ID: PMRREP32597| 289 Pages | 31 Dec 2025 | Format: PDF, Excel, PPT* | Industrial Automation

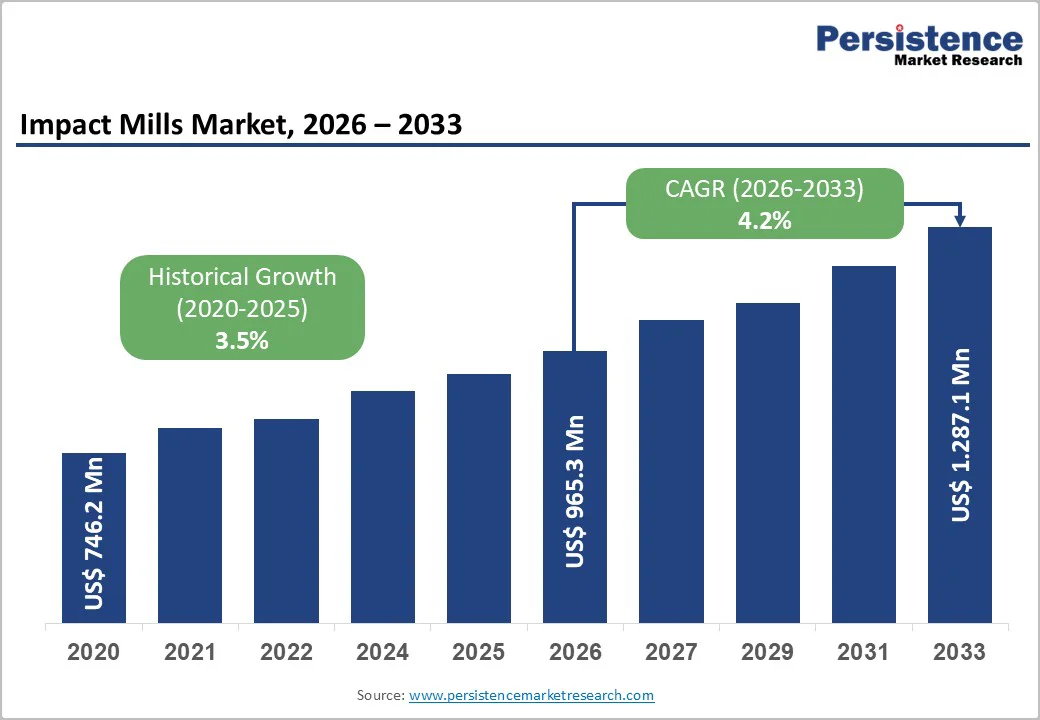

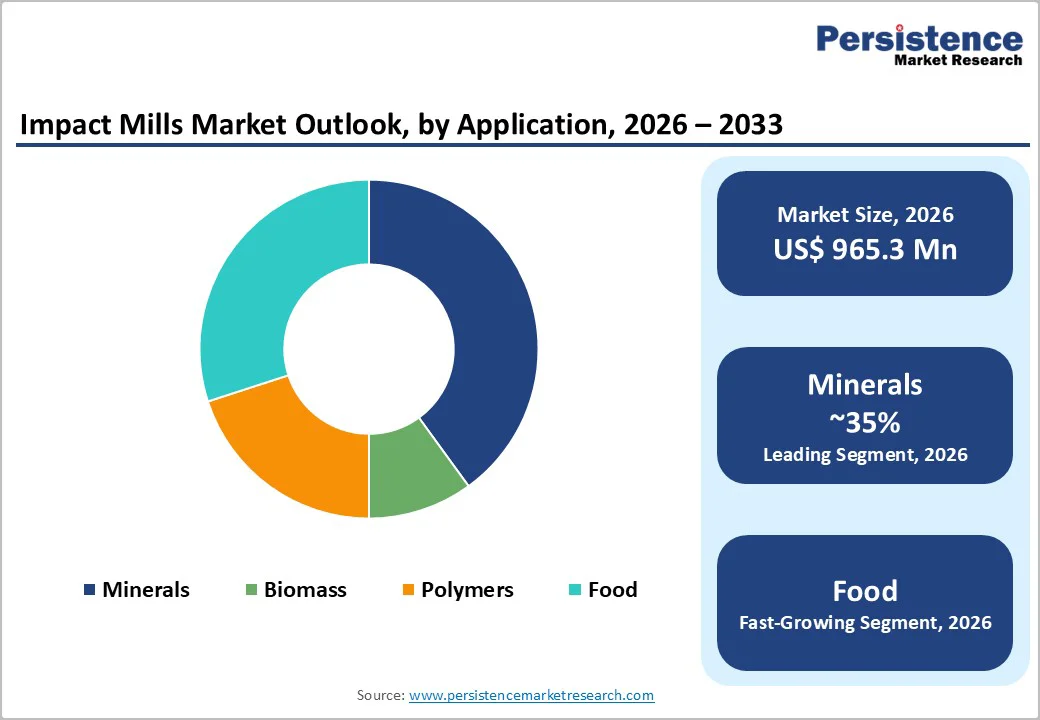

The global Impact Mills market size was valued at US$ 965.3 Mn in 2026 and is projected to reach US$ 1,287.5 Mn by 2033, growing at a CAGR of 4.2% between 2026 and 2033. The impact mills market is experiencing sustained expansion driven by accelerating mineral processing demand, with global mining equipment reaching USD 22.9 billion in 2026, and biomass processing expansion supporting renewable energy transitions, coupled with rising food processing requirements across emerging economies, particularly the Asia-Pacific region, and increasing adoption of advanced grinding technologies supporting industrial automation.

| Key Insights | Details |

|---|---|

|

Impact Mills Market Size (2026E) |

US$ 965.3 Mn |

|

Market Value Forecast (2033F) |

US$ 1,287.5 Mn |

|

Projected Growth (CAGR 2026 to 2033) |

4.2% |

|

Historical Market Growth (CAGR 2020 to 2024) |

3.5% |

Market Growth Drivers

The global mineral processing equipment market, reaching USD 22.9 billion in 2026 and projected to grow to USD 35.6 billion by 2035 at a 4.5% CAGR, establishes a strong demand foundation for impact mills, critical size-reduction components. Mining operations worldwide are expanding, particularly in China with 6.1% equipment market CAGR and India with 5.6% CAGR, driving substantial capital investment in modernized grinding and crushing infrastructure. Impact mills represent integral processing equipment handling 35% of applications in the minerals segment, with increasing demand for fine grinding capabilities supporting metal ore extraction, gold processing, and copper beneficiation operations.

Critical minerals extraction including lithium, cobalt, and rare earth elements expansion necessitates specialized grinding equipment with precise particle control, creating incremental demand estimated at USD 40 million annually by 2033. Energy-efficient equipment adoption mandates drive investment in modernized mills, reducing operational costs by 15-20% compared to conventional systems.

The global biomass pellets market is projected to expand from USD 10.17 billion in 2026 to USD 16.27 billion by 2033 at 5.2% CAGR, driving substantial demand for biomass grinding and processing equipment. Renewable energy transition initiatives globally, including the EU's 80% renewable energy target, the U.S. clean electricity commitments, and China's 45% EV penetration projections, create structural demand growth for biomass processing infrastructure. Agricultural residue utilization is expanding with rice husk, wheat straw, and corn stalk processing, generating an estimated USD 8 billion annual raw material feedstock supporting pellet production globally. The shredding impact mill segment is emerging as the fastest-growing category with specialized applications in biomass pre-processing, addressing fibrous material handling requirements. Government incentives, including feed-in tariffs, renewable energy credits, and carbon pricing mechanisms, encourage investment in biomass conversion infrastructure, supporting impact mill market expansion.

Market Restraints

A major restraint on the impact mills market is the high wear rate on critical components such as hammers, rotors, liners, and impact plates. Because impact mills rely on high-speed impact forces to break down materials, these components are subjected to continuous abrasion, especially when processing hard or abrasive materials like quartz, granite, or slag. Frequent part replacement increases maintenance costs, downtime, and operational expenses, making impact mills less attractive for cost-sensitive operators. Smaller processing plants and mining operators may prefer alternative milling technologies with longer service intervals. Additionally, unplanned downtime due to component failure can disrupt production schedules, reduce overall plant efficiency and limiting broader adoption of impact mills.

Impact mills are most effective for brittle and medium-hard materials, but their performance declines significantly when handling very hard or highly abrasive feedstock. Processing such materials leads to excessive wear, reduced throughput, and inconsistent particle size distribution. As a result, industries dealing with hard minerals often favor technologies such as ball mills, vertical roller mills, or jaw and cone crushers, which offer better durability and lower long-term operating costs. This limitation limits the scope of application for impact mills, particularly in heavy mining and certain industrial mineral segments. The need for careful material selection limits market penetration and slows adoption in high-hardness material processing applications.

Market Opportunities

The food processing segment is emerging as the fastest-growing application category, with spice grinding, grain milling, and food ingredient processing expansion supporting the market opportunity estimated at USD 50-80 million by 2033. High-capacity systems above 5 t/h representing fastest-growing capacity segment with industrial-scale mining and biomass processing applications requiring robust large-capacity equipment. India's food processing sector growth at 8-10% annually, combined with government investment in food processing infrastructure, creates a concentrated demand opportunity for standardized grinding equipment. Specialized configurations for pharmaceutical-grade milling maintaining strict contamination standards command premium positioning opportunities supporting higher margin revenue capture.

A key opportunity for the Impact Mills market lies in expanding mineral processing and construction materials industries, particularly in emerging economies. Rapid urbanization, infrastructure development, and increased mining activity are driving demand for efficient size-reduction equipment capable of handling a wide range of materials, including limestone, gypsum, coal, and industrial minerals. Impact mills are well suited for these applications due to their high throughput, consistent particle size control, and ability to process brittle and medium-hard materials.

Additionally, growing emphasis on improving processing efficiency and reducing energy consumption is encouraging operators to upgrade older grinding systems with modern impact mill designs. As governments invest in roads, housing, and industrial projects, demand for processed aggregates and minerals is expected to rise, creating sustained growth opportunities for impact mill manufacturers across mining, cement, and construction sectors.

Product Type Analysis

Hammer/Impact Mill equipment represents the dominant product segment commanding 60% market share, driven by universal applicability across diverse material types and processing requirements including minerals, food, polymers, and biomass applications. Hammer mill prevalence reflects proven technology maturity, with established design standards enabling consistent performance across multiple operational scales and industry verticals. Equipment versatility supporting rapid changeover between different material processing applications establishes strong competitive positioning, particularly in multi-product processing facilities.

The Shredding Impact Mill segment emerges as the fastest-growing product category, driven by accelerated biomass processing and specialized requirements for fibrous material reduction. Shredding mills optimized for low-speed, high-torque operation provide superior performance for stringy agricultural residues and wood chips compared to conventional hammers. Estimated CAGR of 5.8-6.2% for shredding segment reflects concentrated demand from renewable energy preprocessing and waste valorization applications.

Capacity Range Application Analysis

1-5 t/h capacity systems maintain dominant positioning with 45.5% market share, serving as an optimum balance between processing throughput and equipment cost across diverse industry applications. Mid-range capacity prevalence reflects widespread adoption in feed mills, grain processing facilities, and mineral beneficiation plants where production volumes justify investment without requiring excessive capital outlay. Standard equipment configurations for 1-5 t/h range enable economies of scale support competitive pricing and rapid deployment across global markets.

The 5+ t/h capacity segment is the fastest-growing application category, with an estimated 6.5-7.2% CAGR, driven by large-scale industrial processing requirements in mining operations and biomass conversion facilities. High-capacity systems requiring 55-90 kW motors demand robust construction capable of continuous heavy-duty operation. Market opportunity in this capacity range is estimated at USD 80-120 million by 2033, reflecting industrial-scale processing expansion particularly across Asia-Pacific manufacturing hubs.

Application Segment Analysis

The minerals segment commands dominant positioning with 35% application share, reflecting the universal requirement for size reduction across metal ore extraction, non-metallic mineral processing, and critical minerals beneficiation operations. Mining equipment modernization initiatives globally drive sustained demand for advanced grinding capabilities supporting improved ore recovery rates and processing efficiency. Mineral processing equipment market expanding at 4.5% CAGRestablishes strong structural demand foundation.

The food segment is the fastest-growing application category, with an estimated 7.1% CAGR, driven by expanding food processing infrastructure, particularly in India, China, and Southeast Asia. Specialty applications, including spice milling, grain grinding, and food ingredient processing, require contamination-controlled equipment supporting food-safety compliance standards. Market opportunity in food applications is estimated at USD 60 million by 2033, reflecting rising consumer demand for processed food products and government support for food processing infrastructure expansion.

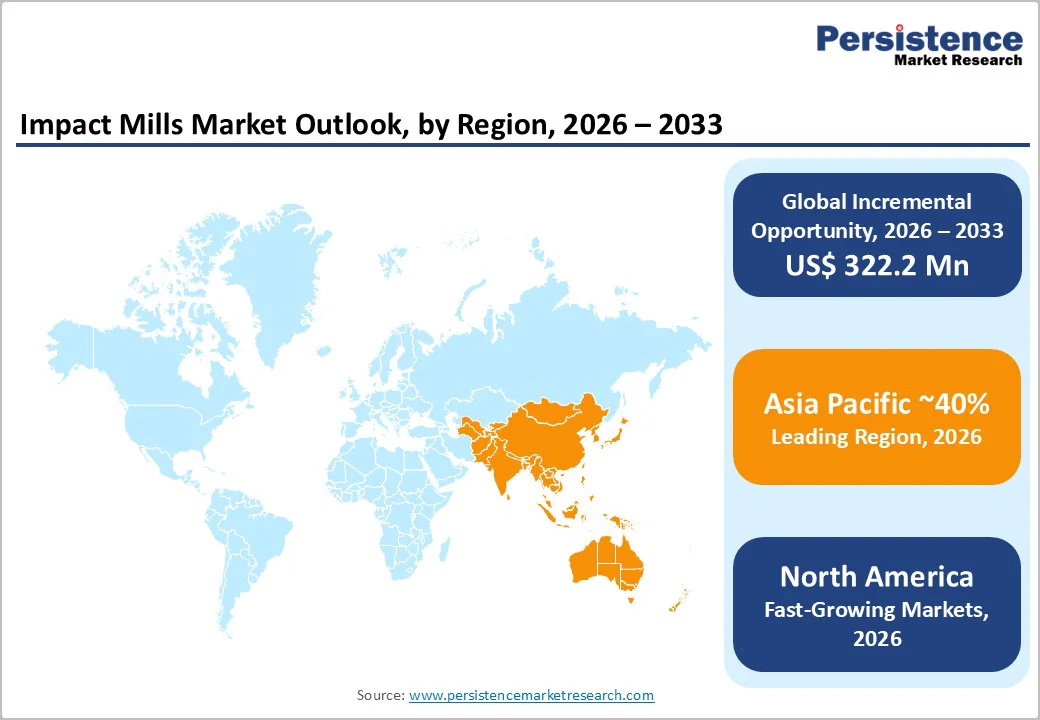

North America

North America, representing approximately 25% of the global impact mills market share, demonstrates a stable growth trajectory with 4.0% CAGR driven by established recycling infrastructure, advanced agricultural processing requirements, and mining equipment modernization. The United States market dominance, supported by major manufacturing hubs including Wisconsin, Illinois, and Indiana, establishes an innovation ecosystem concentration with leading equipment manufacturers, including Stedman Machine Company, Williams Patent Crusher, and Prater Industries, maintaining substantial operational presence.

Recycling industry expansion driven by circular economy mandates and metal recovery from electronic waste processing creates specialized demand for shredding and impact equipment supporting contamination removal and material separation. Biomass processing expansion supporting renewable energy transition, with the North American biomass pellets market reaching USD 3.9 billion in 2024 and expanding at 4.2% CAGR, drives incremental demand for preprocessing equipment. Agricultural modernization, including precision livestock feed production, requires advanced grinding equipment meeting contamination and consistency standards.

Europe

Europe commands approximately 20% global market share with moderate growth at 3.6% CAGRdriven by strict environmental regulations, established feed manufacturing infrastructure, and biomass energy production requirements. Germany, France, and the Netherlands collectively account for 60%+ of the European market value, with biomass processing concentrated in northern European countries, supporting renewable energy targets. The European Union renewable energy mandate requiring 42.5% renewable energy by 2030 drives sustained investment in biomass conversion infrastructure.

Regulatory harmonization across EU member states enables standardized equipment design supporting manufacturing efficiency and regional distribution. Germany's market leadership reflects high-quality engineering demand and industrial feed manufacturing concentration, with an estimated market share of 22% within the European market. Waste valorization regulations are driving demand for metal and construction waste recycling, supporting the adoption of specialized shredding equipment across central and southern European markets.

Asia-Pacific

Asia-Pacific dominates the global market, commanding 40% market share and projecting the strongest regional growth at 4.6% CAGR, driven by massive agricultural processing expansion, rapid mining sector modernization, and food processing infrastructure development. China's market is expanding at a 5.8% CAGR, supported by the mineral processing equipment market's 6.1% growth and the expansion of biomass utilization in the energy generation sector. India's equipment market is reaching USD 6.4 billion in 2024, with projected growth to USD 11.34 billion by 2033 at 6.05% CAGR, establishing the fastest-growing regional opportunity.

India's food processing sector expansion, with government investment programs and rural infrastructure development initiatives, drives machinery demand, estimated at USD 100-150 million incremental opportunity by 2033. Agricultural modernization across India, China, and Southeast Asia, including mechanized feed production, requires standardized grinding equipment supporting intensive livestock operations. Mining sector modernization, particularly in China, drives equipment investment supporting copper, rare earth, and lithium extraction processing requirements.

Market Structure Analysis

The impact mills market demonstrates moderate consolidation with specialized manufacturers including Stedman Machine Company, Williams Patent Crusher, Fitzpatrick Company, Prater Industries, and Schutte-Buffalo Hammermill collectively commanding approximately 45-55% global market share. Market structure reflects substantial manufacturing expertise requirements, established OEM relationships, and technical service capabilities creating barriers protecting incumbent manufacturers.

Emerging regional manufacturers, particularly in China and India, compete through cost-competitive positioning and customized equipment solutions supporting local market requirements. Strategic differentiation emphasis focuses on energy-efficiency improvements, specialized material-handling capabilities, and advanced control-system integration, with leading manufacturers investing 4-6% of revenues in R&D to support product innovation.

Key Market Developments

The global impact mills market valued at US$ 965.3 million in 2026is projected to reach US$ 1,287.5 million by 2033, representing 4.2% CAGR expansion, supported by mineral processing acceleration, biomass expansion, and food processing growth across emerging economies.

Primary market drivers include Global mineral processing equipment market reaching USD 22.9 billion with 4.5% CAGR supporting mining modernization and Biomass pellets market expanding at 5.2% CAGR driving preprocessing equipment demand.

Hammer/Impact Mills dominate commanding 60% market share, driven by universal applicability across diverse material types and industry verticals. However, Shredding Impact Mills emerge as fastest-growing segment expanding at 5.8% CAGR due to specialized biomass preprocessing requirements supporting renewable energy transition.

Asia-Pacific dominates with 40% global market share and 4.6% CAGR, driven by China's equipment market growth at 5.8% CAGR and India's fastest-expanding market at 6.2% CAGR. Food processing infrastructure expansion and agricultural modernization represent primary growth drivers.

Market leaders include Stedman Machine Company, Williams Patent Crusher, Fitzpatrick Company, Prater Industries, and Schutte-Buffalo Hammermill.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2020 – 2024 |

|

Forecast Period |

2026 – 2033 |

|

Market Analysis Units |

Value: US$ Bn, Volume: Units |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

Product Type

Capacity Range

Application

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author