ID: PMRREP12160| 189 Pages | 10 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

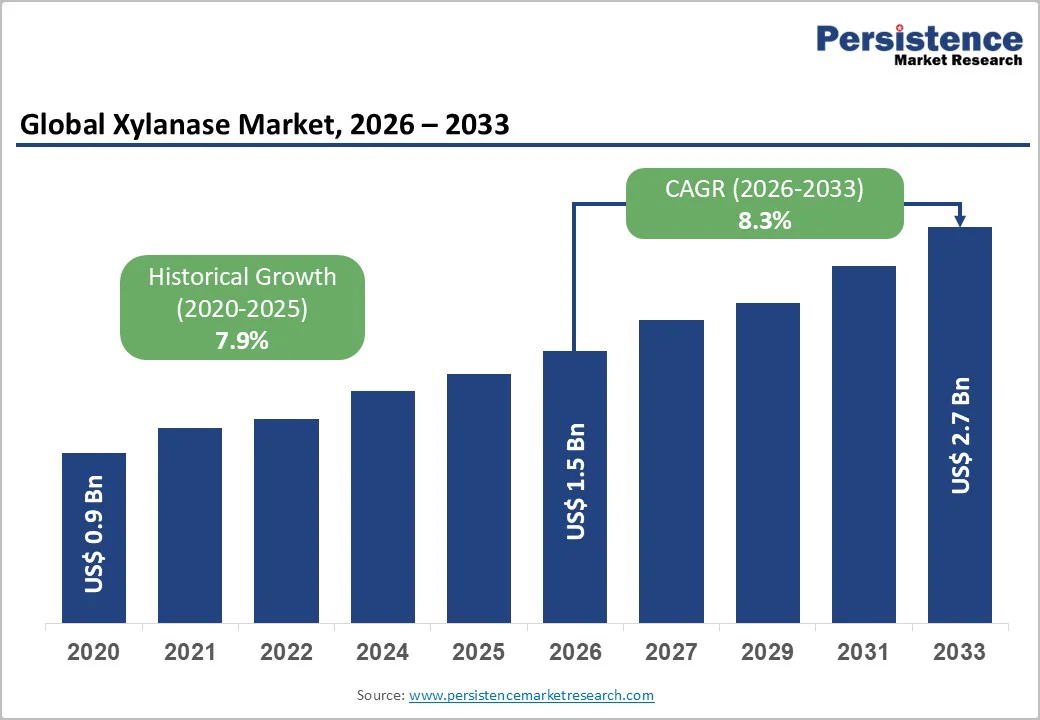

The global xylanase market size is likely to be valued at US$1.5 billion in 2026 and is expected to reach US$2.7 billion by 2033, growing at a CAGR of 8.3% during the forecast period from 2026 to 2033, driven by rising demand in the food & beverage and animal feed sectors, along with biotechnology advancements that improve enzyme performance.

Increasing use in pulp & paper, biofuels, and other industrial applications is further boosting adoption. Meanwhile, the shift toward sustainable and clean-label solutions is opening new opportunities, particularly in emerging markets.

| Key Insights | Details |

|---|---|

| Xylanase Market Size (2026E) | US$1.5 Bn |

| Market Value Forecast (2033F) | US$2.7 Bn |

| Projected Growth CAGR (2026 - 2033) | 8.3% |

| Historical Market Growth (2020 - 2025) | 7.9% |

Growing demand for animal feed, driven by rising meat, poultry, and dairy consumption, has pushed livestock and poultry producers to maximize feed efficiency and reduce costs. Xylanase has become essential as it breaks down plant-based feed ingredients rich in non-starch polysaccharides into simpler sugars, improving nutrient digestibility and absorption.

This improved digestibility helps animals gain weight more efficiently, reduces feed costs, and boosts overall productivity, making xylanase increasingly valuable for feed producers.

Broader industry trends, such as the push for sustainable and antibiotic-free animal farming, amplify xylanase adoption. As feed producers seek natural enzyme-based additives to replace chemical or antibiotic-based growth promoters, xylanase offers a clean, eco-friendly solution that enhances nutrient uptake, promotes gut health, and reduces waste output from undigested feed.

Improved feed digestibility through xylanase allows animals to extract more nutrients from the same feed, enhancing growth rates and feed conversion ratios (FCR).

High production costs remain a key restraint in the market. Enzyme production involves sophisticated fermentation processes using specialized microbial strains, precise temperature and pH control, and downstream purification steps to ensure high activity and stability.

These requirements lead to significant capital investments in facilities, equipment, and skilled labor. Maintaining consistent enzyme quality and yield adds to operational expenses, making xylanase products more expensive than conventional chemical additives in some applications.

The cost factor limits adoption, especially in price-sensitive markets such as developing countries' feed and biofuel sectors. Small and medium-scale feed producers may be reluctant to switch to enzyme-supplemented feed due to higher upfront costs, despite long-term benefits such as improved feed conversion and productivity.

This cost barrier slows broader market penetration and can impact competitive pricing strategies, restraining overall growth in regions where production and operational expenses are high.

The growing emphasis on renewable energy and sustainable fuels presents a significant opportunity for the market. Xylanase plays a key role in breaking down hemicellulose in lignocellulosic biomass into fermentable sugars, which can then be converted into bioethanol and other biofuels.

As governments and industries increasingly invest in biofuel production to meet climate targets and reduce reliance on fossil fuels, the demand for efficient biomass-degrading enzymes such as xylanase is rising.

This trend is supported by policy incentives, subsidies, and mandates in regions such as North America, Europe, and Asia Pacific that encourage bioenergy adoption. By enabling higher sugar yields from agricultural residues, forestry waste, and energy crops, xylanase not only improves the economic feasibility of biofuel production but also opens new revenue streams for enzyme manufacturers.

Xylanase offers a major opportunity in biofuels by efficiently converting lignocellulosic biomass into fermentable sugars, boosting bioethanol yields, and supporting global renewable energy goals.

Fungal xylanase is likely to lead the market, capturing around 55% of the total revenue share in 2026, due to its high yield from filamentous fungi and exceptional stability in industrial processes. Its versatility across animal feed, pulp and paper, and food applications makes it the preferred choice for manufacturers and formulators.

For example, fungal xylanases are extensively used in Kraft pulp bio-bleaching across major paper mills to reduce chlorine consumption and enhance pulp brightness. Production is efficiently scaled through advanced fermentation technologies, such as those employed by Novozymes, ensuring consistent enzyme activity and cost-effective supply.

Bacterial xylanase represents the fastest-growing product type, driven by genetic engineering for improved feed digestibility, rising biofuel demand, and cost-efficient microbial production. For example, bacterial xylanases derived from Bacillus species are increasingly adopted in poultry and swine feeds to reduce gut viscosity and improve nutrient absorption.

Rising demand for biofuel production also contributes to its growth, as bacterial xylanase helps break down lignocellulosic biomass into fermentable sugars. The use of microbial sources for production is reducing costs, increasing market, improving digestibility, which directly supports better feed conversion ratios.

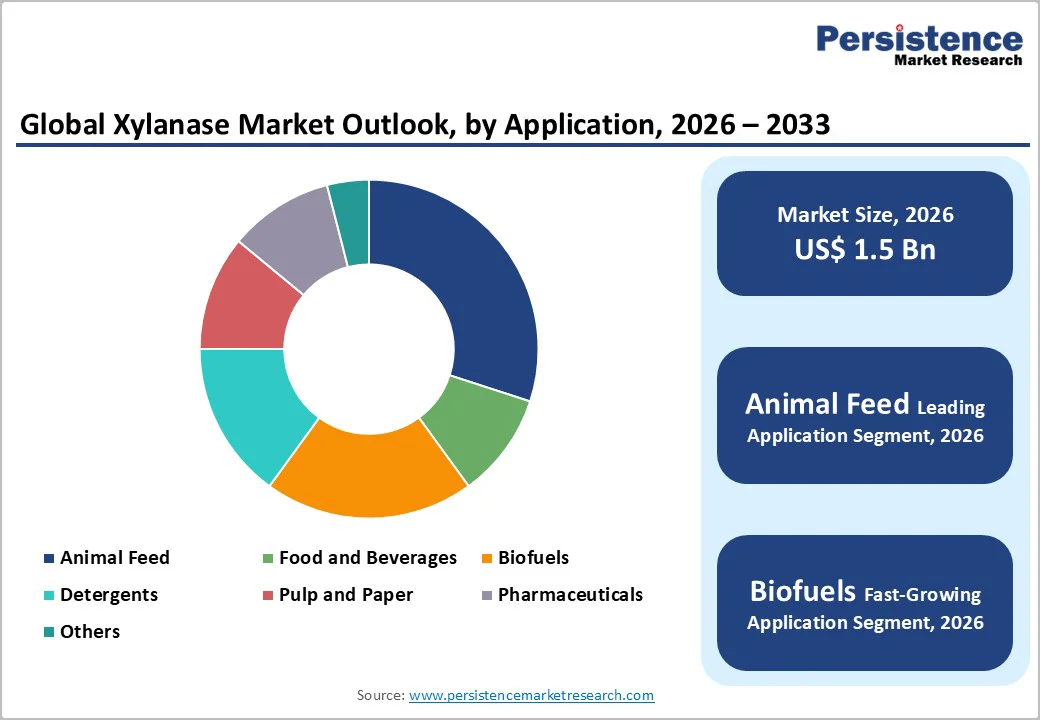

Animal feed application is likely to lead the xylanase market, capturing around 40% of the total revenue share in 2026. Xylanase supplementation enhances poultry and swine nutrition by breaking down non-starch polysaccharides, which improves nutrient digestibility and feed conversion ratios by up to 15%.

For example, for the animal feed industry, xylanase supplementation improves the digestibility of cereal-based feeds. The enzyme degrades arabinoxylans and other non-starch polysaccharides, reducing gut viscosity and enhancing nutrient absorption in poultry and swine. The enzyme’s ability to increase growth performance while reducing feed costs makes it a preferred additive in modern livestock production.

Biofuels application represents the fastest-growing, due to its role in breaking down lignocellulosic biomass into fermentable sugars, which enhances bioethanol production. For example, xylanases (especially microbial ones) help break down hemicellulose from agricultural residues such as wheat straw, sugarcane bagasse, rice straw, and corn cobs into fermentable sugars.

These sugars can then be used for second-generation ethanol or other biofuel production. By enabling more efficient biomass conversion, xylanase supports renewable energy initiatives and helps meet sustainability goals in energy production. Policy incentives and government support for bioenergy adoption further encourage its use, creating expanding opportunities for xylanase in the biofuels sector.

Animal nutrition is likely to be the largest application segment, holding around 35% of the market share in 2026. Its growth is driven by the enzyme’s ability to break down non-starch polysaccharides in feed, enhancing nutrient digestibility and improving growth performance in poultry, swine, and livestock.

The enzyme’s ability to boost feed conversion ratios while reducing undigested waste makes it a valuable additive for feed producers. Increasing livestock production globally underpins the sustained demand for xylanase in this sector, as producers seek to maximize output and reduce costs.

The bioenergy segment is projected to be the fastest-growing application segment as xylanase facilitates the breakdown of lignocellulosic biomass into fermentable sugars, improving bioethanol and other renewable fuel production. This efficiency supports global renewable energy targets and sustainability mandates.

Growing policy incentives and increasing investments in bioenergy infrastructure are driving wider adoption of xylanase in this sector, creating expanding opportunities for enzyme manufacturers in the renewable energy market.

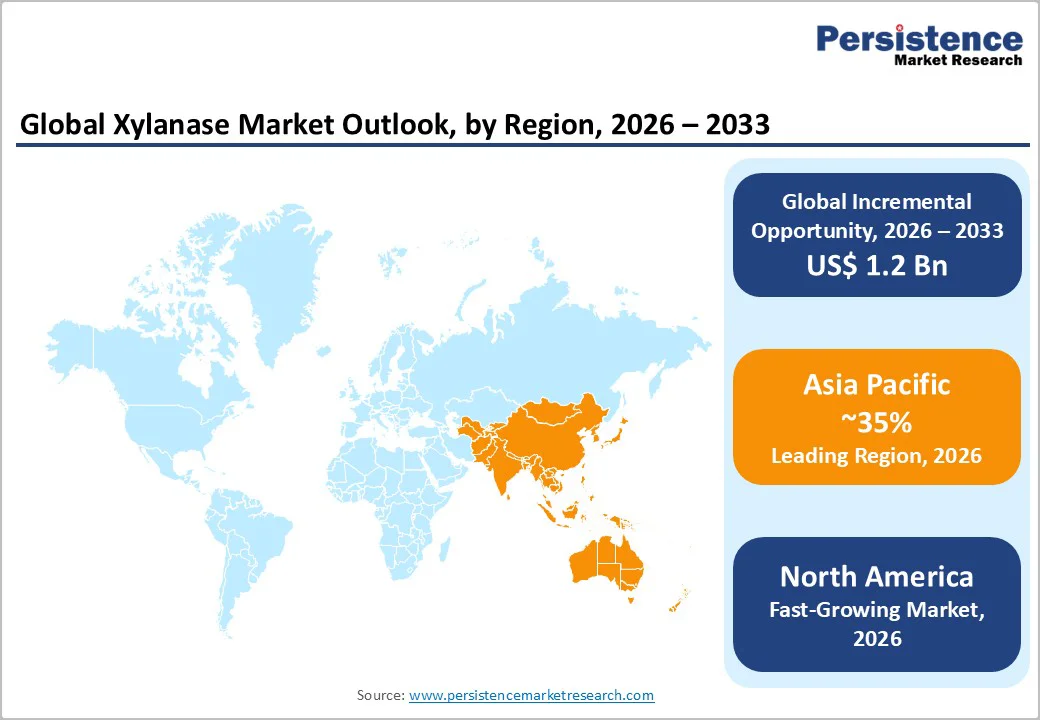

North America is anticipated to be the fastest-growing region in the xylanase market in 2026, fueled by animal-nutrition and food-processing industries, well-established regulatory frameworks, and strong R&D infrastructure.

The region’s feed-enzyme market benefits from widespread adoption of enzyme supplementation in poultry and swine feed, helping improve feed efficiency, nutrient absorption, and gut health under modern livestock practices. Clean-label trends in baking and food processing drive xylanase demand as a natural additive that enhances dough stability, processing, and product quality.

The shift toward sustainable, enzyme-based solutions in feed and food production, driven by regulatory pressure, environmental priorities, and the need for greater efficiency, is accelerating xylanase adoption. In the broader feed enzyme category, including xylanase and other carbohydrases, multi-enzyme blends and heat-stable formulations are becoming increasingly popular, helping mills and producers improve feed conversion and optimize energy utilization.

Europe remains a significant market, due to strong uptake across feed, food-processing, and pulp & paper industries. The region benefits from strict environmental and food-safety regulations, including sustainable-production mandates and a push for antibiotic-free feed, which encourages the use of natural, enzyme-based solutions instead of chemical additives.

In particular, Germany, France, and the U.K. represent major markets with well-developed food and feed sectors and a growing demand for clean-label, sustainable products.

In Europe, xylanase adoption is increasing as feed producers move away from prophylactic antibiotics; these enzymes help sustain feed efficiency and support animal health without relying on antibiotics. Rising feed-grain costs are also driving livestock and poultry producers to incorporate xylanase to enhance nutrient digestibility and minimize feed waste.

On the industrial front, xylanase use is expanding across the pulp and paper, food-processing, and bakery sectors, supported by sustainability initiatives and growing clean-label consumer expectations.

Asia Pacific is expected to lead the global xylanase market with an estimated 35% share in 2026, driven by strong demand in animal feed and food processing across key countries such as China, India, and those in Southeast Asia.

The rapid expansion of intensive poultry, swine, and aquaculture farming, supported by rising consumption of meat, dairy, and fish, is increasing the need for enzyme-supplemented feed to enhance digestibility, nutrient absorption, and feed conversion efficiency. The region’s growing processed-food and bakery industries are also boosting xylanase use for dough improvement and filtration.

Asia Pacific’s expanding biofuel, pulp and paper, and broader industrial sectors, combined with heightened environmental and sustainability awareness, are opening new opportunities for xylanase adoption. Manufacturers are also scaling fermentation capacity and developing stable, high-performance xylanase variants tailored to regional requirements, supporting strong growth across the feed, food, industrial, and bioenergy segments.

The global xylanase market exhibits a moderately fragmented structure, driven by diverse regional producers, specialty biotech firms, and rising demand across food, feed, and industrial applications. Mid-tier and local producers, especially in Asia Pacific, coexist with large multinationals, creating a competitive landscape where innovation, customization, and regional supply chains matter. With key leaders including Novozymes, DuPont (Danisco), DSM, BASF, and AB Enzymes.

These players compete through rapid R&D, tailored formulations, thermo- and pH-stable xylanase, strategic partnerships with feed mills and bioenergy firms, and expanding manufacturing footprints, especially in Asia Pacific, to shorten lead times and cut costs.

Patent activity and enzyme engineering, e.g., Novozymes’ feed xylanase developments, reinforce differentiation, while regulatory approvals and application trials (feed conversion, pulp bleaching, baking) drive commercial adoption.

The xylanase market is valued at US$1.5 billion in 2026 and expected to reach US$2.7 billion by 2033, reflecting robust growth.

Growing demand for animal feed, driven by rising consumption of meat, poultry, and dairy products, which increases the need to improve feed efficiency, nutrient digestibility, and animal growth performance through xylanase supplementation.

The animal nutrition segment currently leads the market, driven by improving poultry and swine nutrition and supporting antibiotic-free trends.

Asia Pacific leads the market with around 35% share, driven by China’s manufacturing dominance, growing food and feed demand, lower costs, relaxed regulations, and ASEAN bioenergy opportunities.

Opportunities lie in the rapid expansion of biofuel production, where xylanase enables efficient breakdown of lignocellulosic biomass into fermentable sugars, boosting ethanol yields, reducing processing costs, and supporting global renewable-energy targets.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author