ID: PMRREP11983| 193 Pages | 18 Sep 2025 | Format: PDF, Excel, PPT* | Food and Beverages

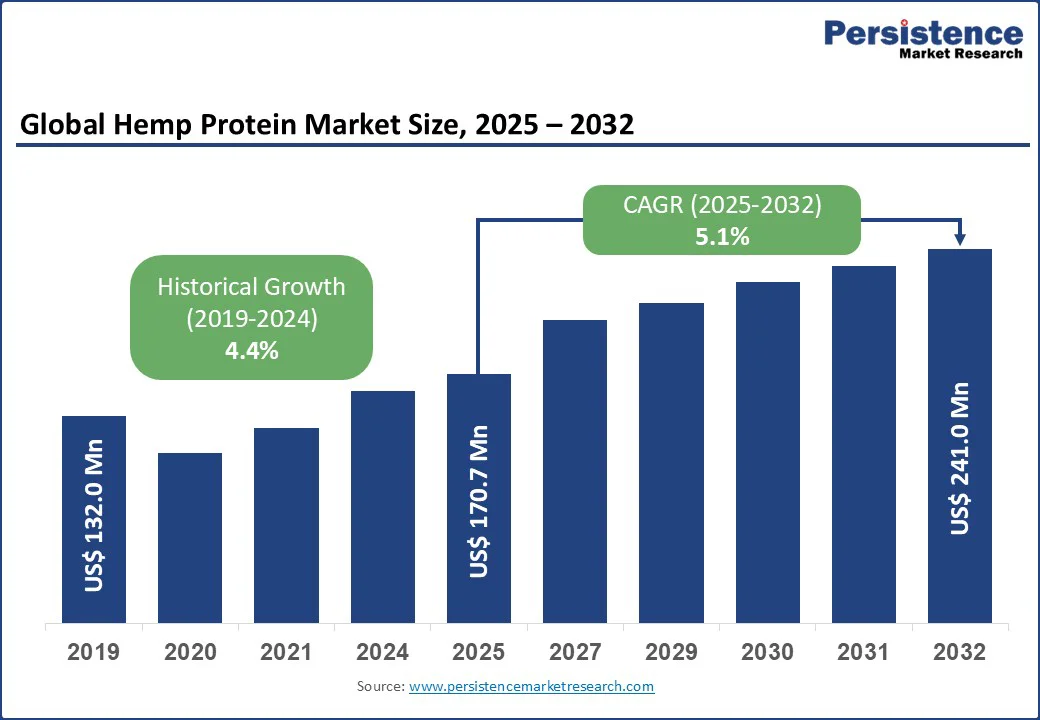

The global hemp protein market size is likely to value at US$170.7 Mn in 2025 and is expected to reach US$241.0 Mn by 2032, registering a CAGR of 5.1% during the forecast period from 2025 to 2032 due to the prevalence of health-conscious consumers and vegan lifestyles, advancements in plant-based protein extraction technologies, and increasing demand for natural and sustainable protein sources.

Key Industry Highlights:

| Key Insights | Details |

|---|---|

|

Hemp Protein Market Size (2025E) |

US$170.7 Mn |

|

Market Value Forecast (2032F) |

US$241.0 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

5.1% |

|

Historical Market Growth (CAGR 2019 to 2024) |

4.4% |

The global surge in chronic diseases and health awareness is a primary driver of the hemp protein market. According to the World Health Organization, non-communicable diseases accounted for nearly 41 million deaths worldwide in 2021, with obesity and diabetes contributing to approximately 4.5 million deaths annually. This rising incidence, particularly in urban areas with sedentary lifestyles, underscores the urgent need for nutritious alternatives such as hemp protein, which offers a complete amino acid profile, omega-3 and omega-6 fatty acids, and essential micronutrients linked to improved metabolic health.

Government initiatives and increased funding for plant-based nutrition are pivotal growth drivers. In Asia Pacific, programs such as India’s National Nutrition Mission and China’s Healthy China plan promote alternative proteins, boosting hemp cultivation. In North America, the USDA’s Hemp Farming Act has facilitated expansion in hemp acreage, while in Europe, the Horizon Europe program has invested heavily in plant-based protein research.

Favorable policies in the Asia Pacific, including tax incentives on production, and in North America, supporting cultivation, encourage food manufacturers to invest in equipment. Post-COVID-19 consumer shifts toward veganism and sustainability further amplify demand, particularly in the fast-growing market.

The high cost of production continues to act as a major barrier, particularly across low- and middle-income countries. Advanced extraction platforms, which incorporate high-purity filtration systems and organic certification processes, demand significant upfront investments, placing them beyond the reach of many small and mid-sized producers. In addition, recurring costs related to sourcing premium-quality seeds, ensuring compliance with organic farming standards, and conducting rigorous quality control such as testing for pesticide residues and maintaining strict THC compliance further increase the total cost of ownership. In regions such as Sub-Saharan Africa and rural parts of Latin America, where food processing budgets remain limited, these financial challenges significantly restrict the availability of hemp protein, despite increasing nutritional needs among the population.

The World Health Organization emphasizes that the high cost of premium nutritional products often acts as a disincentive for adoption in developing markets. Another critical challenge lies in the shortage of skilled personnel to oversee the production. Organic hemp processing requires expertise in sustainable cultivation, advanced extraction techniques, and compliance with regulatory standards. However, trained specialists remain scarce in many developing economies. The cost and duration of training programs further exacerbate this skills gap, slowing down large-scale adoption despite rising consumer demand in regions such as the Asia Pacific.

The development of innovative, flavored products presents significant growth opportunities, enabling deployment across retail stores, e-commerce platforms, and health-focused environments. These offerings address consumer demand for taste and convenience, overcoming the earthy profile often associated with traditional hemp protein.

For example, brands such as Tilray have introduced flavored protein powders in options such as vanilla and chocolate, which mix easily and are gaining strong traction in the Asia Pacific. As global health systems emphasize accessible nutrition, demand for such products is accelerating, particularly in North America, where fitness-driven lifestyles are shaping market expansion.

The growing popularity of point-of-sale supplements, including ready-to-drink shakes, provides another promising avenue for market growth. These products require minimal preparation and deliver rapid nutritional support, making them well-suited to urban consumers with busy routines.

The integration of digital health platforms for product tracking and consumer education further strengthens market potential. Companies such as Axiom Foods are embedding app-enabled tools that help consumers monitor protein intake and associated health benefits in real time. In regions such as North America and the Asia Pacific, innovations such as QR-coded packaging and mobile platforms are improving consumer trust and engagement, boosting adoption and driving growth in both mature and emerging markets.

The global hemp protein market is segmented into organic and conventional. Conventional dominates, holding approximately 35.5% share in 2025, due to its cost-effective production and scalability for high-demand periods. Companies such as ETChem leverage conventional hemp’s lower production costs compared to organic to supply bulk markets, particularly in Asia Pacific’s food and beverage sector.

Organic is the fastest-growing segment, driven by increasing demand for clean-label, sustainable products in health-conscious markets. Innovations in organic extraction, such as Martin Bauer Group’s solvent-free processes, ensure high purity and traceability, meeting stringent standards such as EU Organic Certification.

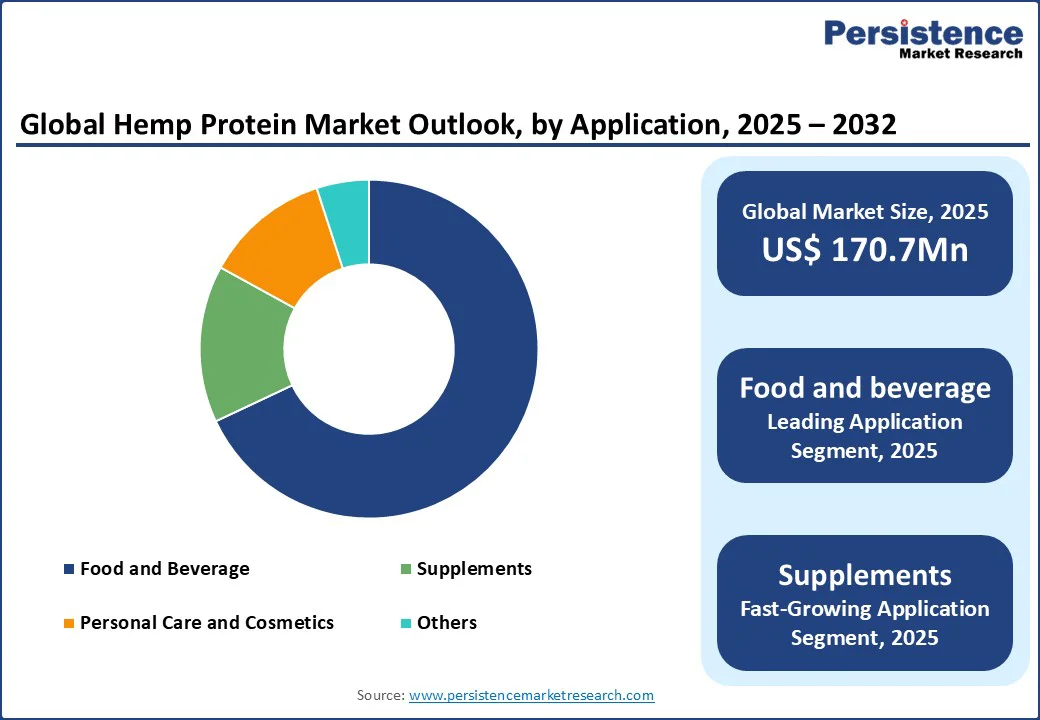

The global hemp protein market is divided into food and beverage, supplements, and personal care and cosmetics. Food and beverage is likely to lead with a 68% share in 2025, driven by its widespread use in consumer and retail settings. Hemp protein’s integration into products such as energy bars, smoothies, and baked goods supports daily nutrition, with significant volumes used annually worldwide for food fortification. In the Asia Pacific, food and beverage applications account for the majority of consumption, driven by demand for plant-based alternatives in China’s urban markets, where vegan product sales continue to grow steadily.

The global hemp protein market is segmented into powder, liquid, and concentrate. Powder dominates with a 55% share in 2025, driven by its versatility and ease of integration into foods and beverages. Powder’s simple mixing process makes it a staple in households and industries, with significant volumes used annually in the Asia Pacific for products such as protein shakes and baking mixes. Companies such as Manitoba Harvest have optimized powder formulations for solubility, boosting consumer adoption in the dominant Asia Pacific market.

Liquid is the fastest-growing segment, propelled by demand for convenient, on-the-go nutrition in North America. Ready-to-drink shakes, such as those by Tilray Brands, cater to busy urban consumers, offering quick absorption and high nutritional value. Growth is supported by e-commerce platforms, fitness trends, and the region’s expanding health-conscious market.

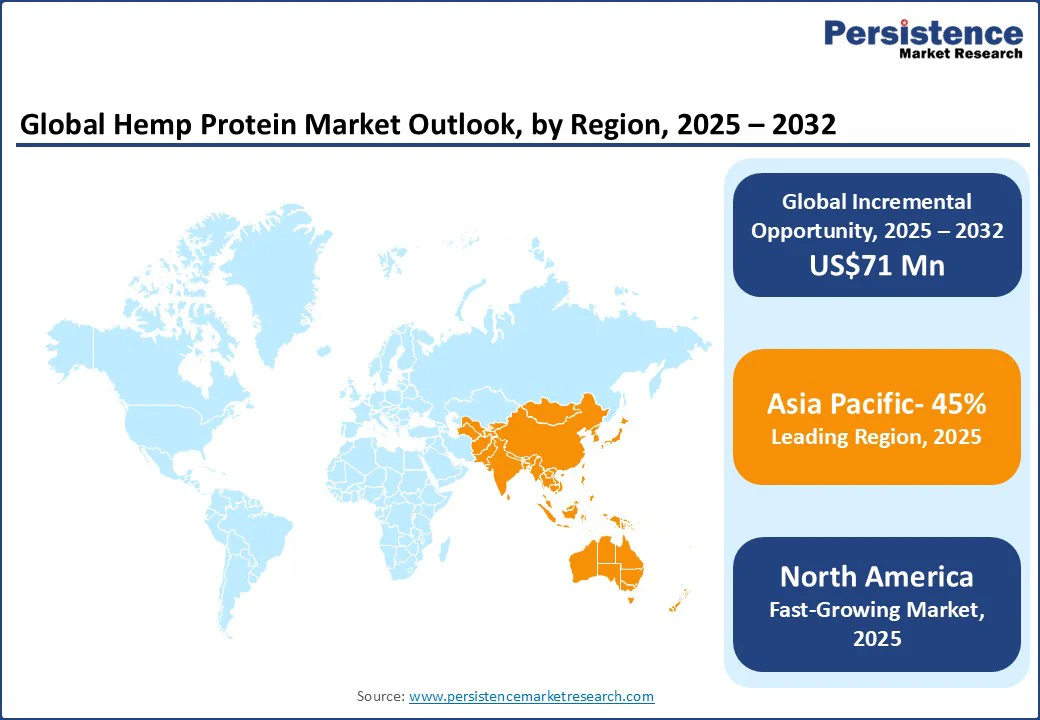

Asia Pacific is a dominant market and is expected to account for a 45% share in 2025, driven by expansive food infrastructure, increasing health awareness, and rising investments in nutrition technologies. China remains a key growth engine, where rising veganism rates and government programs such as the Healthy China 2030 plan boost demand for affordable, conventional hemp protein.

Domestic manufacturers such as ETChem cater to local needs with cost-effective products, with many food processing units adopting hemp protein in recent years. India’s market growth is supported by large-scale factory upgrades and a steady increase in vegan product demand, driven by programs such as the National Nutrition Mission.

Japan’s market focuses on high-precision supplements for wellness, with companies such as Martin Bauer Group strengthening their market presence. Across the region, increased consumer spending, digital platforms such as Alibaba, and a plant-based health emphasis accelerate adoption, solidifying Asia Pacific’s dominance.

North America is the fastest-growing region, driven by high demand for plant-based alternatives, advanced processing infrastructure, and increasing cases of lifestyle diseases. The CDC highlights the significant prevalence of obesity in the U.S., underscoring the need for nutritional solutions. Leading brands such as Manitoba Harvest and Tilray Brands develop innovative platforms to support production with efficiency and consumer-friendly methods.

Consumer preferences are shifting toward organic, flavored systems, such as Axiom Foods’ blends, which enhance taste and nutrition. Stringent FDA regulations prioritize safety, encouraging reliable, high-quality components. Favorable hemp cultivation policies incentivize investment in advanced equipment, supporting steady market growth in the U.S. and Canada.

Europe’s market is led by Germany, the U.K., and France, driven by regulatory support and high consumption volumes. Germany holds a significant share, supported by sales from Martin Bauer Group and ETChem. The EU’s Green Deal promotes advanced organic and conventional systems across numerous food facilities. In the U.K., demand for sustainable supplements drives growth, with Manitoba Harvest’s kits gaining popularity. France witnessed an increased demand for cosmetics-related proteins, with Axiom Foods offering specialized solutions for skin and haircare. Regulatory support for sustainable practices enhances market prospects across Europe, fueling steady growth.

The global hemp protein market is highly competitive, with global and regional players vying for share through innovation, competitive pricing, and reliability. The rise of organic and flavored proteins intensifies competition, as companies meet stringent regulatory and consumer demands. Strategic partnerships, mergers, and regulatory approvals are key differentiators.

The hemp protein market is projected to reach US$170.7 Mn in 2025.

Rising health awareness, technological advancements in plant-based proteins, and government nutrition initiatives are key drivers.

The hemp protein market is poised to witness a CAGR of 5.1% from 2025 to 2032.

Innovations in flavored protein systems and point-of-sale solutions present significant growth opportunities.

Axiom Foods Inc., Manitoba Harvest Hemp Foods, and Tilray Brands Inc. are among the leading players.

| Report Attribute | Details |

|---|---|

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

By Source Type

By Application

By Form

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author