ID: PMRREP35516| 193 Pages | 25 Jul 2025 | Format: PDF, Excel, PPT* | Healthcare

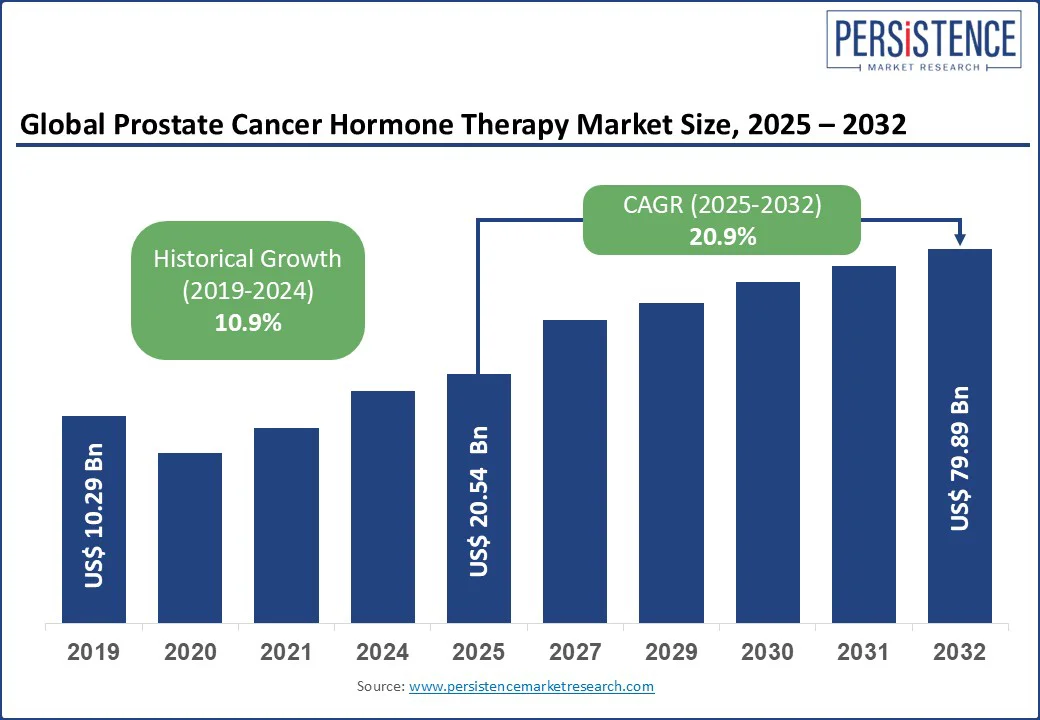

The global prostate cancer hormone therapy market size is likely to be valued at US$ 20.54 Bn in 2025 and is expected to reach US$ 79.89 Bn by 2032, growing at a CAGR of 20.9% during the forecast period from 2025 to 2032. The prostate cancer hormone therapy market is experiencing significant growth, fueled by rising global awareness and advancements in targeted treatment options.

Prostate cancer is a malignant tumor that develops in the prostate gland, a small gland in men responsible for producing seminal fluid and is one of the most common cancers among men worldwide. Hormone therapy, particularly androgen deprivation therapy (ADT), remains a cornerstone in managing prostate cancer, especially in advanced stages. Increasing adoption of targeted hormone therapies and next-generation androgen receptor inhibitors is reshaping treatment protocols and improving patient outcomes. Technological advancements, favorable reimbursement policies, and expanding healthcare infrastructure in emerging economies are further fueling market growth.

Key Industry Highlights:

| Market Attribute | Key Insights |

| Prostate Cancer Hormone Therapy Market Size (2025E) | US$ 20.54 Bn |

| Market Value Forecast (2032F) | US$ 79.89 Bn |

| Projected Growth (CAGR 2025 to 2032) | 20.9% |

| Historical Market Growth (CAGR 2019 to 2024) | 10.9% |

The increasing clinical adoption of GnRH receptor antagonists for castration-resistant prostate cancer is reshaping treatment protocols due to their rapid testosterone suppression and reduced cardiovascular risks. Physicians are favoring non-surgical hormone therapy alternatives for advanced prostate cancer, especially for elderly patients with comorbidities. This shift is supported by growing clinical data and regulatory approvals for agents such as relugolix. The demand for therapies that minimize resistance and improve tolerability is pushing pharmaceutical companies to innovate in this market.

The market is also witnessing strong momentum in oral androgen receptor inhibitors for metastatic prostate cancer therapy, which offer better patient compliance and targeted action. Drugs such as darolutamide and enzalutamide are gaining traction due to their efficacy in delaying disease progression. Moreover, the integration of AI-based personalized hormone therapy for prostate cancer is enabling tailored treatment plans based on genetic profiling, improving outcomes and reducing adverse effects. Strategic collaborations between biotech firms and oncology centers are accelerating the development of next-generation hormone therapies with enhanced bioavailability and precision.

Immunotherapy for hormone-refractory prostate cancer has shown limited efficacy in real-world settings. Treatments such as sipuleucel-T face skepticism due to modest survival benefits and complex administration protocols. The lack of biomarkers for predicting immunotherapy response in prostate cancer further restricts its clinical utility. The underperformance of therapeutic cancer vaccines for metastatic prostate cancer has also led to reduced investment in this segment, slowing innovation and adoption.

The effectiveness of late-line hormone therapy for metastatic castration-resistant prostate cancer (mCRPC) remains a concern, especially in patients previously treated with androgen receptor inhibitors. Resistance mechanisms, such as AR splice variants, diminish the efficacy of second-generation agents. Moreover, the lack of predictive genomic profiling tools for hormone therapy response limits personalized treatment strategies. These challenges hinder the expansion of next-generation hormone therapy for advanced prostate cancer, particularly in heavily pre-treated population.

The emergence of radioligand therapy for metastatic prostate cancer presents a transformative opportunity when combined with hormone-based treatments. Agents such as 177Lu-PSMA-617 are showing promising results in reducing tumor burden and extending survival. This is opening new avenues for combination hormone therapy protocols in advanced prostate cancer, especially for patients resistant to conventional ADT. The growing clinical adoption of dual-modality treatment strategies is expected to redefine therapeutic standards and expand the market’s scope.

The use of AI-based hormone therapy optimization tools for prostate cancer is gaining traction among oncology centers. These platforms analyze patient-specific genomic and clinical data to tailor hormone therapy regimens, improving efficacy and minimizing side effects. The rise of digital biomarkers for hormone therapy response prediction is enabling early intervention and better disease monitoring. This convergence of digital health and oncology is creating a scalable opportunity for precision hormone therapy in prostate cancer management, especially in personalized medicine ecosystems.

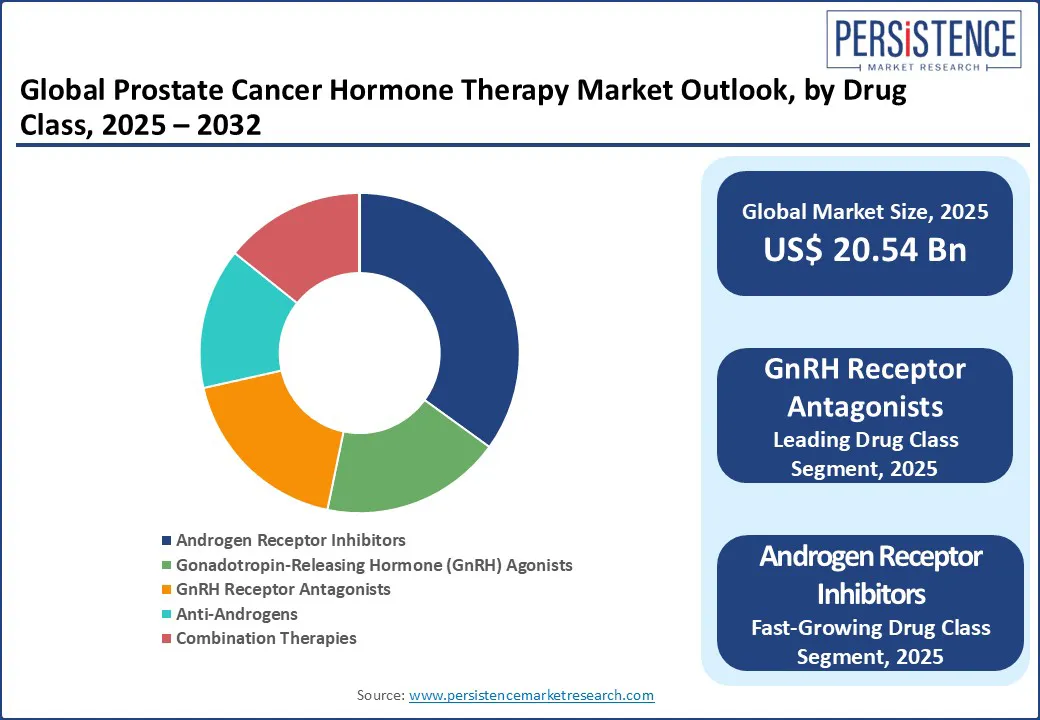

Androgen receptor inhibitors dominate the drug class segment, accounting for 38.3% of the market share in 2025. Their stronghold is attributed to the widespread use of enzalutamide, apalutamide, and the newer darolutamide, all of which target androgen receptors to inhibit the growth of prostate cancer cells.

GnRH receptor antagonists, the fastest growing segment, offer faster testosterone suppression and improved cardiovascular safety profiles. These drugs, such as degarelix and the newly introduced relugolix, provide immediate testosterone suppression without an initial surge, making them safer for patients with cardiovascular comorbidities.

Metastatic castration-resistant prostate cancer (mCRPC) holds the largest share, contributing to 56.4% of the market in 2025. This is due to the growing number of late-stage diagnoses, especially in aging male population, and the widespread adoption of next-generation hormone therapies as first- and second-line treatment options. Non-metastatic castration-resistant prostate cancer (nmCRPC) is the fastest-growing disease segment, supported by early screening initiatives, rising adoption of prostate-specific antigen (PSA) monitoring, and recent drug approvals targeting this disease stage. Agents such as apalutamide, enzalutamide, and darolutamide have received regulatory approval specifically for nmCRPC, demonstrating significant delay in metastasis-free survival and improving long-term outcomes.

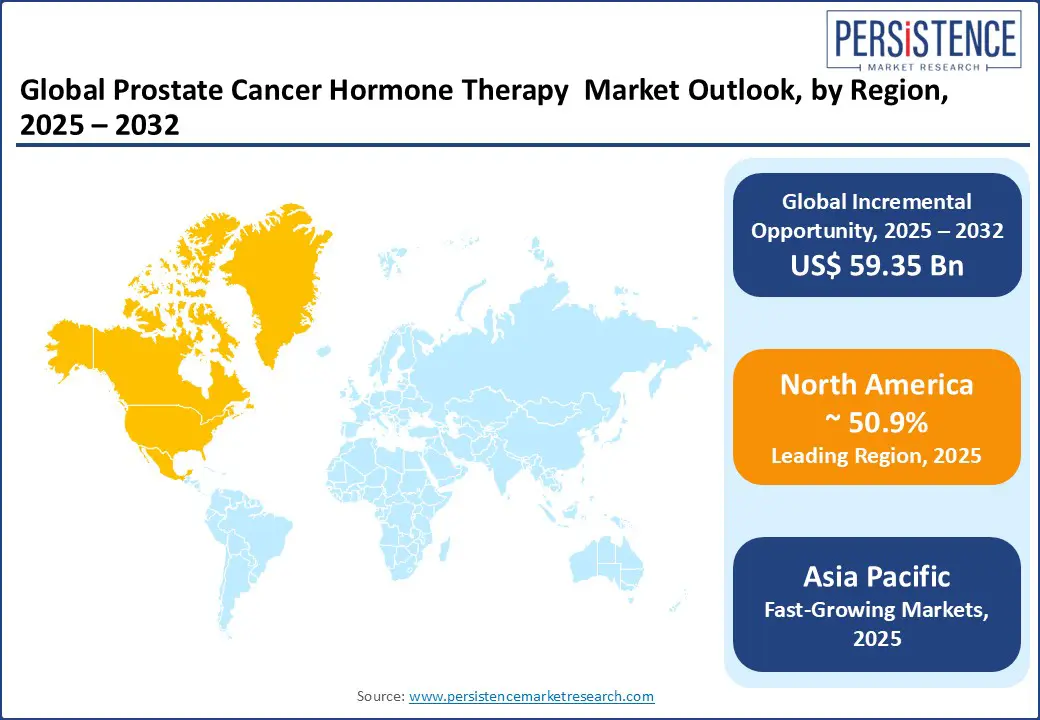

North America leads the global market, holding a 50.9% market share. The region benefits from advanced healthcare infrastructure, early diagnosis programs, and widespread adoption of androgen receptor inhibitors. The U.S. leads in clinical trials and drug approvals, with companies such as Pfizer, Sanofi, and AstraZeneca actively developing next-generation hormone therapies. The National Cancer Institute (NCI) and the Department of Veterans Affairs fund large-scale prostate cancer research, with a growing focus on biomarker-driven and precision medicine approaches.

The country also benefits from early screening initiatives, such as Medicare-covered PSA testing, and a significant aging male population, with 60% of diagnoses occurring in men aged 65 and above. The demand for oral androgen receptor inhibitors, especially enzalutamide and apalutamide is steadily rising due to physician familiarity and insurance coverage.

Europe is the second-largest market, supported by increasing prostate cancer screening programs and favorable reimbursement policies. Countries such as Germany, France, and the UK are investing in AI-based hormone therapy optimization and expanding access to oral androgen receptor inhibitors. Germany leads the regional market due to strong reimbursement systems, a large number of specialized oncology centers, and a focus on personalized hormone therapy regimens. The German Cancer Research Center (DKFZ) is conducting real-world evidence (RWE) studies to compare AR inhibitors and emerging radiopharmaceuticals, influencing both treatment pathways and procurement trends.

France continues to scale up nationwide screening programs, particularly in high-risk male populations over age 60. French hospitals are increasingly using AI algorithms to match patients with the most appropriate androgen-deprivation therapies (ADT) based on disease progression. The government’s support for biosimilar and generic drug use is enhancing access to affordable therapies.

Asia Pacific is the fastest-growing region, projected to expand at a CAGR exceeding 24% during the forecast period. Growth is driven by rising prostate cancer incidence, aging populations, and improving healthcare access in countries such as China, India, and Japan. China is witnessing a significant rise in prostate cancer diagnoses, especially in urban and aging male populations. The Healthy China 2030 initiative is enabling broader access to early screening, while hospitals in cities such as Beijing, Shanghai, and Guangzhou are adopting oral hormone therapies as first-line outpatient treatments. Domestic pharmaceutical companies Jiangsu Hengrui and BeiGene are entering into strategic licensing deals with global players to co-develop advanced hormone therapies.

Countries such as Thailand, Indonesia, and Vietnam are expanding access to prostate cancer treatment through public-private partnerships and regional pharmaceutical collaborations. Thailand, in particular is focusing on expanding its medical tourism services, where prostate cancer treatment packages now include next-generation therapies for international patients.

The global prostate cancer hormone therapy market is highly fragmented, with a mix of established pharmaceutical giants, emerging biotech firms, and regional manufacturers competing across various therapy classes. The landscape is shaped by rapid innovation in androgen receptor inhibitors, GnRH receptor antagonists, and combination hormone therapies, each targeting specific disease stages. The shift toward oral hormone therapies has intensified competition, especially in outpatient and retail channels, where patient convenience drives product preference.

Through strategic collaborations, licensing agreements, and acquisitions, particularly in Asia Pacific and Latin America, local firms are partnering with global players to expand access and affordability. The rise of AI-driven hormone therapy personalization platforms is also influencing competitive positioning, as companies race to integrate digital tools into treatment planning.

The prostate cancer hormone therapy market is projected to reach US$ 20.54 Bn in 2025.

The prostate cancer therapy market is expected to grow to US$ 79.89 Bn, by 2032.

Key trends include the rise of oral androgen receptor inhibitors, AI-driven personalized hormone therapy, and radioligand-hormone combination treatments.

The androgen receptor inhibitors segment leads, accounting for 38.3% of the market share in 2025.

The prostate cancer hormone therapy market is expected to grow at a CAGR of 20.9% from 2025 to 2032, driven by innovation and expanding access.

Major players with strong portfolios include Astellas Pharma Inc., Pfizer Inc., Johnson & Johnson Services, Inc., Bayer AG, and Sanofi.

| Report Attribute | Details |

| Historical Data/Actuals | 2019 - 2024 |

| Forecast Period | 2025 - 2032 |

| Market Analysis | Value: US$ Bn/Mn, Volume: As Applicable |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

| Customization and Pricing | Available upon request |

By Drug Class

By Disease State

By Route of Administration

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author