ID: PMRREP35578| 193 Pages | 25 Aug 2025 | Format: PDF, Excel, PPT* | Automotive & Transportation

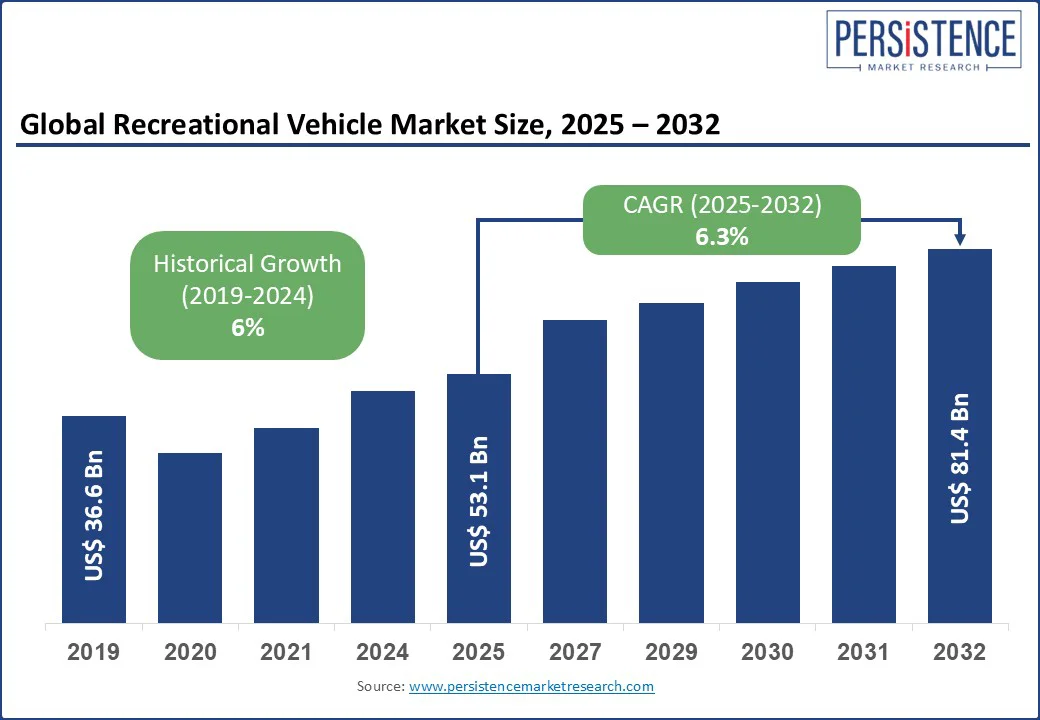

The global recreational vehicle market size is likely to value at US$53.1 Bn in 2025 to approximately US$81.4 Bn by 2032. It is anticipated to witness a CAGR of 6.3% during the forecast period from 2025 to 2032.

The recreational vehicle industry has experienced consistent growth in recent years, fueled by rising demand for flexible travel options, the growing appeal of outdoor lifestyles, and advancements in RV design and technology.

The increasing interest in off-grid living, combined with enhanced features such as smart connectivity, lightweight materials, and energy-efficient systems, has expanded the consumer base across various demographics. As sustainable travel gains momentum, the recreational vehicle industry is evolving to meet changing consumer expectations around mobility, comfort, and environmental impact.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Market Size (2025E) |

US$53.1 Bn |

|

Market Value Forecast (2032F) |

US$81.4 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.3% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6% |

Modern RV buyers prioritize solar-powered off-grid camping features, which prompts OEMs to integrate built-in solar panels and lithium battery systems. This trend drives demand for energy-efficient RV models with smart home integration that support extended stays without campground hookups.

Manufacturers now offer app-controlled climate and power systems optimized for boondocking and remote wilderness usage. Peer-to-peer rental platforms and RV membership services enable exposure to the RV lifestyle without ownership, boosting trial usage.

Platforms such as Outdoorsy and RVshare have expanded access to compact Class B campervan rentals for digital nomads, appealing to younger and remote-working travelers. This rental economy underpins growth in hybrid-work-friendly motorcoach adoption as RVs double as mobile offices.

Subscription-based RV access models and flexible financing options are fueling adoption among first-time buyers. Brands now offer monthly RV subscription services with doorstep delivery, catering to urban millennials who prefer experience over ownership. This shift supports rising demand for customizable travel trailer leasing plans and short-term campervan access for seasonal travel, expanding the market beyond traditional retirees.

The RV manufacturing ecosystem faces ongoing pressure from supply chain fragmentation and raw material instability. Fluctuations in the prices of lightweight metals such as aluminum and specialized materials used in chassis frames have disrupted production planning.

Manufacturers struggle to meet rising demand for solar-integrated RVs and off-road camper trailers due to inconsistent availability of components such as inverters, lithium batteries, and composite panels. These disruptions slow innovation cycles and reduce inventory of high-spec models, particularly in the towable segment.

On the consumer side, operational concerns continue to limit broader market adoption. Many buyers hesitate to invest in diesel-powered Class A motorhomes due to their seasonal maintenance costs, high insurance premiums, and low fuel efficiency.

Additionally, the limited EV charging infrastructure for electric RVs constrains demand, especially among sustainability-driven travelers. In rural and wilderness areas, core destinations for RV users, access to reliable solar recharging and off-grid power remains insufficient, hampering the usability of eco-friendly RV platforms.

Manufacturers can tap into the rising demand for battery-powered electric travel trailers with regenerative towing assist, exemplified by models such as the Pebble Flow, which offers up to seven days of self-sufficient power while towing.

Designing solar-integrated luxury off-grid trailers with atmospheric water generation, inspired by ventures such as Living Vehicle, opens premium segments catering to mobile creatives and sustainability-minded travelers. Building lightweight modular tow-by-wire trailer platforms using advanced composites further enhances appeal among urban weekend adventurers and eco-aware professionals.

The growing demand for compact modular van life and camper trailer rentals for digital nomads creates a market for fleet-ready RV designs with built-in office ergonomics, solar power, and smart connectivity. Operators can leverage growing interest in eco-tourism-focused travel trailer subscription services, offering flexible short-term access to high-end trailers equipped with renewable energy systems and green interior materials.

As campground infrastructure evolves, integrating solar charging hubs and regenerative trailer-park ecosystems can support remote working and sustainable adventures, enabling new ancillary services around energy-sharing and vehicle-to-load integration.

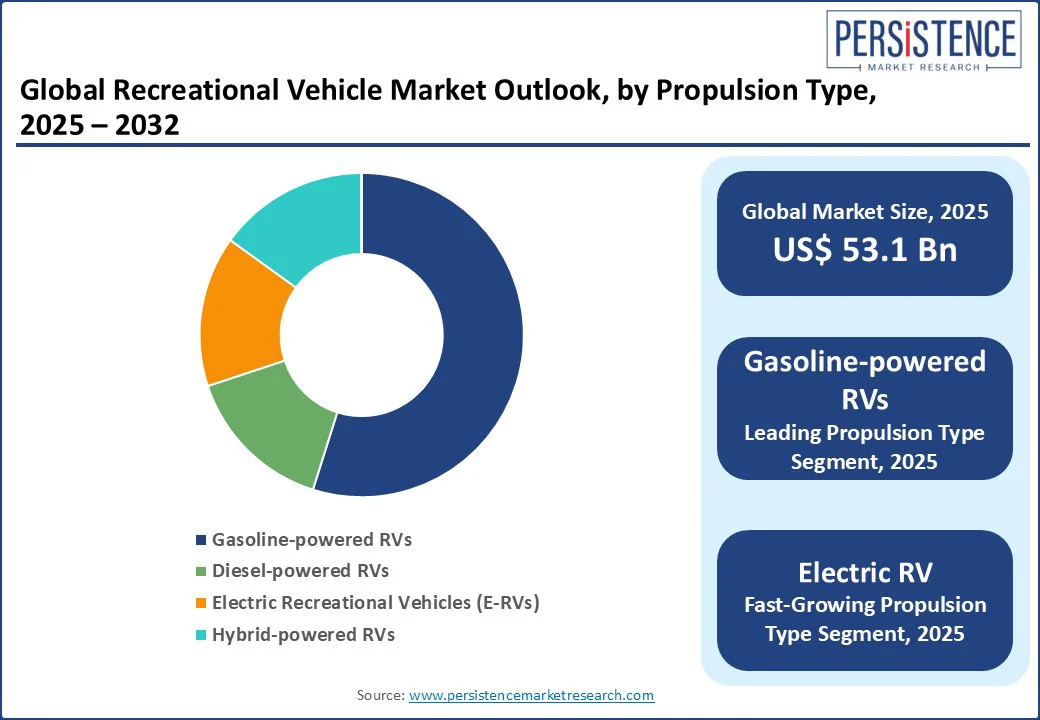

Gasoline-powered RVs continue to dominate the propulsion category, accounting for nearly 72% of the market share. Their stronghold stems from affordability, ease of maintenance, and widespread fuel availability.

Gasoline engines are preferred for most Class C and travel trailer RVs due to their lower upfront cost compared to diesel alternatives, making them especially attractive to first-time buyers and recreational users who don’t clock high annual mileage. Their broad compatibility with existing service infrastructure and towing setups further cements their position as the leading segment.

The electric recreational vehicle (E-RV) segment is emerging as the fastest-growing category, projected to expand at a CAGR of around 23% over the next several years. Advancements in battery technology, growing off-grid camping trends, and the rise of solar-powered RVs are propelling this surge.

OEMs are launching all-electric and hybrid-electric platforms with smart energy management systems, appealing to eco-conscious users. The growing availability of solar-integrated trailers and investment in EV-friendly campgrounds further accelerates demand for E-RVs, particularly among younger, sustainability-minded consumers.

Retirees and senior travelers represent the largest consumer group in the recreational vehicle market, holding an approximate 47% share. This demographic traditionally favors motorhomes and towables for long-term travel and seasonal migration, such as snowbirding between northern and southern states.

With ample time and disposable income, retirees often invest in spacious, high-end RVs equipped with comfort-focused amenities. Their long-standing presence and consistent demand make them a cornerstone of the RV industry.

In contrast, remote workers and digital nomads are driving the fastest growth within the end-user segment. This group includes adventurers who value mobile living and flexible travel, often using compact, smart-equipped Class B campervans as mobile offices.

The post-pandemic remote work culture has fueled interest in van life and part-time RV living, with users seeking features like Wi-Fi boosters, solar power, and ergonomic workspaces. Subscription-based RV access and peer-to-peer rental platforms have also lowered the entry barrier, making RV travel more accessible and appealing to younger, tech-savvy professionals.

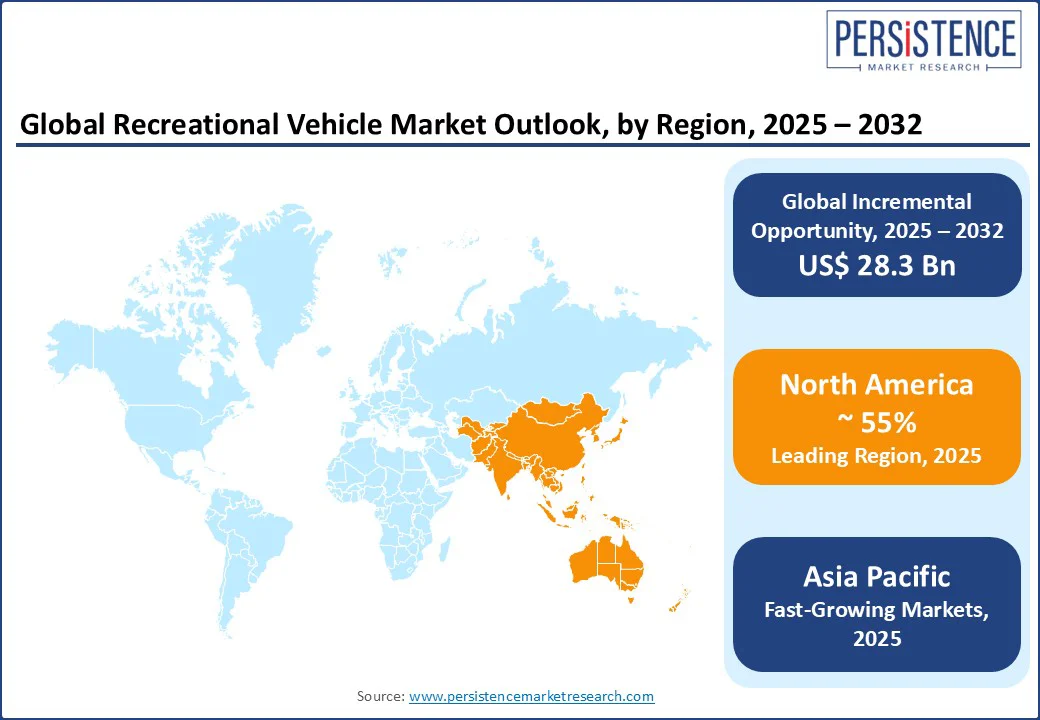

North America continues to dominate the global recreational vehicle market, accounting for approximately 53% of global RV revenue in 2025. The region benefits from a deeply rooted RV culture, widespread campground infrastructure, and a well-established dealer and service network. Growth is being driven by a shift toward towable RVs, adoption of high-end, smart-enabled models, and an influx of younger demographics embracing RV life as part of the mobile and flexible living trend.

In the United States, the industry is evolving rapidly, with the country reporting strong year-over-year growth. Thor Industries, the largest RV manufacturer, posted 9% growth in towable RV sales and 3% growth in motorized RVs in Q3 of fiscal 2025.

The rise of flexible work has significantly contributed to the demand for Class B and van-style RVs, while luxury motorhomes continue to attract retirees. The U.S. also boasts over 16,000 public and private campgrounds, many of which are integrating EV charging stations, Wi-Fi, and remote work-friendly amenities, further encouraging RV adoption.

In Canada, the market is expanding through a combination of strong domestic tourism and government-supported infrastructure development. With over 2,900 campgrounds across the country, Canada supports a vibrant RV lifestyle, particularly in provinces like British Columbia and Alberta.

There is a notable increase in investments in RV park developments, such as a planned 165-acre RV resort with 100 full-service slots, which indicates growing interest in long-term RV camping. Canadian consumers show increasing interest in eco-conscious travel, creating opportunities for electric and hybrid RV manufacturers.

Asia Pacific represents the fastest-growing region globally, fueled by rapid urbanization, an expanding middle class, and increased interest in domestic adventure travel. While RV ownership remains relatively niche compared to the West, the region is witnessing a shift in consumer lifestyle that aligns with RV travel, which is flexibility, safety, and outdoor recreation.

China is emerging as a large market within the Asia Pacific. In recent years, the government has invested heavily in transportation infrastructure, developing long-distance highways and dedicated RV camping areas. Domestic tourism has boomed post-pandemic, with increasing interest in towable trailers and compact motorhomes.

As of 2023, towable RVs made up approximately 38% of the Chinese RV market, while motorhomes accounted for around 42%. The country also benefits from a strong local manufacturing base, which is helping reduce costs and drive adoption among middle-income families and retirees.

In India, the recreational vehicle market is still in its early stages, but it shows significant promise. Rising disposable income, a growing urban middle class, and shifting preferences toward experiential travel are setting the foundation. India’s middle class is growing at 6.3% annually and is projected to represent 38% of the population by 2031.

Indian consumers are increasingly curious about budget-friendly camper vans, especially for short-term family getaways and pilgrimage routes. However, adoption is restrained by low awareness, limited leasing models, and a lack of formal RV parks.

Despite these barriers, peer-to-peer rental platforms and domestic travel campaigns are encouraging new use cases, with the potential to expand the market by over 35% in the coming years if infrastructure and awareness improve.

Europe represents a mature market, characterized by high per-capita ownership, robust manufacturing in caravan-friendly economies, and growing consumer interest in eco-friendly travel. Countries such as Germany, France, and the Netherlands maintain well-developed RV ecosystems, with thousands of caravan parks and strict environmental policies that are reshaping vehicle preferences. Although Europe experienced a moderate contraction in early 2025, partly due to inflationary pressures, long-term prospects remain positive due to ongoing electrification efforts and sustainable tourism trends.

In Germany, the consumer demand is shifting toward compact, electrified, and sustainable vehicles. Germany is already a European leader in electric vehicle adoption, with over 1.18 million plug-in EVs registered in 2021, representing a 26% PEV market share. This readiness for electrification makes it critical for electric RV expansion.

Moreover, the country has a strong manufacturing base, with firms such as Hymer and Dethleffs innovating in electric motorhomes and solar-integrated caravans. However, recent data suggests a temporary slowdown in demand, with some U.S.-based manufacturers reporting a 30% decline in European backlogs in Q3 2025, likely due to post-pandemic inflation and high fuel prices.

The global recreational vehicle market is moderately consolidated, with a few large players dominating the North American and European markets, while regional manufacturers and niche startups are gaining ground in the Asia Pacific and emerging economies. Companies are increasingly focusing on electrification, modular design, and digital integration to attract younger consumers and adapt to changing travel behaviors.

The global recreational vehicle (RV) market is expected to be valued at approximately US$ 53.1 Bn in 2025.

By 2032, the recreational vehicle market is projected to reach around US$ 81.4 Bn, expanding at a steady CAGR due to rising electrification, eco-tourism, and increased adoption across Asia Pacific and Europe.

Key trends include the rise of electric RVs (eRVs), increased adoption of smart and modular interiors, the growth of peer-to-peer rental platforms, and rising demand from remote workers and digital nomads.

By propulsion type, gasoline-powered RVs is the leading segment due to affordability and service infrastructure. By user demographic, retirees and senior travelers remain the dominant user group, accounting for the majority of long-term and seasonal RV usage.

The market is anticipated to grow at a CAGR of 6.3% between 2025 and 2032.

Four to five leading companies with strong portfolios include Thor Industries, Inc., Forest River, Inc., Winnebago Industries, Inc., Trigano SA, and Knaus Tabbert AG.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn/Mn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Vehicle Type

By Propulsion Type

By Application

By End-user Demographic

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author