ID: PMRREP3143| 199 Pages | 18 Dec 2025 | Format: PDF, Excel, PPT* | Healthcare

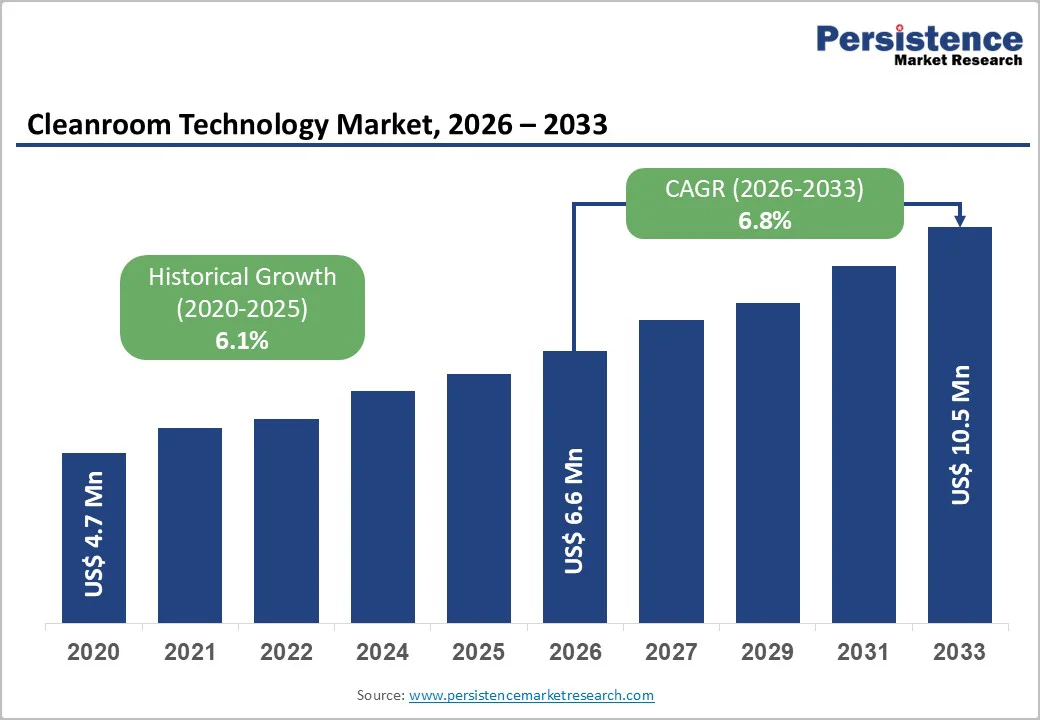

The global cleanroom technology market size is estimated to reach US$ 6.6 billion in 2026 and is projected to reach US$ 10.5 billion by 2033, growing at a CAGR of 6.8% between 2026 and 2033. A cleanroom is a controlled environment where airborne particulate matter, including dust, hair, bacteria, and fungi, is strictly regulated to ensure minimal contamination.

These rooms are designed to reduce the generation, introduction, and retention of particles through carefully engineered structures, air filtration systems, and workflow protocols. Maintaining precise temperature, humidity, and pressure conditions is critical to achieving the required sterility levels.

Cleanrooms are widely used across pharmaceuticals, biotechnology, medical devices, electronics, and aerospace industries, where even minor contamination can compromise product quality, safety, and compliance with stringent regulatory standards.

| Key Insights | Details |

|---|---|

| Global Cleanroom Technology Market Size (2026E) | US$ 6.6 Billion |

| Market Value Forecast (2033F) | US$ 10.5 Billion |

| Projected Growth (CAGR 2026 to 2033) | 6.8% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.1% |

The global cleanroom technology market is accelerating as industries pursue higher product sterility, safety, and regulatory compliance-a trend reinforced by recent capability expansions and stricter global standards.

Growing demand for certified, contamination-free manufacturing in pharmaceuticals, biologics, medical devices, and aseptic implants continues to be a core driver, supported by increasing regulatory scrutiny of packaging, processing, and facility quality.

The rise in Good Manufacturing Practice (GMP) expectations for advanced therapeutics further intensify the need for controlled environments; for instance, live biotherapeutic product (LBP) manufacturing requires facility designs that preserve microbial viability while ensuring stringent contamination control, such as segregated Heating Ventilation and Air Conditioning systems with ≥15 Pa pressure differentials, closed anaerobic processing lines, unidirectional material flow with airlock buffers, and modular ISO Class 5-7 cleanrooms with epoxy-coated surfaces.

Increasing industry investments in high-purity filtration and separation technologies also propel market adoption; notably, in September 2025, Thermo Fisher Scientific Inc. completed its US$4.0 billion acquisition of Solventum’s Purification and Filtration business, expanding access to advanced filtration systems essential for bioprocessing, semiconductor fabrication, battery production, and medical device manufacturing-sectors where ultra-pure, contamination-free environments remain indispensable.

The growth of the global cleanroom technology market is restrained by high capital and operational costs, coupled with a shortage of skilled professionals required to design, construct, and maintain such facilities. Cleanroom setup costs can range from US$75 to US$1,500 per square foot, depending on classification, temperature control, materials, and specialized equipment such as air showers, with ISO-14644-1 cleanroom classification being the primary cost determinant.

Higher cleanliness levels demand more HEPA (High-Efficiency Particulate Air) filtration and increased air changes per hour, significantly increasing Heating, Ventilation, and Air Conditioning (HVAC) costs, which alone can account for 25-50% of total expenses.

Additionally, monitoring systems to maintain regulatory compliance add US$500-20,000 per installation. The complexity of design, including modular enclosures, precise airflow, and environmental control, further adds to planning and construction challenges, often requiring experienced professionals who are in limited supply.

Illustrating these challenges, Micron Technology’s US$100 billion semiconductor megafab in Clay, New York, faced delays announced in November 2025, pushing the opening of its first two fabrication plants by two to three years due to the scale and technical demands of constructing 600,000 square feet of cleanroom space per facility. Such factors continue to limit the pace of cleanroom technology adoption globally.

The global cleanroom technology market presents significant opportunities driven by innovation in cleaning, monitoring, and integrated solutions that enhance operational efficiency and compliance. Advancements in digital and augmented reality (AR) tools are set to revolutionize cleanroom maintenance, addressing gaps in tangible performance tracking.

For example, in October 2024, EAZER Maintenance, in collaboration with ABN Cleanroom Technology and Hasselt University, developed a prototype AR solution, CleanAR, which provides real-time guidance and visual instructions for precise cleaning. The tool is expected to be fully validated for high-critical cleanliness environments within 24 months, offering opportunities to improve training, daily maintenance, and compliance with hygiene standards.

Integrated partnerships between cleanroom solution providers and consumables suppliers also create growth potential by streamlining procurement and ensuring compatibility across systems. In April 2025, Monmouth Scientific expanded its partnership with Integrity Cleanroom, combining modular cleanroom infrastructure with an extensive consumables and supply chain network.

This collaboration targets industries such as aerospace, biotechnology, defence, electronics, medical devices, semiconductor, and pharmaceutical manufacturing, offering one-stop solutions that enhance operational efficiency, reduce downtime, and simplify cleanroom management. These developments underscore the market’s potential to expand through technological innovation and integrated service models.

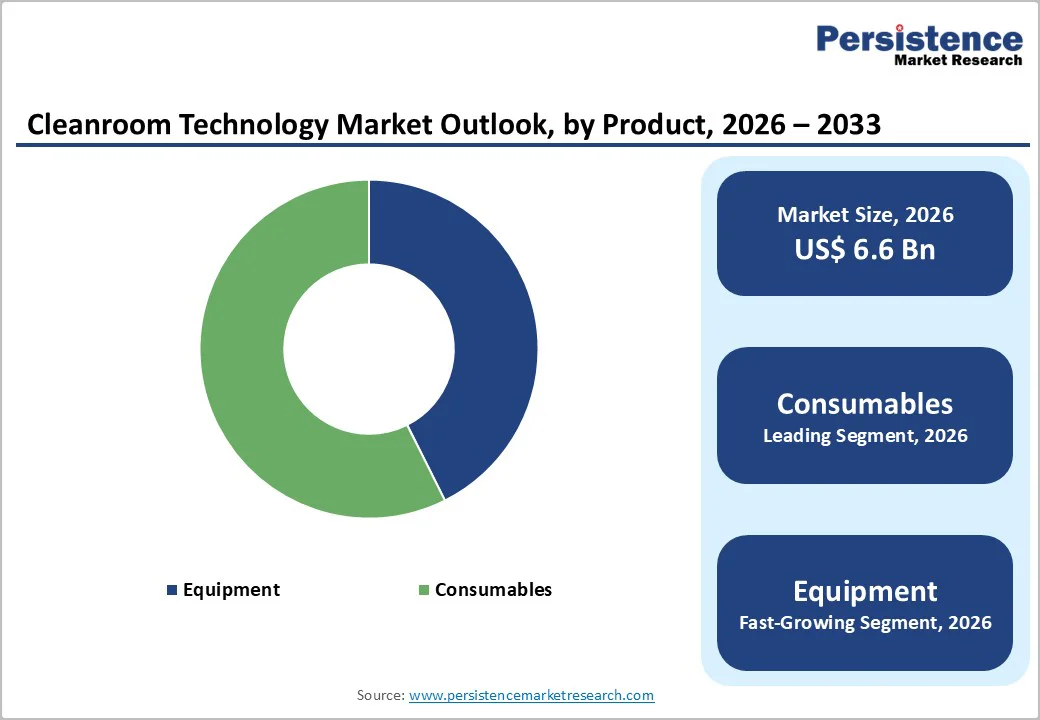

Consumables, including gloves, masks, gowns, and filters, are projected to capture 57.4% of the global cleanroom technology market by 2026. Their frequent replacement, critical role in maintaining sterility, and compliance with ISO and Good Manufacturing Practice standards drive strong demand across pharmaceuticals, biotechnology, electronics, and medical device manufacturing.

As industries expand cleanroom capacity and enhance contamination control measures, consumables remain essential, supporting operational efficiency, minimizing cross-contamination risks, and ensuring adherence to stringent regulatory requirements. Continuous innovation in high-performance, durable consumables further reinforces their market dominance.

Hardwall cleanrooms are expected to account for 48.4% of the global cleanroom technology market by 2026, driven by their robust structural integrity, superior contamination control, and ease of validation to meet ISO 14644 and GMP standards.

These permanent constructions allow precise environmental control, including temperature, humidity, and air pressure, making them ideal for pharmaceuticals, biotechnology, and microelectronics. Their adaptability to integrate advanced HVAC, filtration, and monitoring systems supports complex workflows while maintaining sterility, contributing to operational efficiency and long-term cost-effectiveness compared to softwall or modular alternatives.

The pharmaceutical industry is projected to capture 45.7% of the global cleanroom technology market by 2026, driven by stringent sterility, contamination control, and regulatory compliance requirements. Growth in biologics, vaccines, and sterile drug manufacturing fuels demand for ISO-classified cleanrooms.

Pharmaceutical facilities increasingly adopt modular and hardwall cleanrooms to ensure precise control over air quality, temperature, and humidity, supporting GMP adherence. Rising R&D investments, expansion of production capacity, and a focus on patient safety further reinforce the industry’s leading share in cleanroom technology adoption globally.

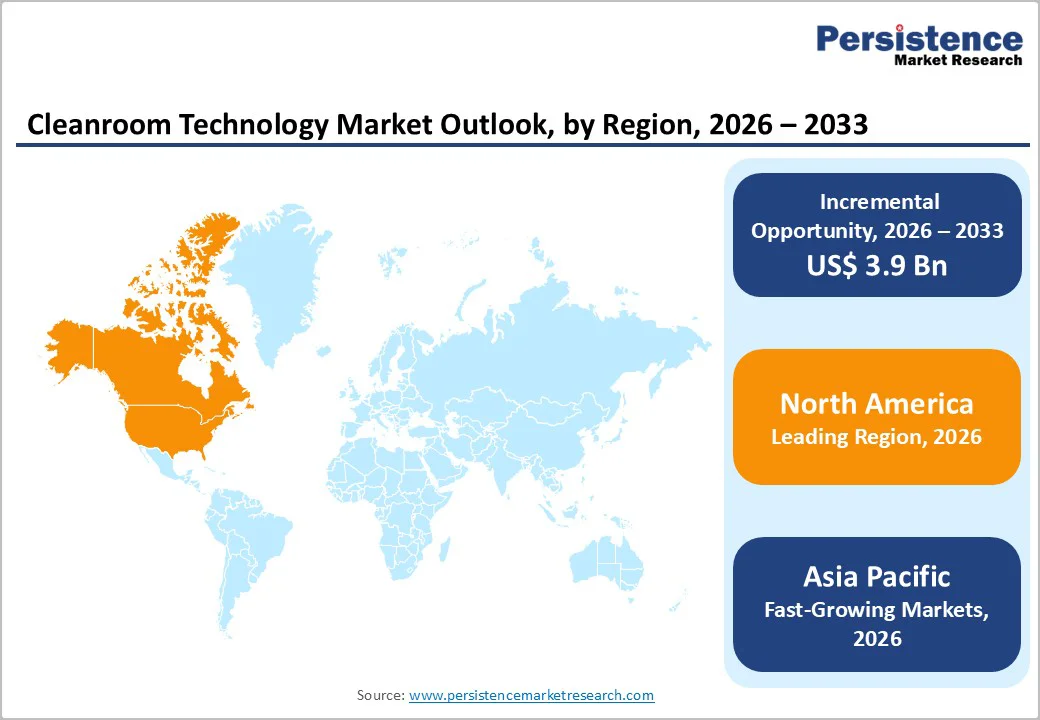

North America is poised to dominate the cleanroom technology market, projected to capture 39.4% of the global share by 2026, driven by advancements in modular, flexible, and high-performance cleanroom solutions that enhance efficiency and compliance.

Innovation in airlock and entry systems significantly reduces contamination risk and improves operational workflow; for example, in April 2024, AES Clean Technology launched its CleanLock Module™, integrating proprietary finishes, advanced lighting, predictable airflow, and automated door controls, enabling secure and efficient transition of people and materials while minimizing contamination in pharmaceutical and biotechnology facilities.

Next-generation utility integration further strengthens market growth by optimizing cleanroom layout and functionality, allowing facilities to meet stringent regulatory standards while improving productivity. In April 2025, AES introduced Omni ASCENT at INTERPHEX 2025, an Off-Site Manufactured vertical utility solution built on the proven Omni utility raceway system.

Unlike conventional systems restricted to wall or ceiling mounts, Omni ASCENT enables strategic placement of utilities across the cleanroom floor, enhancing flexibility, safety, and workflow efficiency for high-compliance environments. These technological innovations, coupled with strong regional demand for advanced pharmaceuticals, biotechnology products, and sterile manufacturing processes, are key drivers supporting North America’s leadership in the global market.

Europe is set to hold 31.7% of the global cleanroom technology market by 2026, driven by increasing demand for high-precision, compliant laboratory and manufacturing environments across pharmaceuticals, biotechnology, and high-tech industries.

Expansion into specialized laboratory cleanrooms supports regional growth by addressing stringent safety and precision requirements; for instance, in March 2024, ABN Cleanroom Technology launched ABN Labs, a subsidiary dedicated to designing, installing, and maintaining laboratory facilities across pharma, healthcare, and high-tech sectors. The company provides customized solutions to meet unique laboratory needs, enhancing efficiency and compliance while supporting research and manufacturing excellence.

Advances in modular, off-site cleanroom construction further drive market adoption by reducing build times and ensuring regulatory compliance. In November 2025, Modular Clean Air (MCA), a joint venture between Total Clean Air and Vanguard Healthcare Solutions, began delivering UKAS 17025-accredited cleanrooms for biotech, pharmaceutical, and life sciences applications.

Each facility is manufactured off-site in Britain using precision-engineered modular units that meet ISO 14644 and Good Manufacturing Practice requirements, combining the quality of conventional construction with faster deployment. These innovations, coupled with Europe’s emphasis on regulatory standards, high-quality manufacturing, and laboratory research, continue to propel cleanroom technology adoption across the region.

Asia Pacific is rapidly expanding, projected to achieve a CAGR of 8.5% over the forecast period, fueled by rising industrialization, pharmaceutical manufacturing, and biotechnology research in the region. Increasing regional investments in air filtration and cleanroom infrastructure are key growth drivers, supporting compliance with stringent hygiene and contamination standards.

For example, in May 2024, Sweden-based air filtration specialist Camfil inaugurated an expanded manufacturing facility in Batu Gajah near Ipoh, Malaysia, enhancing its production capabilities for the Asian markets. The facility features advanced laboratories for research and development, a showroom, and an auditorium for product showcases, launches, and training, enabling faster adoption of innovative cleanroom solutions across multiple industries.

Rising demand for customized and high-performance cleanroom solutions in pharmaceuticals, biotechnology, electronics, and medical device manufacturing further propels market growth, as regional companies increasingly seek efficient, scalable, and regulatory-compliant facilities.

Strategic facility expansions and investments in research and development facilitate technological innovation, enable local production of advanced cleanroom components, and strengthen supply chains. These factors collectively support the Asia Pacific’s rapid cleanroom technology adoption and underscore its significance in the global cleanroom technology landscape.

The global cleanroom technology market is highly competitive, driven by strategic expansions, partnerships, and technological innovations. Key players focus on mergers, acquisitions, and collaborations to enhance capabilities across pharmaceuticals, biotechnology, microelectronics, and similar sectors, strengthening regional presence and offering advanced, regulatory-compliant cleanroom solutions worldwide.

The global cleanroom technology market is projected to be valued at US$ 6.6 Billion in 2026.

Increasing demand for contamination control in biopharma, semiconductor, and medical device manufacturing drives widespread cleanroom adoption.

The global market is poised to witness a CAGR of 6.8% between 2026 and 2033.

Rising biologics production, nanotechnology expansion, and modular cleanroom innovations create strong growth opportunities.

Major players in the global are American Cleanroom Systems, Clean Air Technology, Inc., NGS, AES Cleanroom Technology, ABN Cleanroom Technology, Seimens Healthineers AG, and others.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Component

By Construction

By Industry

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author