- Executive Summary

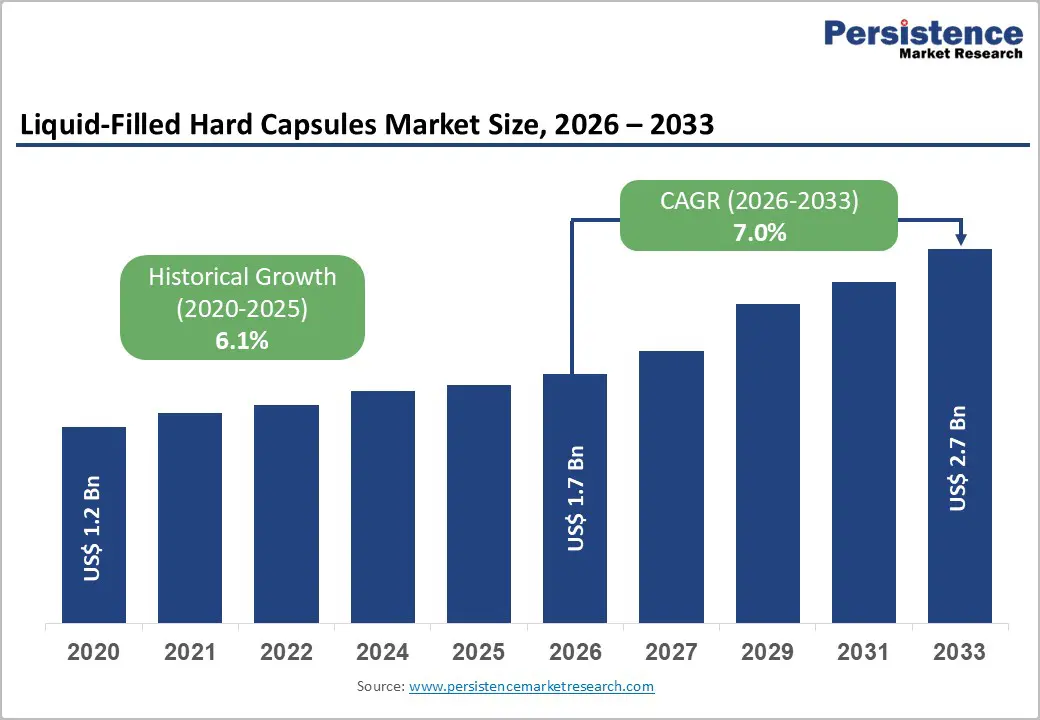

- Global Liquid-Filled Hard Capsules Market Snapshot 2026 and 2033

- Market Opportunity Assessment, 2026-2033, US$ Bn

- Key Market Trends

- Industry Developments and Key Market Events

- Demand Side and Supply-Side Analysis

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definitions

- Market Dynamics

- Driver

- Restraint

- Opportunities

- Trends

- Macro-Economic Factors

- Global GDP Outlook

- Global Prison Growth Outlook

- Global Prison Population by Country

- Global Private Prison Market Growth Outlook

- Forecast Factors – Relevance and Impact

- COVID-19 Impact Assessment

- Value Added Insights

- Value Chain analysis

- Key Market Players

- Product Adoption Analysis

- Key Promotional Strategies by key players

- PESTLE Analysis

- Porter's Five Forces Analysis

- Regulatory and Technology Landscape

- Global Liquid-Filled Hard Capsules Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

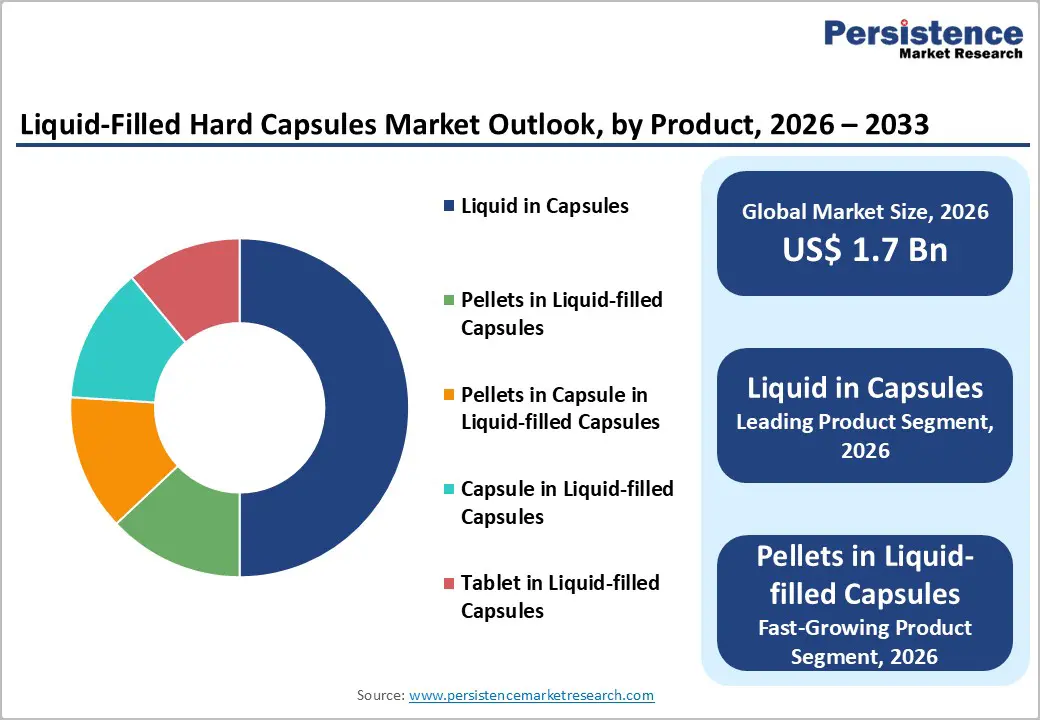

- Global Liquid-Filled Hard Capsules Market Outlook: Product

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Product, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Product, 2026-2033

- Liquid in Capsules

- Pellets in Liquid-filled Capsules

- Pellets in Capsule in Liquid-filled Capsules

- Capsule in Liquid-filled Capsules

- Tablet in Liquid-filled Capsules

- Market Attractiveness Analysis: Product

- Global Liquid-Filled Hard Capsules Market Outlook: Raw Material

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Raw Material, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Raw Material, 2026-2033

- Gelatin

- Hypromellose Capsules (HPMCs)

- Market Attractiveness Analysis: Raw Material

- Global Liquid-Filled Hard Capsules Market Outlook: Application

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Application, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Application, 2026-2033

- Cough & Cold Preparations

- Cardiovascular Therapy Drugs

- Health Supplements

- Vitamin & Dietary Supplements

- Other

- Market Attractiveness Analysis: Application

- Global Liquid-Filled Hard Capsules Market Outlook: End User

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by End User, 2020-2025

- Current Market Size (US$ Bn) Forecast, by End User, 2026-2033

- Pharmaceutical Companies

- Nutraceutical Companies

- Cosmeceutical Companies

- Contract Manufacturing Organizations

- Market Attractiveness Analysis: End User

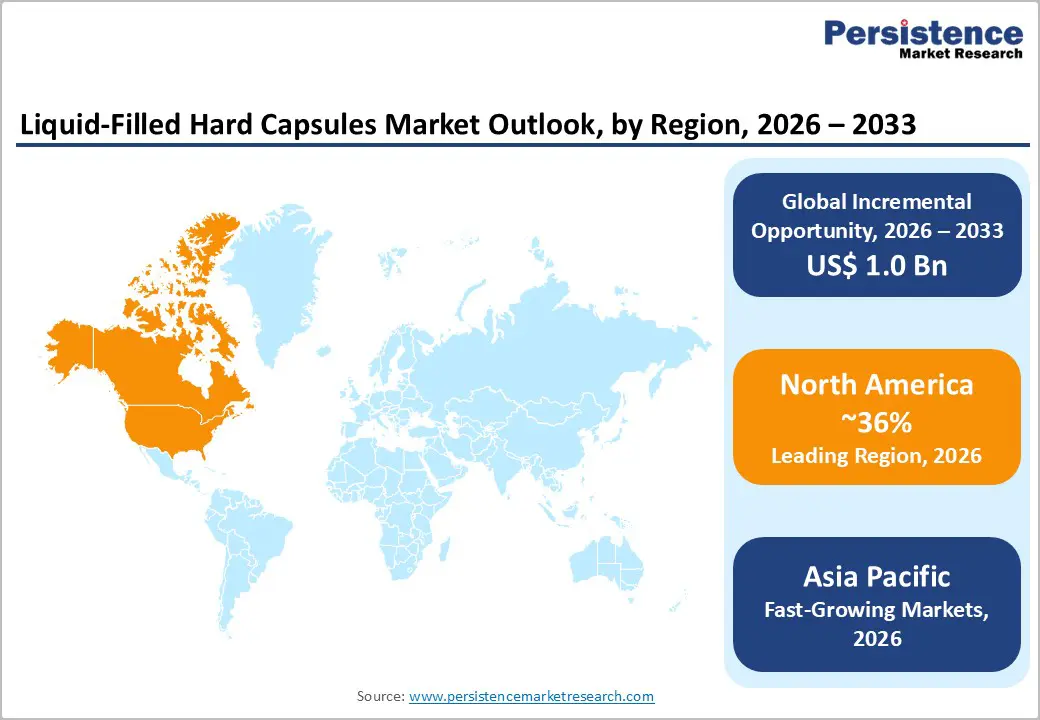

- Global Liquid-Filled Hard Capsules Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) Analysis by Region, 2020-2025

- Current Market Size (US$ Bn) Forecast by Region, 2026-2033

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Liquid-Filled Hard Capsules Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- North America Market Size (US$ Bn) Forecast, by Country, 2026-2033

- U.S.

- Canada

- North America Market Size (US$ Bn) Forecast, by Product, 2026-2033

- Liquid in Capsules

- Pellets in Liquid-filled Capsules

- Pellets in Capsule in Liquid-filled Capsules

- Capsule in Liquid-filled Capsules

- Tablet in Liquid-filled Capsules

- North America Market Size (US$ Bn) Forecast, by Raw Material, 2026-2033

- Gelatin

- Hypromellose Capsules (HPMCs)

- North America Market Size (US$ Bn) Forecast, by Application, 2026-2033

- Cough & Cold Preparations

- Cardiovascular Therapy Drugs

- Health Supplements

- Vitamin & Dietary Supplements

- Other

- North America Market Size (US$ Bn) Forecast, by End User, 2026-2033

- Pharmaceutical Companies

- Nutraceutical Companies

- Cosmeceutical Companies

- Contract Manufacturing Organizations

- Europe Liquid-Filled Hard Capsules Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Europe Market Size (US$ Bn) Forecast, by Country, 2026-2033

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- Rest of Europe

- Europe Market Size (US$ Bn) Forecast, by Product, 2026-2033

- Liquid in Capsules

- Pellets in Liquid-filled Capsules

- Pellets in Capsule in Liquid-filled Capsules

- Capsule in Liquid-filled Capsules

- Tablet in Liquid-filled Capsules

- Europe Market Size (US$ Bn) Forecast, by Raw Material, 2026-2033

- Gelatin

- Hypromellose Capsules (HPMCs)

- Europe Market Size (US$ Bn) Forecast, by Application, 2026-2033

- Cough & Cold Preparations

- Cardiovascular Therapy Drugs

- Health Supplements

- Vitamin & Dietary Supplements

- Other

- Europe Market Size (US$ Bn) Forecast, by End User, 2026-2033

- Pharmaceutical Companies

- Nutraceutical Companies

- Cosmeceutical Companies

- Contract Manufacturing Organizations

- East Asia Liquid-Filled Hard Capsules Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- East Asia Market Size (US$ Bn) Forecast, by Country, 2026-2033

- China

- Japan

- South Korea

- East Asia Market Size (US$ Bn) Forecast, by Product, 2026-2033

- Liquid in Capsules

- Pellets in Liquid-filled Capsules

- Pellets in Capsule in Liquid-filled Capsules

- Capsule in Liquid-filled Capsules

- Tablet in Liquid-filled Capsules

- East Asia Market Size (US$ Bn) Forecast, by Raw Material, 2026-2033

- Gelatin

- Hypromellose Capsules (HPMCs)

- East Asia Market Size (US$ Bn) Forecast, by Application, 2026-2033

- Cough & Cold Preparations

- Cardiovascular Therapy Drugs

- Health Supplements

- Vitamin & Dietary Supplements

- Other

- East Asia Market Size (US$ Bn) Forecast, by End User, 2026-2033

- Pharmaceutical Companies

- Nutraceutical Companies

- Cosmeceutical Companies

- Contract Manufacturing Organizations

- South Asia & Oceania Liquid-Filled Hard Capsules Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Country, 2026-2033

- India

- Southeast Asia

- ANZ

- Rest of SAO

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Product, 2026-2033

- Liquid in Capsules

- Pellets in Liquid-filled Capsules

- Pellets in Capsule in Liquid-filled Capsules

- Capsule in Liquid-filled Capsules

- Tablet in Liquid-filled Capsules

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Raw Material, 2026-2033

- Gelatin

- Hypromellose Capsules (HPMCs)

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Application, 2026-2033

- Cough & Cold Preparations

- Cardiovascular Therapy Drugs

- Health Supplements

- Vitamin & Dietary Supplements

- Other

- South Asia & Oceania Market Size (US$ Bn) Forecast, by End User, 2026-2033

- Pharmaceutical Companies

- Nutraceutical Companies

- Cosmeceutical Companies

- Contract Manufacturing Organizations

- Latin America Liquid-Filled Hard Capsules Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Latin America Market Size (US$ Bn) Forecast, by Country, 2026-2033

- Brazil

- Mexico

- Rest of LATAM

- Latin America Market Size (US$ Bn) Forecast, by Product, 2026-2033

- Liquid in Capsules

- Pellets in Liquid-filled Capsules

- Pellets in Capsule in Liquid-filled Capsules

- Capsule in Liquid-filled Capsules

- Tablet in Liquid-filled Capsules

- Latin America Market Size (US$ Bn) Forecast, by Raw Material, 2026-2033

- Gelatin

- Hypromellose Capsules (HPMCs)

- Latin America Market Size (US$ Bn) Forecast, by Application, 2026-2033

- Cough & Cold Preparations

- Cardiovascular Therapy Drugs

- Health Supplements

- Vitamin & Dietary Supplements

- Other

- Latin America Market Size (US$ Bn) Forecast, by End User, 2026-2033

- Pharmaceutical Companies

- Nutraceutical Companies

- Cosmeceutical Companies

- Contract Manufacturing Organizations

- Middle East & Africa Liquid-Filled Hard Capsules Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Middle East & Africa Market Size (US$ Bn) Forecast, by Country, 2026-2033

- GCC Countries

- South Africa

- Northern Africa

- Rest of MEA

- Middle East & Africa Market Size (US$ Bn) Forecast, by Product, 2026-2033

- Liquid in Capsules

- Pellets in Liquid-filled Capsules

- Pellets in Capsule in Liquid-filled Capsules

- Capsule in Liquid-filled Capsules

- Tablet in Liquid-filled Capsules

- Middle East & Africa Market Size (US$ Bn) Forecast, by Raw Material, 2026-2033

- Gelatin

- Hypromellose Capsules (HPMCs)

- Middle East & Africa Market Size (US$ Bn) Forecast, by Application, 2026-2033

- Cough & Cold Preparations

- Cardiovascular Therapy Drugs

- Health Supplements

- Vitamin & Dietary Supplements

- Other

- Middle East & Africa Market Size (US$ Bn) Forecast, by End User, 2026-2033

- Pharmaceutical Companies

- Nutraceutical Companies

- Cosmeceutical Companies

- Contract Manufacturing Organizations

- Competition Landscape

- Market Share Analysis, 2025

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles

- Lonza

- Company Overview

- Product Portfolio/Offerings

- Key Financials

- SWOT Analysis

- Company Strategy and Key Developments

- VANTAGE NUTRITION

- INNERCAP Technologies, Inc.

- LIQUIDCAPSULE MANUFACTURING LLC

- SuHeung

- Altasciences

- Others

- Lonza

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment