ID: PMRREP3531| 200 Pages | 14 Aug 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

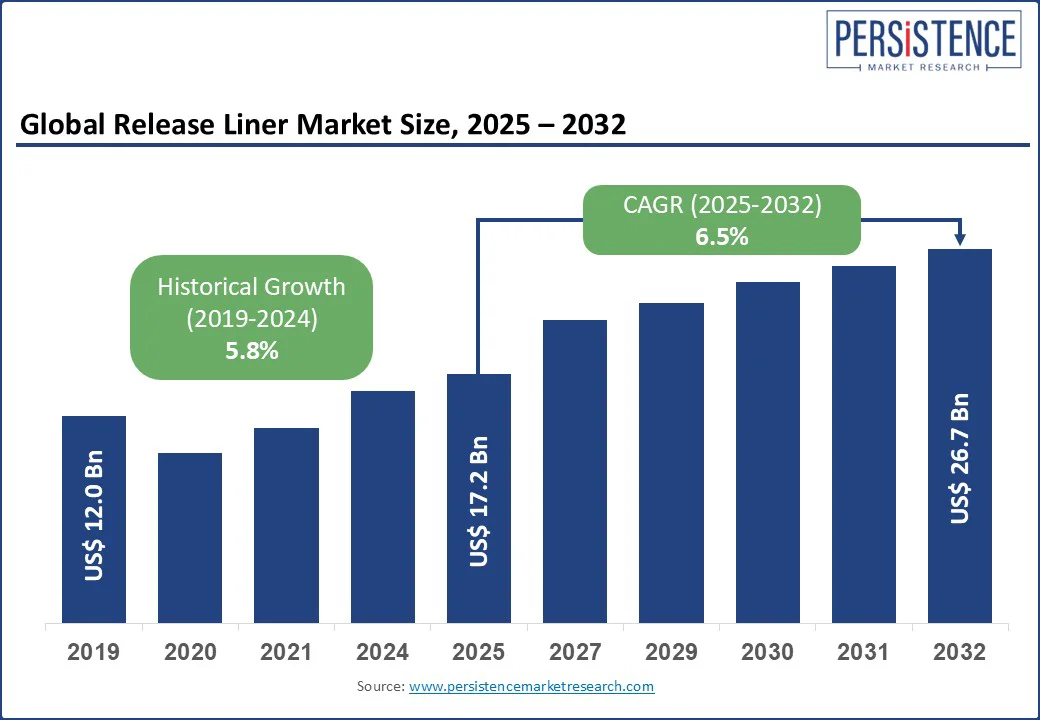

The global Release Liner Market is projected to grow from US$ 17.2 Bn in 2025 to US$ 26.7 Bn by 2032, achieving a CAGR of 6.5% during the forecast period 2025- 2032.

The release liner Industry expansion is driven by the increasing demand for pressure-sensitive adhesives across industries, the growth of e-commerce requiring advanced labeling solutions, and the rising adoption of sustainable and recyclable liner materials.

Release liners, critical for protecting adhesive surfaces in products such as labels, tapes, and medical applications, are benefiting from technological advancements in silicone and non-silicone coatings that enhance performance and sustainability.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Release Liner Market Size (2025E) |

US$ 17.2 Bn |

|

Market Value Forecast (2032F) |

US$ 26.7 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.5% |

|

Historical Market Growth (CAGR 2019 to 2024) |

5.8% |

The release liner market is witnessing substantial growth driven by the rising demand from the labeling and packaging industries. As global packaging needs surge, particularly within the food and beverage, e-commerce, retail, and logistics sectors, there is a parallel increase in the use of pressure-sensitive labels, which are highly dependent on release liners for effective application and handling.

These liners play a critical role in ensuring clean, efficient label application on diverse surfaces, maintaining product integrity throughout the supply chain.

The key contributors to this trend are the growing adoption of self-adhesive labels, widely used for branding, tracking, barcoding, and product information. Companies across industries are investing in smart labeling solutions to enhance inventory management, product visibility, and consumer engagement. For instance, Amazon and other major e-commerce players use millions of self-adhesive labels daily for inventory tracking and last-mile delivery, driving significant demand for high-performance release liners.

The ability of release liners to support high-speed labeling and compatibility with automated packaging lines makes them indispensable, thereby reinforcing their demand across global manufacturing and distribution networks.

The release liner market faces significant restraint due to growing environmental concerns and the challenges associated with liner waste disposal. Most release liners, especially those coated with silicone, are not easily recyclable and often end up in landfills, contributing to industrial waste. This raises sustainability issues, particularly in regions with strict environmental regulations pushing for greener manufacturing practices.

The lack of efficient recycling infrastructure for silicone-coated liners further complicates waste management for manufacturers and end-users. Companies may also incur additional costs related to waste collection, segregation, and disposal.

As sustainability becomes a priority across industries, the environmental impact of release liners is prompting demand for eco-friendly alternatives, potentially hindering the growth of conventional liner products. For instance, leading label manufacturers like Avery Dennison have initiated liner recycling programs in North America and Europe to address these concerns, but such initiatives are not yet widely scalable across all regions.

As environmental regulations tighten and sustainability becomes a core focus across industries, there is a significant opportunity in developing eco-friendly and recyclable release liners. Manufacturers are investing in linerless labeling technologies, compostable materials, and recyclable paper-based liners to reduce waste and carbon footprint. This shift is driven by growing consumer and regulatory pressure for greener packaging solutions, especially in Europe and North America.

For instance, companies like UPM Raflatac and Mondi Group are developing sustainable liner solutions using recyclable and renewable materials. The push toward circular economy practices, including take-back and recycling programs, is also encouraging innovation in liner design and disposal systems. These developments not only open new avenues for product differentiation but also align with global sustainability goals, presenting a lucrative opportunity for release liner manufacturers to capture market share through green product offerings.

Paper-based release liners dominate the release liner market, expected to account for approximately 56% of the industry share in 2025. Their dominance is attributed to their cost-effectiveness, recyclability, and widespread use in applications like labels and tapes. Paper-based liners are lightweight and compatible with various adhesive systems, making them ideal for high-volume industries such as e-commerce and retail packaging.

The film-based release liner segment is the fastest-growing from 2025 to 2032, driven by increasing demand for durable and high-performance liners in medical, industrial, and composite applications. Film-based liners, made from materials like polyester and polypropylene, offer superior moisture resistance and dimensional stability, making them suitable for specialized applications requiring precision and durability.

Silicone-based release liners hold the largest market share, accounting for approximately 63% of revenue in 2025. Their popularity stems from their excellent release properties, compatibility with a wide range of adhesives, and ability to provide a smooth surface for high-quality printing. Silicone-based liners are widely used in labels, tapes, and medical applications due to their reliability and versatility.

Non-silicone-based release liners are the fastest-growing segment, driven by advancements in alternative coating technologies that reduce dependency on silicone, which can be costly and less environmentally friendly. Non-silicone liners, often using materials like fluoropolymers, are gaining traction in niche applications such as electronics and high-performance industrial products.

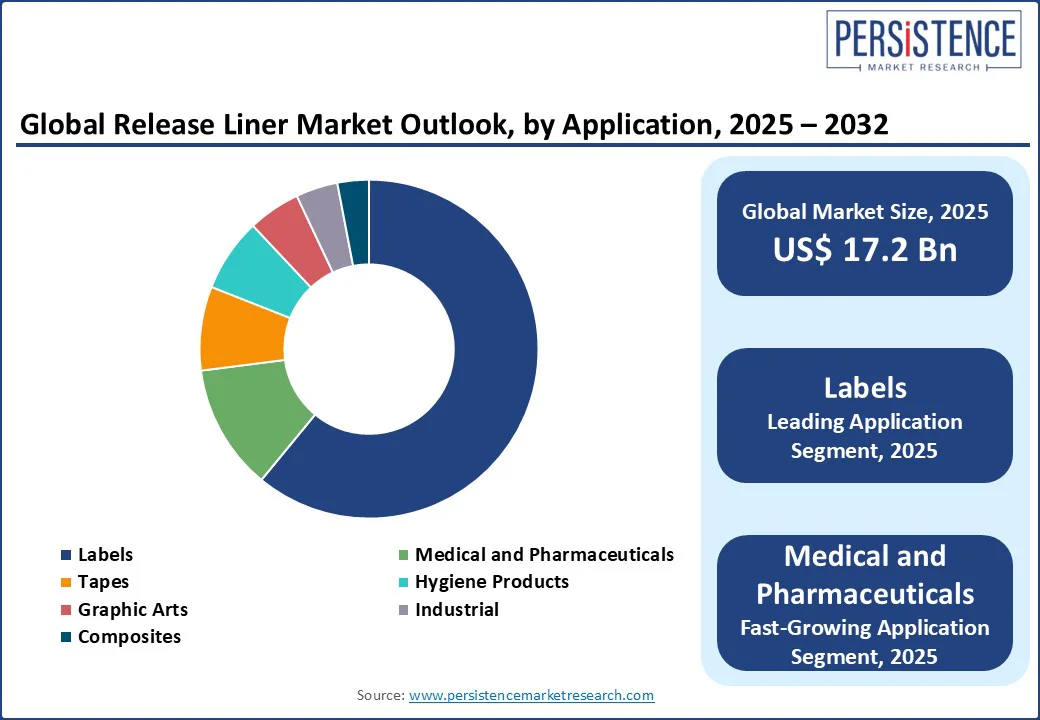

Labels lead the release liner market, holding a 60.9% share in 2025. The segment’s dominance is driven by the global boom in e-commerce and retail, where pressure-sensitive labels are critical for product identification, branding, and logistics. Innovations like right-sized labels and sustainable liners further enhance their adoption in this sector.

The medical and pharmaceutical segment is the fastest-growing, fueled by rising demand for sterile and reliable packaging for medical devices, wound care products, and pharmaceuticals. Regulatory requirements for safe and sustainable packaging, combined with increasing global healthcare needs, are accelerating the adoption of release liners in this sector.

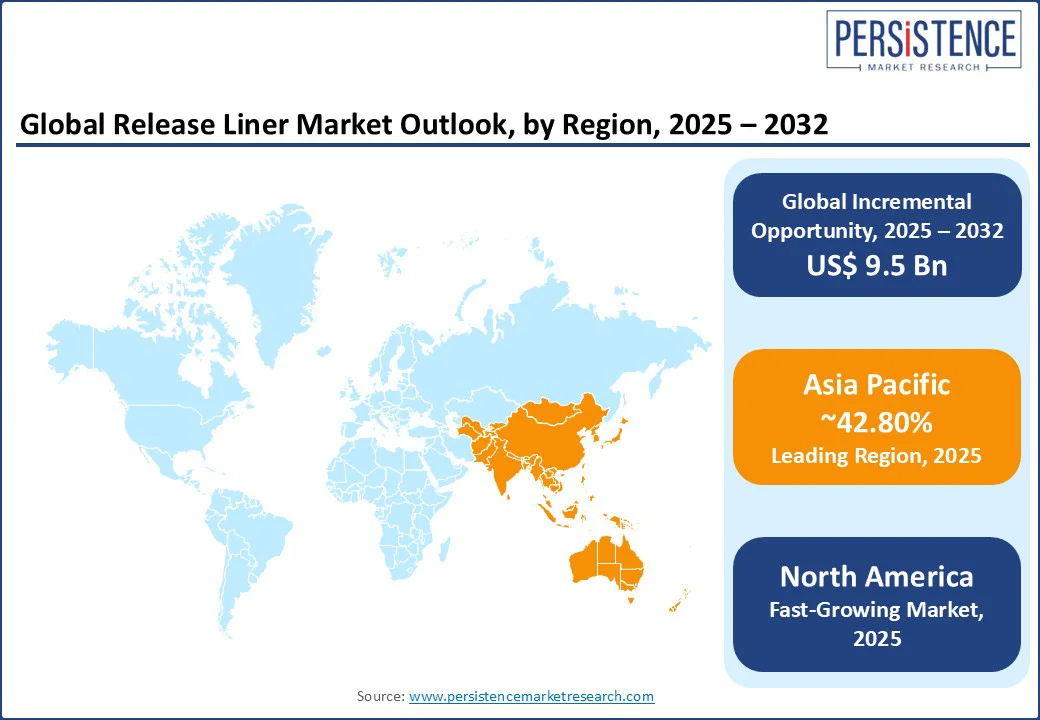

North America is rapidly emerging as the fastest-growing region in the release liner market, with the United States and Canada leading the charge. The region’s growth is driven by the explosive rise of e-commerce, which has heightened demand for advanced labeling solutions for packaging and logistics.

The U.S., in particular, holds a dominant position due to its advanced manufacturing infrastructure and significant investments in sustainable packaging solutions. The growing consumer preference for eco-friendly products, coupled with stringent regulations such as the U.S. Environmental Protection Agency’s guidelines on recyclable packaging, has accelerated the adoption of paper-based and recyclable film-based release liners.

The presence of major players like 3M and Avery Dennison further strengthens the region’s market, with ongoing innovations in high-performance liners for medical and industrial applications. The U.S. market is poised to maintain high growth rates due to continued investments in e-commerce infrastructure and sustainable packaging technologies.

Europe holds a significant share in the global release liner market, driven by strong sustainability initiatives, advanced manufacturing capabilities, and growing e-commerce adoption. Leading countries include Germany, the UK, and France. Germany benefits from its robust industrial base and leadership in sustainable packaging, with companies like Mondi investing heavily in recyclable release liners.

The U.K. market is bolstered by the rapid growth of e-commerce and policies promoting alternatives to single-use plastics. France’s market is supported by significant investments in sustainable packaging innovation. The EU’s stringent regulations, such as the Packaging and Packaging Waste Regulation, drive the adoption of eco-friendly release liners, though compliance with complex environmental laws poses challenges. Europe’s release liner market is projected to grow steadily from 2025 to 2032.

Asia Pacific dominates the global release liner market, accounting for over 42.80% of total revenue in 2025. This leadership is driven by high industrial activity in countries like China, India, and Japan.

China leads the market, benefiting from a well-developed manufacturing ecosystem and significant export volumes that rely on advanced labeling solutions. The rapid expansion of e-commerce, particularly in last-mile delivery, has increased demand for durable and sustainable release liners. India’s market is fueled by rising urbanization, a growing middle class, and increasing consumption of packaged goods.

Japan’s advanced technological capabilities drive demand for high-performance liners in electronics and medical applications. Government policies promoting sustainability, such as China’s National Sword policy encouraging recyclable materials, further reinforce the adoption of eco-friendly release liners, aligning with circular economy objectives.

The global release liner market is highly competitive, comprising global leaders and regional specialists. In developed regions such as North America and Europe, companies such as 3M, Avery Dennison, and Mondi dominate with advanced technologies and strong supply chains. In Asia Pacific, rising e-commerce and industrialization are attracting both established and emerging players.

Firms are emphasizing sustainability, innovation, and customization to stand out. Automation and digital printing enable faster, more personalized production, while strategic acquisitions and partnerships with logistics and packaging firms help expand market reach and meet evolving customer needs in a dynamic and growing industry landscape.

The Release Liner Market is projected to reach US$ 17.2 Bn in 2025.

The surge in e-commerce and demand for sustainable labeling solutions are key drivers.

The Release Liner market is poised to witness a CAGR of 6.5% from 2025 to 2032.

Advancements in sustainable release liner technologies, such as recyclable and biodegradable liners, are a key opportunity.

3M Company, Avery Dennison Corporation, Lintec Corporation, Dow Inc., and Mondi Group are among the key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

|

By Substrate Type

By Material Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author