ID: PMRREP33537| 220 Pages | 12 Dec 2025 | Format: PDF, Excel, PPT* | Consumer Goods

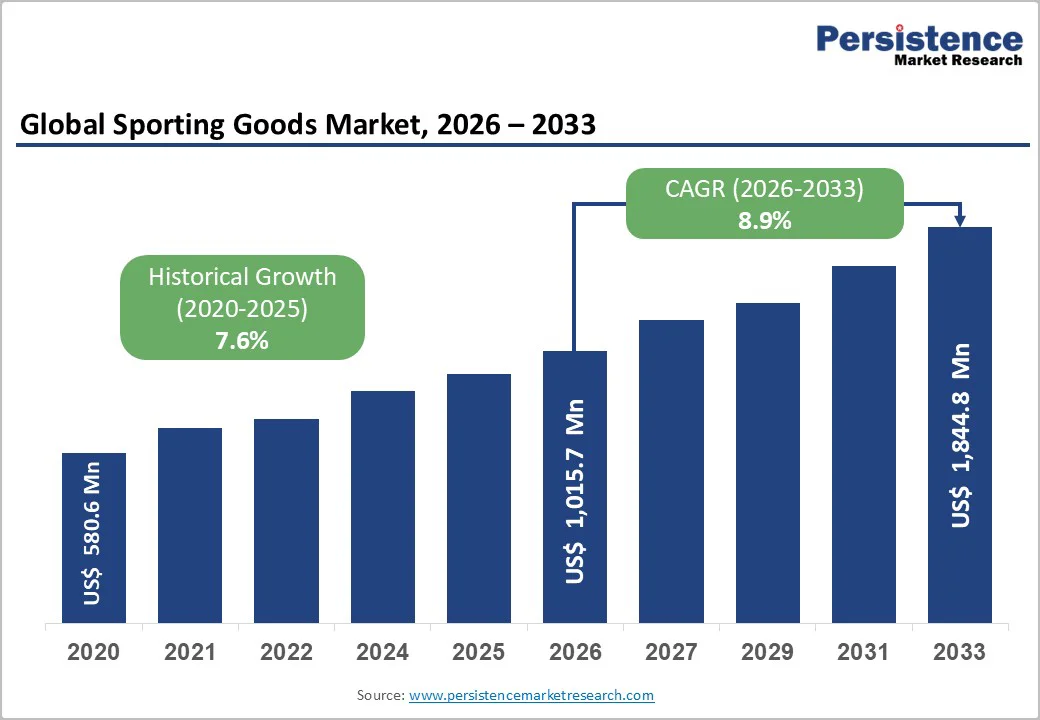

The global sporting goods market size is likely to be valued at US$1,015.7 million in 2026 and is projected to reach US$1,844.8 million by 2033, growing at a CAGR of 8.9% between 2026 and 2033.

Sports equipment, including golf clubs, soccer gear, and tennis rackets, accounted for 25% to 28% of the total market. E-commerce also accounted for a significant share of sporting goods sales in 2022 and is projected to grow at a CAGR of around 9% by 2025, driven by rising smartphone usage and digital platforms.

| Key Insights | Details |

|---|---|

| Sporting Goods Market Size (2026E) | US$ 1,015.7 Mn |

| Market Value Forecast (2033F) | US$ 1,844.8 Mn |

| Projected Growth (CAGR 2026 to 2033) | 8.9% |

| Historical Market Growth (CAGR 2020 to 2024) | 7.6% |

The popularity of sports, both amateur and professional, has grown in recent years. As participation in sports activities rises, it has triggered the urgency for sporting items such as equipment, footwear, and apparel. Outdoor recreational pursuits such as hiking, camping, cycling, and water sports have seen a rise in popularity during the pandemic, as users seek better ways to exercise and enjoy leisure activities.

In 2023, companies such as Oru Kayak, which specializes in foldable kayaks, and Red Paddle Co., known for their inflatable paddleboards, introduced more user-friendly and portable options to cater to new outdoor adventurers.

Technological innovations are another major growth driver for the sporting goods market. Advances in materials, design, and functionality have led to the development of performance-enhancing sports equipment and gear. For example, lightweight, durable materials like carbon fiber and advanced polymers have revolutionized products such as tennis rackets, bicycles, and running shoes, offering enhanced performance and comfort.

Wearable technology, such as fitness trackers and smart clothing, has gained widespread adoption, enabling users to monitor and optimize their physical activity. These advancements improve athletic performance and attract a broad audience, including tech-savvy consumers interested in integrating fitness into their daily routines.

The continuous evolution of smart, connected sporting goods is likely to drive further growth in the market, as more people seek data-driven ways to improve their physical performance. In 2024, companies such as Wilson developed smart basketballs and tennis rackets equipped with embedded sensors to track performance metrics, including shot accuracy, spin rate, and speed.

Consumers’ preferences change quickly, especially with the rise of social media and influencer marketing. Companies struggle to keep up with shifting trends and preferences, affecting their ability to produce and promote consumer-friendly products. To avoid this risk, businesses should invest in market research to keep track of current trends and collaborate closely with influencers and social media platforms.

The sporting goods industry is also vulnerable to creating and selling counterfeit items, which can weaken customer trust in authentic brands and impact product sales. Counterfeit items can also represent a safety concern to consumers who are unaware they are acquiring a counterfeit product, as these products may not meet safety regulations or go through necessary quality control inspections, thereby putting consumers in danger.

Integrating digital technology and Internet of Things (IoT) into sporting goods presents a transformative opportunity. Connected sports equipment, such as smart basketballs, tennis rackets, and even smart clothing, allows athletes to track their performance data in real-time.

This fusion of physical sports equipment with digital tracking and analytics offers tremendous growth potential as more amateur and professional consumers demand data-driven insights to enhance their skills and fitness levels.

Products like Wilson’s Smart Basketball or Babolat Play Smart Tennis Rackets have sensors embedded that track metrics such as ball speed, spin rate, shot accuracy and more. Paired with apps, these products provide users with performance breakdowns and tailored recommendations.

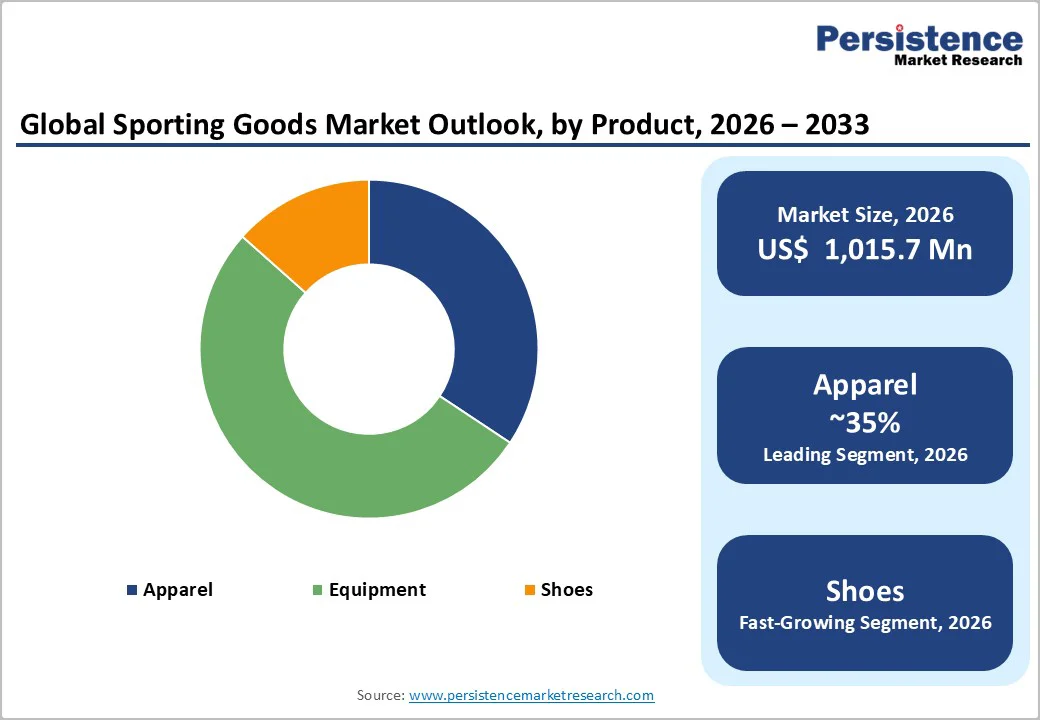

Based on product type, the market is further divided into apparel, equipment, and shoes. Among these, apparel is dominant and expected to expand at a CAGR of 7.5% by 2033. It encompasses apparel and accessories designed to enhance the comfort, performance, and style of athletes and fitness enthusiasts across various sports and physical activities.

Companies in this sector continually innovate by introducing novel technologies, materials, and designs to meet the distinct needs and preferences of individuals engaged in various sports and exercise routines. The advent of athleisure wear, which combines sports performance qualities with casual styling, has broadened the market and blurred the distinction between sports apparel and everyday fashion.

Based on sales channel, the market is classified into distributors, supermarkets, specialty stores, online stores, and independent stores. Sales of sporting goods through independent sports stores are projected to grow at a notable CAGR over the forecast period. Independent sports stores play an important role in enhancing the variety and accessibility of sports-related products.

Independent sports stores cater to niche markets by focusing on specific sports or recreational activities and offering specialized equipment for soccer, tennis, golf, cycling, hiking, and water sports. Specializing allows sports stores to provide a tailored and curated range of merchandise, catering directly to enthusiasts of specific sports.

This specialization makes independent sports stores a compelling sales channel choice for consumers. Soccer gear accounts for particularly high sales since it is the most popular sport globally.

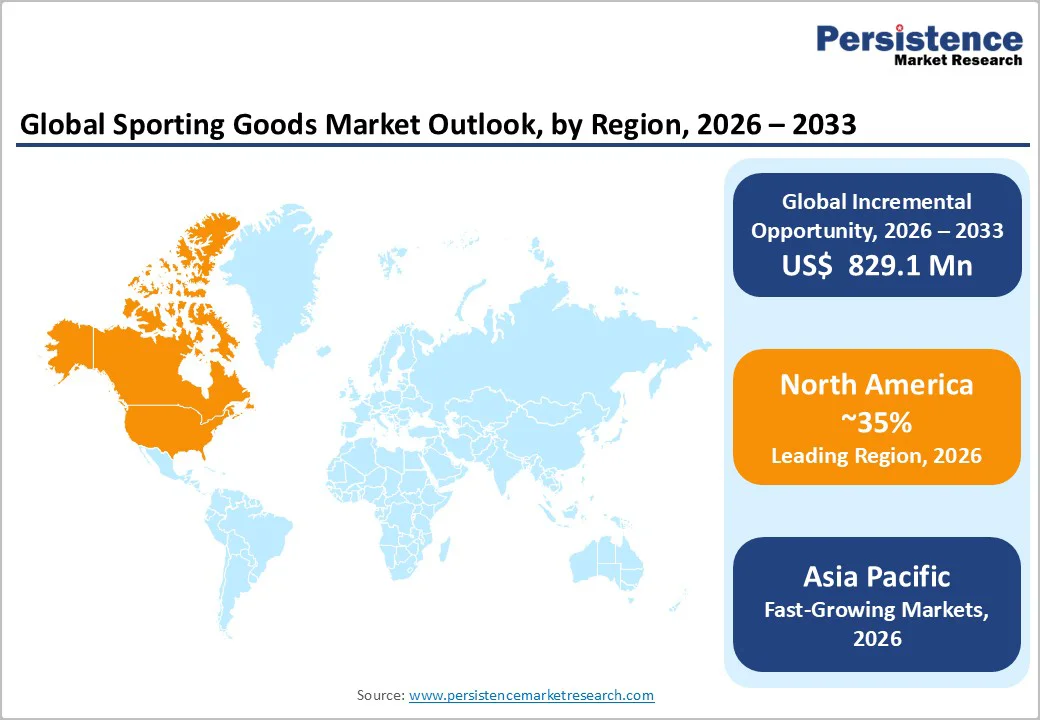

North America is the dominant region due to a high level of sports participation across various disciplines, from professional leagues to recreational activities. The U.S. is home to several leading sporting goods manufacturers such as Nike, Under Armour, and New Balance, which drive both domestic sales and the international market.

The growing trend of fitness and wellness, coupled with the increasing popularity of athleisure wear, has boosted the demand for sports apparel and equipment. Additionally, a robust distribution network of online and physical retail outlets enhances consumer accessibility.

The region benefits from high consumer spending on premium sporting goods, especially in well-established sports leagues. Moreover, government initiatives promoting physical activity and healthy lifestyles have encouraged the adoption of sports products, making North America a key player in the sporting goods market.

Europe represents approximately 22% of the global sporting goods market with a projected expansion to USD 315 million by 2033 at approximately 8.1% CAGR. Germany dominates the European market (approximately 35% of the European market value), driven by its manufacturing heritage and premium consumer positioning.

The United Kingdom, France, and Spain follow with comparable market dynamics; the Nordic countries demonstrate premium market positioning with the highest per-capita sporting goods spending globally.

The European Union's regulatory framework emphasizes sustainability and circular economy principles; the EU Circular Economy Action Plan and upcoming Extended Producer Responsibility (EPR) directives create compliance requirements that drive innovation in sustainable materials and take-back programs.

GDPR compliance requirements for consumer data in e-commerce platforms create operational complexity but a competitive advantage for compliant vendors. European consumers demonstrate sustainability consciousness, with approximately 58% considering environmental factors in purchasing decisions, supporting premium positioning for sustainable brands.

Asia Pacific represents approximately 25% of the global sporting goods market, with a projected expansion to USD 410 million by 2033, reflecting a 16% CAGR that substantially exceeds the global average (9.1%).

The region demonstrates the highest absolute growth velocity, reflecting rapid income growth, emerging middle-class participation in sports, and manufacturing ecosystem dominance. China commands approximately 40% of the Asia-Pacific market value, India is the fastest-growing country market at 19% CAGR, while Japan maintains mature market dynamics comparable to developed Western markets.

China's market shows concentration in urban population centers, with growing secondary-city expansion. China's sporting goods exports rose 44% year-on-year in 2024, indicating manufacturing momentum. Yiwu, a manufacturing hub, accounts for approximately 65% of global sporting goods exports.

India represents the fastest-growing market, demonstrating mass-market affordability dynamics; rising middle-class sports participation (cricket dominance, emerging fitness culture), government infrastructure investment, and e-commerce accessibility drive a 19% CAGR.

The competitive landscape of the sporting goods market is characterized by established global brands and innovative newcomers. Key players include Nike, Adidas, Under Armour, Puma, and Decathlon, dominating the market with extensive product portfolios, strong brand equity, and vast distribution networks. These companies leverage advanced technology, sustainability initiatives, and celebrity endorsements to maintain market share.

New entrants and niche brands such as Lululemon in activewear and Babolat in smart sports equipment focus on innovation and specialized products to capture targeted consumer segments. E-commerce growth has also intensified competition, with brands like Amazon and Alibaba expanding their offerings in sporting goods. The market is highly competitive, driven by innovation, technological integration, and evolving consumer preferences.

The Sporting Goods market is estimated to be valued at US$ 1,015.7 Mn in 2026.

The key demand driver for the Sporting Goods market is the rising global focus on health, fitness, and active lifestyles.

In 2026, the North America region will dominate the market with an exceeding 35% revenue share in the global Sporting Goods market.

Among the Product Type, Apparel holds the highest preference, capturing beyond 32.3% of the market revenue share in 2026, surpassing other Product type.

The key players in Sporting Goods are Adidas AG, Nike, Inc., Under Armour, Inc. and PUMA SE.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2026 - 2033 |

| Market Analysis Units | Value: US$ Mn, Volume: Units |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Solution

By Sales Channel

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author