ID: PMRREP33568| 210 Pages | 5 Jan 2026 | Format: PDF, Excel, PPT* | Industrial Automation

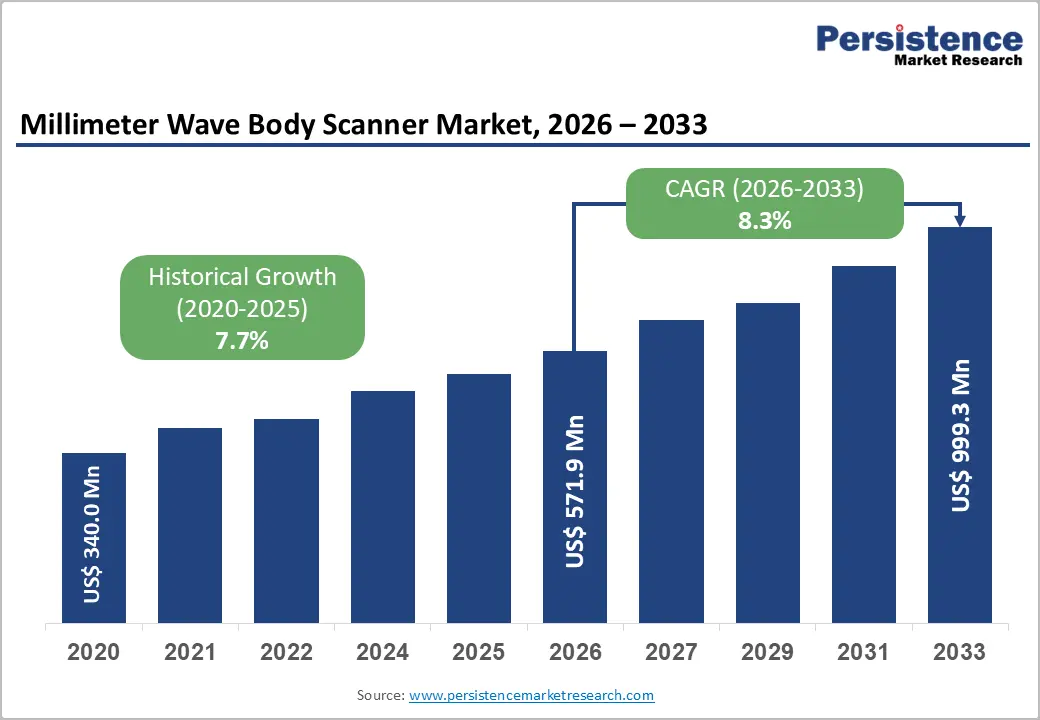

The global millimeter wave body scanner market size is likely to be valued at US$ 571.9 million in 2026 and is projected to reach US$ 999.3 million by 2033, growing at a CAGR of 8.3% between 2026 and 2033. The market is driven by increasing airport passenger volumes requiring high-throughput screening solutions, critical infrastructure protection requirements across transportation hubs, and governmental investment in border and transportation security modernization.

| Key Insights | Details |

|---|---|

|

Millimeter Wave Body Scanner Market Size (2026E) |

US$ 571.9 Mn |

|

Market Value Forecast (2033F) |

US$ 999.3 Mn |

|

Projected Growth (CAGR 2026 to 2033) |

8.3% |

|

Historical Market Growth (CAGR 2020 to 2024) |

7.7% |

Global security has fundamentally transformed public venue protection priorities, with approximately 195 countries implementing advanced screening requirements at critical infrastructure facilities. Aviation security regulations, including TSA mandates requiring the deployment of employee screening systems by April 2026 and International Civil Aviation Organization (ICAO) standards establishing non-negotiable security requirements, are establishing binding compliance obligations.

The European Union's transport security directives mandate millimeter-wave or equivalent threat-detection systems at major transportation hubs, with enforcement carrying substantial financial penalties for noncompliance. United Nations and International Maritime Organization regulations establish mandatory vessel and port facility screening protocols across 150+ signatory nations. Government security budgets, which allocate approximately US$ 45-50 billion annually to transportation security infrastructure, create sustained procurement demand.

Global aviation passenger volumes have recovered post-pandemic, exceeding 4.5 billion annually in 2025, with projections approaching 7.5 billion by 2035, representing 5% annual growth. Airport security checkpoint queuing times, averaging 15-25 minutes at major hubs, create operational bottlenecks that reduce passenger satisfaction and airport throughput efficiency. Millimeter wave body scanners, capable of processing 300-400 passengers per hour versus traditional metal detector capacity of 150-200 per hour, establish compelling operational efficiency advantages enabling airport capacity expansion without proportional staffing increases.

Metro and railway passenger volumes in the Asia Pacific, exceeding 15 billion annually, create distinct high-volume screening requirements that necessitate automated threat detection systems. Port facility container volumes, exceeding 800 million twenty-foot equivalent units (TEU) annually, require non-intrusive cargo and personnel screening systems.

Privacy advocacy organizations, including the European Digital Rights (EDRi) coalition and Privacy International, have successfully challenged the deployment of millimeter-wave scanners in multiple European jurisdictions, arguing that image protection protocols are insufficiently robust. The European Union General Data Protection Regulation (GDPR) compliance requirements establish stringent standards for handling personal image data, creating legal barriers to deployment in EU member states. Image retention regulations, including bans on storing images without explicit passenger consent in multiple European countries, constrain system functionality and complicate operational compliance.

Public perception challenges, with surveys indicating that 25-35% of passengers report discomfort with millimeter-wave scanning procedures, create political barriers that limit airport and transit authority procurement. Canada, Australia, and multiple EU nations have implemented deployment restrictions or moratoria pending enhanced privacy safeguards, eliminating market opportunities in these regions.

Millimeter wave scanner system costs, ranging from US$ 150,000-250,000 per unit excluding installation, create significant capital barriers for smaller regional airports, transit authorities, and government facilities with constrained budgets. Installation requirements, including dedicated power infrastructure, environmental conditioning, and structural modifications for portal installation, add 40-60% to total project costs, increasing total system deployment expense to US$ 250,000-400,000 per installation.

Retrofit complexity, with existing facility modifications often exceeding those of new installations, constrains replacement cycles for legacy metal detector systems. Operational training requirements, which require security personnel to complete 40-80 hours of certification training, create workforce development barriers, particularly in developing economies with limited training capacity.

Urban railway and metro transit systems, collectively serving 3+ billion annual passengers globally, represent distinct market opportunities with stringent security requirements and limited existing millimeter-wave deployment. Metropolitan Transit Authority systems across North America, Europe, and the Asia-Pacific have identified passenger security and threat detection as critical operational priorities, with funding allocations increasing by 15-20% annually. Walkthrough scanning systems, including HEXWAVE and comparable technologies, that enable seamless threat detection during passenger movement without requiring stationary scanning establish operational advantages previously unavailable in transit environments.

Market projections indicate that railway and metro millimeter-wave scanner deployments will expand from approximately 150-200 installed systems globally in 2025 to 800-1,000 installations by 2033, representing a 22-25% segment-level CAGR. Government infrastructure spending allocations, including US$ 110 billion in U.S. Bipartisan Infrastructure Law transit funding and €100+ billion in EU Connecting Europe Facility investment, establish sustained procurement budgets that support technology deployment.

Artificial intelligence and machine learning algorithm development represent a distinct market opportunity, enabling automatic threat identification and eliminating the need for human operators. Advanced detection systems achieving 98% threat-identification accuracy and simultaneously reducing false positives to below 2% are establishing compelling value propositions for high-volume deployment environments. The commercialization of automatic detection systems, with multiple manufacturers including L3Harris, Rapiscan, and Nuctech introducing systems with advanced ATD capabilities, is enabling expanded deployment in resource-constrained environments. Software licensing revenue models that enable recurring revenue through annual algorithm updates and system enhancements establish attractive business model characteristics.

Market projections indicate automatic detection system penetration will expand from approximately 35% of the installed base in 2026 to 60% by 2033, reflecting accelerated technology adoption as cost reduction and performance validation drive purchasing decisions.

Manual millimeter-wave body scanners hold 62% market share due to long-standing deployments, operator familiarity, and proven security performance. These systems rely on trained personnel for image interpretation, offering human oversight preferred by government agencies. Their widespread use in North American airports, cost-competitive pricing from established suppliers (L3Harris, Rapiscan, Smiths Detection), and compatibility with existing infrastructure reinforce their dominance.

Automatic millimeter-wave scanners are the fastest-growing segment, expanding at a 13% CAGR through 2033. AI-based threat detection removes operator subjectivity, delivering 95–98% accuracy with low false positives and processing 350–450 passengers per hour, significantly higher than manual systems. Government procurement guidelines, including TSA and EU directives, increasingly favor autonomous detection, driving adoption of automatic systems in new facilities and major security upgrades.

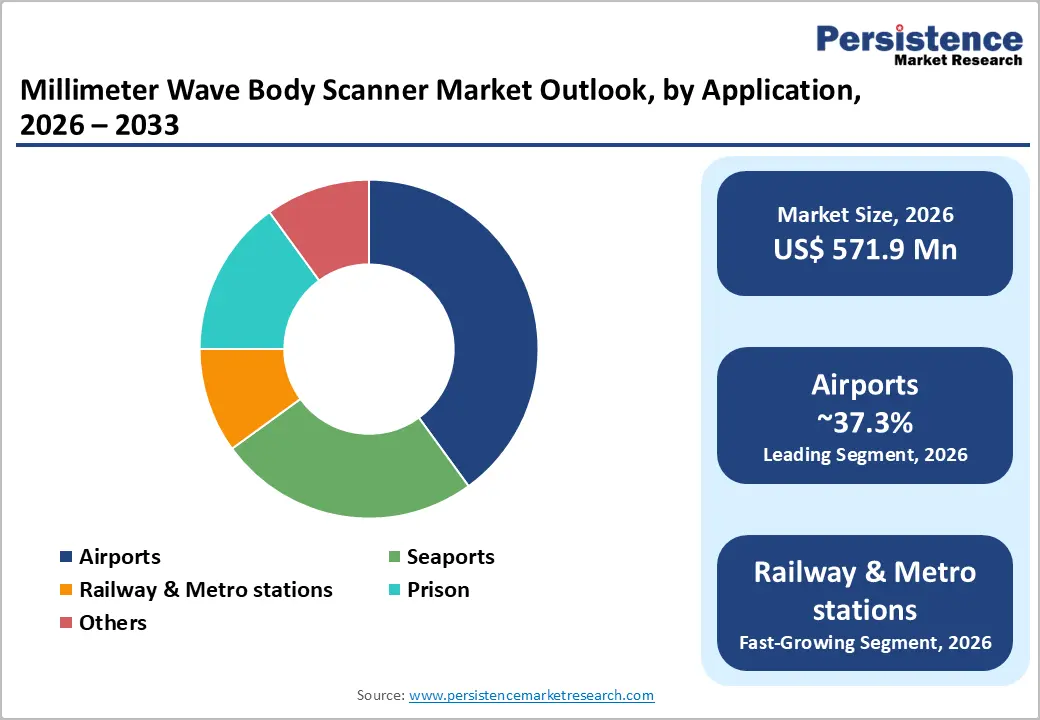

Airport security applications hold 37.3% market share, driven by global aviation traffic exceeding 4.5 billion passengers annually and standardized international security regulations. Airports are rapidly upgrading screening systems, accelerated by TSA’s 2026 employee-screening mandate and deployments of solutions like HEXWAVE in 2024–2025. Major hubs across Europe, Asia Pacific, and the Middle East now integrate millimeter wave scanners as core security equipment, especially in PreCheck and premium lanes. With airports allocating 5% of operating budgets to security and 15% of the US$3 billion global airport security equipment spend to body scanners, this segment remains dominant.

Railway and metro stations represent the fastest-growing segment, expanding at 16% CAGR. Rising security concerns, high passenger volumes, increased transit funding, and the adoption of walkthrough scanning technologies are driving strong procurement momentum across global urban transit networks.

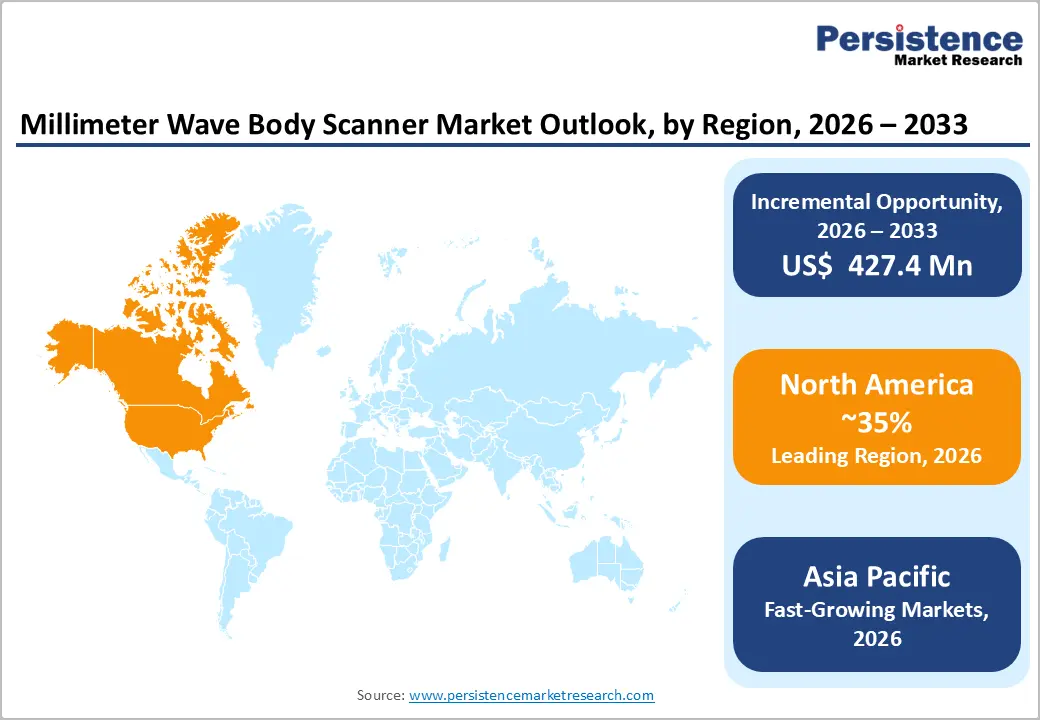

North America commands approximately 35% of the global millimeter wave body scanner market share, valued at approximately US$ 217 million in 2026, with projections approaching US$ 380 million by 2033. The United States represents the dominant regional market contributor, accounting for 85% of the North American market value, driven by TSA security mandates, airport modernization initiatives, and government security infrastructure investment priorities.

Regulatory framework establishment represents the primary market driver, with TSA mandates requiring employee screening systems deployment at all federally managed security operations by April 2026, creating immediate procurement requirements. Government security budgets allocating approximately US$ 15-18 billion annually to transportation and border security infrastructure establish substantial procurement capacity.

Europe accounts for approximately 25% of the global millimeter-wave body scanner market, valued at approximately US$ 160 million in 2026. Germany, the United Kingdom, France, and Spain collectively represent 75% of the European market value, reflecting economic development, aviation infrastructure investment, and regulatory framework implementation.

The European market includes established manufacturers, such as Smiths Detection (UK), Rapiscan Systems (European operations), and German security equipment manufacturers. GDPR compliance focus has elevated the importance of European-based manufacturers capable of meeting privacy regulations.

Asia Pacific dominates the global millimeter-wave body scanner market, commanding approximately 22% market share and projected to increase to 30% by 2033. The region, valued at approximately US$ 114 million in 2026, is anticipated to reach US$ 280 million by 2033, representing the fastest-growing regional market, with an estimated CAGR of 13% over the forecast period.

Chinese government standards and procurement specifications establish binding technical requirements for government facility deployments. Indian aviation authority modernization initiatives and ASEAN regional security coordination protocols are establishing emerging regulatory frameworks that guide technology adoption.

Regional investment concentrates on airport expansion and metro system development, with China investing US$ 5-8 billion annually in airport security modernization and India allocating US$ 2-3 billion through 2030 for airport and transit system upgrades.

The global millimeter wave body scanner market demonstrates moderate consolidation with established security equipment manufacturers maintaining dominant market positioning through integrated manufacturing capabilities, established regulatory relationships, and service networks. The top 5 suppliers, including L3Harris Technologies, Rapiscan Systems, Smiths Detection, and Nuctech, collectively control approximately 60% of global market share, reflecting incumbent advantages and government security procurement relationships.

Market structure reflects bifurcation between traditional government security suppliers, maintaining established regulatory approval relationships, and emerging technology companies introducing differentiated product platforms, including walkthrough scanning systems.

The Millimeter Wave Body Scanner market is estimated to be valued at US$ 571.9 Mn in 2026.

The key demand driver for the Millimeter Wave Body Scanner market is the rising global emphasis on aviation and critical infrastructure security, driven by increasing passenger volumes and heightened threat detection requirements.

In 2026, the North America region will dominate the market with an exceeding 35% revenue share in the global Millimeter Wave Body Scanner market.

Among the application category, Airports hold the highest preference, capturing beyond 37.3% of the market revenue share in 2026.

The key players in Millimeter Wave Body Scanner are L3Harris Technologies, Rapiscan Systems (OSI Systems, Inc.), Smiths Detection, Nuctech Company Limited, and Thruvision Group

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 - 2025 |

|

Forecast Period |

2026 - 2033 |

|

Market Analysis Units |

Value: US$ Bn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Product Type

By Application

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author