ID: PMRREP20779| 221 Pages | 12 Jan 2026 | Format: PDF, Excel, PPT* | Consumer Goods

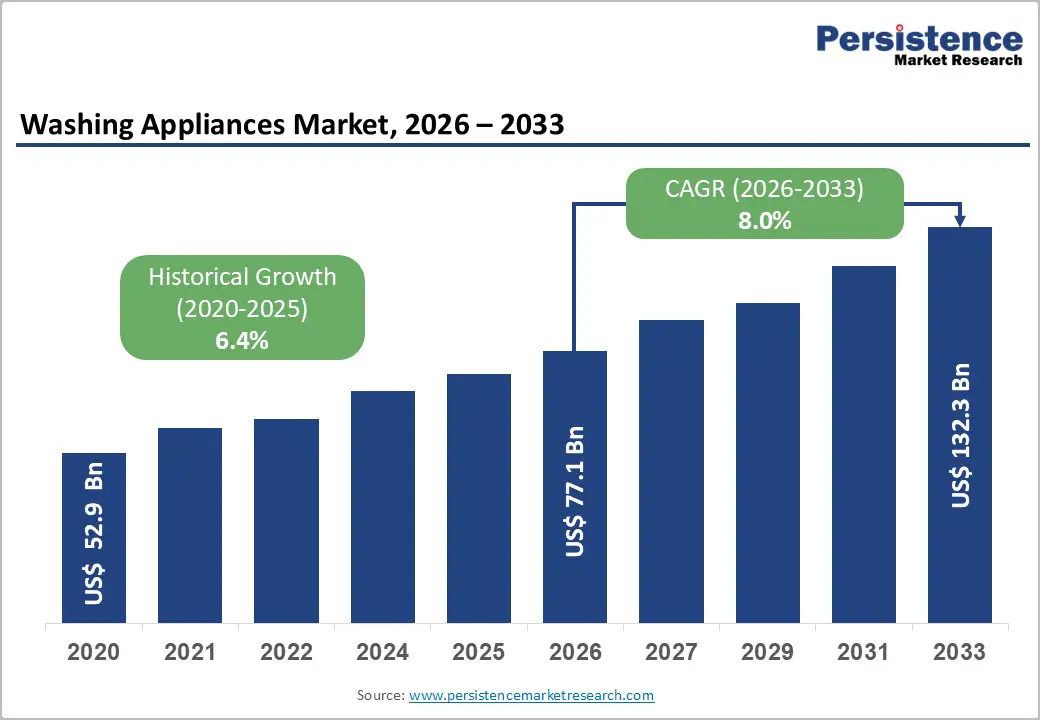

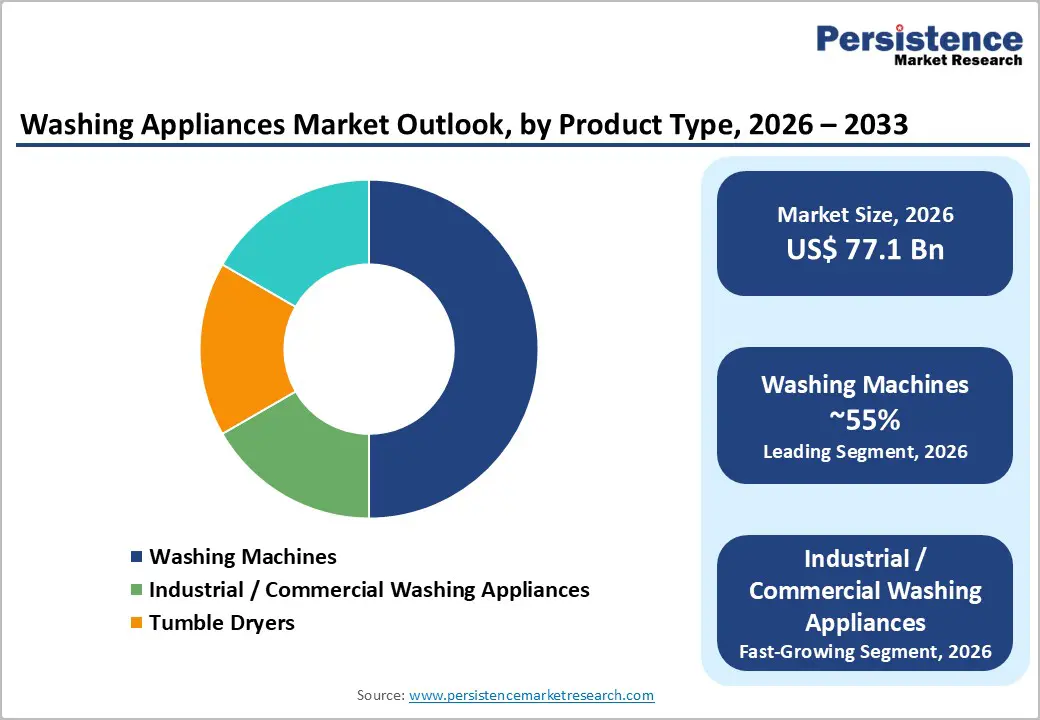

The global Washing Appliances Market size was valued at US$ 77.1 Billion in 2026 and is projected to reach US$ 132.3 Billion by 2033, growing at a CAGR of 8.0% between 2026 and 2033. Market expansion is driven by accelerating urbanization across developing economies, rising disposable incomes supporting appliance adoption, and technological advancement in energy-efficient and smart-connected washing solutions. Washing machines command market dominance through universal household penetration, while industrial/commercial laundry equipment demonstrates fastest growth driven by hospitality sector expansion. The convergence of sustainability mandates, IoT integration enabling remote monitoring, and demographic shifts toward dual-income household structures creates sustained adoption momentum throughout the forecast period.

| Global Market Attributes | Key Insights |

|---|---|

| Washing Appliances Market Size (2026E) | US$ 77.1 Bn |

| Market Value Forecast (2033F) | US$ 132.3 Bn |

| Projected Growth (CAGR 2026 to 2033) | 8.0% |

| Historical Market Growth (CAGR 2020 to 2025) | 6.4% |

Urbanization and Rising Middle-Class Consumer Base in Developing Economies

Global urbanization momentum continues accelerating, with 1.5 billion individuals transitioning from rural to urban environments between 2020-2033, establishing fundamental demand for labor-saving household appliances including washing machines. India's urban migration demonstrates particular significance, with rural-to-urban transition accelerating at 2.3% annually, fundamentally reshaping consumer behavior toward modern appliance adoption supporting time-constrained lifestyles. The Washing Appliances Market directly benefits from middle-class household expansion in Asia-Pacific regions, as emerging market consumers prioritize labor-saving technologies addressing dual-income household requirements. China's urbanization reaching 65% penetration by 2026 establishes saturating first-time adoption patterns, compelling manufacturers to focus on premium feature development and replacement-cycle management. Southeast Asian markets including Vietnam, Indonesia, and Thailand demonstrate high-growth trajectories, with household appliance penetration doubling from 12% to 24% between 2020-2026 supporting robust market expansion. African emerging markets represent nascent opportunity zones, with household appliance adoption commencing from minimal baseline penetration supporting long-term market expansion potential. Government infrastructure development initiatives supporting rural electrification expand addressable customer bases, particularly in India and Southeast Asia where electricity access improvements unlock washing machine adoption potential.

High Energy Consumption Concerns and Premium Product Cost Barriers in Price-Sensitive Markets

Consumer sensitivity to energy consumption and premium pricing for advanced washing appliances creates market penetration barriers, particularly in emerging markets where price considerations dominate purchase decisions over efficiency features. Conventional washing machines, consuming 3-4 kWh per cycle, create utility cost concerns among price-conscious households, limiting premium smart-appliance adoption in developing markets where average monthly utility costs represent 8-12% of household expenditure. Initial capital investment requirements for advanced models, particularly front-load machines commanding 20-30% pricing premiums compared to conventional top-load alternatives, create affordability barriers limiting the addressable market within lower-income consumer segments.

Aftermarket Services and Connected Device Ecosystem Revenue Streams

Smart washing machine ecosystem development creates substantial opportunity for recurring subscription-based revenue streams extending beyond initial product sale economics. Predictive maintenance service subscriptions leveraging IoT sensor data enable proactive equipment replacement recommendations and service scheduling, establishing aftermarket revenue opportunities for manufacturers and authorized service providers. Detergent auto-replenishment services, enabled through IoT connectivity and machine learning algorithms, create consumer lock-in mechanisms supporting brand loyalty while establishing consumables-focused revenue streams. Diagnostic data analytics provided to laundry operators supporting equipment optimization and capacity planning create value-added service revenue opportunities supporting commercial-segment customer retention.

Washing Machines Dominate Market While Industrial Laundry Appliances Drive Rapid Growth Globally

The washing appliances market, by product type, is clearly led by washing machines, which are expected to account for over 55% of total market share by 2026. Their dominance is supported by near-universal household adoption across both developed and emerging economies, high compatibility with existing residential infrastructure, and long-standing consumer familiarity. The segment includes fully automatic front-load and top-load models, semi-automatic systems, and manual machines, enabling manufacturers to address a wide range of income levels, lifestyle preferences, and regional requirements. Continuous investments in automation, energy efficiency, water optimization, and smart features have strengthened the competitive position of washing machines. By 2026, global production is projected to exceed 90 million units annually, creating a robust manufacturing ecosystem that supports economies of scale, cost efficiency, and sustained technological innovation.

In contrast, industrial and commercial washing appliances represent the fastest-growing segment, registering a CAGR of 9.1%. Growth is primarily driven by the rapid expansion of hospitality, healthcare facilities, and organized commercial laundry services seeking high-capacity, reliable, and efficient solutions. Rising capital expenditure on modernizing laundry operations underscores this trend. The US$4.83 billion IPO valuation of Alliance Laundry Systems in 2024 highlights strong investor confidence, while LG Electronics’s December 2024 launch of advanced 30-kilogram professional washers with heat pump technology reflects growing manufacturer focus on this high-growth segment.

Automatic Dominance and Semi-Automatic Growth Shape the Washing Machine Technology Landscape Globally

Automatic washing machine technology leads the global market, accounting for over 60% of total share by 2026, driven by superior washing performance, minimal user intervention, and enhanced convenience. Fully automatic machines align well with modern lifestyle preferences, particularly in urban households where time efficiency and ease of use are key purchase drivers. Consumers across both developed and emerging economies increasingly prefer these machines due to features such as programmable wash cycles, energy efficiency, and integrated drying options. Their premium positioning compared to semi-automatic models has not restrained demand, as rising disposable incomes and growing acceptance of smart home appliances continue to support strong adoption. This dominance reflects a broader shift away from labor-intensive manual washing toward convenience-oriented household solutions.

In contrast, semi-automatic washing machines represent the fastest-growing technology segment, expanding at a CAGR of 8.9%. Growth is primarily fueled by price-sensitive consumers in developing regions who prioritize affordability and operational flexibility over full automation. Semi-automatic machines allow manual control over washing and rinsing processes, making them suitable for areas with inconsistent water supply and power constraints. Manufacturers are also focusing on incremental efficiency improvements and durability enhancements in this segment, enabling cost reductions without sacrificing affordability. As a result, semi-automatic machines maintain strong relevance and growth potential in emerging markets, complementing the overall expansion of the washing appliances market.

Front-Load Dominance and Rapid Top-Load Growth Reshape Global Washing Appliances Market

The washing appliances market, when segmented by loading type, highlights a clear contrast between established dominance and emerging growth momentum. Front-load washing machines lead the global market, accounting for over 65% of total share by 2026. Their leadership is driven by superior operational efficiency, including 21–30% lower power consumption and nearly 40% reduced water usage compared to conventional alternatives. In addition, compact designs that support stackable installations and higher spin extraction efficiency reducing drying time make front-load machines especially attractive for urban households. Sustainability-focused consumer preferences in developed regions further strengthen adoption. Europe, in particular, demonstrates the highest penetration, with front-load machines representing approximately 70.1% of the regional market, reflecting strong regulatory emphasis on energy efficiency and environmentally responsible appliance usage.

In contrast, top-load washing machines represent the fastest-growing segment, registering a projected CAGR of 9.3%. Growth is primarily supported by affordability, ease of use, and shorter wash cycles that appeal to cost-sensitive and convenience-driven consumers. Emerging economies, especially in the Asia-Pacific region, account for 55.54% of top-load demand, driven by middle-income households. Ongoing advancements in high-efficiency top-load technology are also addressing water-consumption concerns, enhancing competitiveness and sustaining long-term growth.

6 to 8 Kg Dominance and Rising Demand for Larger Washing Capacities

Capacity-based segmentation in the washing appliances market highlights clear leadership and emerging growth patterns aligned with changing household dynamics and consumer preferences. The 6–8 kg capacity segment dominates the market, accounting for over 40% share in 2026, primarily due to its strong alignment with average household sizes of two to three members. These machines offer an optimal balance between functionality, efficiency, and affordability, making them suitable for standard laundry requirements. In Europe, this dominance is even more pronounced, with nearly 46.8% of washing machine sales concentrated in the 6–8 kg range, reflecting prevalent household demographics and a preference for practical, cost-effective appliance solutions. The mid-range positioning of this capacity ensures broad market appeal by meeting performance expectations without imposing high purchase costs, thereby maximizing addressable demand.

Meanwhile, the 8–10 kg capacity segment is emerging as the fastest-growing category, registering a robust CAGR of around 9.0%. This growth is driven by expanding household sizes in emerging economies, the rise of dual-income families, and increasing consumer inclination toward fewer, consolidated laundry cycles. In India, in particular, average drum capacities are steadily exceeding 8 kg as household incomes rise and lifestyle expectations evolve. Manufacturers are actively enhancing large-capacity models with advanced features, reinforcing growth opportunities among increasingly sophisticated middle-class consumers.

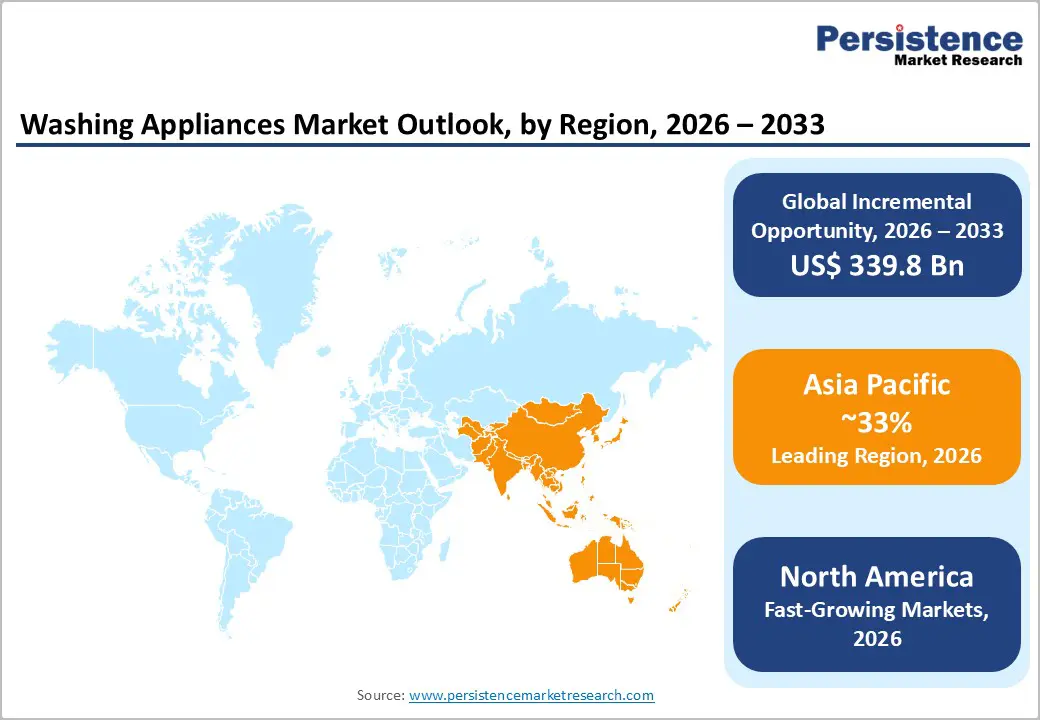

Asia-Pacific accounts for nearly 40% of global washing appliances market share and represents the fastest-growing regional market, supported by strong structural and economic fundamentals. India stands out as the fastest-expanding national market, registering a projected CAGR of 13.76% through 2030, while China continues to dominate regional volumes due to its mature manufacturing base and extensive consumer penetration. Rapid urbanization, coupled with accelerated infrastructure development and rising female workforce participation, is reshaping household priorities and increasing demand for time-saving home appliances across urban and semi-urban areas.

Growth is further reinforced by steady rural-to-urban migration of approximately 2.3% annually, which is expanding the core addressable consumer base. Large-scale rural electrification programs are unlocking previously underserved regions, while government-led housing initiatives increasingly promote appliance standardization, supporting bulk procurement and commercial sales. Rising disposable incomes among the emerging middle class are also encouraging adoption of feature-rich and technologically advanced washing machines.

From a regulatory perspective, energy-efficiency mandates in China and smart infrastructure initiatives in India are accelerating demand for premium and connected appliances. Regionally, competitive intensity remains high, with China’s Haier and Hisense leading in volume, while LG Electronics and Samsung compete through innovation, premium positioning, and localized manufacturing strategies.

North America accounts for approximately 28% of the global washing appliances market, supported by mature appliance penetration, high consumer disposable incomes, and strong technological leadership. The region demonstrates a clear shift toward premium and high-efficiency products, particularly in the United States, where front-load washing machines have emerged as the primary growth segment. Consumer preference for advanced performance, water efficiency, and fabric care has enabled manufacturers such as Electrolux Group to outperform broader market averages through strategic positioning in energy-efficient and premium appliance categories.

Market growth is largely driven by appliance replacement cycles, as aging units are replaced with technologically advanced models offering improved efficiency and durability. Adoption of smart washing machines continues to accelerate, fueled by the integration of IoT connectivity, AI-based load optimization, and remote monitoring features that enhance user convenience. Regulatory frameworks further reinforce this trend, with EPA water consumption standards, DOE energy efficiency regulations, and expanded ENERGY STAR certifications encouraging continuous innovation and higher-value product development.

The competitive landscape remains concentrated, led by Whirlpool, LG Electronics, Samsung, GE Appliances, and Electrolux. Meanwhile, direct-to-consumer sales models and niche players like Speed Queen are diversifying distribution channels and strengthening commercial segment growth.

The Global Washing Appliances Market demonstrates consolidated market structure with significant concentration among established multinational manufacturers. Leading players including Whirlpool, LG Electronics, Samsung Electronics, Electrolux, Haier, and Arçelik control 45-50% of global market revenue, establishing competitive advantages through technology innovation, global distribution infrastructure, and manufacturing scale. Secondary-tier competitors including Bosch/Siemens, Miele, IFB, and regional manufacturers compete through specialized technology focus, premium positioning, and emerging market localization strategies. This consolidated-with-regional-competitor structure reflects substantial barriers to entry in appliance manufacturing combined with differentiation opportunities through technology innovation and geographic market positioning.

Key Industry Developments

| Report Attributes | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis Units | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

| Customization and Pricing | Available upon request |

By Product Type

By Technology

By Loading Type

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author