ID: PMRREP35735| 199 Pages | 15 Oct 2025 | Format: PDF, Excel, PPT* | Industrial Automation

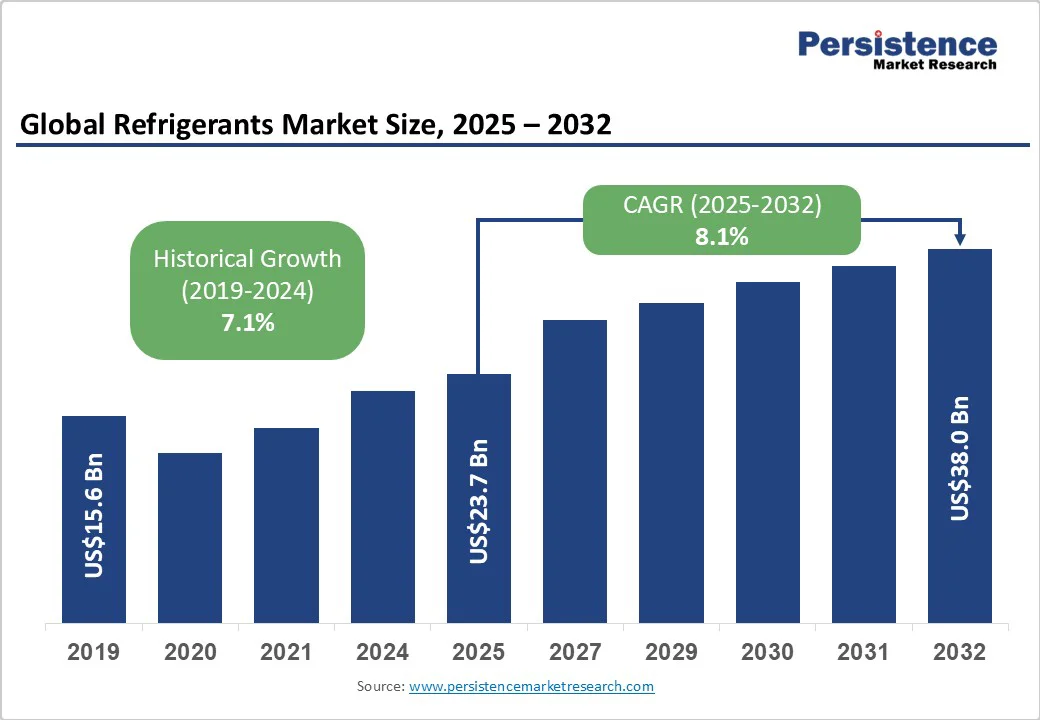

The global refrigerants market size is expected to reach US$23.7 billion by 2025. It is estimated to reach US$38.0 Billion by 2032, growing at a CAGR of 8.1% during the forecast period 2025 - 2032, driven by the increasing demand for energy-efficient cooling technologies and international mandates to phase down high global warming potential (GWP) refrigerants.

Growth is also propelled by expanding HVAC installations, rising automotive AC demand, and large-scale cold storage projects. Supportive regulations, such as the Kigali Amendment and innovations in low-GWP refrigerants, position them as key enablers of global sustainability.

| Key Insights | Details |

|---|---|

| Refrigerants Market Size (2025E) | US$23.7 Bn |

| Market Value Forecast (2032F) | US$38.0 Bn |

| Projected Growth (CAGR 2025 to 2032) | 8.1% |

| Historical Market Growth (CAGR 2019 to 2024) | 7.1% |

Global policy regimes are intensifying actions to reduce the climate impacts of refrigerants, significantly influencing market growth trajectories. The Kigali Amendment to the Montreal Protocol, ratified by 134 countries as of 2025, mandates phased reductions in hydrofluorocarbon (HFC) usage, compelling accelerated adoption of hydrofluoroolefins (HFOs), natural refrigerants such as hydrocarbons and CO2, and blends with lower GWP.

According to the United Nations Environment Programme (UNEP), compliance requires a 65.0%-85.0% cut in HFC consumption by 2036 in developed countries, and 80-85% cuts by 2045 in developing markets, directly enlarging demand for alternative refrigerants.

This regulatory push has boosted industry investment in compliant refrigerants, encouraged innovation, and reshaped supply chains to provide sustainable solutions aligned with global environmental targets. Consequently, businesses that proactively align with evolving standards are positioned to capture emerging market share and capitalize on premium product demand.

Structural challenges in securing raw materials for next-generation refrigerants pose significant risks, as they disrupt production continuity and increase operational expenses. Critical feedstocks, such as hydrofluoric acid and fluorite minerals, integral to fluorocarbon and HFO synthesis, confront supply volatility exacerbated by geopolitical tensions and mining restrictions, particularly in concentrated suppliers like China and Mexico.

The International Energy Agency (IEA) highlights vulnerabilities in the fluorochemical supply chain, leading to price fluctuations up to 15.0%-20.0% annually since 2023. Apart from this, logistical bottlenecks and freight cost inflation elevate costs, potentially delaying product delivery and complicating inventory management.

Businesses reliant on stable raw material supply face operational uncertainties, necessitating strategic diversification, vertical integration, and supplier partnerships to mitigate these risks and ensure market resilience during the transition period to low-GWP refrigerants.

The burgeoning economies of Asia, Latin America, and Africa are rapidly developing cold chain logistics networks to reduce food spoilage and improve pharmaceutical distribution, driving demand for refrigerants tailored to this sector. The Food and Agriculture Organization (FAO) estimates that up to 40.0% of perishable food value is lost post-harvest in these regions due to inadequate refrigeration infrastructure.

Investment in cold storage facilities, refrigerated transport, and last-mile delivery solutions is projected to grow at a high CAGR through 2032, creating lucrative opportunities for refrigerants optimized for transport refrigeration and temperature-controlled warehouses. The COVID-19 pandemic highlighted vaccine distribution challenges, prompting a surge in refrigerated logistics investment funded by global health initiatives and governments.

The incorporation of low-GWP and natural refrigerants in this infrastructure not only meets environmental compliance but also offers operational cost savings, motivating adoption. Market participants who tailor products and services to meet the needs of cold chain expansion in developing markets can leverage this unmet need for profitable growth.

Fluorocarbon refrigerants are expected to maintain their position as the dominant product category, commanding an estimated 52% market share in 2025, reflecting their established presence across residential, commercial, and industrial cooling applications.

Within this segment, hydrofluorocarbons (HFCs) continue to represent the largest sub-category despite regulatory pressure, while hydrofluoroolefins (HFOs) are experiencing broadening adoption as direct replacements. The segment's leadership is rooted in proven performance characteristics, extensive infrastructure compatibility, and widespread technical expertise among HVAC professionals.

However, this dominance is increasingly challenged by environmental regulations, particularly the Kigali Amendment's phase-down schedules and regional F-Gas regulations that mandate GWP reductions.

The fastest-growing product segment is hydrocarbons, particularly propane (R290) and isobutane (R600a). The exceptional growth trajectory of this segment is driven by its classification as a natural refrigerant, its zero ozone depletion potential, and ultra-low GWP values, which align perfectly with global environmental objectives.

The adoption of hydrocarbons is accelerating in residential refrigeration, heat pumps, and commercial display cases, where their energy efficiency advantages translate into operational cost savings. Technological advancements in safety protocols, charge reduction techniques, and system design optimization are addressing traditional barriers related to flammability concerns, enabling broader market penetration across diverse applications.

Stationary HVAC represents the leading application segment, estimated to capture approximately 47% of the refrigerants market revenue share in 2025, supported by global urbanization trends and increasing cooling demand across residential and commercial buildings.

This segment dominance reflects the fundamental shift toward climate-controlled environments driven by rising living standards, extreme weather events, and expanding commercial infrastructure. Growth is particularly pronounced in emerging economies where air conditioning penetration remains low relative to developed markets, creating substantial expansion opportunities.

Energy efficiency regulations and green building certifications are reshaping product specifications, favoring low-GWP refrigerants and advanced system designs that optimize performance while minimizing environmental impact.

The fastest-growing application is transport, due to the explosive growth in cold chain logistics and refrigerated freight transport. This acceleration reflects structural changes in global supply chains, e-commerce expansion, and pharmaceutical distribution requirements that demand precise temperature control throughout the logistics network.

Electric vehicle (EV) integration is introducing additional complexity and opportunity, as battery thermal management systems require specialized refrigerant solutions optimized for automotive applications. Market participants are prioritizing innovation in compact, efficient refrigerant systems that can operate reliably across diverse transport modes while meeting increasingly stringent environmental and safety standards.

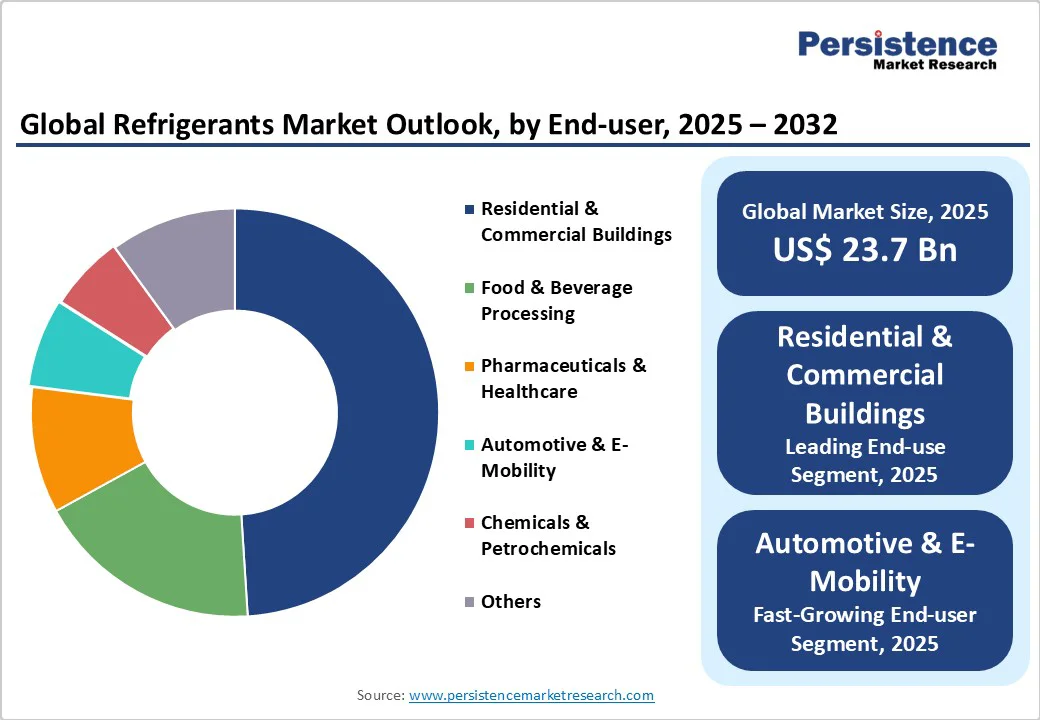

Residential and commercial buildings are expected to dominate end-use consumption, accounting for 49% of the market share in 2025, driven by global construction activity and HVAC system modernization initiatives. This segment's leadership underscores the crucial role of refrigerants in maintaining comfortable indoor environments across a wide range of building types, from single-family homes to office complexes and retail facilities.

Growth drivers include urbanization trends, rising disposable incomes in emerging markets, and increasing adoption of heat pump technologies for space heating and cooling. Energy efficiency programs and building codes are accelerating the transition toward low-GWP refrigerants, creating opportunities for suppliers who can deliver compliant solutions without compromising performance.

The fastest-growing end-use segment is likely to be automotive & e-mobility, as the transportation sector undergoes electrification and thermal management becomes increasingly sophisticated. EV adoption is driving the development of new refrigerant applications in battery cooling systems, cabin climate control, and component thermal management, which extend beyond traditional automotive air conditioning.

This growth is supported by regulatory mandates phasing out high-GWP refrigerants in favor of HFO-1234yf and other low-impact alternatives that meet stringent environmental standards. Manufacturers are investing heavily in specialized refrigerant formulations optimized for automotive applications, including improved efficiency in extreme temperature conditions and compatibility with advanced HVAC system designs.

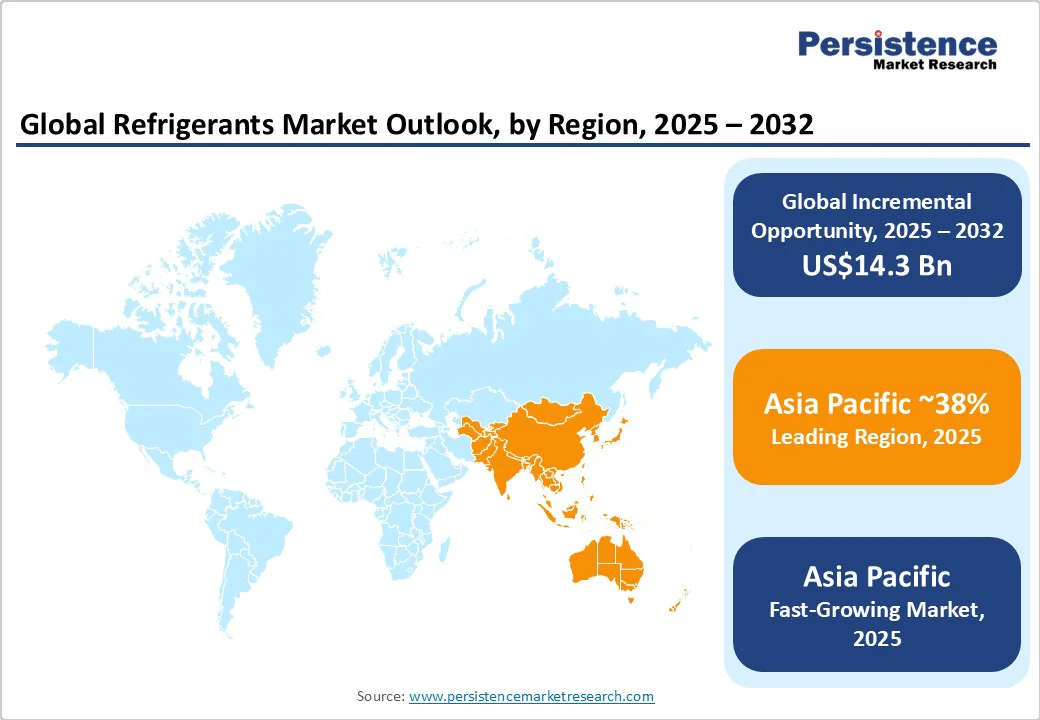

Asia Pacific is positioned as the largest and fastest-growing regional market, projected to secure 38% of the market in 2025 and exhibit the highest CAGR from 2025 to 2032. This exceptional growth trajectory reflects the region's unique combination of rapid economic development, massive urbanization, expanding middle-class populations, and increasingly sophisticated manufacturing capabilities, positioning it as both a major consumer and producer of refrigerants.

The growth dynamics of Athe sia Pacific are fundamentally different from mature markets, driven by first-time adoption of air conditioning and refrigeration rather than replacement cycles, creating sustained demand expansion across multiple market segments.

China dominates as both the world's largest manufacturer and consumer of refrigerants, with domestic consumption fueled by continued urbanization, rising living standards, and expanding industrial production capacity. India also represents the most dynamic growth opportunity within the region, with household air conditioning penetration remaining below 10% despite rapidly rising disposable incomes and extreme temperature conditions that drive cooling demand.

The Indian Government’s Production Linked Incentive (PLI) scheme for white goods includes specific support for low-GWP refrigerant research and development, accelerating domestic technological capabilities while attracting international investment in manufacturing facilities.

Europe is likely to command an estimated 31% global market share in 2025, establishing itself as the world's most stringent and progressive regulatory environment for refrigerants. The region's leadership reflects harmonized implementation of the F-Gas Regulation, which imposes quota-based restrictions on HFC consumption while providing clear incentives for adoption of natural refrigerants and HFOs.

This regulatory framework has created a uniquely competitive environment where compliance drives innovation, enabling European companies to develop advanced refrigerant technologies and system designs that exceed global environmental standards.

Germany leads regional growth with its ambitious climate neutrality targets by 2045, supported by comprehensive subsidy programs that accelerate heat pump adoption and building energy efficiency improvements. The German refrigerants market demonstrates exceptional growth in natural refrigerants, particularly R-290 heat pumps that have achieved mainstream market acceptance through government incentives and consumer environmental awareness.

Further, the market in Europe is characterized by sophisticated supply chain integration and technology leadership in natural refrigerants, with companies such as Daikin, Carrier, and Johnson Controls maintaining significant R&D and manufacturing presence across multiple countries.

North America is projected to command approximately 23% of the refrigerants market share in 2025.

The U.S. leads the regional market on the back of a sophisticated regulatory framework anchored by the Significant New Alternatives Policy (SNAP) program of the Environmental Protection Agency (EPA) and comprehensive implementation of the American Innovation and Manufacturing (AIM) Act, which establishes clear phase-down schedules for high-GWP refrigerants while promoting domestic manufacturing of alternatives.

This regulatory clarity positions North American companies at the forefront of low-GWP refrigerant innovation and commercial deployment.

The robust industrial ecosystem of North America also supports rapid technology transfer from laboratory to market, with major chemical manufacturers including Honeywell, Chemours, and Dow maintaining significant R&D facilities and production capacity across the U.S. Regional competitive dynamics emphasize technological differentiation and supply chain resilience, with companies leveraging strategic partnerships and vertical integration to maintain market position during the transition period.

The global refrigerants market structure exhibits moderate concentration, with leading players collectively capturing approximately 45% of the market share. Dominant companies include globally recognized chemical manufacturers and refrigerant specialists possessing extensive product portfolios and strong distribution networks.

Market competition is characterized by innovation leadership, regulatory compliance capabilities, and strategic alliances underpinning sustainability transitions. The remainder of the market is relatively fragmented, with numerous regional players targeting niche applications and emerging markets.

This structure incentivizes both collaboration and competitive differentiation through proprietary refrigerant technologies, supply chain optimization, and value-added services, fostering dynamic competitive repositioning.

The refrigerants market is projected to reach US$23.7 Billion in 2025.

Soaring demand for energy-efficient cooling technologies and international mandates, mainly the Kigali Amendment to the Montreal Protocol, to phase down high global warming potential (GWP) refrigerants are driving the market.

The market is poised to witness a CAGR of 8.1% from 2025 to 2032.

Widening HVAC installations, high demand for automotive air conditioning, large-scale deployments of cold storage facilities, and technological innovations favoring low-GWP and natural refrigerants are key market opportunities.

Honeywell International Inc., Chemours Company, and Daikin Industries, Ltd. are some of the key players in the refrigerants market.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By End-user

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author