ID: PMRREP27382| 190 Pages | 9 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

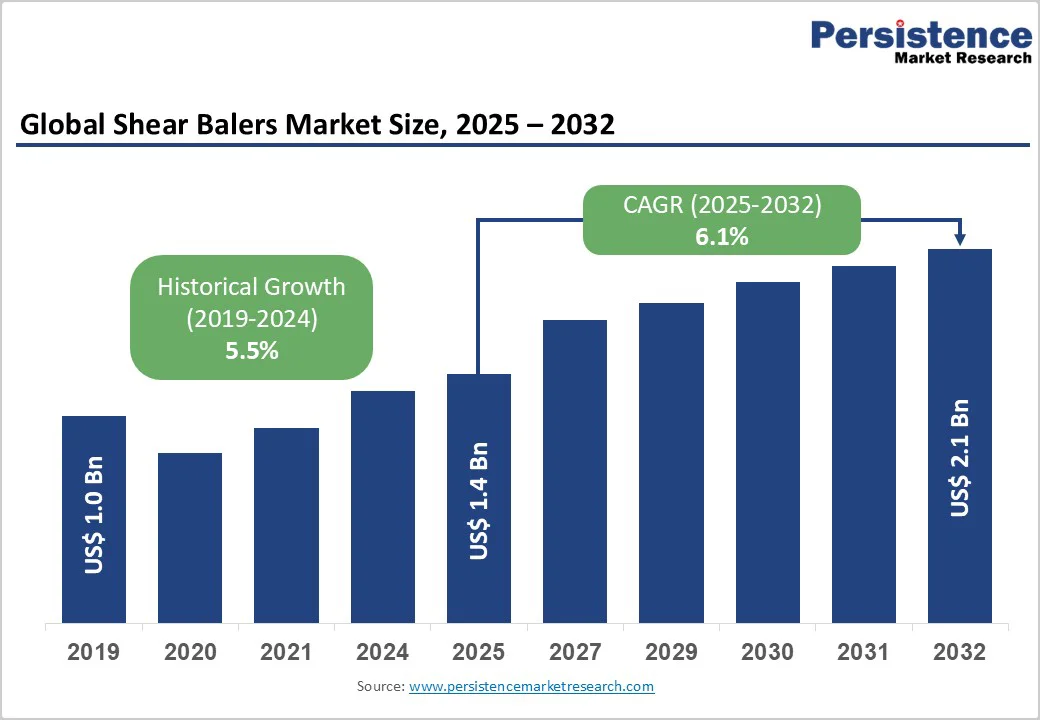

The global shear balers market size is likely to be valued US$1.4 Billion in 2025, expected to reach US$2.1 Billion by 2032 with achieving at a CAGR of 6.1% during the forecast period from 2025 to 2032 driven by increasing demand for efficient scrap metal recycling, rising focus on sustainable waste management, and advancements in automated baling technologies. The sector is further propelled by innovations in energy-efficient and automated shear balers, catering to preferences for cost-effective and environmentally friendly solutions.

| Key Insights | Details |

|---|---|

|

Shear Balers Market Size (2025E) |

US$1.4 Bn |

|

Market Value Forecast (2032F) |

US$2.1 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.5% |

Rising Demand for Scrap Metal Recycling and Sustainable Waste Management

Rising demand for scrap metal recycling and sustainable waste management is a major driver of growth in the global shear balers market. Industrialization, urbanization, and increasing construction and manufacturing activities have led to significant volumes of metal scrap, including steel, aluminum, and other alloys. Efficient processing of these materials is critical for reducing environmental impact, conserving natural resources, and supporting circular economy initiatives. Automatic balers play a vital role by compacting scrap into dense, transportable bales, facilitating efficient storage, handling, and transportation to recycling facilities.

Sustainability goals and stricter environmental regulations worldwide are accelerating the adoption of recycling technologies. Governments and municipalities are implementing policies that encourage industries to minimize landfill waste and optimize recycling practices. This has heightened demand for advanced baling equipment that is energy-efficient, automated, and capable of processing large volumes of scrap with minimal labour. The metal recycling sector, in particular, is capitalizing on rising global steel and aluminum consumption, as recycled materials reduce production costs and carbon emissions.

High Initial Costs and Maintenance Requirements

High initial costs and maintenance requirements remain significant challenges in the global automatic balers market, influencing adoption rates across industries. Shear balers, especially high-capacity and automated units, require substantial upfront investment due to advanced components, precision engineering, and integration of automation or electric-powered systems. For small- and medium-sized enterprises, this high capital expenditure can be a barrier, limiting access to the latest technologies despite potential long-term operational efficiencies.

Maintenance requirements further contribute to the total cost of ownership. Regular servicing is necessary to ensure hydraulic systems, electric motors, cutting blades, and control systems function optimally. Wear and tear from continuous processing of metals, plastics, and other hard materials can lead to unexpected downtime, affecting productivity and increasing operational expenses. In addition, spare parts for advanced or customized balers are often costly and may require specialized technicians for installation or repair.

Advancements in Automation and Electric-Powered Balers

Advancements in automation and electric-powered technology are transforming the global shear balers market, enabling higher efficiency, precision, and sustainability in recycling operations. Automated hydraulic balers integrate sophisticated control systems, sensors, and programmable logic controllers (PLCs) to streamline the baling process, reduce human intervention, and minimize operational errors. These systems allow for consistent compression of various waste materials, including metals, plastics, and paper, while optimizing cycle times and throughput. Automation also enhances workplace safety by reducing the need for manual handling of heavy or hazardous scrap materials.

Electric-powered shear balers are increasingly replacing traditional hydraulic or diesel-driven units, driven by the need for energy efficiency and reduced environmental impact. Electric systems consume less energy, have lower operating costs, and produce minimal noise and emissions, aligning with stricter regulatory standards and corporate sustainability goals. The combination of electric power with automation enables precise control over pressure, stroke, and bale size, improving output quality and operational reliability.

Product Type Insights

Stationary dominates the market, accounting for 45% of the market share in 2025. Its dominance is driven by high-capacity processing for large-scale recycling facilities. hese fixed units efficiently compact metals, plastics, and other materials, optimizing storage and transportation. Their robust design, consistent performance, and suitability for continuous operations make them essential for industrial recycling plants and major waste management centers.

Mobile is the fastest-growing segment, driven by increasing demand for on-site scrap processing in construction and demolition projects. These portable units allow efficient compaction of metals and other recyclables directly at job sites, reducing transportation costs and handling time. Their flexibility, speed, and ease of deployment make them ideal for dynamic industrial and recycling operations.

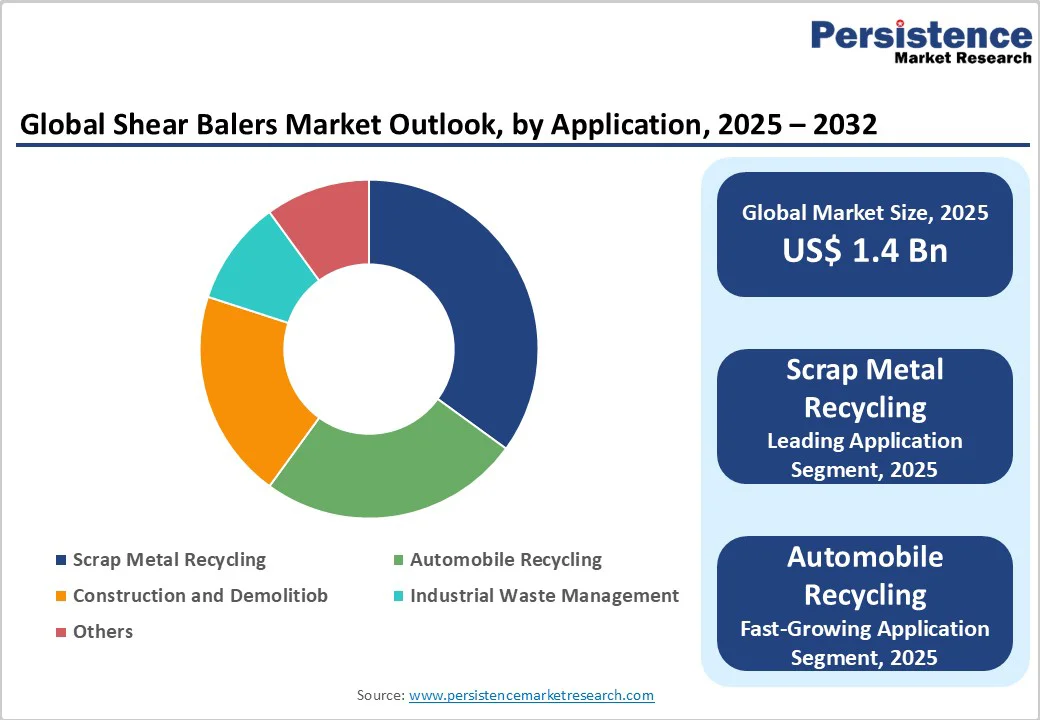

Application Insights

Scrap Metal Recycling leads with over 40% share, driven by growing demand for steel and aluminium recycling. Industrial expansion and rising construction and manufacturing activities generate large scrap volumes, necessitating efficient baling solutions. High-capacity and automated hydraulic balers improve processing speed, reduce labour costs, and enable compact storage and transport, supporting sustainable and cost-effective metal recycling operations.

Automobile Recycling is the fastest-growing, driven by the rising volume of end-of-life vehicles. Efficient dismantling and recycling of metals, plastics, and other components requires high-capacity balers to streamline operations. Adoption of automated and energy-efficient systems enhances processing speed, reduces labor, and supports sustainable practices, meeting increasing regulatory and environmental demands in the automotive recycling industry.

Operation Mode Insights

Automatic holds nearly 50% share, valued for their precision and speed in high-volume recycling operations. By automating the baling process, these systems reduce manual labor, enhance safety, and increase throughput. They efficiently handle diverse waste streams, from metals to plastics, enabling recycling plants to optimize space, cut operational costs, and maintain consistent, reliable performance.

Electric Operation is the fastest-growing, fueled by rising demand for energy-efficient solutions and stricter emission regulations. These machines reduce electricity consumption, minimize carbon footprint, and lower operational costs compared to hydraulic or diesel alternatives. Industries adopting electric balers benefit from cleaner, quieter operations while meeting sustainability and regulatory compliance requirements in modern recycling and waste management.

End-use Insights

Metal Recycling Companies hold over 50% share. They rely on these machines to efficiently process large volumes of scrap metal, compacting materials into transportable bales. This improves storage, logistics, and overall operational efficiency. High-capacity and automated hydraulic balers enable faster throughput, lower labor costs, and support sustainable recycling practices in the metal industry.

Waste Management Companies are the fastest-growing, driven by increasing municipal and industrial waste contracts. Rising urbanization and industrial activities generate large volumes of recyclable materials, prompting companies to adopt efficient baling solutions. Automated and high-capacity automatic balers enable faster processing, reduce labor costs, and improve transportation efficiency, making them essential for modern waste management operations.

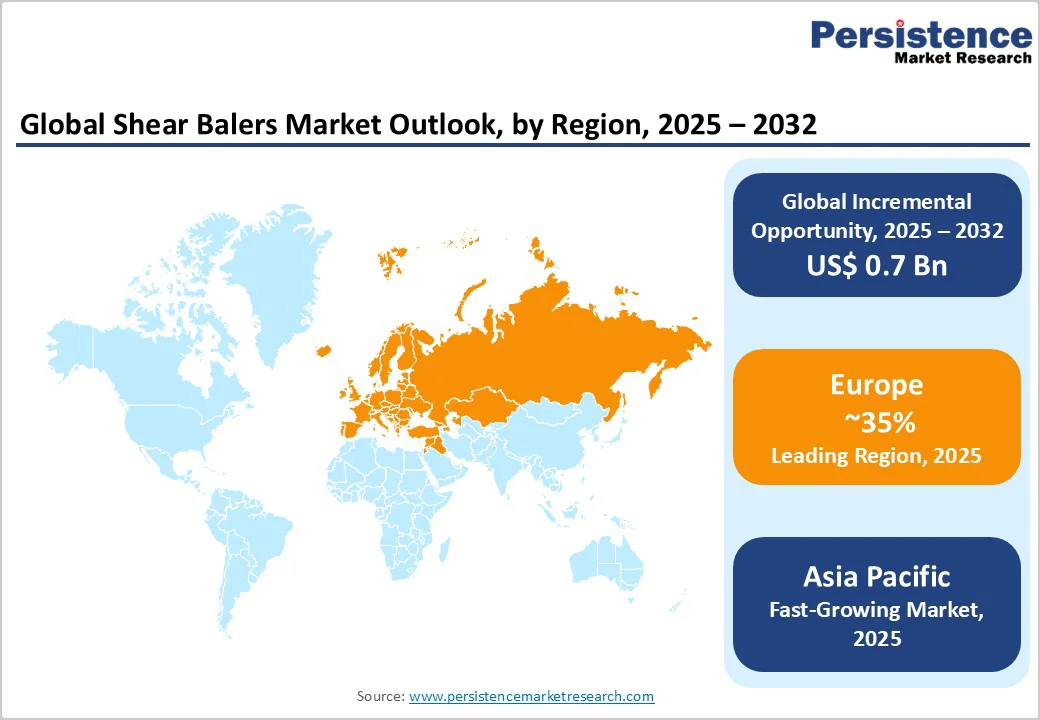

Europe Shear Balers Market Trends

Europe holds about 35% market share, led by Germany and France, which have well-established industrial infrastructures and advanced recycling practices. Stringent European Union (EU) policies promoting a circular economy play a pivotal role in shaping market demand. These regulations encourage industries to reduce waste, enhance resource efficiency, and adopt sustainable recycling processes, directly increasing the need for efficient baling equipment.

Germany, known for its strong steel and automotive sectors, demonstrates high recycling rates, particularly in metal processing. Efficient hydraulic balers are essential for compacting scrap metal, facilitating transportation, and optimizing recycling operations, aligning with environmental goals and cost-effectiveness. Similarly, France has implemented extensive recycling programs and waste management initiatives, encouraging the adoption of automated and energy-efficient balers.

North America Shear Balers Market Trends

North America accounts for 30% in 2025, driven by significant investments in recycling infrastructure in the United States and stringent regulations from the Environmental Protection Agency (EPA) promoting sustainable waste management practices. Rising urbanization, industrial activities, and the increasing volume of scrap materials have heightened the need for efficient, automated baling solutions. Automatic balers help compact metals, plastics, and other recyclable materials, improving transportation efficiency and reducing operational costs, making them essential for modern recycling facilities.

The United Kingdom, while part of Europe, exhibits similar growth dynamics. Rising recycling targets set by the Department for Environment, Food & Rural Affairs (DEFRA) are encouraging businesses and municipal facilities to adopt advanced baling equipment. Automated hydraulic balers are increasingly preferred in U.K. scrap yards and recycling centers due to their ability to handle large volumes, improve operational safety, and reduce manual labour requirements.

Asia Pacific Shear Balers Market Trends

Asia Pacific commands around 25% share and is the fastest-growing region, propelled by China’s scrap metal imports and India’s industrial growth driving demand for efficient balers. This has created a strong demand for efficient hydraulic balers capable of processing large volumes of scrap metal into compact, transportable bales, enabling streamlined recycling operations and cost-effective logistics.

India’s industrial sector is also witnessing robust growth, with rising production across automotive, construction, and packaging industries. This surge in industrial output generates significant volumes of recyclable waste, further driving the adoption of automated and energy-efficient shear balers. Additionally, government initiatives promoting sustainable waste management and recycling practices are encouraging industries to invest in advanced baling equipment.

The global shear balers market is highly competitive, driven by the increasing need for efficient waste management and recycling solutions. Key players in the market, including Danieli Centro Recycling, Lefort Group, Sierra International Machinery, and Metso Outotec, are focusing on technological innovations such as automation to enhance operational efficiency, reduce manual intervention, and minimize errors in baling processes. Automation not only improves throughput but also allows for better handling of diverse waste streams, including metals, plastics, and paper.

Energy efficiency is another critical focus area, as manufacturers aim to reduce operational costs and comply with stricter environmental regulations. Advanced hydraulic and electric systems are being integrated to optimize power consumption while maintaining high performance. Global expansion strategies are also prominent, with companies establishing manufacturing facilities and service centers in emerging markets such as Asia-Pacific and Latin America, where urbanization and industrialization are driving higher waste generation.

Key Developments

The global shear balers market is projected to reach US$ 1.4 Billion in 2025, driven by efficient scrap recycling solutions.

The industry is growing demand for efficient scrap metal recycling and sustainable waste management, fueled by industrial expansion, urbanization, and stricter environmental regulations.

The sector is poised to witness a CAGR of 6.1% from 2025 to 2032, supported by automation and electric baler innovations

Expansion in electric and automated shear balers offers opportunities for energy-efficient recycling in industrial applications.

Danieli Centro Recycling, LEFORT Group, Metso Outotec, JMC Recycling, and Sierra lead through innovations in automated shear balers.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By Operation Mode

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author