ID: PMRREP30661| 175 Pages | 8 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

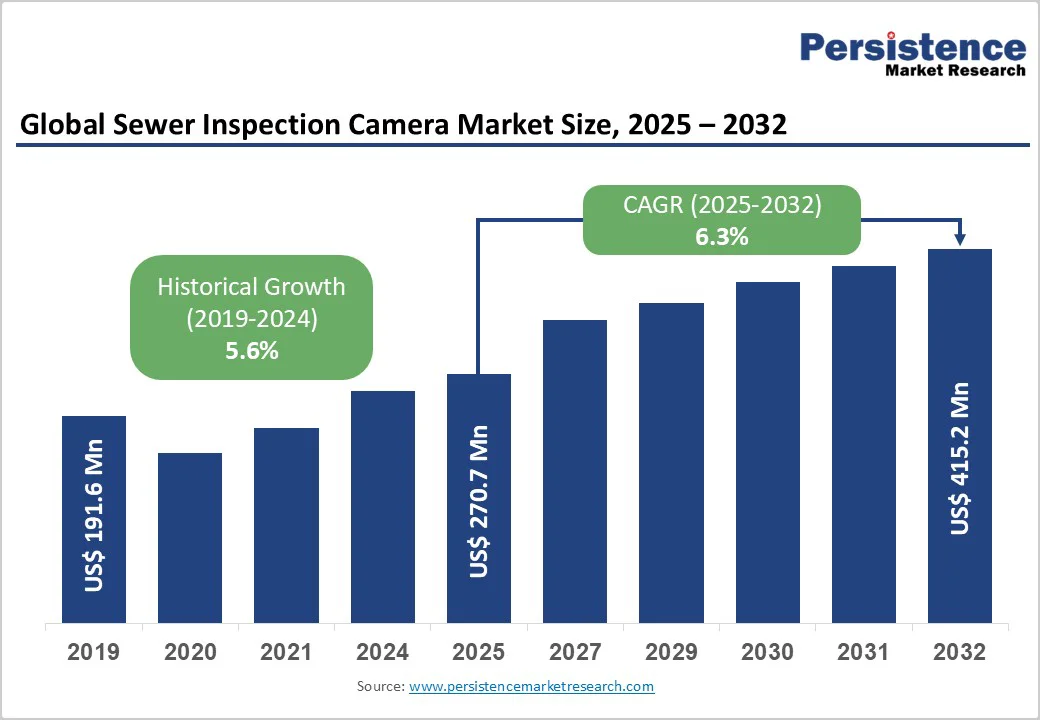

The global sewer inspection camera market size is likely to be valued at US$270.7 Million in 2025, growing to US$415.2 Million by 2032 at a CAGR of 6.3% during the forecast period from 2025 to 2032.

The market is experiencing robust growth driven by the increasing emphasis on aging infrastructure maintenance, rising demand for non-destructive inspection technologies in urban sewer systems, and advancements in high-resolution imaging and AI integration.

The need to proactively detect pipe defects, leaks, and blockages to prevent costly repairs and environmental hazards has significantly boosted the adoption of drain cameras across municipal and industrial applications, particularly in developed and emerging economies.

The market is further propelled by innovations in wireless and self-propelled systems, catering to preferences for efficient, remote monitoring solutions. The growing acceptance of drain cameras as cost-effective alternatives to manual inspections, especially for underground pipelines and drainage networks, is a key driver of growth.

| Global Market Attribute | Key Insights |

|---|---|

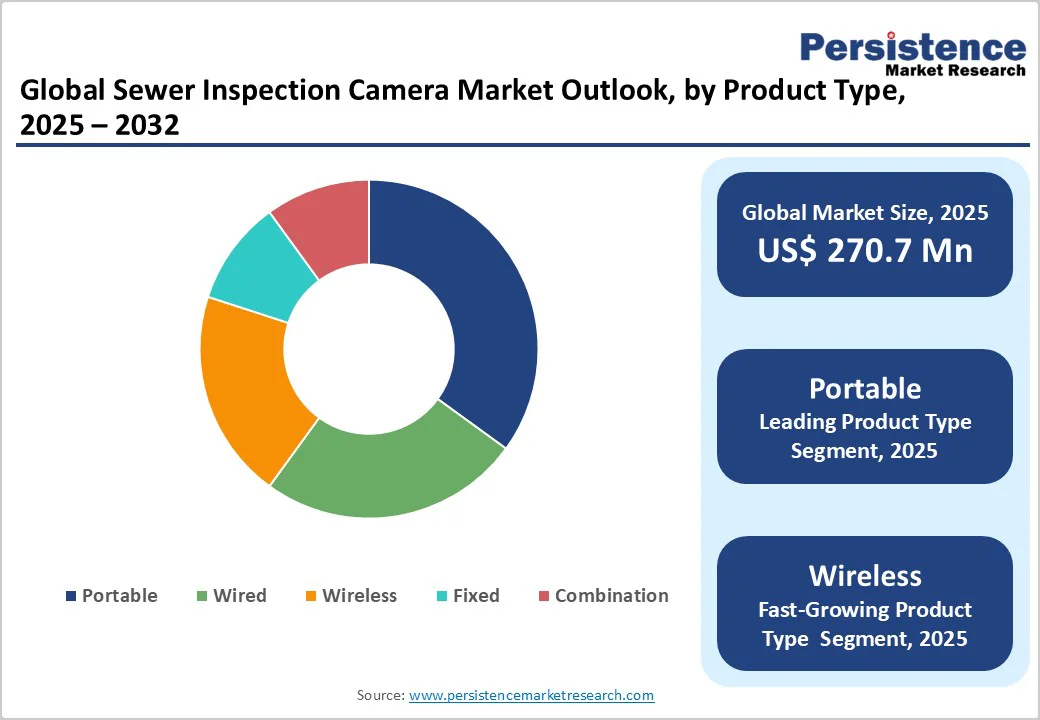

| Sewer Inspection Camera Market Size (2025E) | US$270.7 Mn |

| Market Value Forecast (2032F) | US$415.2 Mn |

| Projected Growth (CAGR 2025 to 2032) | 6.3% |

| Historical Market Growth (CAGR 2019 to 2024) | 5.6% |

The increasing urbanization and aging sewer infrastructure globally are primary drivers of the sewer inspection camera market. Urban populations are projected to reach 68% of the global total by 2050, up from 55% in 2018, necessitating extensive maintenance of resilient wastewater systems. This surge creates substantial demand for non-invasive inspection tools to combat water ingress and overflows, which cause significant economic and environmental damage.

CCTV drain cameras, equipped with HD imaging and LED lighting, provide real-time visuals with over 95% accuracy in defect detection, reducing excavation needs by up to 70% and enabling timely repairs. For instance, systems from companies such as Envirosight LLC have demonstrated 80% faster inspections in municipal projects, supporting regulatory compliance and preventing contamination.

In the U.S., with over 800,000 miles of public sewer lines averaging high ages, the demand for efficient diagnostics is critical, backed by EPA initiatives and global investments in infrastructure totaling trillions by 2030. This continues to propel the sewer inspection camera market forward, particularly in regions with high urban density, such as the Asia Pacific and North America.

The high initial costs and need for skilled operators associated with pipeline cameras pose a significant restraint on market growth. While effective, advanced systems with AI and wireless features can cost US$10,000-50,000 per unit, adding 15-25% to maintenance budgets and deterring adoption in budget-constrained municipalities. Deployment requires certified training, with shortages leading to up to 30% operational inefficiencies in emerging markets.

Regulatory compliance for safety and data accuracy adds expenses, often exceeding US$20,000 per project. For example, USA Borescopes' implementations have faced delays due to certification hurdles, increasing costs by 20%. Smaller service providers struggle against giants such as Envirosight LLC, limiting penetration in residential segments where manual methods prevail.

Advancements in smart city projects and AI-integrated robotic systems present significant growth opportunities for the CCTV drain camera market. Self-propelled crawlers with AI analytics enable automated defect recognition, improving detection rates to 98% and reducing manual labor by 60%. For instance, companies such as MyTana are investing in cloud-connected cameras, with trials showing 75% faster reporting.

Modular designs cut deployment costs by 30%, and IoT integration boosts remote monitoring. As urbanization drives trillions in infrastructure investment across the Asia Pacific by 2030, these opportunities are set to fuel expansion in high-growth regions such as North America and Europe.

Portable dominates the market, expected to account for approximately 45% of the share in 2025. Its dominance is driven by versatility in on-site use, lightweight design, and compatibility with various pipe sizes, making it essential for quick residential and commercial inspections.

Wireless is the fastest-growing segment, fueled by demand for cable-free operations and real-time data transmission. Its integration with mobile apps supports remote diagnostics, with rapid adoption in municipal and industrial settings.

High-Resolution Cameras lead with over 50% share, favored for their ability to capture fine details such as cracks, corrosion, and blockages, even in low-light conditions. Their superior image clarity enables accurate condition assessments, supporting effective maintenance and repair planning. This precision makes them highly preferred by utility companies and municipalities managing critical wastewater infrastructure.

Wide Field of View is the fastest-growing, driven by the need for comprehensive inspection of larger pipelines. Advanced lens technologies now enable coverage up to 120 degrees, allowing operators to capture more of the pipe interior in a single pass. This innovation enhances inspection efficiency, reduces operational time, and improves defect detection accuracy.

Remote-Controlled Deployment holds nearly 40% share, valued for enhancing safety in confined or hazardous spaces. They allow precise navigation through bends and complex pipelines, reducing the need for human entry. By minimizing risk while extending inspection reach, these systems improve operational efficiency and enable accurate monitoring of extensive sewer networks.

Self-Propelled Cameras are the fastest-growing, driven by automation and efficiency trends. Equipped with robotic propulsion, these cameras can independently traverse pipelines up to 500 meters, making them ideal for long municipal sewer lines. Their advanced mobility reduces manual intervention, enhances inspection accuracy, and supports predictive maintenance in extensive wastewater networks.

Municipalities dominate with a 50% share, using these systems extensively for large-scale pipeline monitoring, maintenance, and rehabilitation. They play a crucial role in ensuring wastewater infrastructure efficiency and meeting environmental regulations. Growing urbanization and government mandates for sustainable sanitation further drive the adoption of advanced inspection technologies in municipal operations.

Industrial Companies are the fastest-growing, driven by strict safety and environmental regulations. The chemical, oil, and gas industries increasingly use these systems to detect leaks, monitor pipelines, and ensure regulatory compliance. Advanced inspection technologies help prevent costly spills and enhance operational safety in hazardous industrial environments.

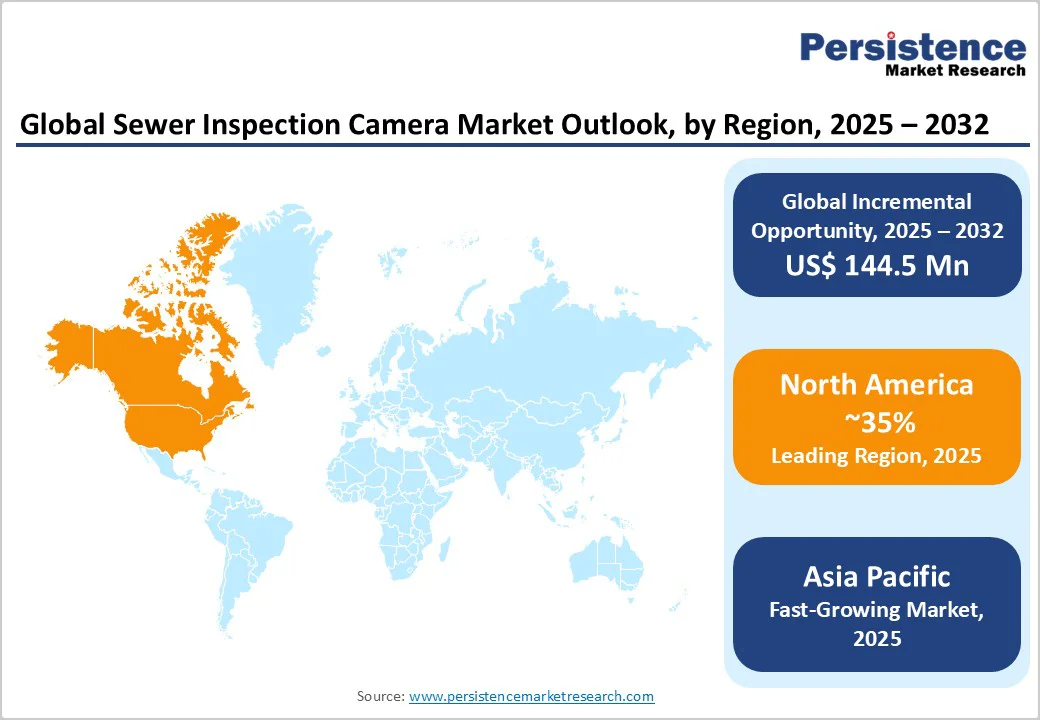

North America accounts for 35% in 2025, driven by aging wastewater infrastructure and stringent environmental regulations. The U.S. and Canada collectively operate over 800,000 miles of sewer pipelines, many of which are decades old and in need of rehabilitation. Regulatory agencies such as the U.S. EPA have implemented mandates encouraging proactive maintenance and advanced inspection practices to prevent leaks, blockages, and contamination.

This has accelerated the adoption of AI-enhanced sewer inspection systems capable of automated defect detection, predictive analytics, and real-time reporting, significantly improving operational efficiency and cost management. Interestingly, similar trends are emerging in the U.K., where major projects such as Thames Water’s infrastructure upgrades and Environment Agency regulations are promoting the use of non-invasive inspection technologies.

Together, these initiatives highlight a growing emphasis on sustainability, digitalization, and preventive maintenance in wastewater management.

Europe holds about 25% market share, led by Germany and France, primarily due to strict environmental regulations such as the EU Urban Wastewater Directive and significant investments in green infrastructure. The directive emphasizes effective wastewater monitoring and pollution prevention, pushing municipalities and utilities to adopt advanced inspection systems for pipeline assessment, maintenance, and rehabilitation.

Growing concerns over climate change and urban flooding have further accelerated investment in sustainable infrastructure, with many European cities implementing flood-prevention and water-resilience projects. This has boosted the adoption of high-definition, AI-enabled, and robotic CCTV drain cameras, enhancing real-time monitoring and predictive maintenance capabilities.

Additionally, Europe’s focus on sustainability and the circular economy has encouraged innovation in energy-efficient and eco-friendly inspection technologies.

Asia Pacific commands around a 25% share and is the fastest-growing region, driven by rapid urbanization, infrastructure development, and government-led smart city projects in China and India. The expansion of urban populations has created significant pressure on wastewater and drainage systems, increasing the need for efficient and reliable sewer diagnostic solutions.

Smart city initiatives across the region are increasingly incorporating advanced technologies such as AI-enabled and robotic inspection cameras to enhance real-time monitoring, defect detection, and predictive maintenance.

Governments and municipal bodies are also investing heavily in modernizing underground infrastructure to improve sanitation and reduce environmental risks. Additionally, the adoption of trenchless and remotely controlled inspection systems is increasing, as these technologies minimize disruption and lower maintenance costs.

The global sewer inspection camera market is highly competitive, driven by the growing need to maintain aging wastewater infrastructure efficiently. Key players are increasingly focusing on technological innovation to enhance camera performance, image resolution, and data analytics capabilities.

The integration of artificial intelligence (AI), robotics, and cloud-based monitoring is transforming sewer inspection processes by enabling automated defect detection and predictive maintenance. Companies are investing heavily in R&D to develop compact, durable, and high-definition camera systems suitable for diverse pipe conditions.

Strategic mergers and acquisitions are also reshaping the competitive landscape, allowing firms to expand their product portfolios and global reach. Partnerships with municipalities and utility service providers have become essential for tailoring solutions to local infrastructure challenges and regulatory standards.

The global sewer inspection camera market is projected to reach US$270.7 Million in 2025, driven by surging demand for non-destructive diagnostics amid aging infrastructure and urbanization worldwide.

The market is driven by over 800,000 miles of aging U.S. sewers and global urbanization to 68% by 2050, necessitating advanced sewer inspection cameras for proactive maintenance and regulatory compliance.

The market is poised to witness a CAGR of 6.3% from 2025 to 2032, supported by innovations in wireless systems and AI for enhanced imaging and automation.

Expansion in smart cities projected at US$ 1,445.6 Bn by 2030 offers key opportunities, enabling AI-driven predictive maintenance for sewer inspection cameras in emerging urban infrastructures.

Key players include Envirosight LLC, MyTana, VU-Rite, USA Borescopes, and Camtronics, leading through innovations in portable and remote-controlled systems for global infrastructure needs.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Camera Specification

By Deployment Method

By End-use

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author