ID: PMRREP32342| 190 Pages | 6 Jan 2026 | Format: PDF, Excel, PPT* | Healthcare

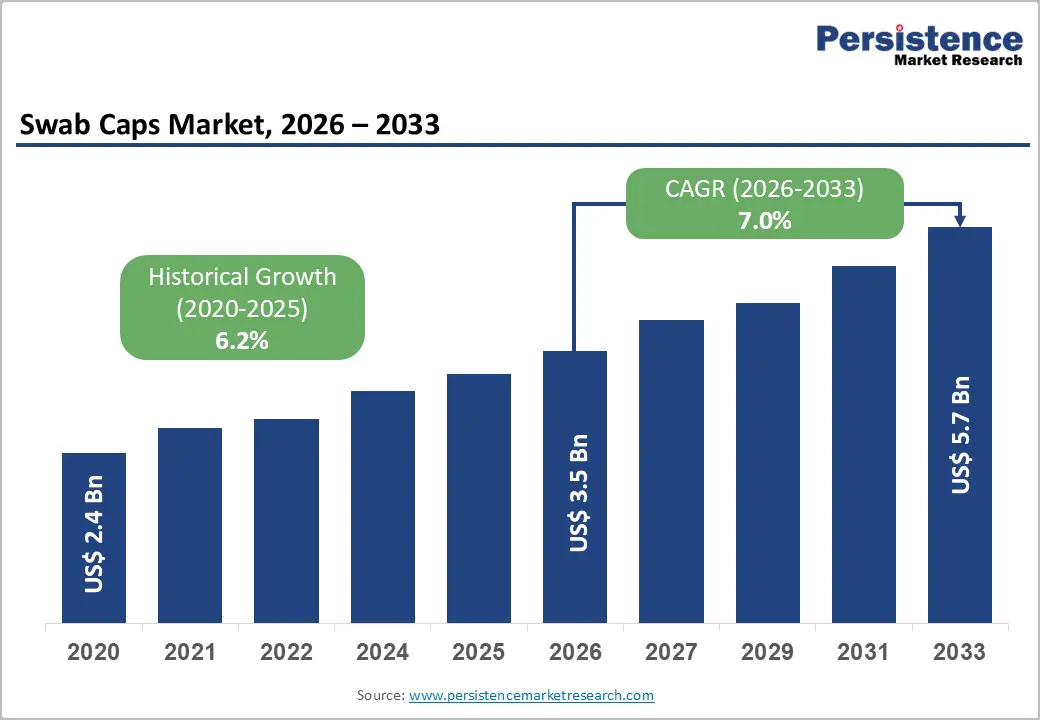

The global swab caps market is estimated to grow from US$ 3.5 Bn in 2026 to US$ 5.7 Bn by 2033. The market is projected to record a CAGR of 7.0% from 2026 to 2033.

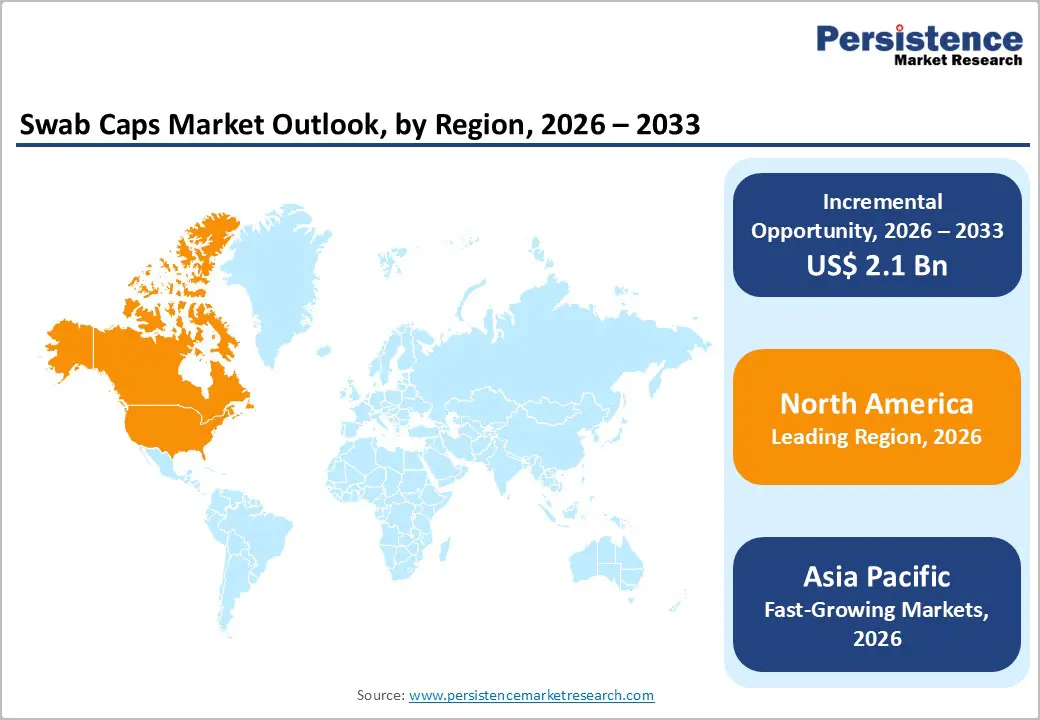

The swab caps market is growing steadily, driven by rising focus on infection prevention, heightened awareness of hospital-acquired infections, and widespread use of IV access devices. North America leads due to strict infection control protocols and advanced healthcare infrastructure, while Asia-Pacific is expanding rapidly, supported by growing healthcare investments, improving hospital standards, and rising adoption across emerging clinical settings.

| Report Attribute | Details |

|---|---|

|

Global Swab Caps Market Size (2026E) |

US$ 3.5 Bn |

|

Market Value Forecast (2033F) |

US$ 5.7 Bn |

|

Projected Growth (CAGR 2026 to 2033) |

7.0% |

|

Historical Market Growth (CAGR 2020 to 2025) |

6.2% |

Driver – Rising focus on preventing hospital-acquired infections (HAIs), particularly catheter-related bloodstream infections

Hospital-acquired infections (HAIs) remain a major concern for healthcare systems worldwide and are a key driver for the swab caps market. Government health data indicate that in the United States, nearly 1 in 31 hospitalized patients acquires at least one HAI on any given day. Bloodstream infections account for roughly 10% of all HAIs, with a large proportion linked to the use of central venous catheters and other intravascular devices. These infections significantly increase patient morbidity, length of hospital stay, and treatment costs, prompting hospitals to prioritize standardized, evidence-based infection prevention practices, including effective disinfection of catheter hubs and needleless connectors.

Catheter-related bloodstream infections pose an even greater challenge in high-risk settings such as intensive care units and dialysis centers. A report on public hospital data from emerging economies found central line-associated bloodstream infection rates exceeding 8 per 1,000 central line days, underscoring the persistent risk associated with frequent line access. In the U.S. alone, thousands of such infections are considered preventable each year, contributing to billions of dollars in avoidable healthcare costs. As governments and public health agencies emphasize zero-tolerance policies for preventable HAIs, hospitals increasingly adopt tools like swab caps to ensure consistent, reliable catheter disinfection and compliance with infection control protocols.

Restraints – Higher cost of sterile, pre-moistened swab caps compared to conventional manual disinfection methods

Sterile, pre-moistened swab caps and similar ready-to-use disinfection consumables generally incur higher per-unit costs than conventional manual cleaning supplies, such as alcohol swabs or wipes. For example, basic alcohol prep pads are often priced at only a few cents per piece in high-volume hospital procurement, whereas sterile, specialized disinfection caps command higher prices due to added manufacturing steps (sterilization, packaging, integrated disinfectant), specialized materials, and regulatory compliance requirements. Even basic antiseptic preparations, such as chlorhexidine or alcohol handrub solutions, can cost hospitals $0.72% per day in modestly sized facilities, which is higher than simple soap or nonmedicated solutions, illustrating how enhanced infection control products increase operational costs on a large scale. This cost differential can constrain purchasing decisions, particularly for facilities operating on tight budgets.

These cost differences are amplified in resource-limited settings and among smaller healthcare providers where budget allocations for infection control are limited. Data show that many low-income hospitals allocate less than 5% of their operating budgets to infection prevention infrastructure, making it challenging to adopt higher-cost consumables. In such environments, administrators may favor traditional manual disinfection methods or basic wipes despite their variable efficacy because they are significantly less expensive up front. The upfront cost barrier to purchasing sterile, pre-moistened swab caps thus remains a restraint on market growth, as facilities must balance the immediate financial outlay against the long-term infection control benefits, often under constrained funding and reimbursement structures.

Opportunity – Expanding adoption of swab caps in home healthcare, outpatient, and ambulatory care settings

The expanding use of home healthcare and outpatient services presents a clear opportunity for the swab caps market because more patients receive intravenous therapies and vascular access outside traditional hospital settings. In the United States, the number of home health agencies has steadily increased, with more than 12,000 agencies providing care to roughly 5 million patients annually, many of whom require IV antibiotics, hydration, or chronic disease management. As care shifts to homes and ambulatory clinics, maintaining aseptic access becomes crucial. Unlike controlled hospital environments, these settings often exhibit greater variability in technique, making standardized products such as swab caps valuable for consistent infection control.

Outpatient infusion centers and ambulatory care facilities are also proliferating. National health data indicate that visits to ambulatory care settings account for hundreds of millions of encounters each year, with a significant portion involving injections, infusions, or catheter access for chemotherapy, biologics, and supportive care. These environments historically relied on manual cleaning with swabs or wipes, which can be inconsistent. Swab caps offer a simple, single-step disinfection solution that fits high-throughput workflows, enhances compliance with aseptic technique, and reduces the risk of access-related infections. As utilization of outpatient and home-based clinical services grows, the need for reliable, easy-to-use disinfection tools expands concurrently.

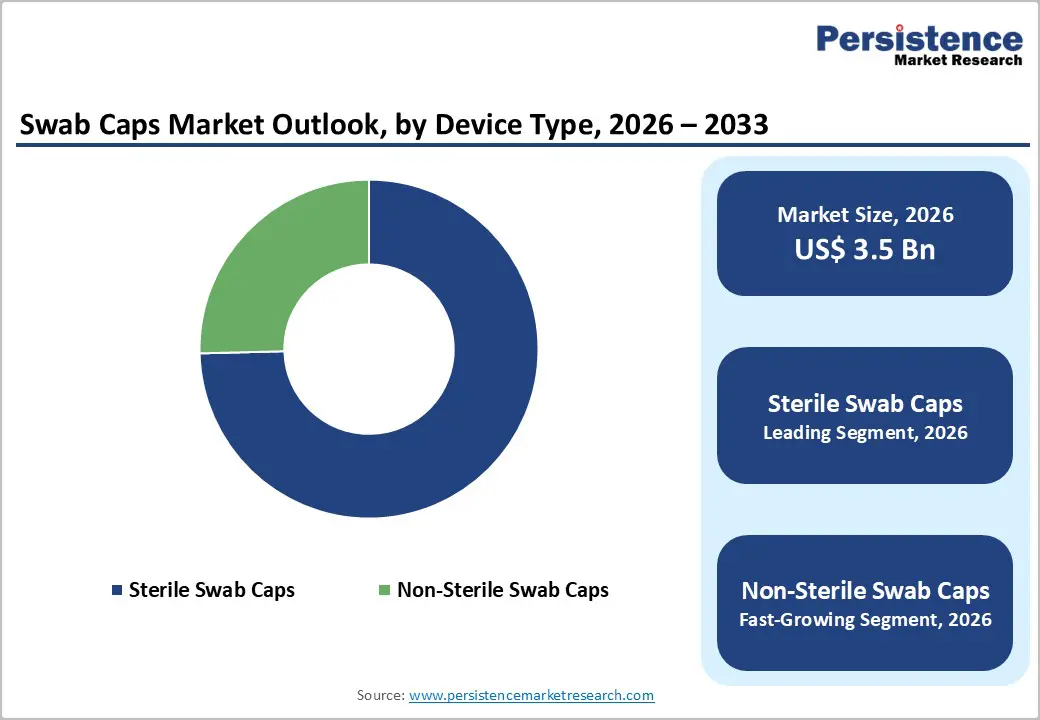

By Product, Sterile Swab Caps Dominate the Swab Caps Market

Sterile swab caps dominates with 75.1% share of the global market in 2025, because they directly address stringent infection control requirements in clinical environments where bloodstream infections and catheter-related infections are a major safety focus. Government health data show that central line-associated bloodstream infections (CLABSIs) affect thousands of patients annually, and prevention guidelines emphasize the use of sterile techniques and devices to reduce these events. Sterile consumables reduce the risk of introducing pathogens during vascular access, as even brief contamination can lead to serious infection. In U.S. hospitals, HAI surveillance programs report that strict adherence to sterile protocols can significantly lower infection rates, reinforcing demand for sterile products over non-sterile options. Additionally, accreditation standards for hospitals often mandate the use of sterile supplies in high-risk procedures, further entrenching sterile swab caps as the preferred product.

By Application, Infection Control dominates, driven by preventing bloodstream infections and ensuring hospital safety

Infection control dominates the swab caps market because preventing healthcare-associated infections (HAIs) is a central priority for patient safety and quality care worldwide. Government health surveillance data indicate that HAIs affect roughly 1 in 31 hospitalized patients at any given time, with bloodstream infections accounting for a significant proportion of morbidity and cost. Central line-associated bloodstream infections (CLABSIs) and other access-related infections are directly linked to contamination during catheter use, prompting national guidelines that emphasize aseptic technique and standardized disinfection practices. Swab caps provide a consistent, sterile barrier that simplifies hub decontamination and improves compliance versus manual methods. Given that reducing HAIs is tied to reimbursement and accreditation outcomes in many health systems, infection control remains the primary application driving swab cap adoption across acute and ambulatory care settings.

North America Swab Caps Market Trends

North America dominates the swab caps market with a 44.7% share in 2025, driven by strict infection control protocols and high utilization of vascular access devices. Data from the CDC indicate that approximately 250,000 central line-associated bloodstream infections (CLABSIs) occur annually in U.S. hospitals, contributing to thousands of preventable deaths and substantial healthcare costs. Hospitals implement sterile consumables, including swab caps, to reduce these infections and comply with regulatory standards. The region’s advanced healthcare infrastructure, high hospital density, and focus on quality metrics ensure widespread adoption of evidence-based infection prevention practices. Additionally, outpatient infusion and home healthcare services are expanding, further driving the demand for standardized, sterile swab caps to maintain aseptic technique and patient safety.

Europe Swab Caps Market Trends

Europe is an important region in the swab caps market because healthcare-associated infections (HAIs) remain a significant burden on patient safety and costs, driving sustained demand for effective disinfection products. Recent public health data estimate that about 4.3 million patients in acute care hospitals across the EU and European Economic Area acquire at least one HAI each year, with bloodstream infections among the most frequent serious complications. The prevalence of HAIs in European hospitals is around 7?% of patients during their stay, indicating persistent infection risks despite ongoing control efforts. European health systems also face high treatment costs and extended hospital stays due to HAIs, with related expenses consuming up to 6?% of public hospital budgets. These figures underscore the critical need for standardized infection prevention tools such as swab caps to support aseptic practice and improve patient outcomes in European healthcare settings.

Asia-Pacific Swab Caps Market Trends

Asia Pacific is the fastest-growing region in the swab caps market due to the rapid expansion of healthcare services, rising healthcare spending, and increasing focus on infection prevention. World Bank data show that health expenditure in countries like China and India has grown significantly over the past decade, with China’s health spending reaching over 6% of GDP and India’s per capita health expenditure steadily increasing, reflecting greater investment in clinical care infrastructure. Hospitalization rates are also rising as populations age and chronic diseases increase, driving demand for vascular access procedures and associated infection control products. Additionally, several Asia-Pacific countries report higher rates of healthcare-associated infections than developed regions, reinforcing the urgency of standardized disinfection practices. These dynamics create strong momentum for swab cap adoption across both urban and rapidly developing rural healthcare settings.

Leading applications in the swab caps market focus on infection control, catheter hub disinfection, and prevention of bloodstream infections. Sterile swab caps ensure aseptic access for IV lines, needleless connectors, and vascular devices. High adoption in hospitals, outpatient clinics, and home healthcare drives growth, while standardized, pre?moistened designs improve compliance, safety, and workflow efficiency.

Key Industry Developments:

The global swab caps market is projected to be valued at US$ 3.5 Bn in 2026.

Rising infection prevention focus, increased catheter use, stringent regulations, and healthcare infrastructure expansion drive market growth.

The global swab caps market is poised to witness a CAGR of 7.0% between 2026 and 2033.

Expansion in home healthcare, outpatient settings, eco-friendly caps, pre-moistened designs, and emerging market adoption.

3M Company, BD (Becton, Dickinson and Company), ICU Medical, Inc., Medline Industries, LP, Smiths Medical (part of ICU Medical), Greiner Bio-One International GmbH.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2025 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product

By Application

By End User

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author