significantly lower environmental impact by reducing carbon emissions to nearly one-fifth of those generated during the production of traditional carbon fibres.

Their growing use in renewable energy applications, such as wind turbine components and lightweight reinforced structures, aligns well with global sustainability commitments, including the European Union’s carbon-neutral goals. Advanced fibres such as Imidetex provide long-lasting durability and thermal stability, helping reduce waste and extend equipment lifespan.

New production methods, such as UV-enhanced gelation, support large-scale, high-quality fibre manufacturing. The bio-based polyimide fibres to capture nearly 20% additional market share in segments like protective clothing and filtration systems, due to rising demand for sustainable and high-performance materials.

The rapid global shift toward electric vehicles (EVs) offers strong growth opportunities for polyimide fibres, especially in battery insulation and thermal protection systems. As EV production is projected to increase by nearly 30% worldwide, manufacturers require materials with excellent flame-retardant and heat-resistant properties to ensure battery safety and efficiency.

Polyimide fibres help prevent overheating and thermal runaway, making them essential for next-generation EV battery packs.

Innovations involving nanotechnology are enabling the development of self-healing fibres that improve conductivity and extend the lifespan of electronic components. Technology transfers from aerospace applications are also accelerating the adoption of polyimide fibres in automotive power systems. Government incentives, including the U.S. Inflation Reduction Act, further support this growth by promoting advanced, energy-efficient automotive materials.

Continuous Filament leads the product type segment with nearly 35% market share because it delivers high strength, durability, and consistent performance in demanding applications. Its uniform tensile strength of over 3 GPa makes it ideal for aerospace composites and industrial reinforcement where reliability is essential.

These filaments also create seamless woven structures, reducing defects under extreme heat and vibration, such as in spacecraft cabling. Their strong preference in filtration systems operating above 260°C, where they outperform staple fibres in lifespan and efficiency.

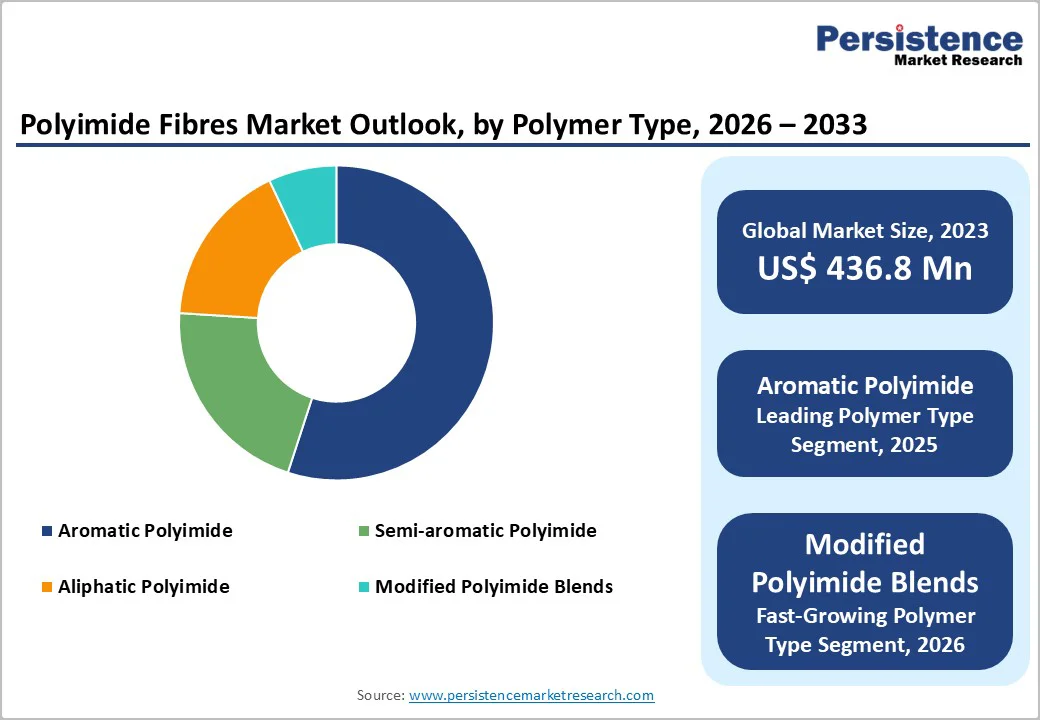

Aromatic Polyimide holds around 55% of the polymer segment due to its excellent thermal stability, chemical resistance, and flame-retardant nature. Its rigid molecular structure offers a limiting oxygen index above 38%, making it suitable for harsh environments like electronics insulation and protective clothing.

Its ability to maintain strength under extreme temperatures, including re-entry simulations in aerospace applications. Compared with semi-aromatic alternatives, aromatic polyimides demonstrate superior durability, longer service life, and better performance in high-temperature composite materials.

Aerospace & Defense dominates the application segment with approximately 32% market share because these industries require lightweight, heat-resistant materials for critical components. Polyimide fibres are used in aircraft skins, missile structures, and thermal protection systems that withstand temperatures up to 500°F without degrading.

Their role in space missions, including NASA programs, highlights their reliability in reducing weight while strengthening structural performance. The composites using polyimide fibres can improve fuel efficiency by nearly 25%, increasing their adoption across advanced aerospace platforms.

Aerospace leads the End-user segment with about 28% share because it depends heavily on high-performance materials for propulsion systems, avionics, and thermal protection. Polyimide fibres offer high dielectric strength, low thermal expansion, and strong resistance to oxidation, making them ideal for radomes, engine linings, and insulation components.

Supported by global defense spending of more than $2 trillion, their use continues to expand. Engineering studies also show that polyimide-based composites help reduce aircraft weight by nearly 15%, improving performance and overall fuel efficiency.

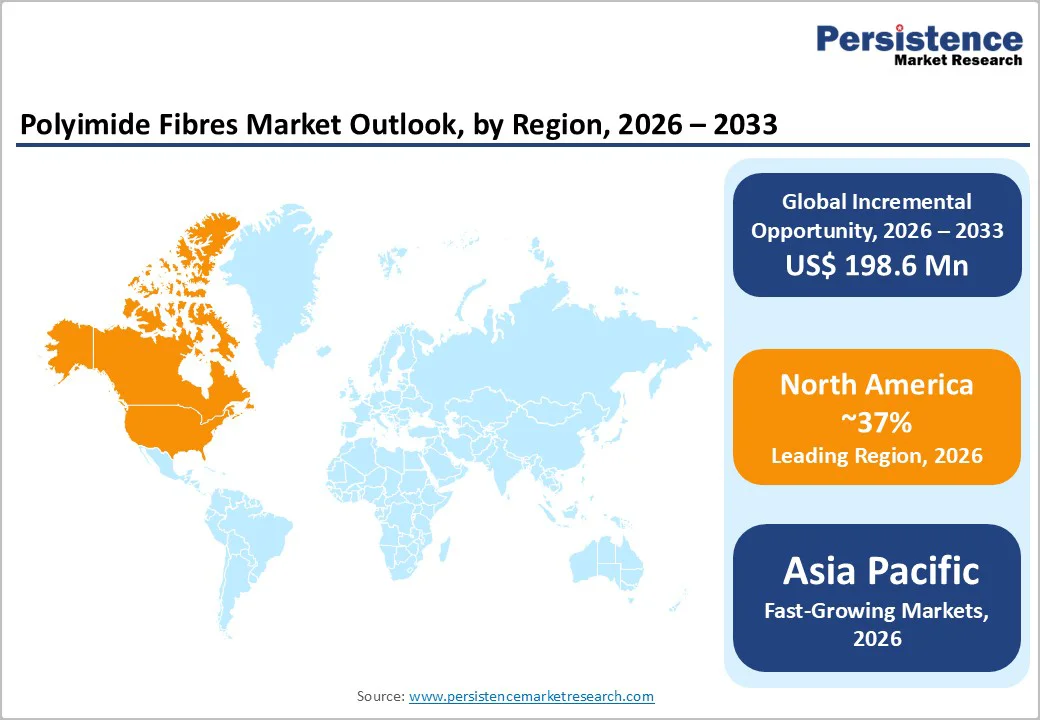

North America remains a leading market for polyimide fibres, driven primarily by the United States, which has a strong aerospace and defense ecosystem. Organizations such as NASA and leading manufacturers such as Boeing rely heavily on polyimide fibres for satellite insulation, aircraft engines, and thermal protection materials.

The region hosts more than 500 advanced R&D centers dedicated to developing next-generation polymers and high-performance materials, promoting ongoing innovation.

Strict regulatory standards set by the Federal Aviation Administration (FAA) encourage the use of flame-retardant composite materials that meet FAR 25 safety requirements. The region is also investing in electric vehicle battery technologies, which increases demand for thermal barrier materials. An annual rise of nearly 10% in space launch activities further supports market expansion.

Europe’s polyimide fibres market is shaped by strict regulatory frameworks like REACH and EU Emission Standards, which encourage the use of high-performance, environmentally responsible materials.

Germany leads the region, particularly in automotive exhaust filtration, where polyimide fibres help achieve up to 95% particulate capture under high-temperature conditions, supporting Euro 7 emission standards. The UK and France continue to invest in defence applications, using polyimide fibres in radar and communication systems because of their thermal stability and radar transparency.

Spain is expanding production of industrial safety clothing that meets EN ISO 11612 fire-resistance requirements, boosting fibre adoption. Europe’s strong semiconductor sector, especially in Germany, uses polyimide fibres to protect chips from heat during soldering processes reaching 300°C. Collaborative EU-funded research continues to promote bio-based polymer development.

Asia Pacific is experiencing rapid growth driven by large-scale manufacturing, strong government support, and rising demand for high-performance materials. China accounts for nearly 40% of global polyimide fibre production, supported by state-backed factories and integrated supply chains that enable lower production costs.

Japan specializes in precision electronics, using polyimide fibres in semiconductor wiring and flexible substrates that support advanced chip fabrication as small as 5 nm.

India’s aerospace sector, led by ISRO, incorporates polyimide fibres in satellite thermal control systems, benefiting from a 15% CAGR in space investments.

South Korea and other ASEAN countries drive demand through electronics manufacturing, particularly in OLED displays that require flexible substrates capable of withstanding more than 100,000 bending cycles. Regional policies like “Made in China 2025” further accelerate the use of polyimide fibres in EVs, filtration, and industrial insulation.

The global polyimide fibres market is moderately consolidated, with a handful of key players controlling over 60% through specialized R&D in thermal enhancements and sustainable blends, while smaller firms focus on niche customizations.

Expansion strategies include joint ventures for supply chain localization, as seen in Asian manufacturing hubs, and heavy investment in nanotechnology for self-healing properties to differentiate offerings. Leaders emphasize certifications like ISO 9001 for quality, with emerging models shifting toward circular economy practices like recyclable composites to capture eco-conscious segments.

The market is valued at US$ 436.8 Mn in 2026 and expected to reach US$ 635.4 Mn by 2033, reflecting steady growth in high-performance applications.

Key drivers include aerospace needs for lightweight thermal insulation and electronics' requirement for high-dielectric strength materials, supporting miniaturization and EV advancements.

Aromatic Polyimide leads with 55% share, due to its unmatched thermal and chemical resistance in defense and semiconductor uses.

North America leads, driven by U.S. aerospace innovations and regulatory support from agencies like NASA.

Sustainable bio-based variants offer significant potential in EVs and renewables, reducing emissions and aligning with global green policies.

Prominent players include Evonik Industries AG, PPG Industries, Inc., and DuPont de Nemours, Inc., focusing on R&D for advanced applications.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn, Volume: Tons |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Polymer Type

By Application

By End-user

By Regions

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author